Cigna Corp

Latest Cigna Corp News and Updates

How Can Changing Demographics Impact Investors?

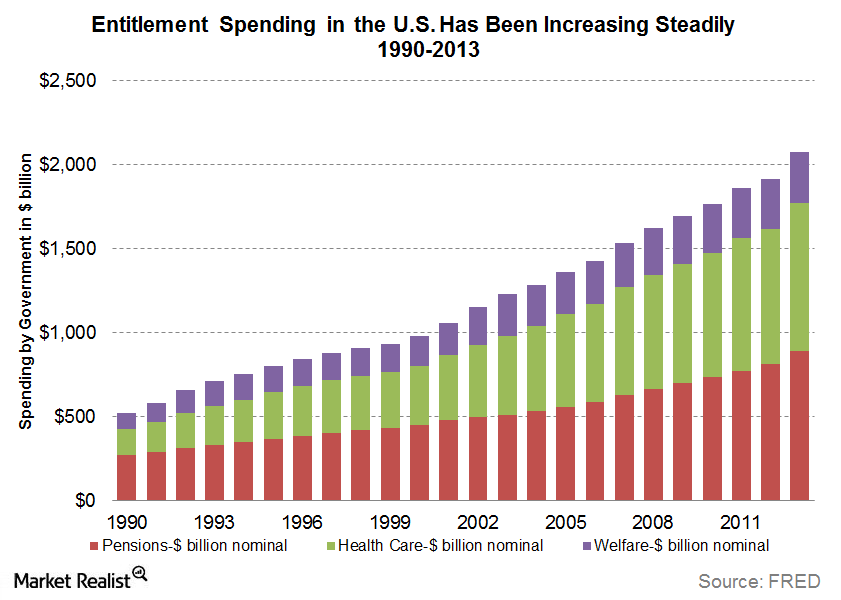

Changing demographics impact investors in many ways. The demand for bonds could increase, putting downward pressure on yields.

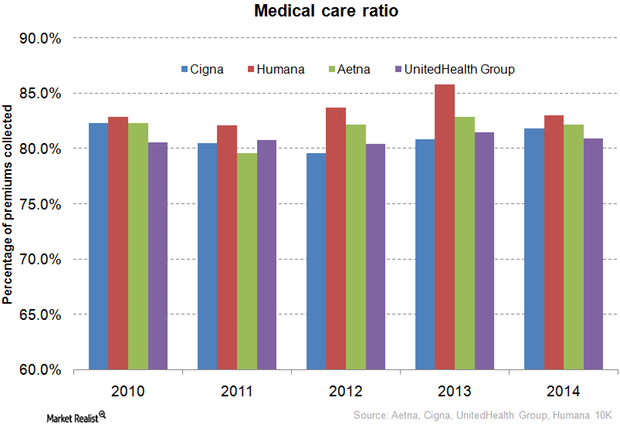

How Does Aetna Compare to Its Peers in Medical Care Ratio?

The medical care ratio of health insurance companies is calculated as the ratio of the total money spent in health care claims to premiums earned.

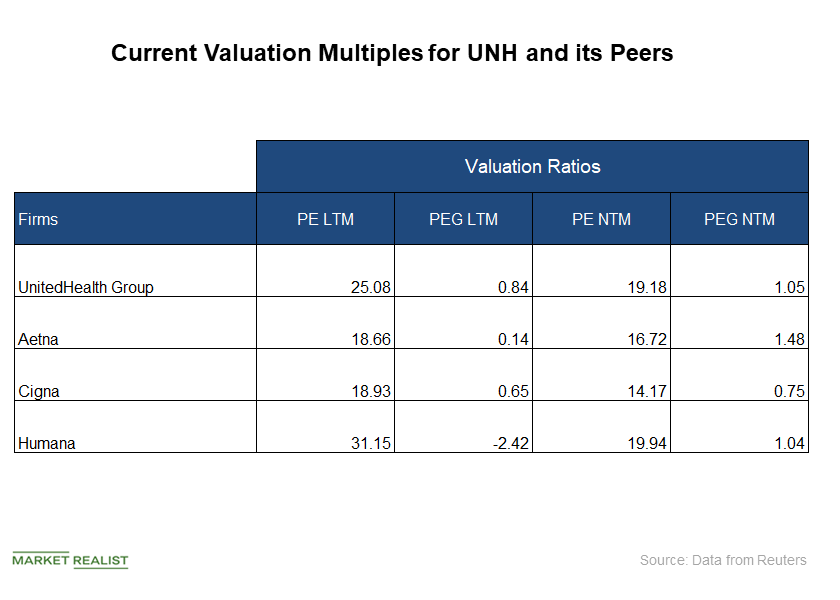

How Does UNH’s Valuation Look in October?

UnitedHealth Group is a leading managed healthcare firm in the United States.

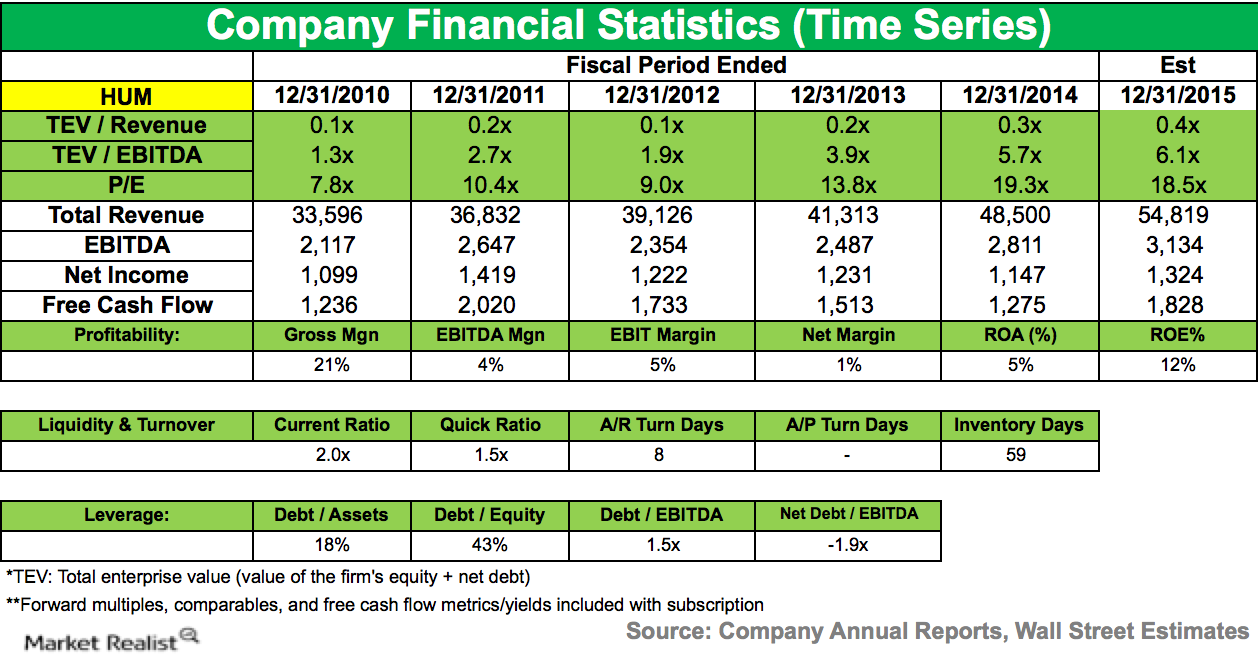

Eminence Capital Reduces Position in Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The company accounted for 1.33% of the fund’s 4Q14 portfolio.

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

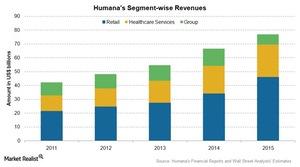

Decoding Humana’s Revenue Stream in 2015

Humana reported revenues of about $54.3 billion in its 2015 results. This amounts to a 12% revenue growth in 2015, compared to ~$48.1 billion in 2014.

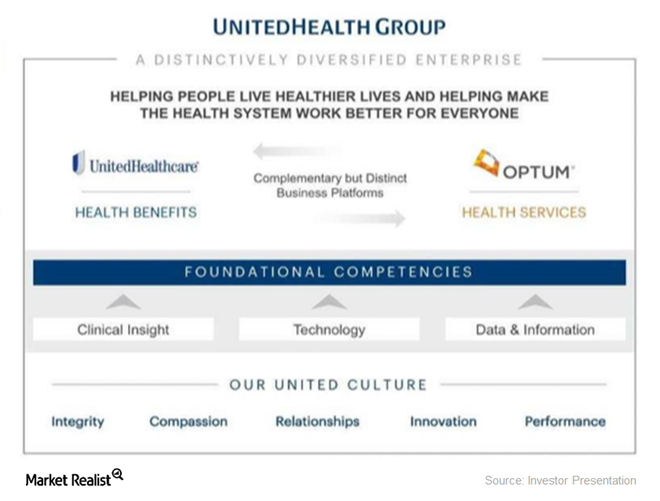

How Is UNH’s Optum Business Positioned in the Industry?

UnitedHealth Group is, by revenue, the largest healthcare company in the world.

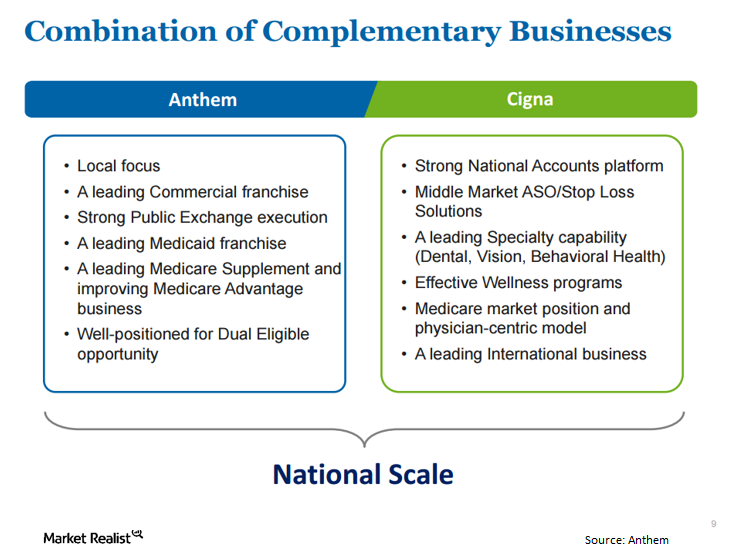

Anthem Files Bear Hug Letter for Cigna on June 21

On June 21, Anthem (ANTM) filed a bear hug letter for Cigna (CI). A bear hug letter is a formal press release in which an acquiring company discloses its interest in a target company.

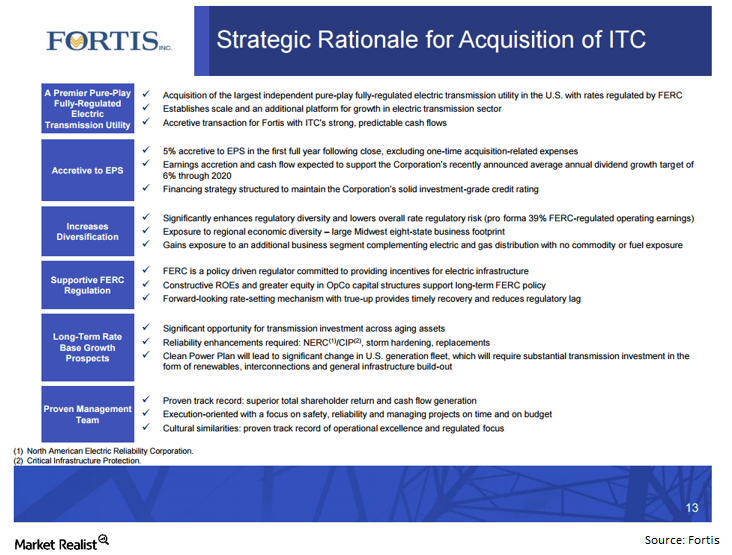

What’s the Rationale for the ITC-Fortis Merger?

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. Fortis intends to sell a 19% stake in order to help finance the transaction.

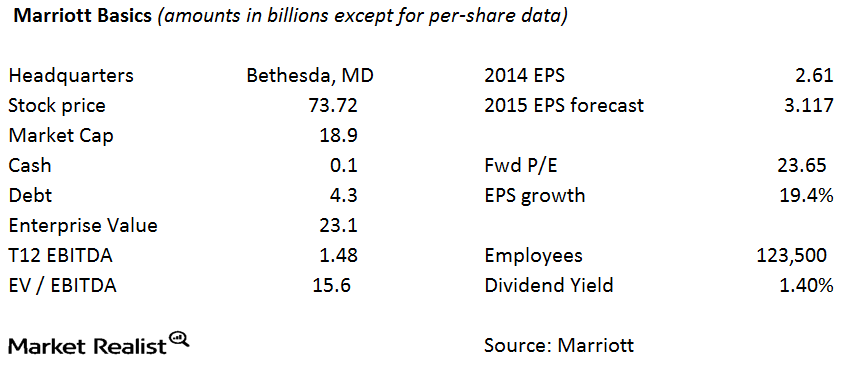

Rationale for the Starwood-Marriott Merger

With the Starwood-Marriott merger, the companies expect to generate at least $200 million in annual cost savings beginning in the second year after the deal closes.

‘Medicare for All’ Is No Reason to Drop Healthcare Stocks

While the media caters to Millennial preferences, there’s one economic sector that’s shifting to a more seasoned crowd: healthcare stocks.

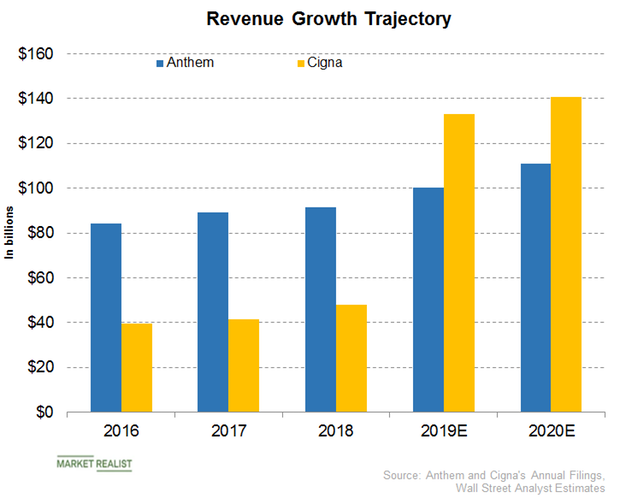

ANTM or CI: Comparing Their Revenue Growth in 2019

In its fourth-quarter earnings press release, Anthem (ANTM) guided for 2019 operating revenue of $100 billion, a YoY (year-over-year) rise of $8.7 billion.

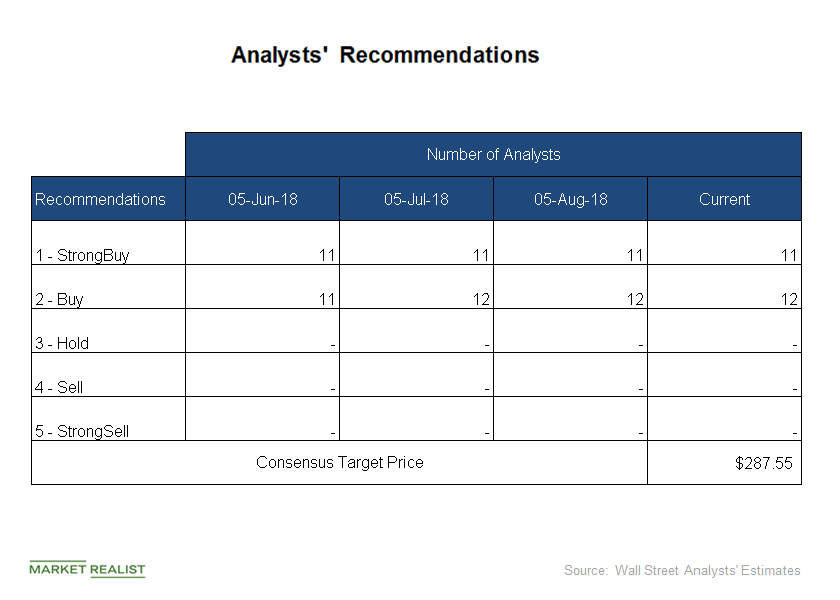

Analysts Raise Target Prices on UNH Stock in September

Of the 23 analysts covering UNH stock, all of them have “buy” or “strong buy” recommendations for UnitedHealth Group.

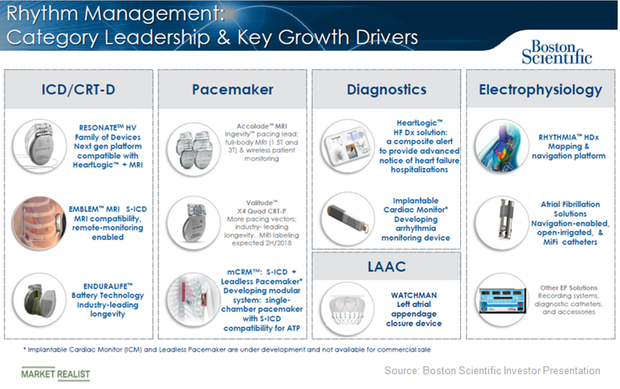

BSX Focuses on Advancing Its Cardiac Rhythm Management Portfolio

Boston Scientific expects the results from its UNTOUCHED trial by 2020.

How Has Universal Health Services Fared Compared to Peers?

Between November 22 and February 21, Universal Health Services stock has risen 19% to reach $117.

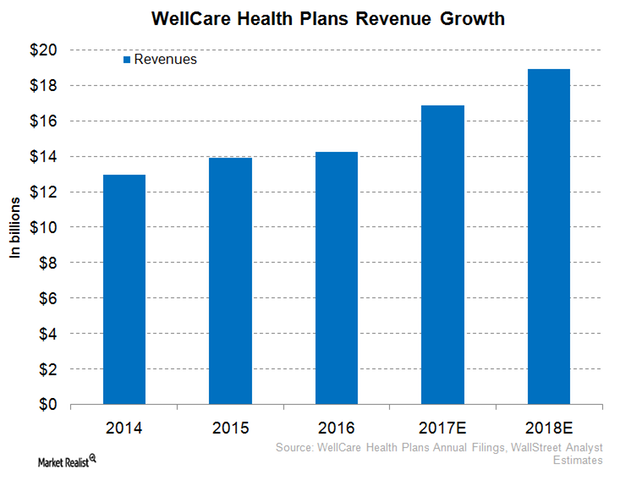

WellCare Health Plans Expects Robust Revenue Performance in 2017

In 1Q17, WellCare Health Plans (WCG) reported revenues of ~$3.9 billion, which totals year-over-year growth of around 11.7%.

Centene Saw Robust Rise in Medicaid Enrollments in 1Q17

In 1Q17, around 12.1 million members were enrolled in Centene’s (CNC) various healthcare plans, which is a year-over-year (or YoY) rise of around 600,000 beneficiaries.

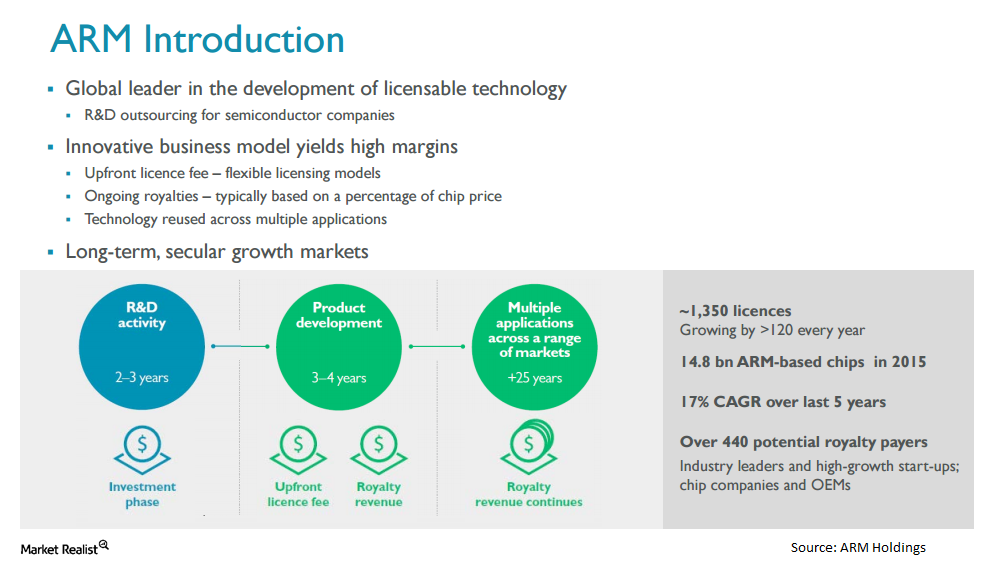

What Are the Conditions for the ARM Holdings-Softbank Merger?

ARM Holdings and Softbank are merging in a cash transaction. In an unusual step, there aren’t regulatory or antitrust conditions to the transaction.

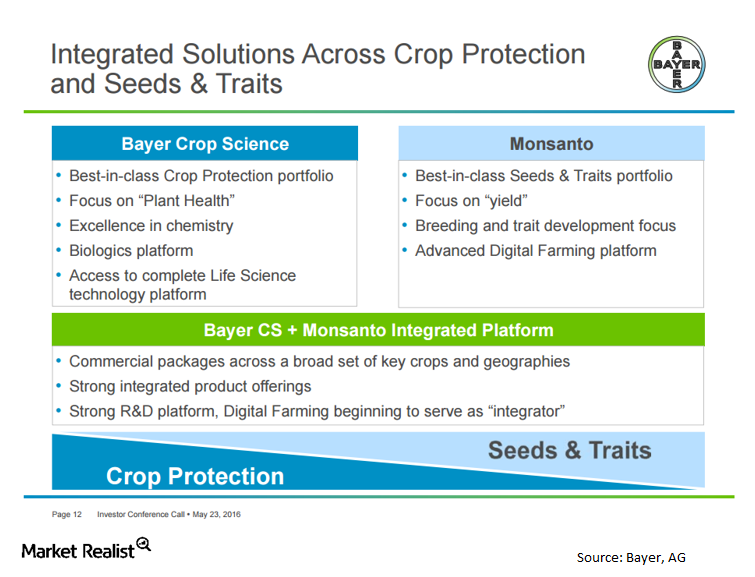

What’s the Rationale for the Bayer-Monsanto Deal?

In the Monsanto-Bayer deal, Bayer’s shareholders should expect to see mid-single-digit accretion to core EPS (earnings per share) in the first year and double-digit accretion thereafter.

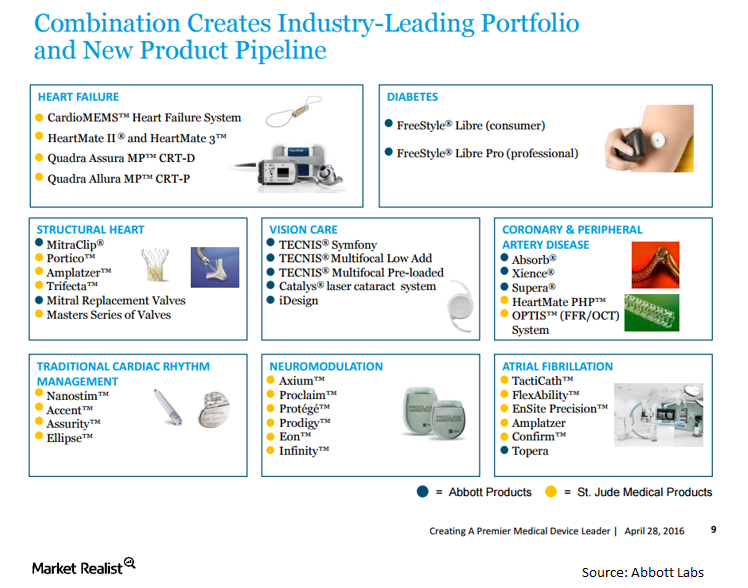

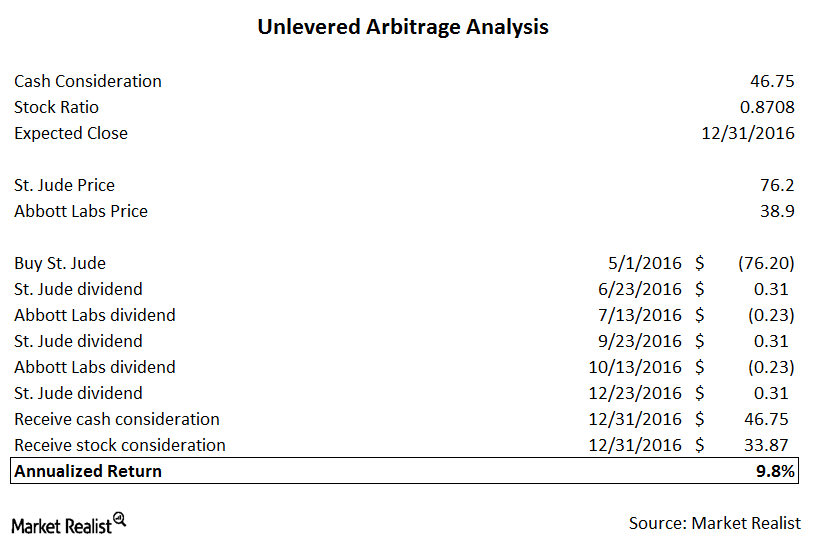

Rationale for the St. Jude Medical-Abbott Merger Transaction

Abbott Labs is buying St. Jude Medical for about $30 billion in cash, stock, and assumed debt to become a dominant player in the cardiovascular health space.

Abbott Buys St. Jude Medical for $85 per Share in Cash and Stock

On April 28, Abbott Labs and St. Jude Medical announced an agreement where Abbott will buy St. Jude for $30 billion in cash, stock, and assumed debt.

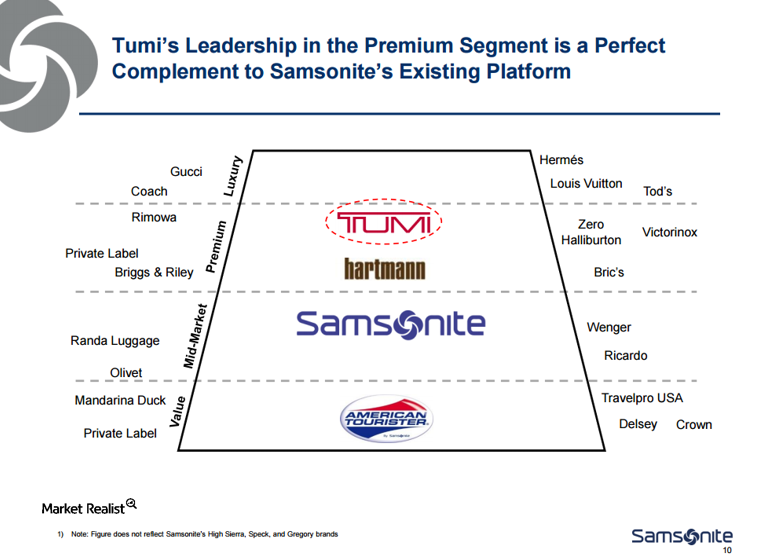

Can the Samsonite-Tumi Merger Get Antitrust Approval?

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will need to file for Canadian antitrust approval.

What’s the Rationale for the Samsonite-Tumi Transaction?

Hong Kong-based Samsonite is buying luxury brand Tumi (TUMI) in a $1.8 billion deal. Samsonite is mainly known as a utilitarian luggage company.

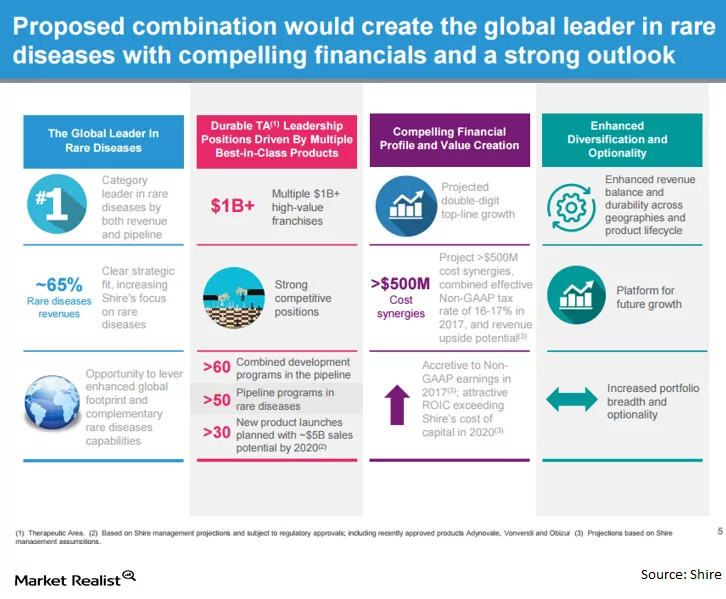

The Baxalta–Shire merger: Basics of Shire Pharmaceuticals

Shire is a biopharmaceutical company that focuses on rare diseases. Shire is best known for its treatments in ADHD, and the market here is quite large.

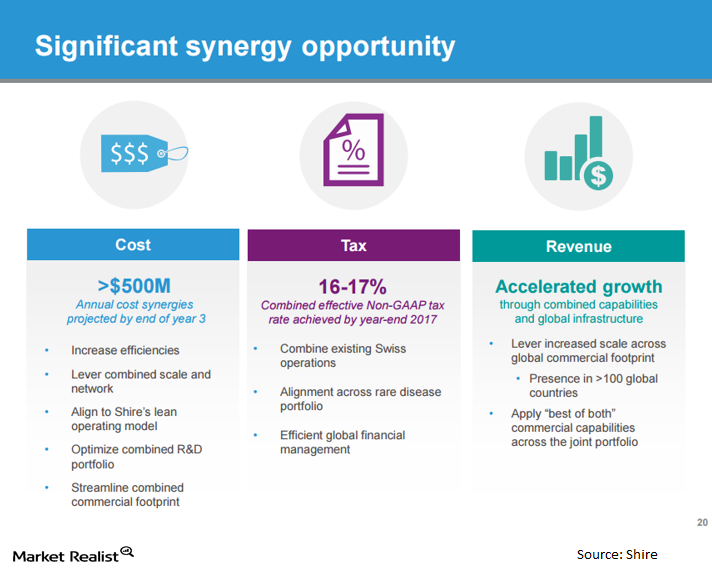

Growth and Synergies Drive the Baxalta–Shire Merger

The Baxalta–Shire merger could create the top platform for rare diseases in the world. Baxalta brings Advate, a treatment for hemophilia, a rare blood disease.

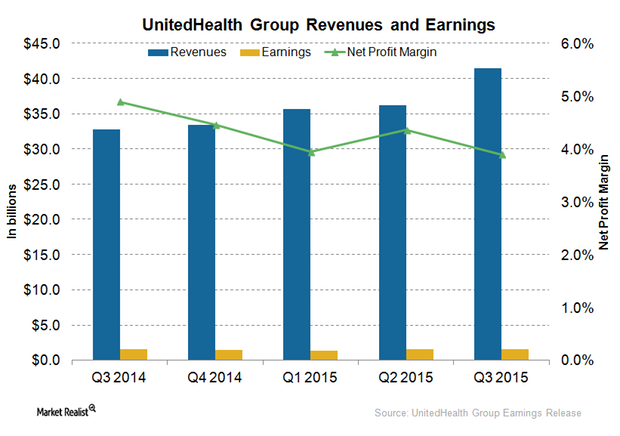

Why UnitedHealth Group’s Net Profit Margins Fell

In 3Q15, despite a rise of total revenues by 27% year-over-year, which includes 10% organic growth, UnitedHealth Group reported a decline of about 1% in net profit margins.

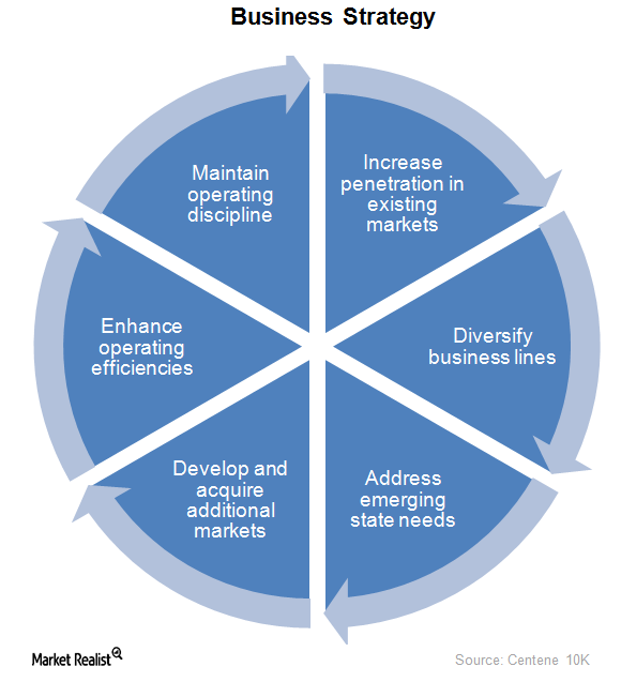

What’s Centene’s Business Strategy?

Centene’s business strategy focuses on improving the quality of its services. It provides services to the uninsured and underinsured population in 22 states in the US.

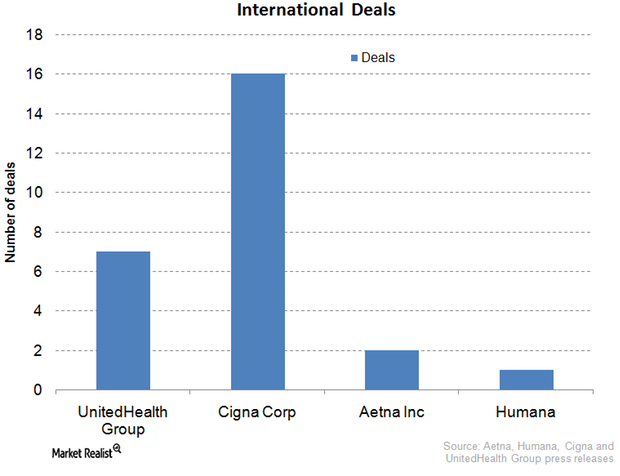

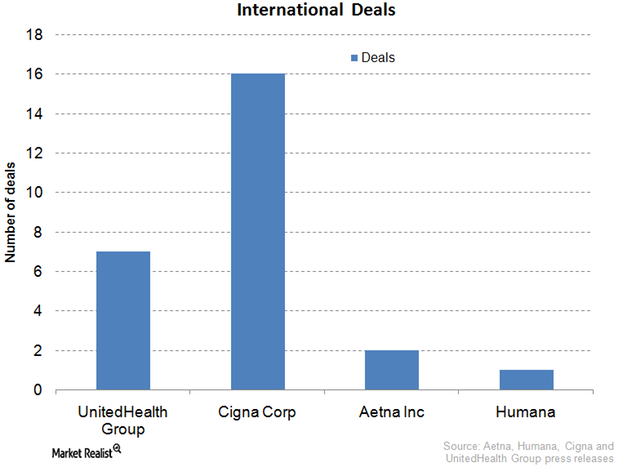

Cigna: International Expansion Key to Growth Strategy

International expansion is a hallmark of Cigna’s business. Cigna has inked deals in Turkey, Belgium, Brazil, Japan, Taiwan, Thailand, et cetera.

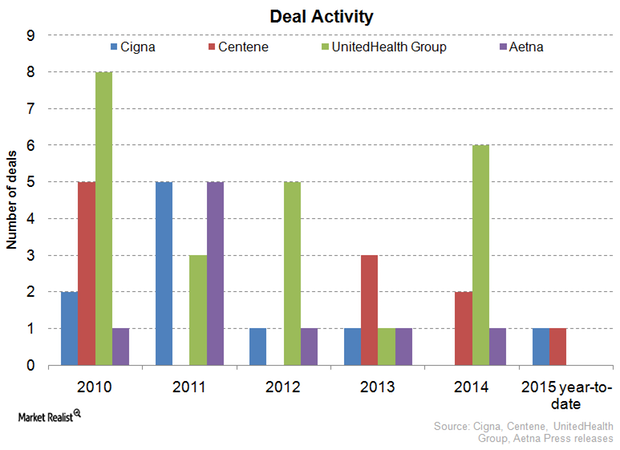

Cigna Diversifies Via Mergers and Acquisitions

Among Cigna’s major strategic mergers and acquisitions was HealthSpring, acquired in 2012 for a consideration of $3.8 billion.

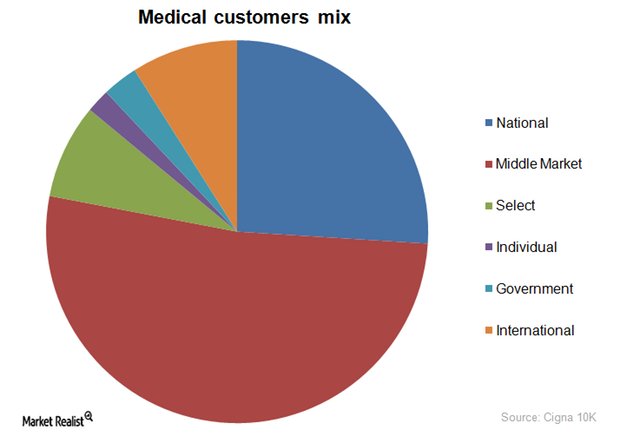

Cigna’s Customer Segments a Healthy Mix

Customer segments The players in the private health insurance industry (IYH) aim for a favorable enrollment mix to reduce taxes and other liabilities while at the same time generating sustainable profits. Accordingly, managed care organizations such as Humana (HUM), Aetna (AET), Anthem, Cigna (CI), and WellCare Health Plans (WCG) are increasingly focusing on government-sponsored and international enrollments to balance […]

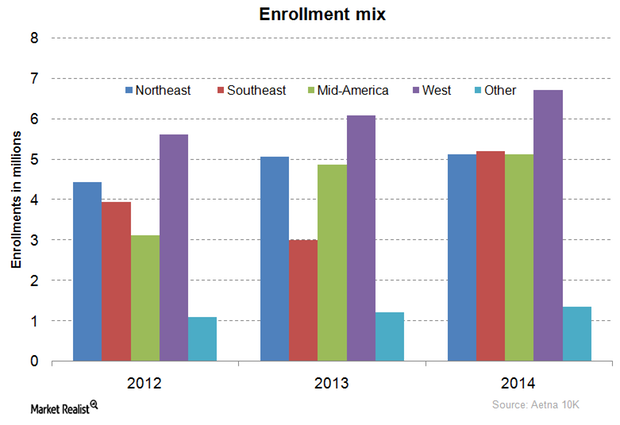

How Is Aetna’s Membership Distributed Across Its Key Markets?

Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the Mid-US, and finally consolidated international enrollments.

What’s UnitedHealth Group’s strategy for international expansion?

The private health insurance industry in the US has been expanding its footprint in international markets. International markets are less penetrated and competitive.

What are UnitedHealth Group’s key business segments?

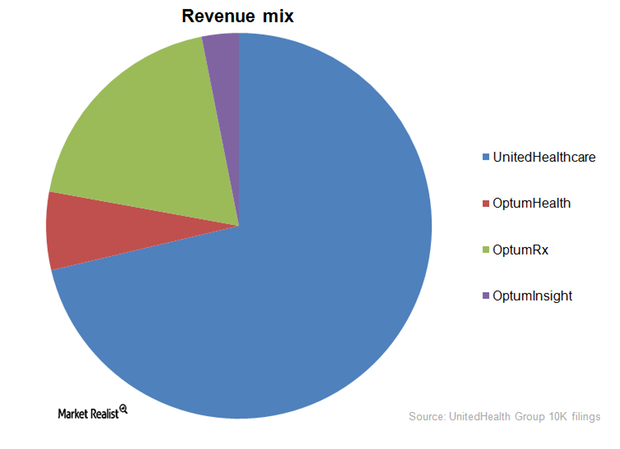

Out of UnitedHealth Group’s (UNH) four business segments, UnitedHealthcare accounted for 71.3% of the company’s revenue.

What Are Aetna’s Key Business Segments?

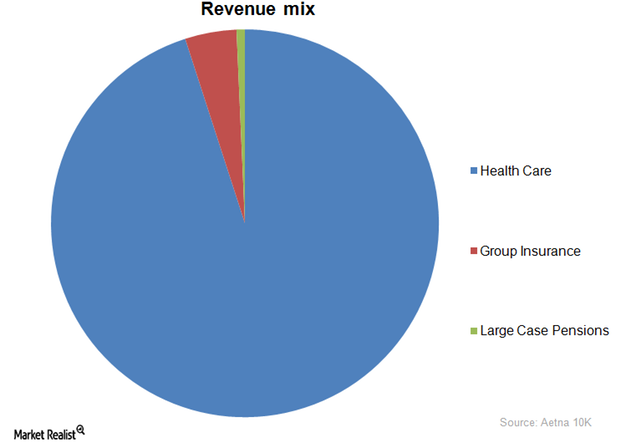

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue.

A Key Overview of Aetna, One of the Largest Insurance Providers

With a market capitalization of $35.1 billion, Aetna (AET) is one of the largest insurance providers in the US.

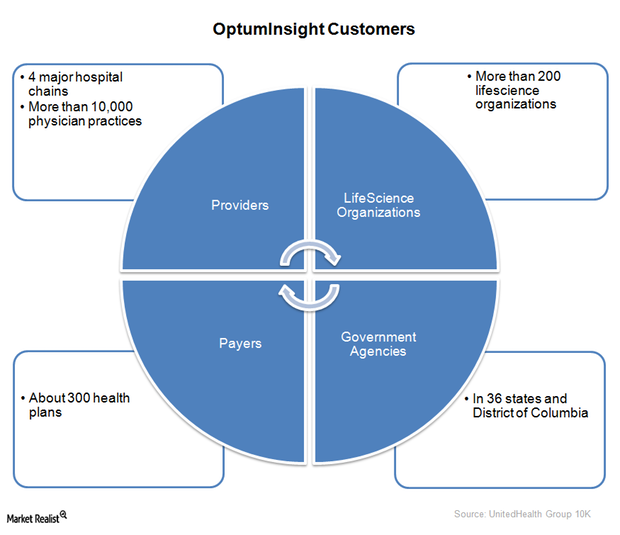

UnitedHealth Group’s OptumInsight – improving medical care

In 2014, OptumInsight released a population health analytics tool—OptumOne. It enables hospitals to improve the quality of care.

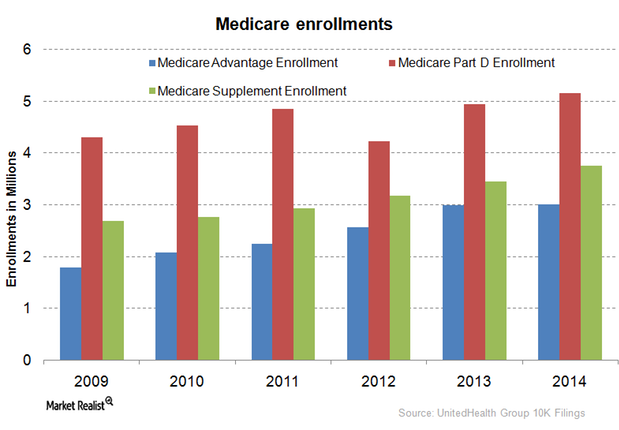

UnitedHealth Group provides services to Medicare beneficiaries

Medicare Part D is a federal government program. It subsidizes prescription drug expenses for Medicare beneficiaries.

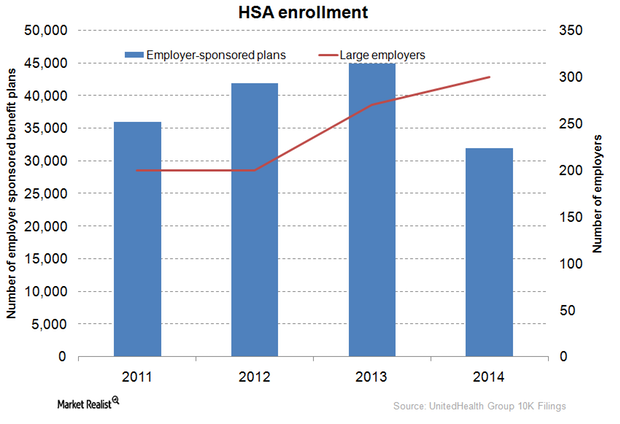

What are UnitedHealth Group’s consumer engagement products?

The private health insurance industry offers a diverse range of products. The products combine health plans with financial accounts to cater to different consumers’ needs.

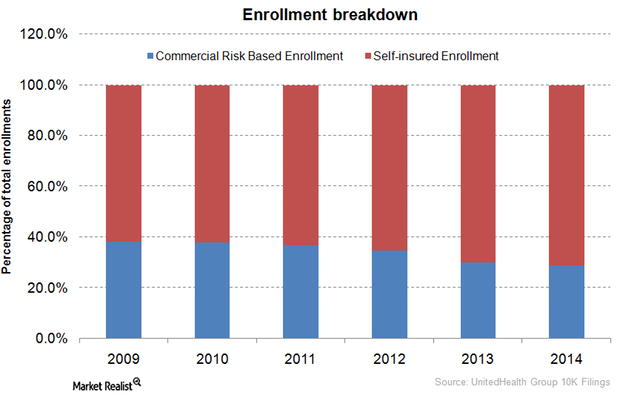

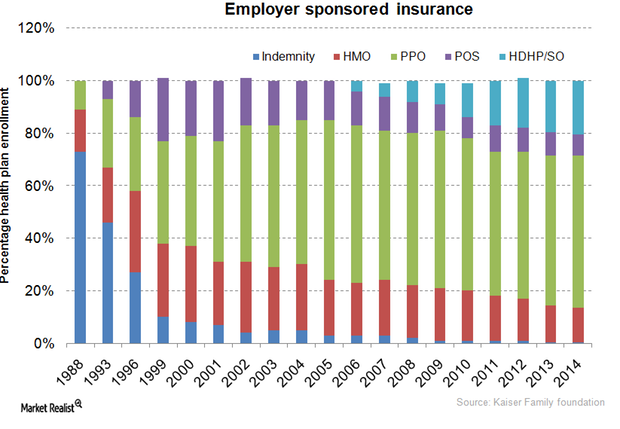

UnitedHealth Group’s employer-sponsored and individual insurance

Employer-sponsored coverage, a major form of insurance, increasingly adopted self-insured plans. They’re more cost-effective and flexible than fully-insured plans.

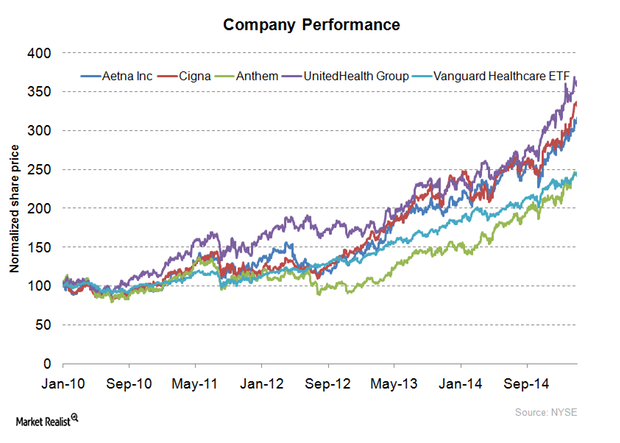

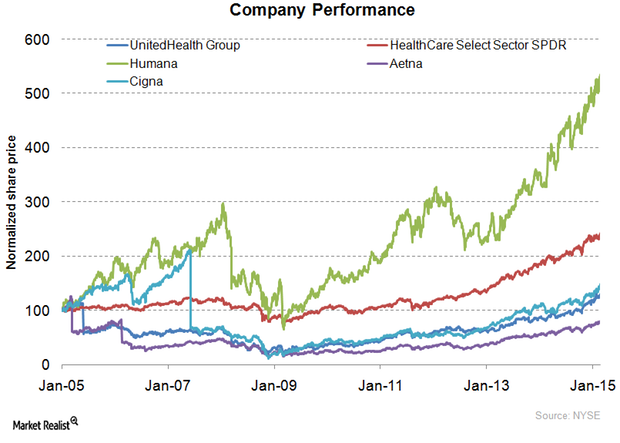

UnitedHealth Group: The history of a health insurance giant

With a market capitalization of $107.1 billion, UnitedHealth Group is the largest insurance provider in the US. It registered revenue worth $130.5 billion in 2014.

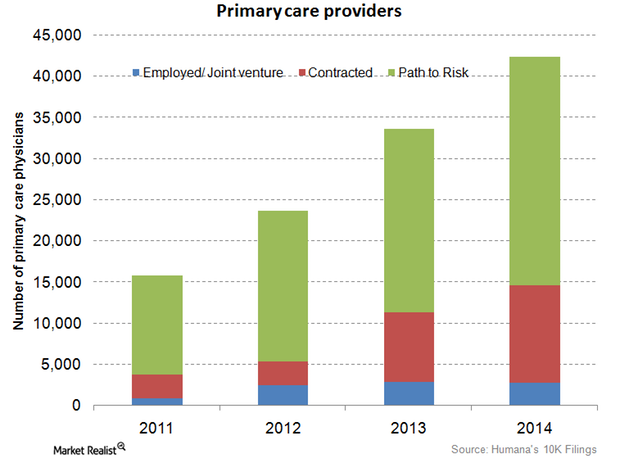

Humana employs and contracts more primary-care physicians in 4Q14

Humana’s employed and contracted primary-care physicians rose by 29.2% from 11,300 in 2013 to 14,600 in 2014.

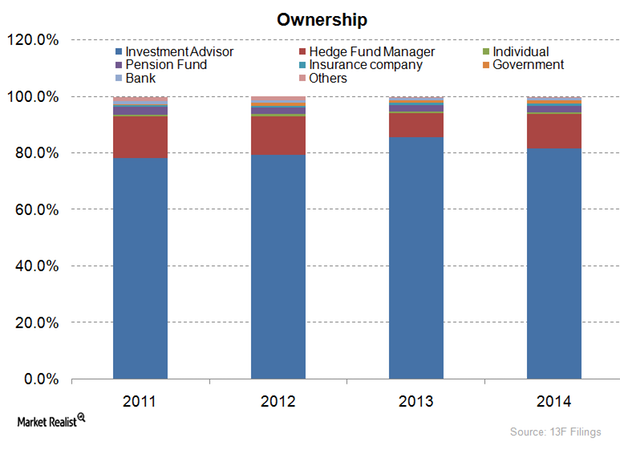

Most Humana stakeholders are mutual funds or advisers

Investment advisers or mutual funds are the main stakeholders in Humana, accounting for about 81.7% of its total ownership picture.

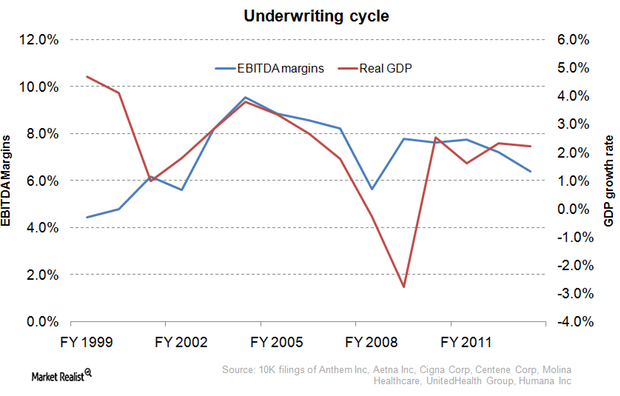

Underwriting cycle: What health insurance investors need to know

The underwriting cycle results from the uncertainty of predicting healthcare expenses and the fluctuating participants in the health insurance industry.

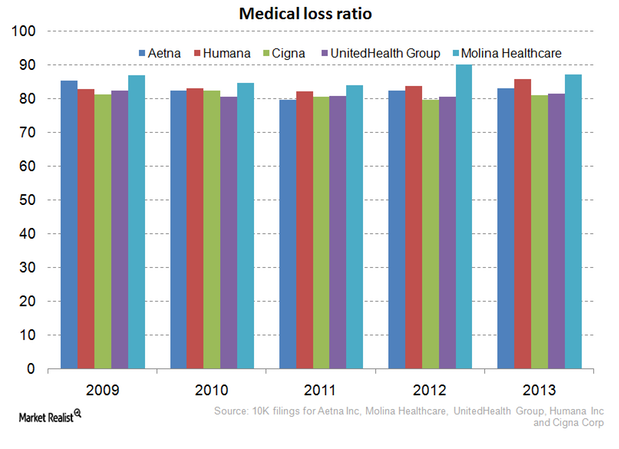

Why the Affordable Care Act hurts the managed care industry

The Affordable Care Act requires health insurers spend at least 80% of premiums on health expenses for small group plans and 85% for large group plans.

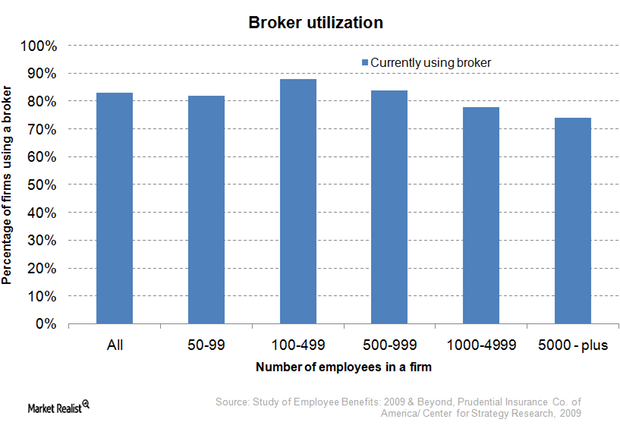

Must-know distribution channels for commercial health plans

The private health insurance industry categorizes commercial health plans as either individual plans, small group plans, or large group plans.

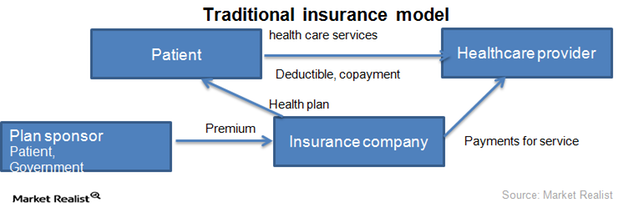

2 key business models of the health insurance industry

The health insurance industry runs on two business models: traditional insurance and managed care organizations.

Your must-read guide to health insurance managed care plans

Employer-sponsored coverage is a key factor for nationwide enrollment trends of managed care plans and independent insurance plans.

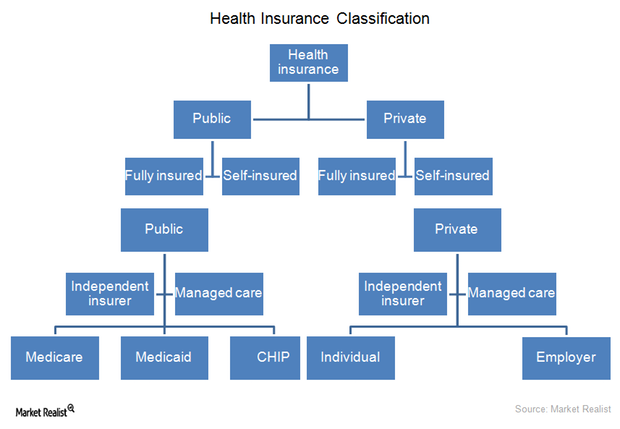

Making sense of health insurance types: An investor’s guide

The health insurance industry operates through two types of organizations: independent insurance companies and managed care organizations.

How the health insurance industry manages risks

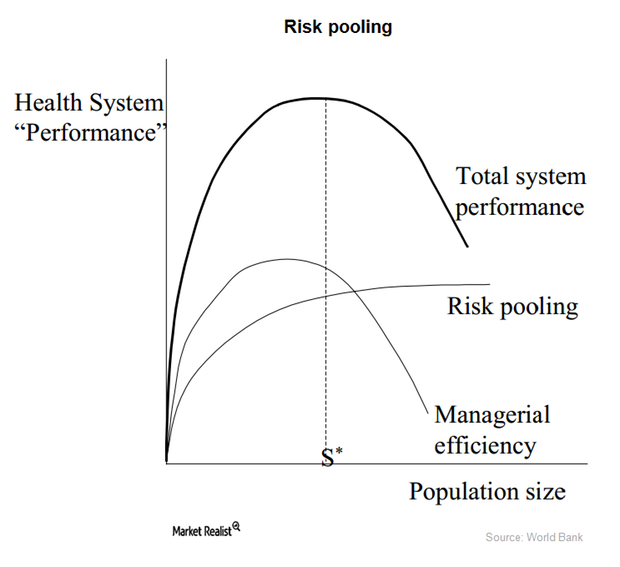

The health insurance industry mainly gives individuals a risk management tool. People can’t predict the extent or timing of their their healthcare expenses.