Merck & Co Inc

Latest Merck & Co Inc News and Updates

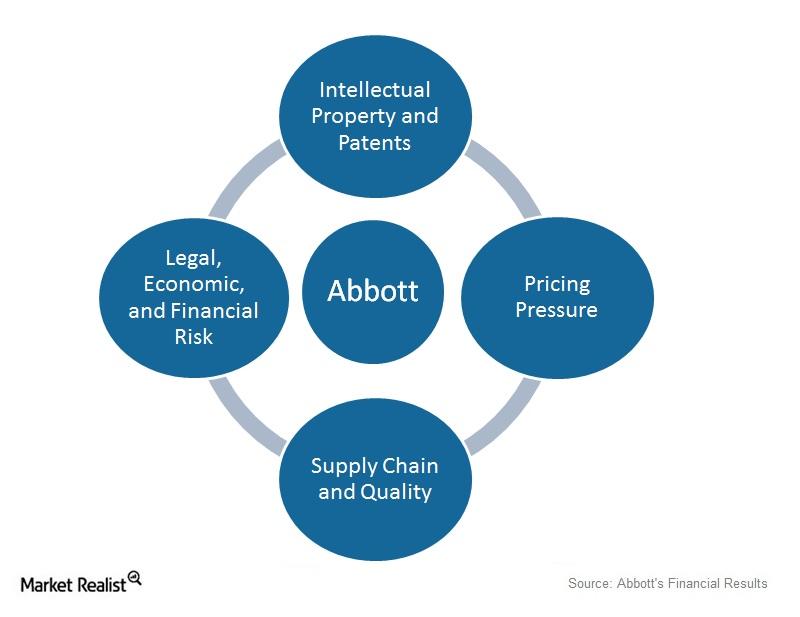

Why Abbott’s Business Is Susceptible to Numerous Risks

Abbott deals with innovative devices and established pharmaceutical products. Any infringement of intellectual property rights may lead to huge losses.

Risks for GlaxoSmithKline

GSK operates in over 170 countries and is subject to political, socioeconomic, and financial factors and risks across the globe.

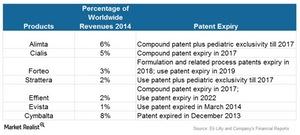

What Risks Does Eli Lilly and Company Face?

The risk of losing market share due to losing patents is the highest risk that Eli Lilly and other pharmaceutical companies face.

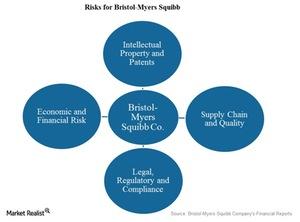

What Are the Risks for Bristol-Myers Squibb?

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights is a huge risk and may lead to huge losses.

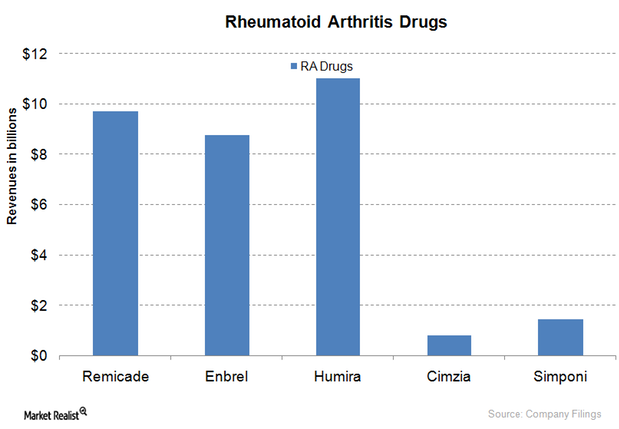

Humira Takes Top Spot for Rheumatoid Arthritis Drugs

There’s no complete cure for rheumatoid arthritis, so most RA drugs are part of disease-management therapy. Humira accounts for 23.5% of the RA market share.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.

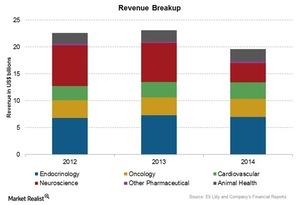

Analyzing Eli Lilly and Company’s Associated Business Segments

The human pharmaceutical segment includes the discovery, development, manufacturing, marketing, and sales of human pharmaceutical products.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

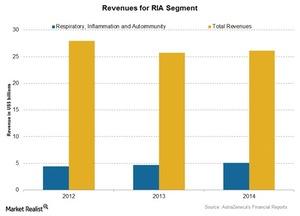

AstraZeneca’s Respiratory, Inflammation, and Autoimmunity Segment

The respiratory, inflammation, and autoimmunity (or RI&A) franchise contributed nearly 19.2% of AstraZeneca’s (AZN) total assets in 2014.

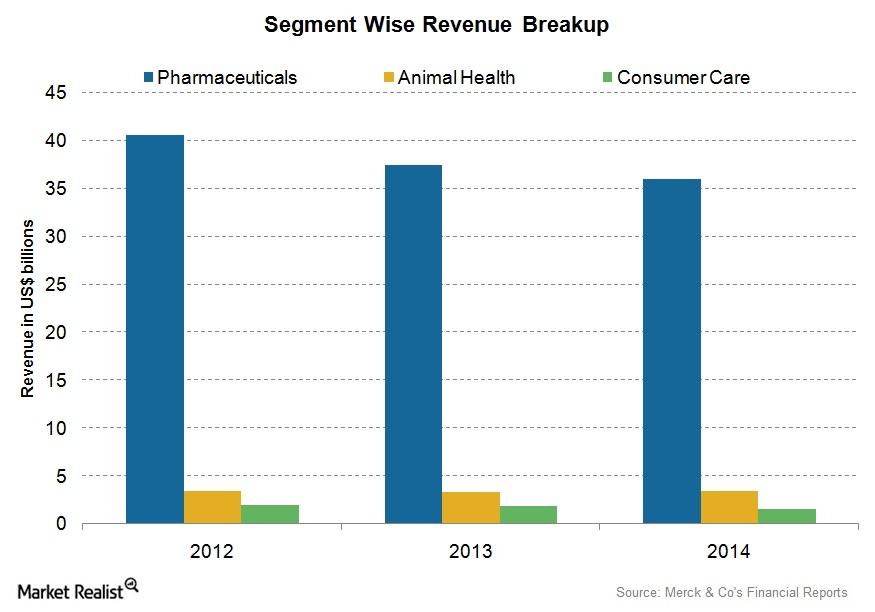

Merck’s Associated Business Segments

Merck’s Pharmaceuticals division accounted for $36.0 billion, or 85%, of group net sales during 2014.

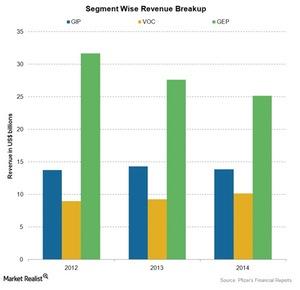

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

Where Does Johnson & Johnson Stand in the Industry?

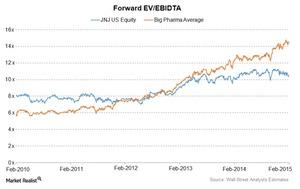

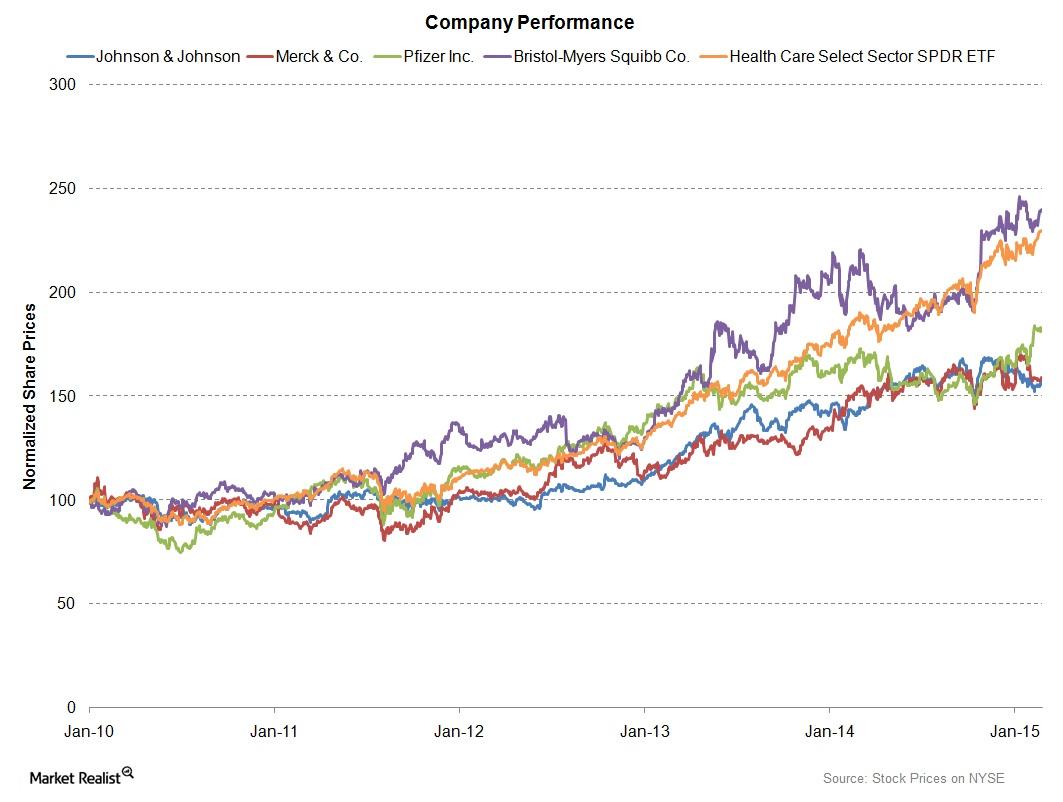

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

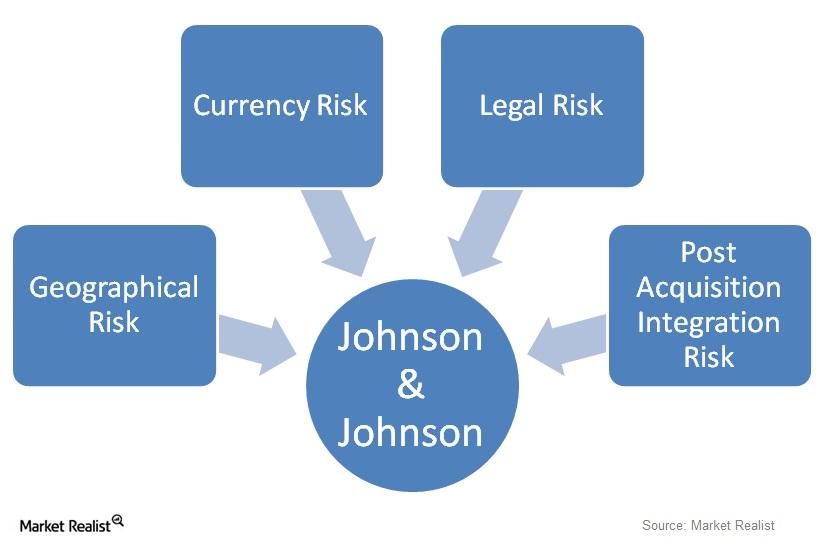

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

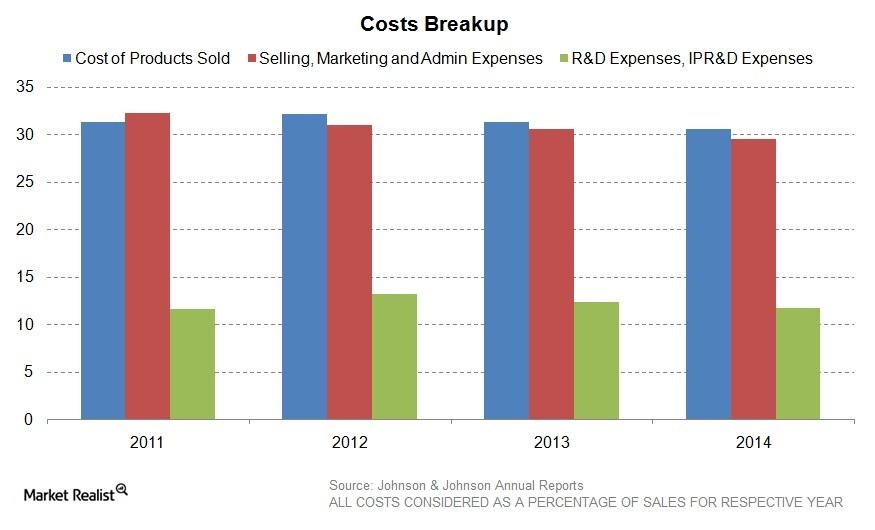

What Were Johnson & Johnson’s Outstanding Expenses?

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

Johnson & Johnson’s Revenue Stream Increased in 2014

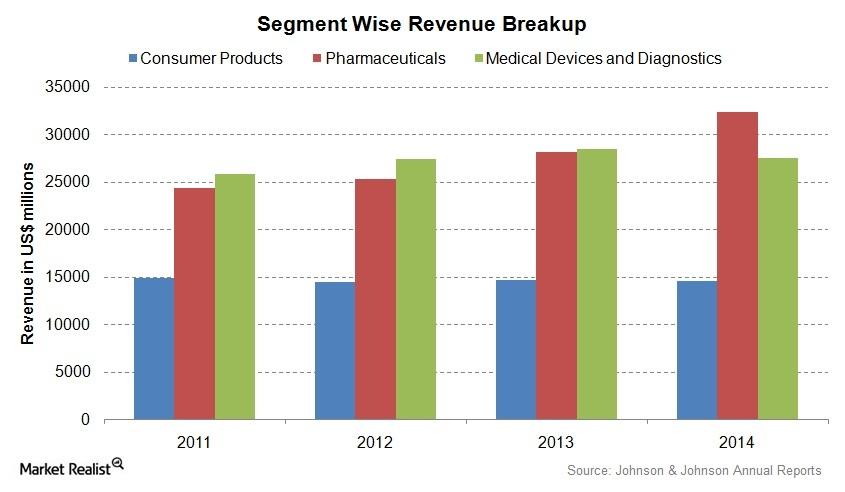

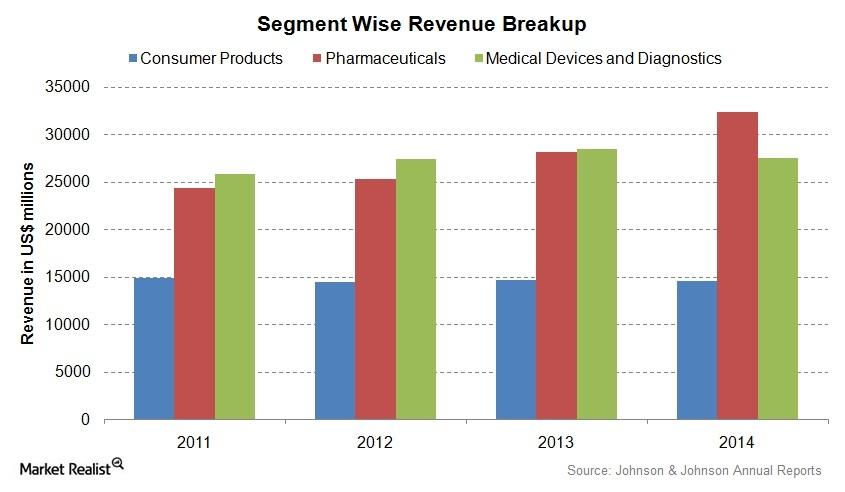

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

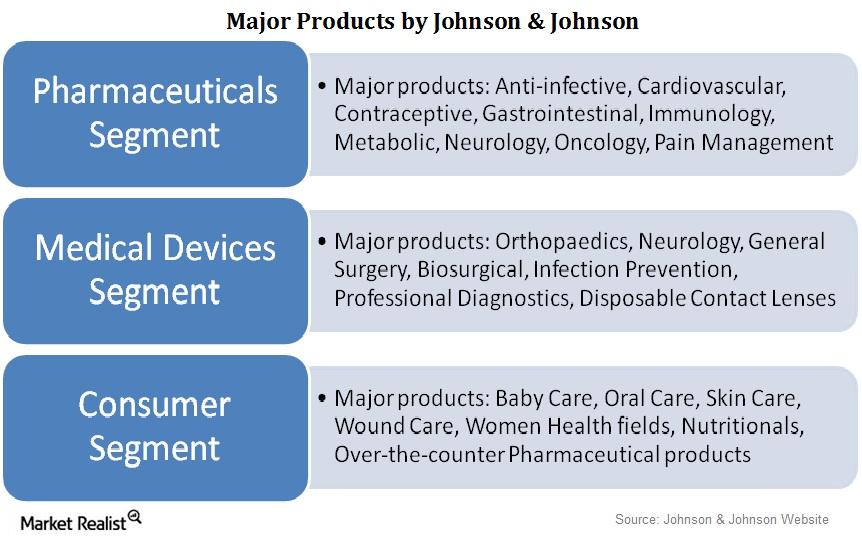

Analyzing Johnson & Johnson’s Three Main Business Segments

Over a period of 128 years, Johnson & Johnson (JNJ) diversified its business into three business segments.

Johnson & Johnson: A Leading Pharmaceuticals Company

Johnson & Johnson is a leading pharmaceuticals and healthcare company in the US. It delivered returns of 13.4% from February 2010 to February 2015.

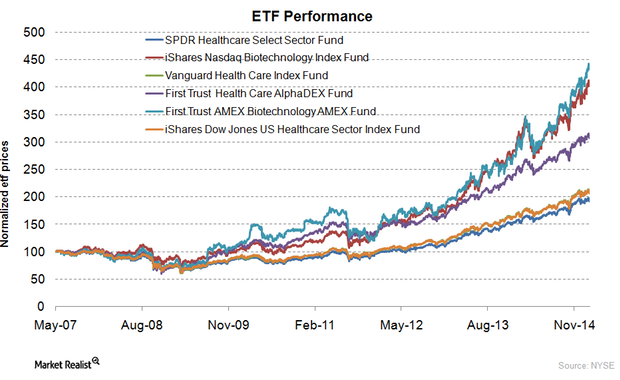

Why should you invest in healthcare ETFs?

Biotechnology funds have performed better than other healthcare ETFs. They invest in companies that use biological processes to produce medical products.

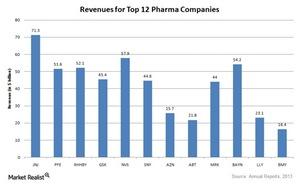

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.