Merck & Co Inc

Latest Merck & Co Inc News and Updates

Merck Sells COVID Pill to U.S. at $700 Per Treatment Course

Merck is requesting emergency use for its COVID-19 treatment pill. How much will the drug cost?

Why 2021 Could Be a Very Healthy Year for Merck Stock

Merck stock rose 8 percent on Oct. 1, and was higher in premarket trading on Oct. 4. What’s the forecast for MRK stock?

Study Shows Merck Antiviral Drug Is Effective in Treating COVID-19

A recent study found that Merck's antiviral drug is effective in treating COVID-19. The jury is still out on whether the drug is as effective as the vaccine.

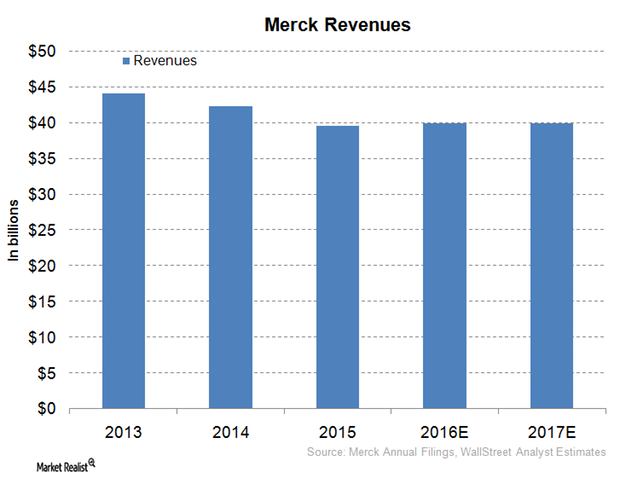

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

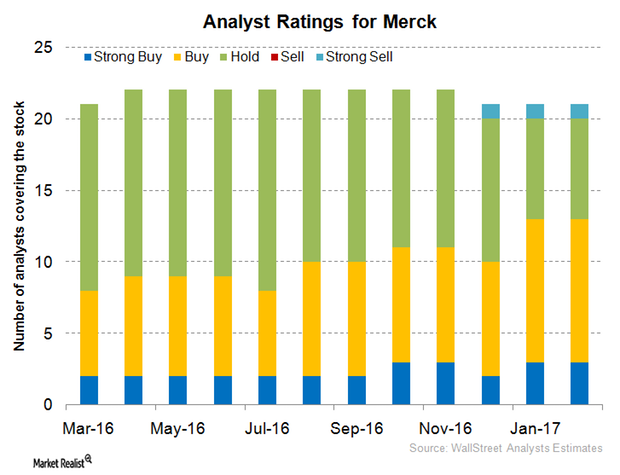

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

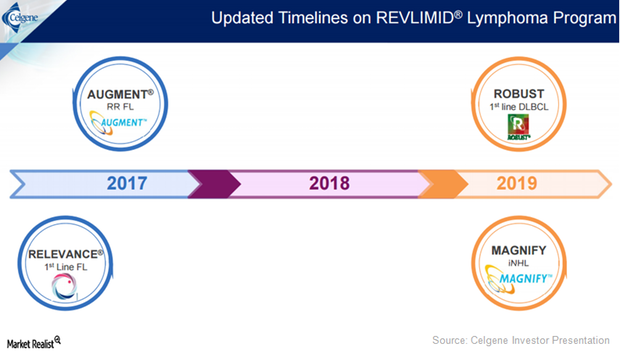

Celgene’s Revlimid Expected to Post Strong Revenue in 2017

According to unaudited financial results published by Celgene (CELG) on January 9, 2017, Revlimid sales for 2016 are about $7.0 billion, a YoY rise of about 20.0%.

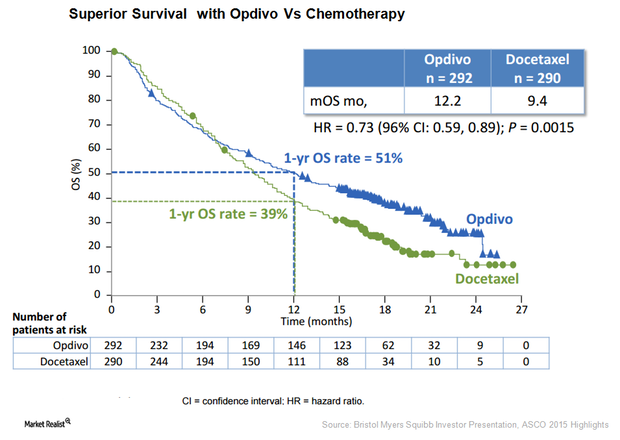

Bristol-Myer Squibb’s Opdivo Is Keytruda’s Strong Competitor

the U.S. Food and Drug Administration accepted the filing of a supplemental Biologics License Application for Bristol-Myers Squibb’s Opdivo.

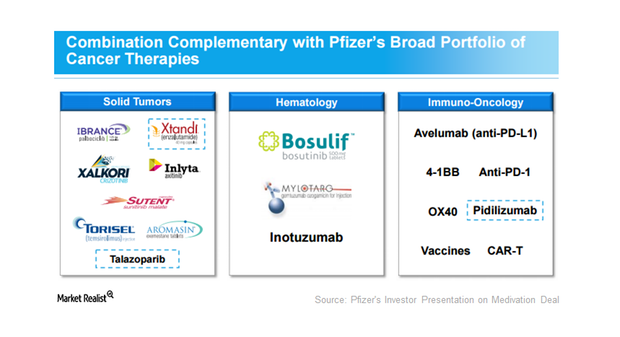

What’s the Story behind the Pfizer-Medivation Deal?

Medivation’s portfolio complements Pfizer’s existing oncology portfolio that includes solid tumors, hematology, and immunology-oncology.

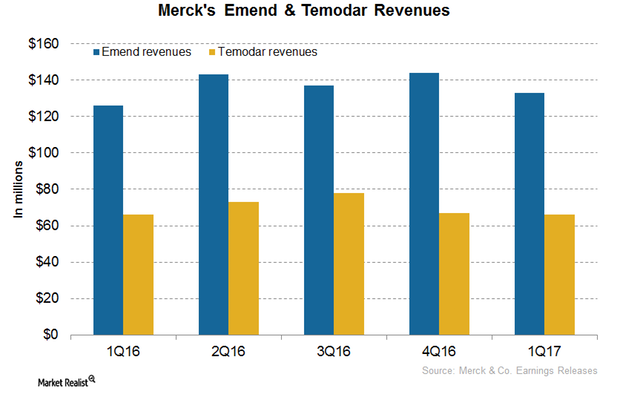

How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017

In 2016, Merck’s (MRK) Emend reported revenues of around $549 million, which reflected 3% year-over-year growth.

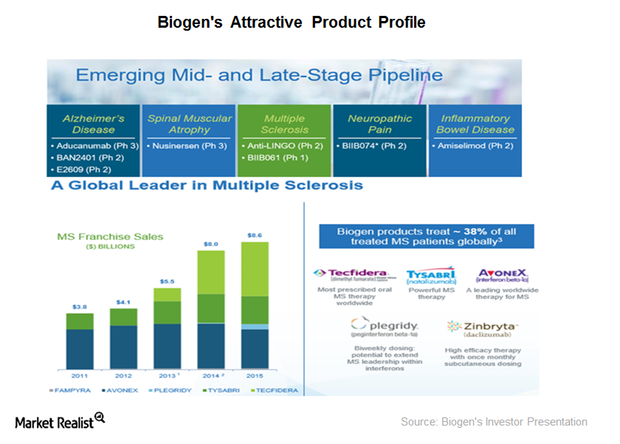

What’s behind Biogen Buyout Rumors?

Since early August 2016, there have been rumors of a likely buyout of Biogen (BIIB) by one of the many interested suitors in the biotechnology industry.

GlaxoSmithKline Increases Top Line in 2Q16

GlaxoSmithKline (GSK) reported a 10.9% increase in its top line in its 2Q16 earnings on July 27, 2016. It met Wall Street analysts’ estimates for revenues and EPS.

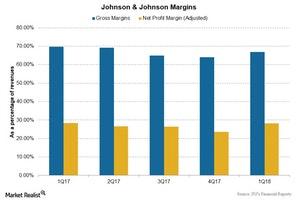

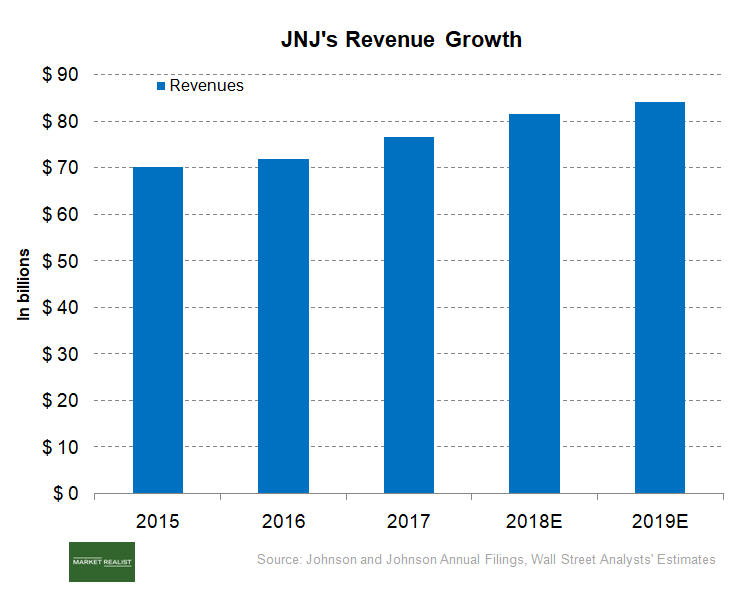

Analyzing Johnson & Johnson’s 1Q18 Profitability

Johnson & Johnson (JNJ) reported revenues of $20.0 billion during 1Q18, 12.6% growth as compared to revenues of $17.8 billion during 1Q17.

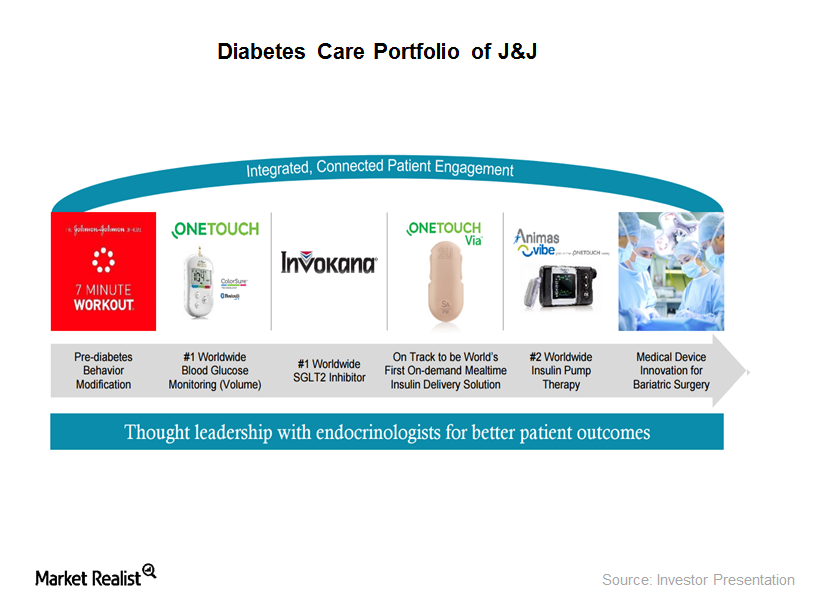

Johnson & Johnson Gets FDA Approval for Type 2 Diabetes Drug

On September 21, 2016, the FDA approved Jannsen Pharmaceuticals’ Invokamet XR for the treatment of adults suffering from Type 2 diabetes.

What Are Generic Drugs and Why Are They Important?

TOM BUTCHER: What are generic drugs, and why are they important? JAMES DUFFY: Generic drugs are drugs that are comparable to their brand-name counterparts. They are comparable in terms of the dosage, effectiveness, and intended use. Generics are important because they are essentially a less-expensive alternative to their brand-name counterparts. This, of course, is expected […]

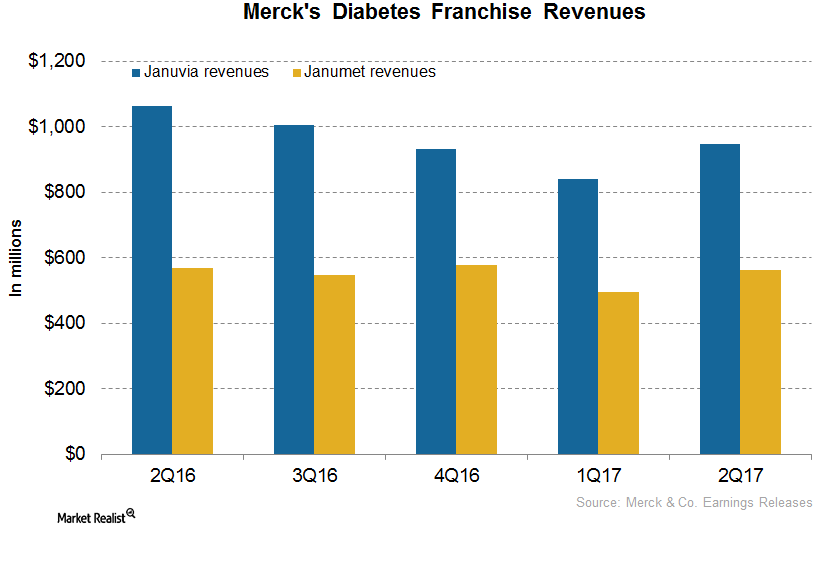

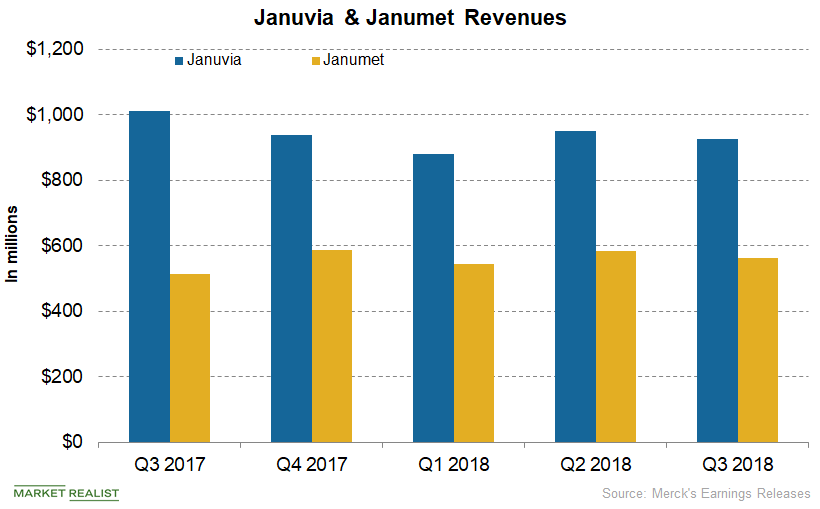

Januvia and Janument: An Update on Merck’s Diabetes Franchise after 2Q17

In 2Q17, Merck’s (MRK) Januvia generated revenues of around $948 million, which reflected an ~11% decline on a year-over-year basis and 13% growth on a quarter-over-quarter basis.

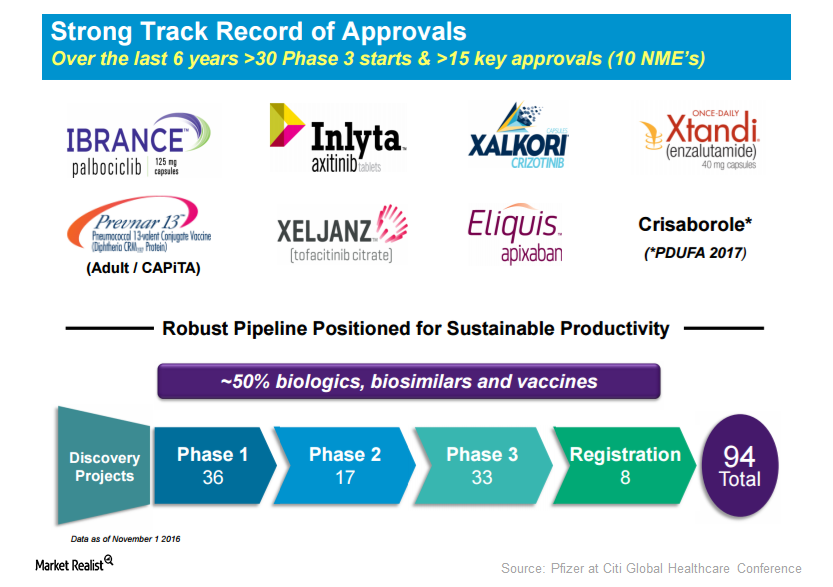

Pfizer Has Strong Track Record since 2010

As of November 1, Pfizer had ~94 projects in various development stages. More than 40% of these projects are in phase three or the registration phase.

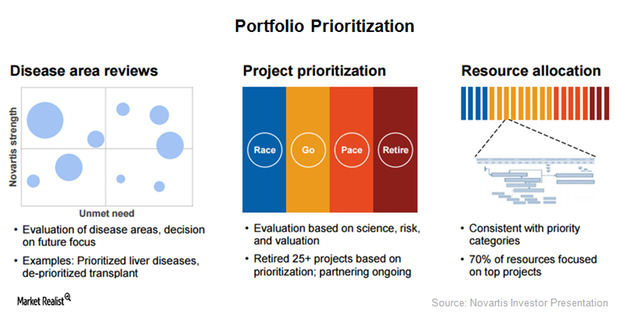

Novartis Focuses on Portfolio Prioritization to Boost Profitability

To ensure long-term relevance as well as quick adaptability to changing market needs, Novartis (NVS) is focusing on five major initiatives in 2017.

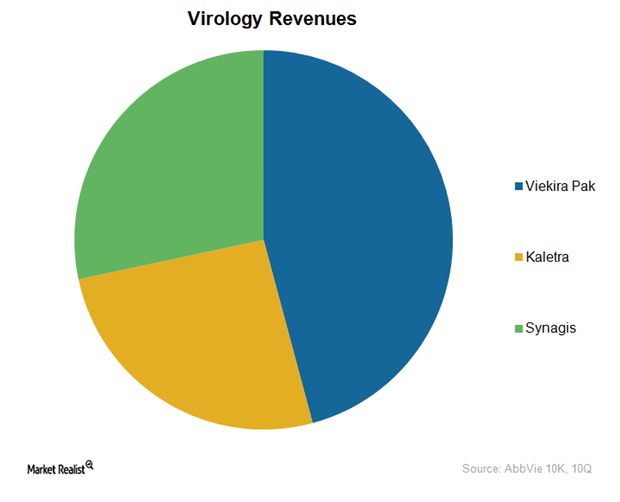

AbbVie Strengthens Its Position in the Virology Segment

In addition to Humira, AbbVie also offers several virology drugs targeting diseases such as hepatitis C, HIV, and respiratory syncytial virus.

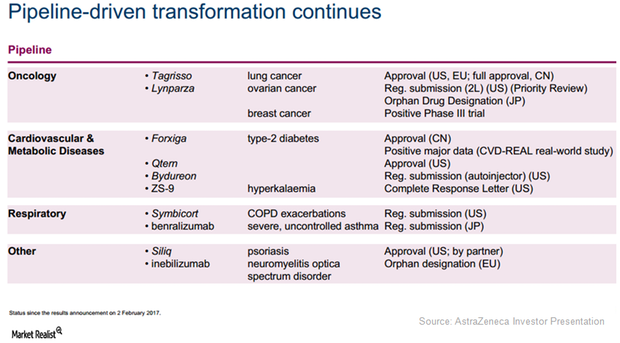

AstraZeneca May Witness a Fall in 2017 Net Profit Margin

Wall Street analysts have projected AstraZeneca’s (AZN) 2017 net profit margins at about 12.2%, which is lower by 300 basis points on a YoY basis.

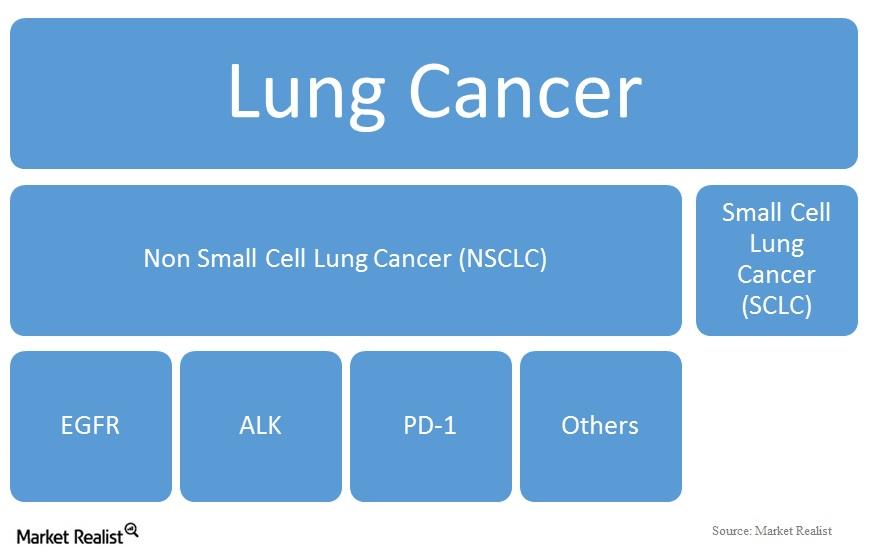

Other Drugs for Non-small Cell Lung Cancer

Approximately 85% of all lung cancers in the United States are non-small cell lung cancers, and 10% to 15% of these are EGFR mutation-positive.

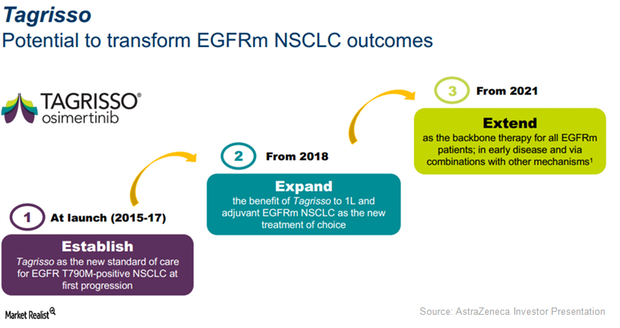

Tagrisso Expected to Be a Key Growth Driver for AstraZeneca in 2017

Launched in Japan in 2Q16, AstraZeneca’s (AZN) 1Q17 revenues for Tagrisso approached $39 million in this major emerging market.

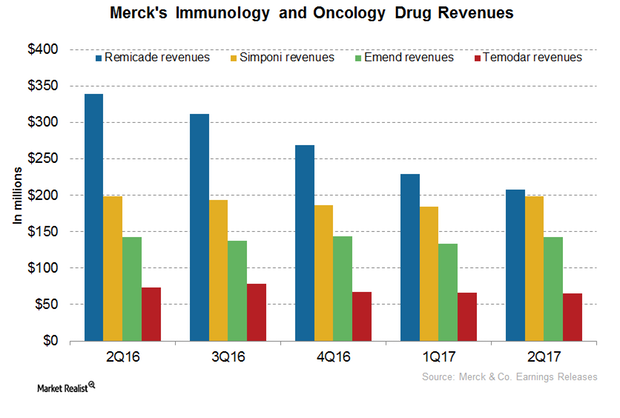

A Look into Merck’s Immunology and Oncology Portfolio

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline year-over-year.

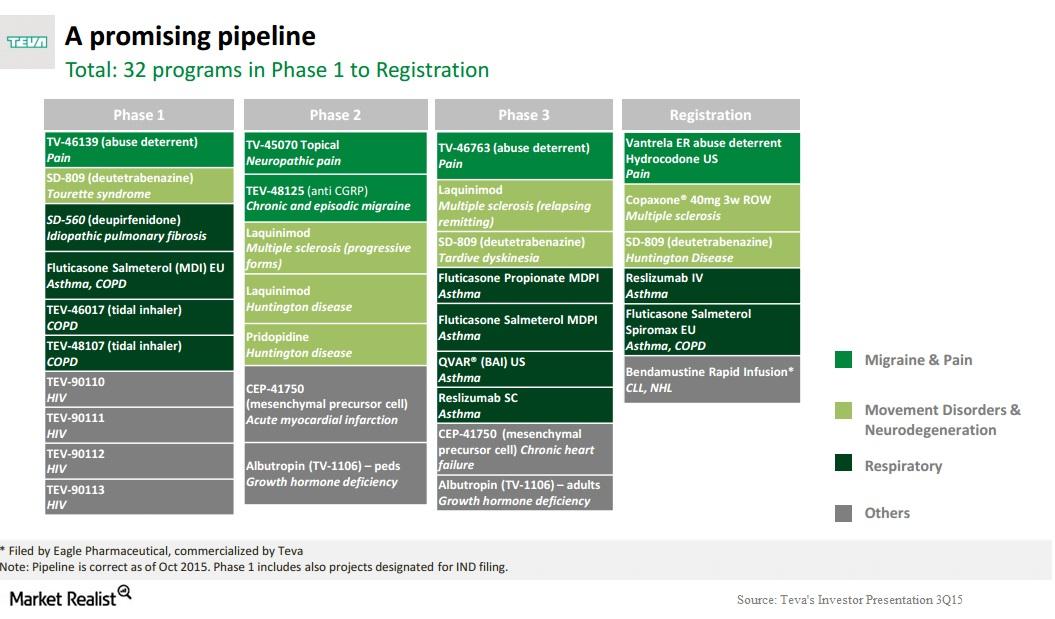

Teva’s Respiratory Drugs Contribute 11% to Specialty Medicines

Teva’s respiratory drugs franchise provides solutions for asthma, COPD, and allergic rhinitis. Respiratory drugs contributed nearly 11% of total revenues for Teva’s Specialty Medicines in 2014.

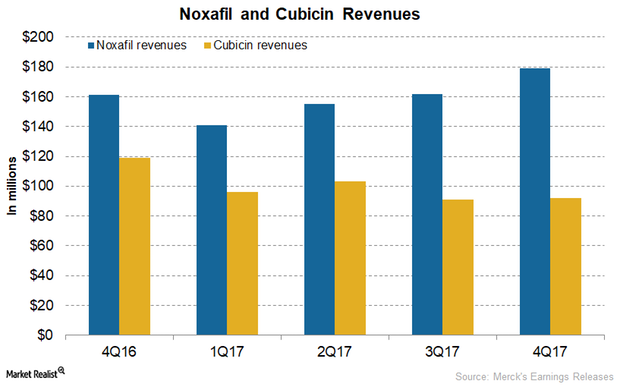

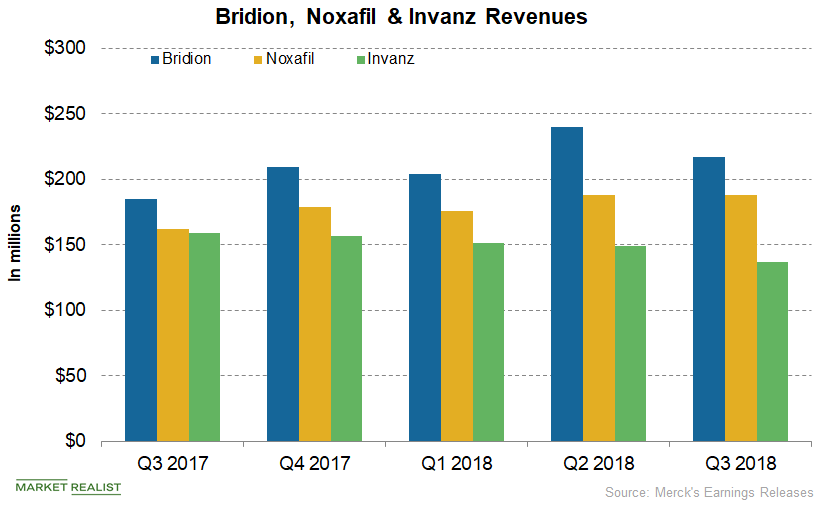

Understanding the Performance of Merck’s Hospital Acute Care Drugs Noxafil and Cubicin

In 4Q17, Merck’s (MRK) Cubicin reported revenues of $92 million, which was ~23% lower on a YoY (year-over-year) basis.

Pfizer Reports 1Q18 Earnings and Revenue Growth

Pfizer (PFE) released its 1Q18 earnings today, reporting another strong quarter for the Innovative health business.

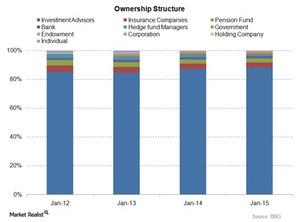

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 2)

(continued from Part 1) 4. What is the nature of the cash flows for generics companies? Stable, driven by a constant demand for prescription drugs? Or lumpy, driven by growth from drugs coming off patent? The larger companies in this sector tend to have stable, steadier cash flows due to established lineups of approved products. […]

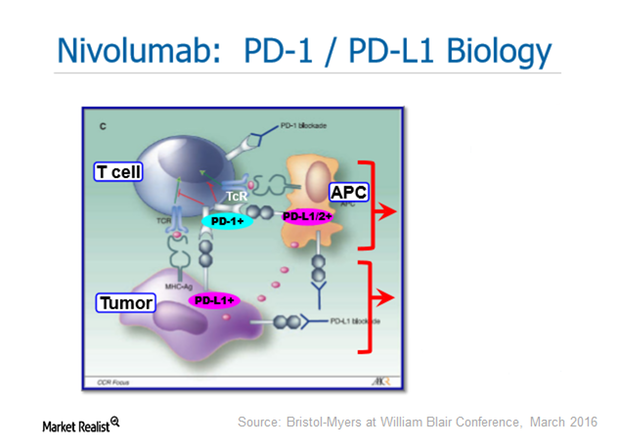

Brace Yourself: AstraZeneca Could Be a Fourth Entrant into the PD-1/PD-L1 Drug Class

The PD-1 (programmed death-1)/PD-L1 (programmed death-ligand 1) class consists of Bristol-Myers Squibb’s Opdivo, Merck’s Keytruda, and Roche’s Tecentriq.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

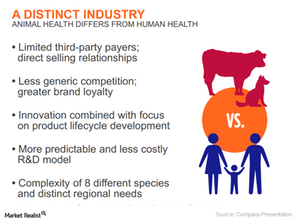

Must-know trends that drive Zoetis’ growth

Demand for Zoetis’ products is driven by a growing population coupled with a rising middle class in emerging markets and increased relocation from rural to urban areas.

‘Medicare for All’ Is No Reason to Drop Healthcare Stocks

While the media caters to Millennial preferences, there’s one economic sector that’s shifting to a more seasoned crowd: healthcare stocks.

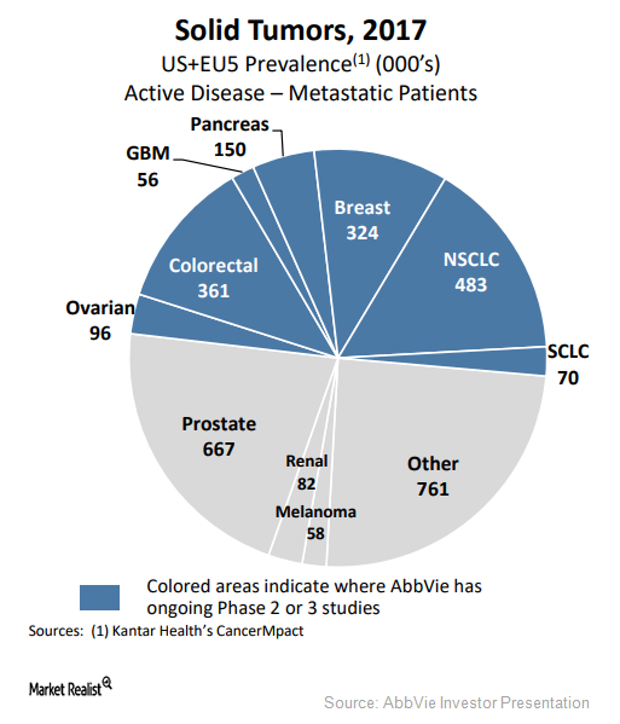

AbbVie Rapidly Advancing Its 2018 Solid Tumor Portfolio

AbbVie (ABBV) is currently evaluating more than 20 investigational therapies targeting solid tumors. Seventeen of them are in Phase 1 trials.

Comparing Pfizer’s and Merck’s Vaccines Businesses

In the first quarter, Pfizer’s (PFE) vaccine franchise reported revenue of $1.61 billion, a YoY (year-over-year) rise of 10.18%.

Comparing Pfizer’s and Merck’s 2019 Revenue Growth Trajectories

In its first-quarter earnings investor presentation, Pfizer (PFE) reaffirmed its 2019 revenue guidance of $52.0 billion–$54 billion.

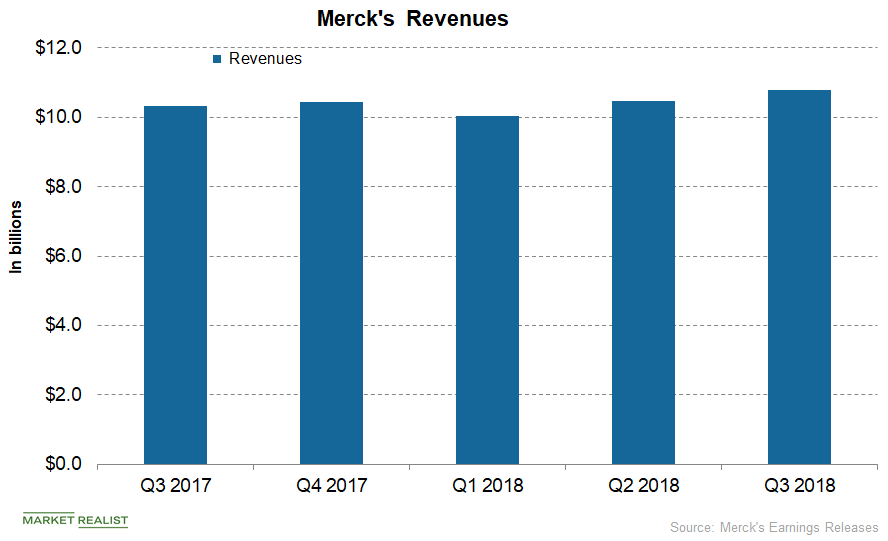

Merck’s Stock Price Has Increased ~34% in 2018

On November 16, Merck’s stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15.

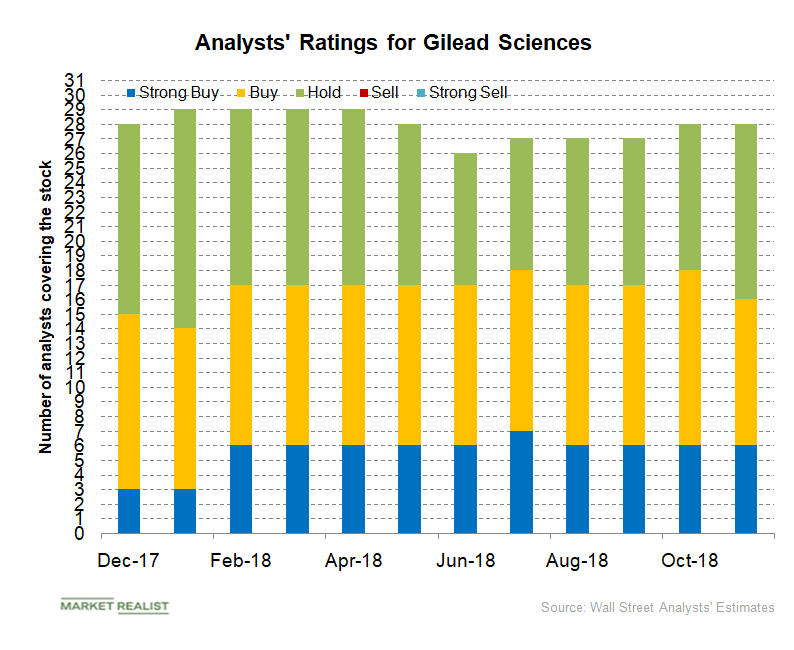

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

A Look at Merck’s Diabetes and Women’s Health Business

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline.

A Performance Overview of Merck’s Hospital Acute Care Business

Merck & Co.’s (MRK) Bridion generated revenues of $217 million in the third quarter, which reflected a ~17% YoY growth.

How Wall Street Analysts View Merck

On October 25, Merck (MRK) announced a dividend of $0.55 per share for its outstanding common stock in the fourth quarter of 2018.

A Look at the Performance of Novartis’s Alcon

Alcon reported revenue of ~$1.82 billion in the second quarter, a 7% rise.

A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

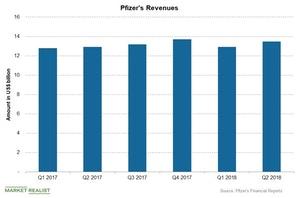

Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

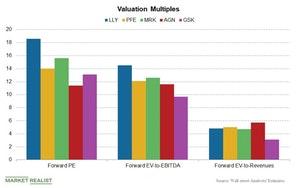

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

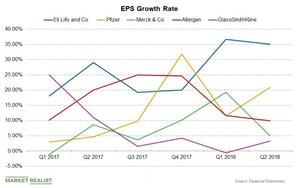

A Review of Pharma Stocks’ EPS Growth Rates

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

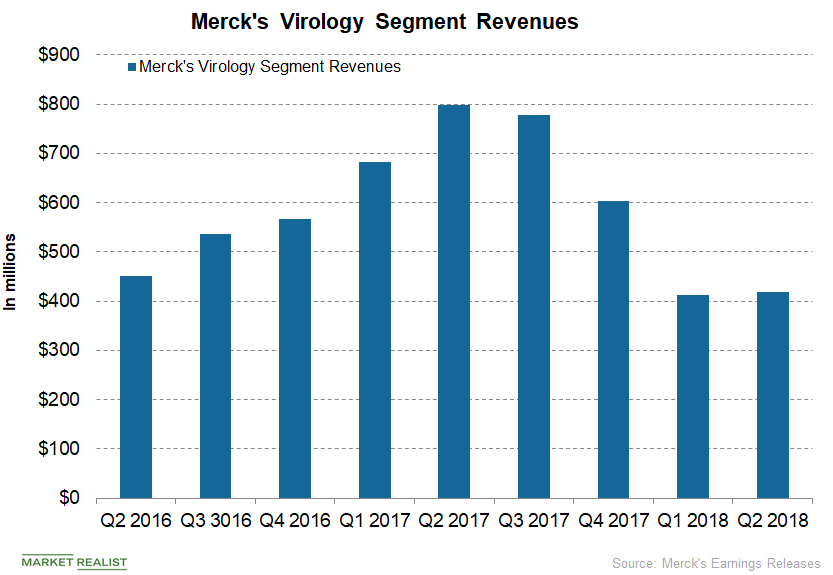

Delstrigo, Pifeltro, and Merck’s Antiviral Therapy Portfolio

Gilead Sciences’ Atripla, Genvoya, and Stribild generated revenues of $663.0 million, $2.2 billion, and $361.0 million, respectively, in the first half of 2018.

Johnson & Johnson’s Financial Performance

In 1Q18, Johnson & Johnson (JNJ) generated revenue of $20 billion, compared with $17.7 billion in 1Q17.

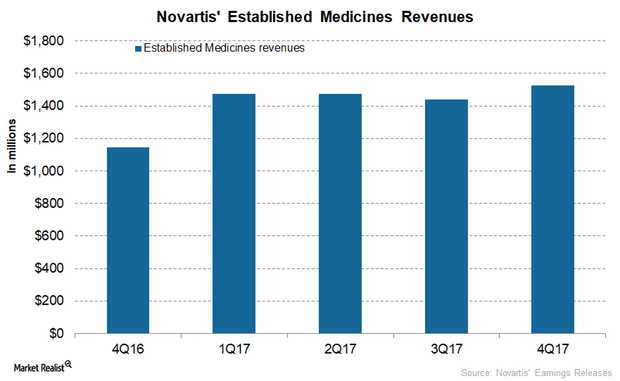

How Did Novartis’s Established Medicines Segment Perform in 2017?

In 4Q17, Novartis’s (NVS) Galvus generated revenues of $327 million, which is ~10% growth on a year-over-year (or YoY) basis and 5% growth quarter-over-quarter.

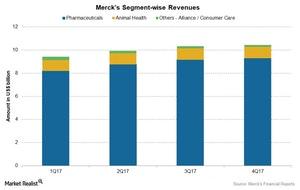

How Merck’s Business Segments Performed

Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

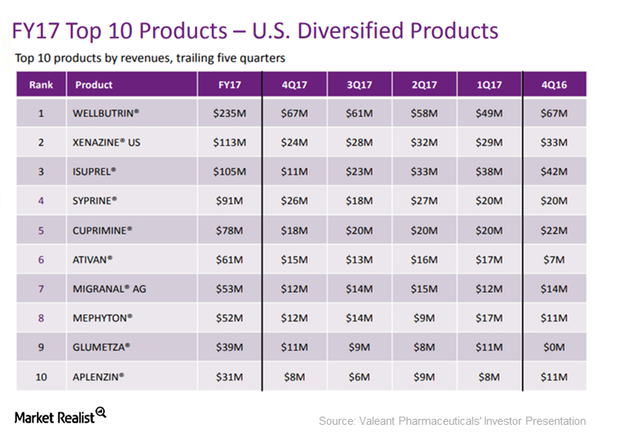

How the Market Reacted to Teva’s Pricing of Its Generic Syprine

On February 9, 2018, Teva Pharmaceuticals (TEVA) announced the US launch of its generic version of 250 mg Syprine capsules.