Humana Inc

Latest Humana Inc News and Updates

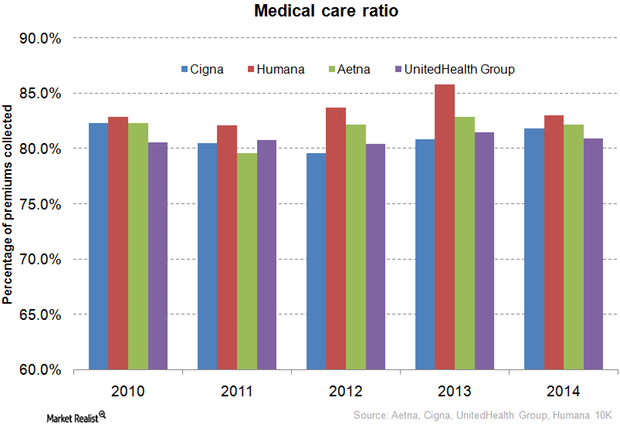

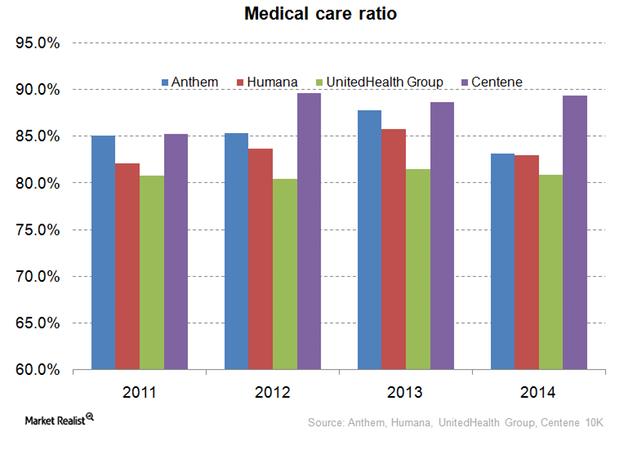

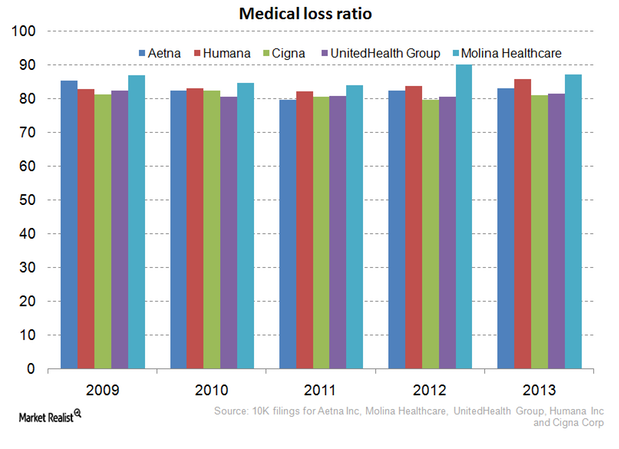

How Does Aetna Compare to Its Peers in Medical Care Ratio?

The medical care ratio of health insurance companies is calculated as the ratio of the total money spent in health care claims to premiums earned.

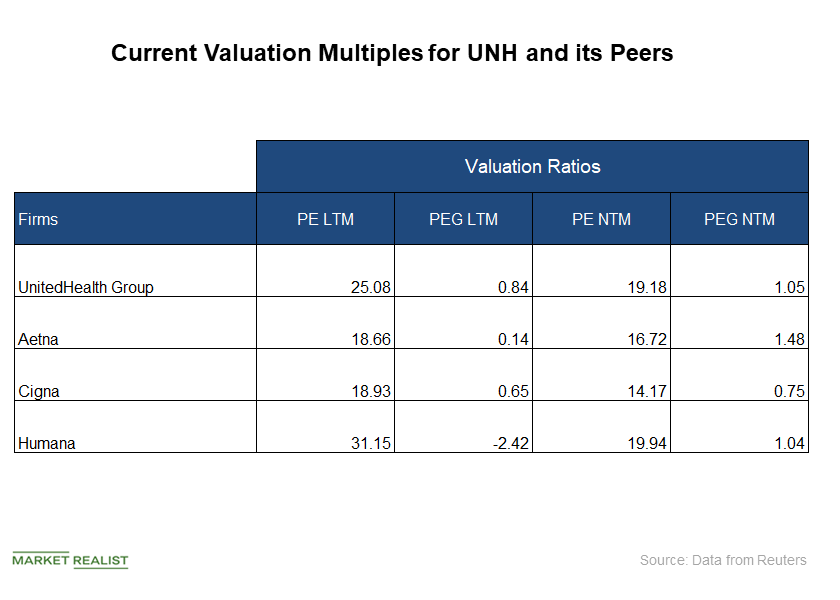

How Does UNH’s Valuation Look in October?

UnitedHealth Group is a leading managed healthcare firm in the United States.

Eminence Capital Reduces Position in Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The company accounted for 1.33% of the fund’s 4Q14 portfolio.

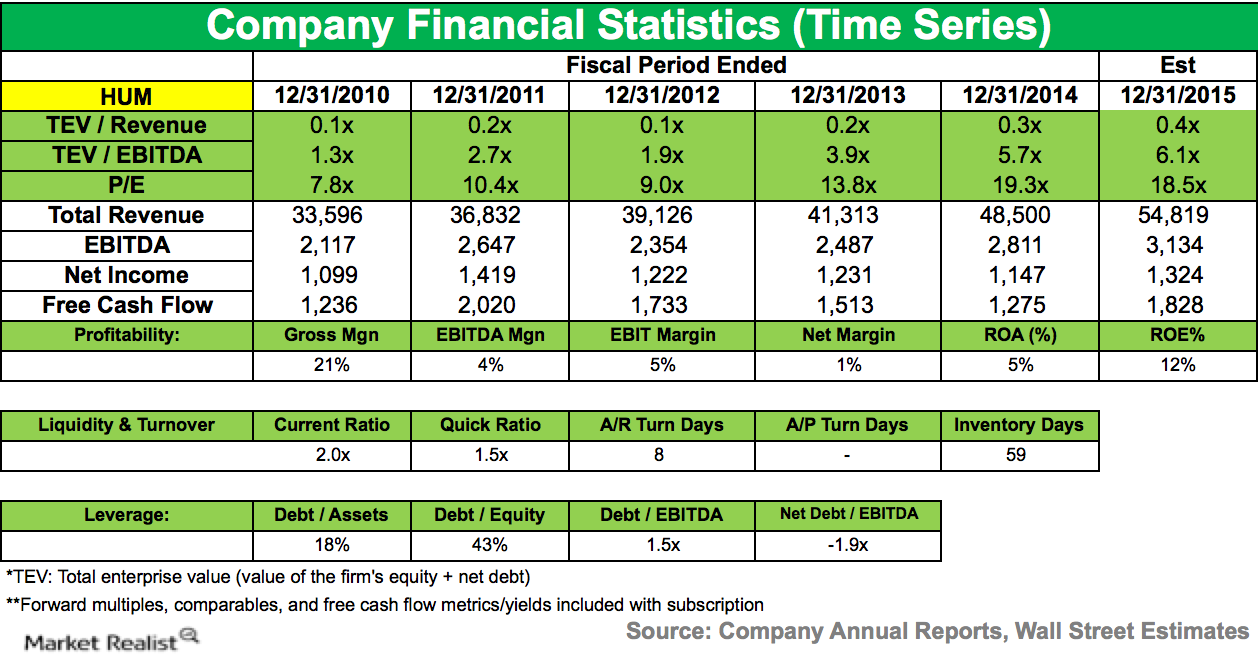

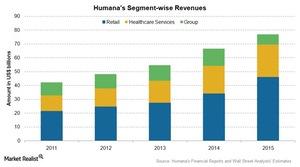

Decoding Humana’s Revenue Stream in 2015

Humana reported revenues of about $54.3 billion in its 2015 results. This amounts to a 12% revenue growth in 2015, compared to ~$48.1 billion in 2014.

How Is UNH’s Optum Business Positioned in the Industry?

UnitedHealth Group is, by revenue, the largest healthcare company in the world.

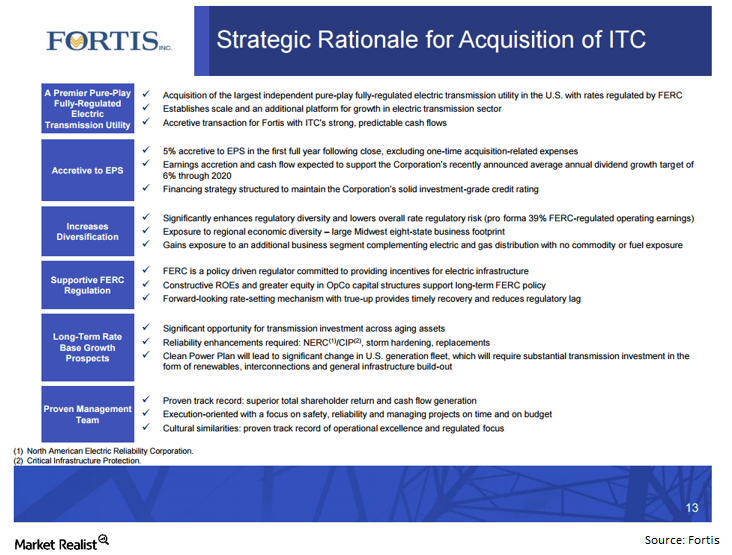

What’s the Rationale for the ITC-Fortis Merger?

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. Fortis intends to sell a 19% stake in order to help finance the transaction.

‘Medicare for All’ Is No Reason to Drop Healthcare Stocks

While the media caters to Millennial preferences, there’s one economic sector that’s shifting to a more seasoned crowd: healthcare stocks.

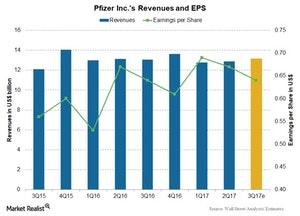

Inside Pfizer’s Performance in 3Q17

PFE stock rose ~7.3% in 3Q17 and has risen ~11.3% YTD (year-to-date) as of October 16.

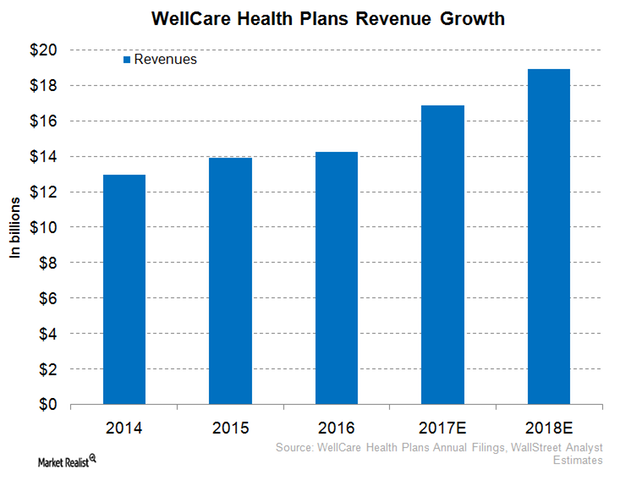

WellCare Health Plans Expects Robust Revenue Performance in 2017

In 1Q17, WellCare Health Plans (WCG) reported revenues of ~$3.9 billion, which totals year-over-year growth of around 11.7%.

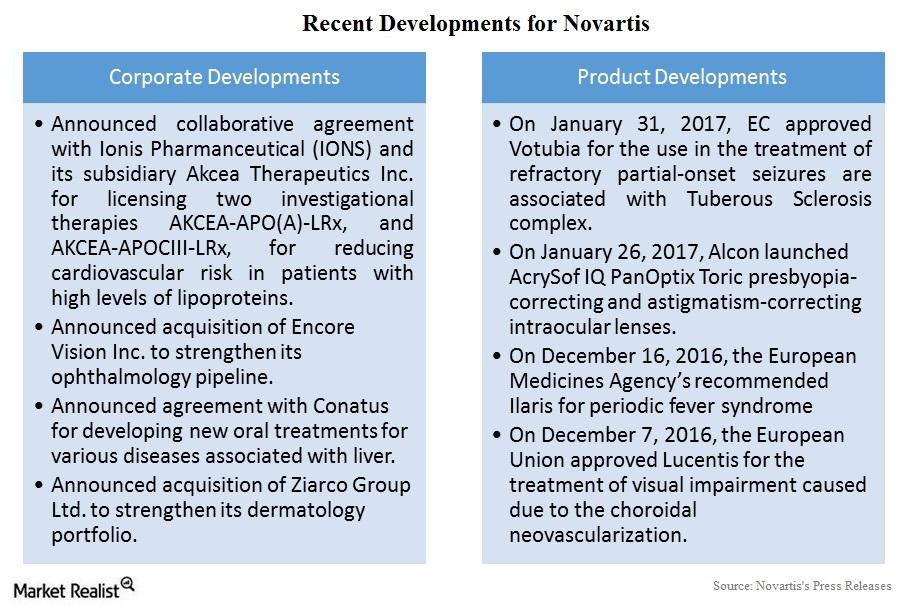

Novartis’s Recent Developments

Novartis (NVS) reported flat revenues at constant exchange rates during 4Q16 as well as in fiscal 2016. This was driven by growth in Sandoz revenues.

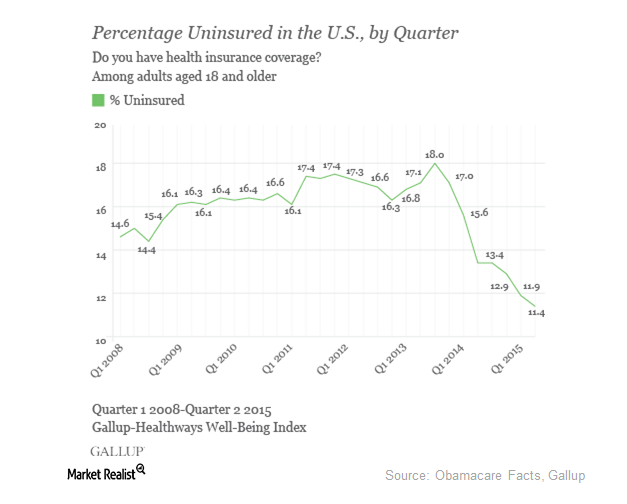

How Could Trump’s Presidency Affect Hospitals and Insurance?

The effects of repealing Obamacare Donald Trump is definitely not in favor of the Affordable Care Act, known as Obamacare. As he wants to repeal the act completely and replace it with another policy, the hospital sector fell on November 9, the day after the election. Trump believes that providing healthcare facilities to illegal immigrants costs […]

Medical Care Ratio – Centene Compared to Its Peers

For health insurance companies, the medical care ratio is the ratio of total money spent on healthcare claims to premiums earned—adjusted for tax and regulatory expenses.

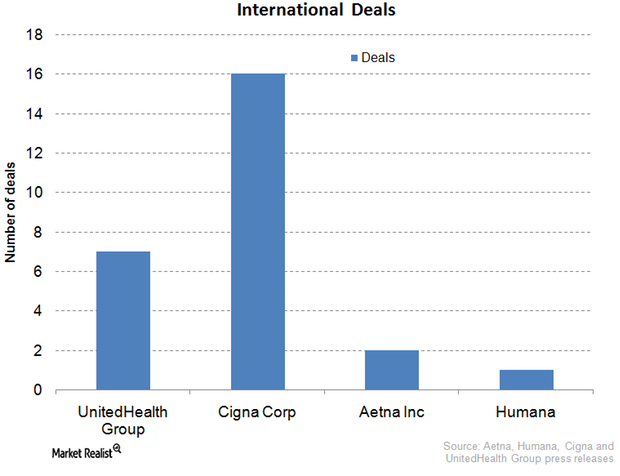

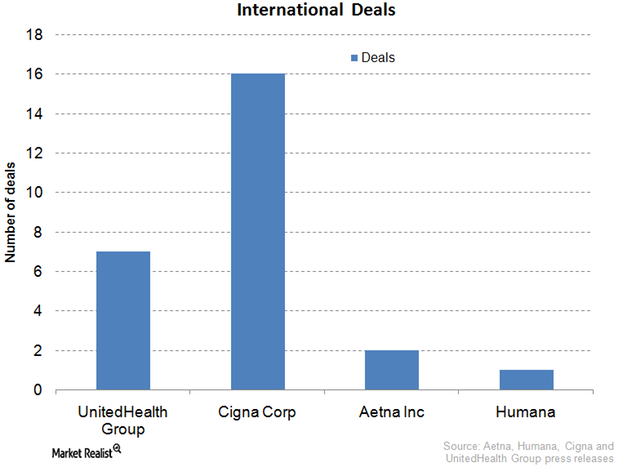

Cigna: International Expansion Key to Growth Strategy

International expansion is a hallmark of Cigna’s business. Cigna has inked deals in Turkey, Belgium, Brazil, Japan, Taiwan, Thailand, et cetera.

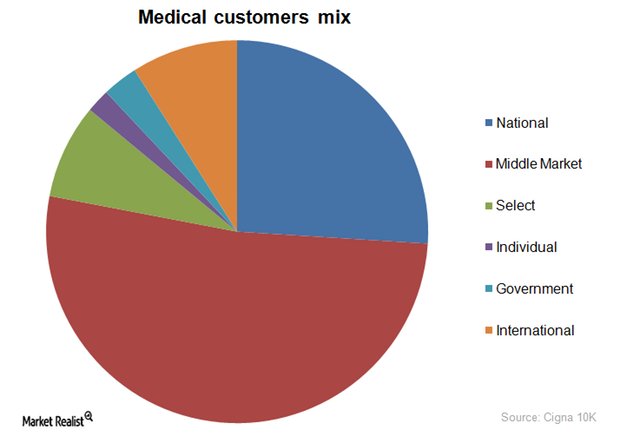

Cigna’s Customer Segments a Healthy Mix

Customer segments The players in the private health insurance industry (IYH) aim for a favorable enrollment mix to reduce taxes and other liabilities while at the same time generating sustainable profits. Accordingly, managed care organizations such as Humana (HUM), Aetna (AET), Anthem, Cigna (CI), and WellCare Health Plans (WCG) are increasingly focusing on government-sponsored and international enrollments to balance […]

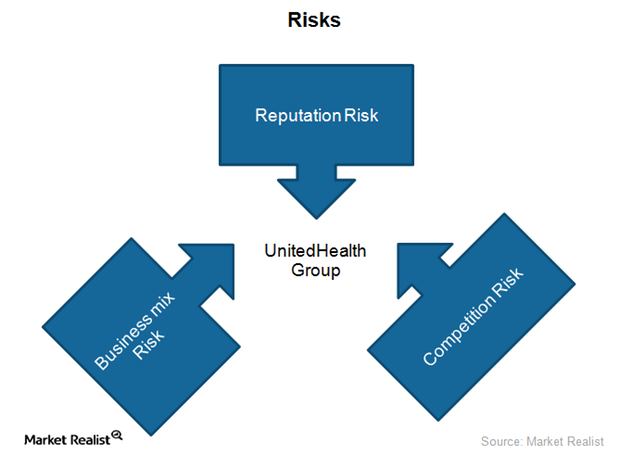

What key risks does UnitedHealth Group face?

UnitedHealth Group (UNH) is a health insurance provider. It faces a unique combination of business risks, including business mix and competition risks.

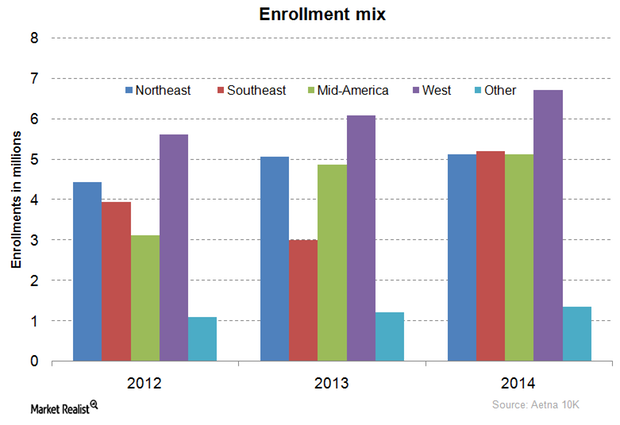

How Is Aetna’s Membership Distributed Across Its Key Markets?

Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the Mid-US, and finally consolidated international enrollments.

What’s UnitedHealth Group’s strategy for international expansion?

The private health insurance industry in the US has been expanding its footprint in international markets. International markets are less penetrated and competitive.

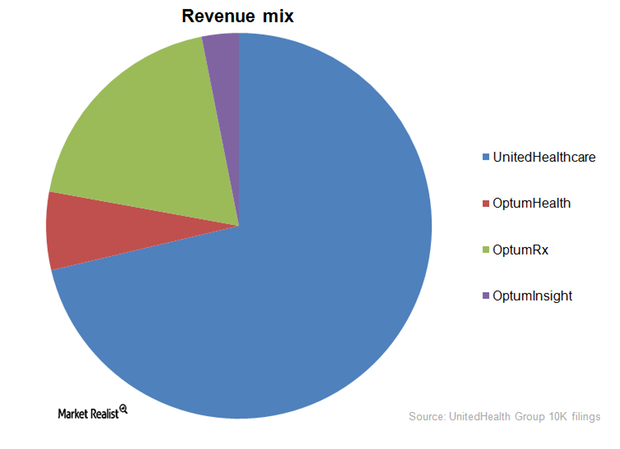

What are UnitedHealth Group’s key business segments?

Out of UnitedHealth Group’s (UNH) four business segments, UnitedHealthcare accounted for 71.3% of the company’s revenue.

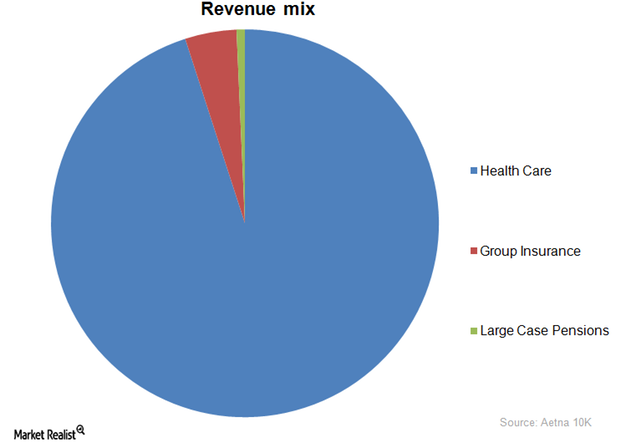

What Are Aetna’s Key Business Segments?

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue.

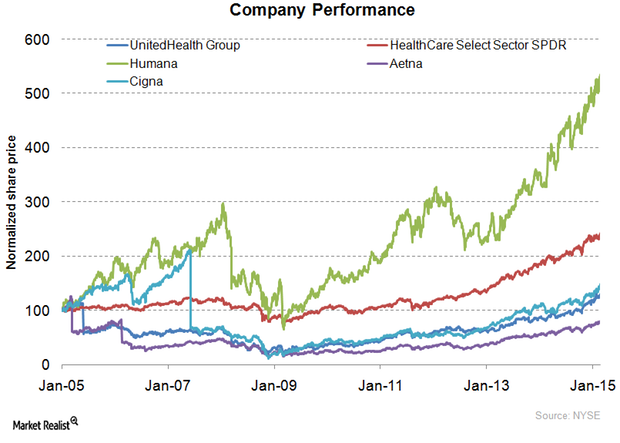

UnitedHealth Group: The history of a health insurance giant

With a market capitalization of $107.1 billion, UnitedHealth Group is the largest insurance provider in the US. It registered revenue worth $130.5 billion in 2014.

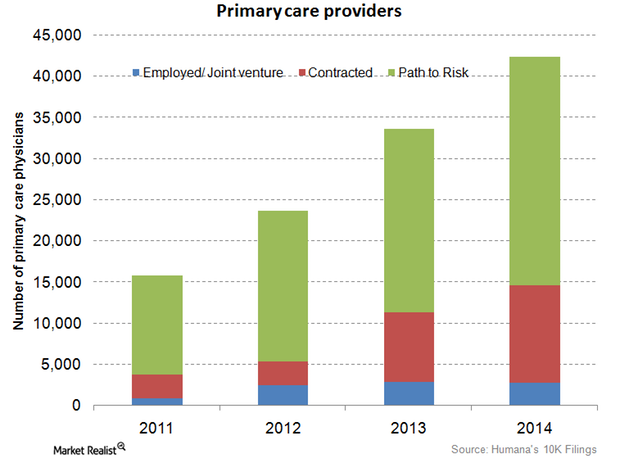

Humana employs and contracts more primary-care physicians in 4Q14

Humana’s employed and contracted primary-care physicians rose by 29.2% from 11,300 in 2013 to 14,600 in 2014.

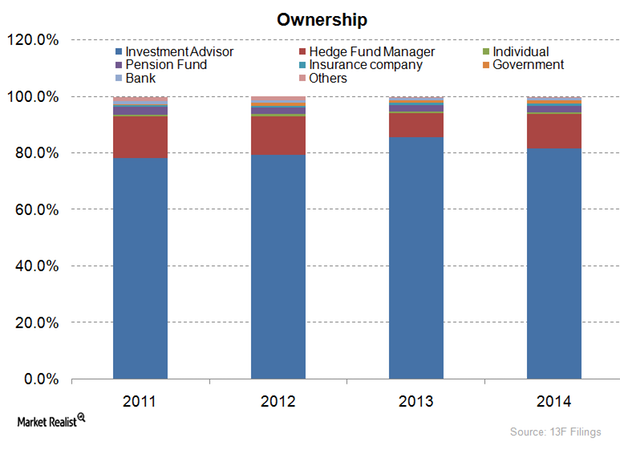

Most Humana stakeholders are mutual funds or advisers

Investment advisers or mutual funds are the main stakeholders in Humana, accounting for about 81.7% of its total ownership picture.

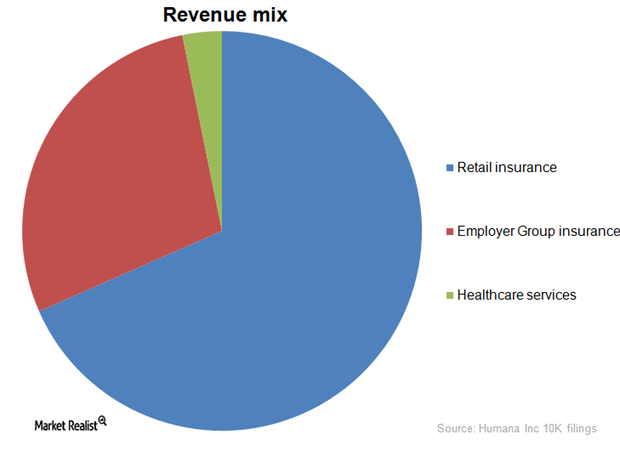

Humana’s Retail Insurance business segment is biggest earner

Humana’s retail insurance business segment contributes 66.5% of overall company revenues. Employer-sponsored programs follow with 27.6%.

Humana: Unraveling the history of a health insurance giant

Humana (HUM) is the third-largest health insurance provider in the US, with over 13 million customers. Humana is also 73rd in Fortune 500 rankings.

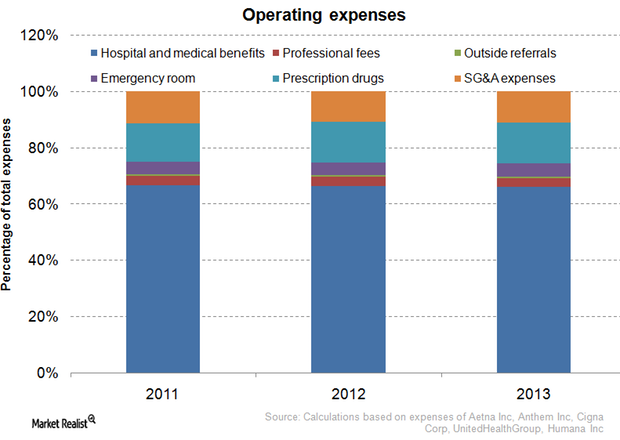

Understanding health insurance companies’ major operating expenses

The operating expenses of the private health insurance industry depend on the design of health plans and on the life history, age, and health of enrollees.

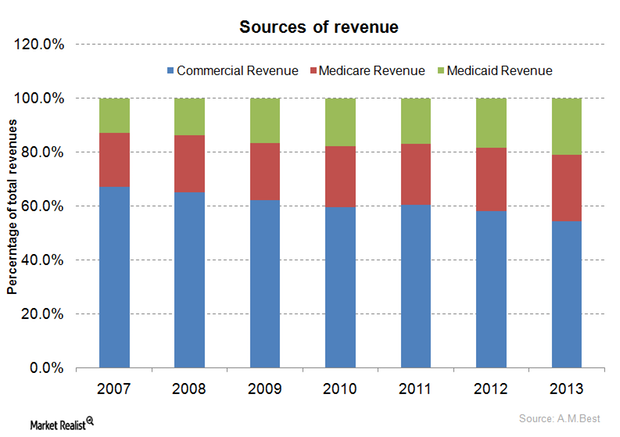

The health insurance industry’s major sources of revenue: A guide

The share of commercial revenues within the private health insurance industry’s total revenues decreased from 67.0% in 2007 to 54.3% in 2013.

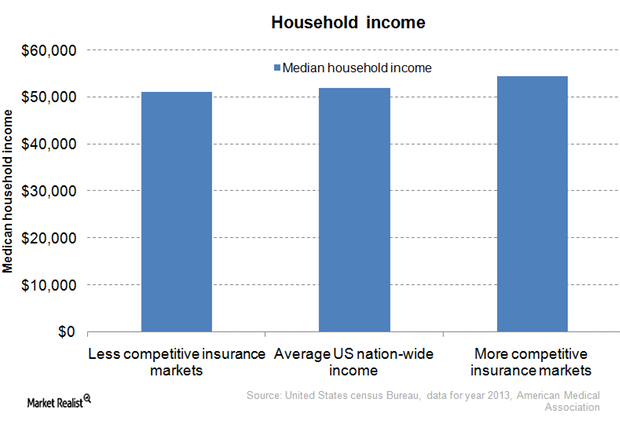

Health insurance monopolies: What you need to know

45 states have only two dominant health insurers accounting for half of the enrollments, giving rise to local market health insurance monopolies.

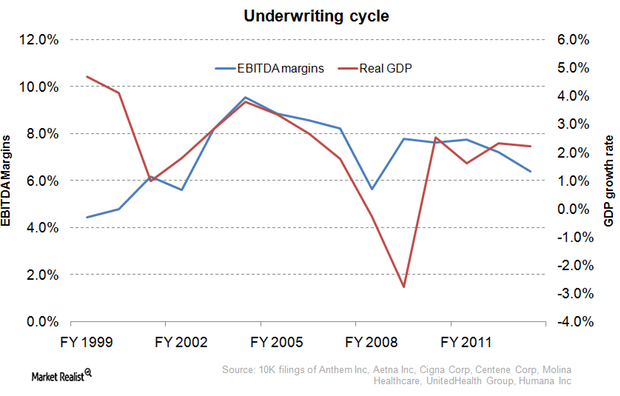

Underwriting cycle: What health insurance investors need to know

The underwriting cycle results from the uncertainty of predicting healthcare expenses and the fluctuating participants in the health insurance industry.

Why the Affordable Care Act hurts the managed care industry

The Affordable Care Act requires health insurers spend at least 80% of premiums on health expenses for small group plans and 85% for large group plans.

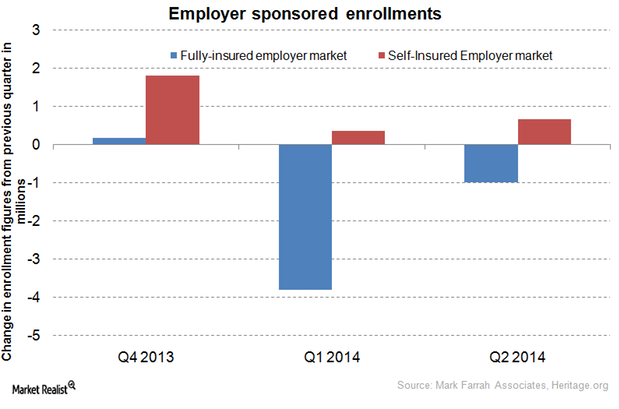

Shift to self-insurance plans affects health insurance stocks

As hospital utilization remains low, more employers are exploring the option of self-insurance to reduce their employee benefit costs.

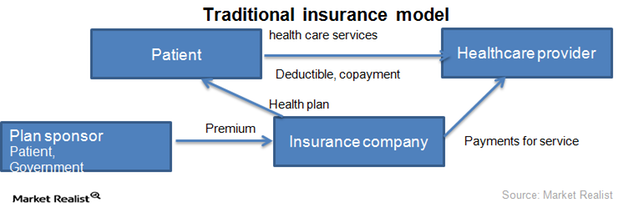

2 key business models of the health insurance industry

The health insurance industry runs on two business models: traditional insurance and managed care organizations.

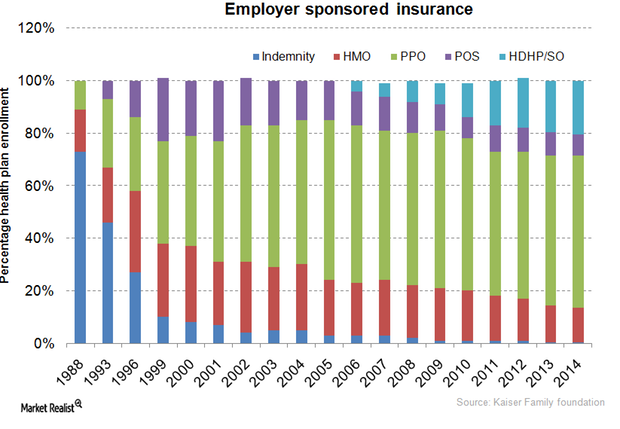

Your must-read guide to health insurance managed care plans

Employer-sponsored coverage is a key factor for nationwide enrollment trends of managed care plans and independent insurance plans.

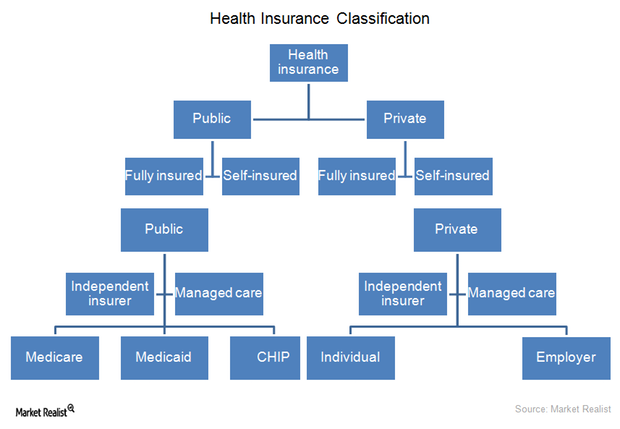

Making sense of health insurance types: An investor’s guide

The health insurance industry operates through two types of organizations: independent insurance companies and managed care organizations.

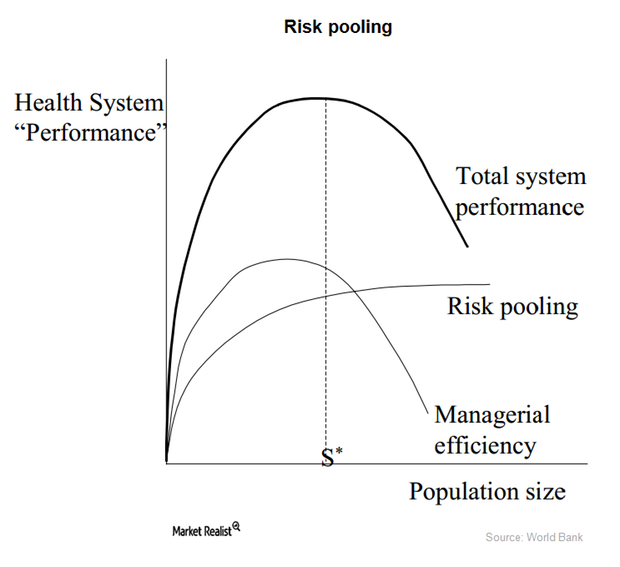

How the health insurance industry manages risks

The health insurance industry mainly gives individuals a risk management tool. People can’t predict the extent or timing of their their healthcare expenses.