Decoding Humana’s Revenue Stream in 2015

Humana reported revenues of about $54.3 billion in its 2015 results. This amounts to a 12% revenue growth in 2015, compared to ~$48.1 billion in 2014.

Nov. 20 2020, Updated 4:59 p.m. ET

Humana’s 2015 revenues

Humana (HUM) reported revenues of nearly $54.3 billion for 2015. This reflects a 12% revenue growth in 2015 as compared to about $48.1 billion in 2014. The company also completed the sale of Concentra business in June 2015 and expects the effects to show up in its 2016 revenues as well.

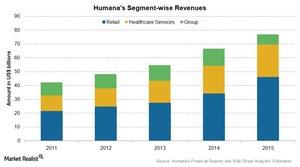

The above graph shows the revenues of Humana in each quarter. Premiums and service revenues drive business for Humana, but the company’s Retail Insurance segment is its largest revenue contributor, followed by its Healthcare Services segment.

Revenue performance

Humana’s business is classified into three segments. Recent changes in these segments on a YoY (year-over-year) basis include the following:

- The Retail Insurance segment contributed ~60% of the company’s total revenues and reported revenues of $45.8 billion in 2015—an increase of 16% over 2014. Over 60% of this segment’s revenues came from the premiums of Individual Medicare Advantage.

- The Healthcare Services segment contributed ~31% of Humana’s total revenues and reported revenues of $23.6 billion in 2015—an increase of ~17% over 2014. Over 87% of this segment’s revenues came from Pharmacy Solutions.

- The Group Insurance segment contributed ~10% of the company’s total revenues and reported revenues of nearly $7.4 billion in 2015—a decrease of ~40% over 2014. Nearly 75% of this segment’s revenues came from fully-insured medical commercial.

In order to divest risk, you might consider ETFs like the Grail American Beacon Large-Cap Value ETF (GVT), which has ~3.4% of its total assets in Humana, or the iShares US Healthcare Providers ETF (IHF), which has ~5.5% of its total assets in Humana. IHF also has 6.6% of its total assets in CIGNA (CI), 13.7% in Unitedhealth Group (UNH), and 6.3% in Anthem (ANTM).