iShares US Healthcare Providers

Latest iShares US Healthcare Providers News and Updates

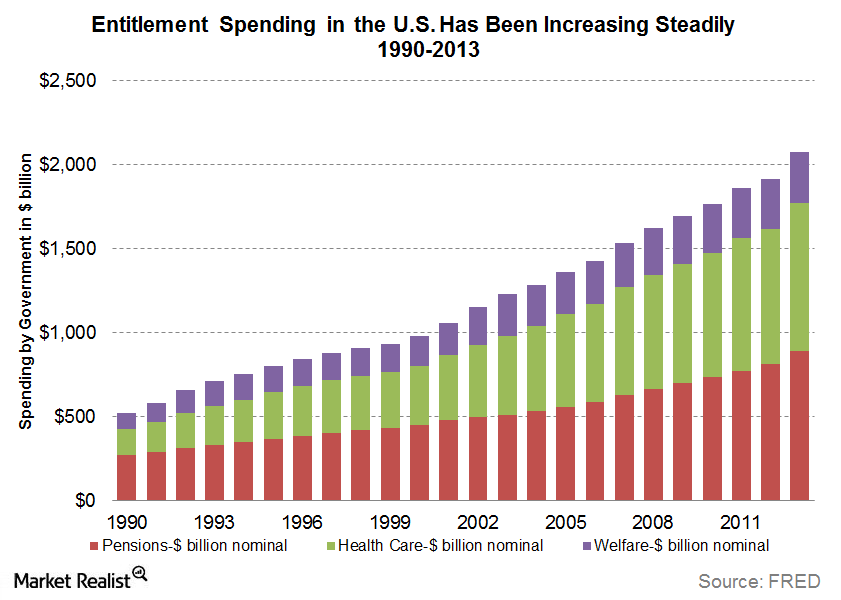

How Can Changing Demographics Impact Investors?

Changing demographics impact investors in many ways. The demand for bonds could increase, putting downward pressure on yields.

Decoding Humana’s Revenue Stream in 2015

Humana reported revenues of about $54.3 billion in its 2015 results. This amounts to a 12% revenue growth in 2015, compared to ~$48.1 billion in 2014.

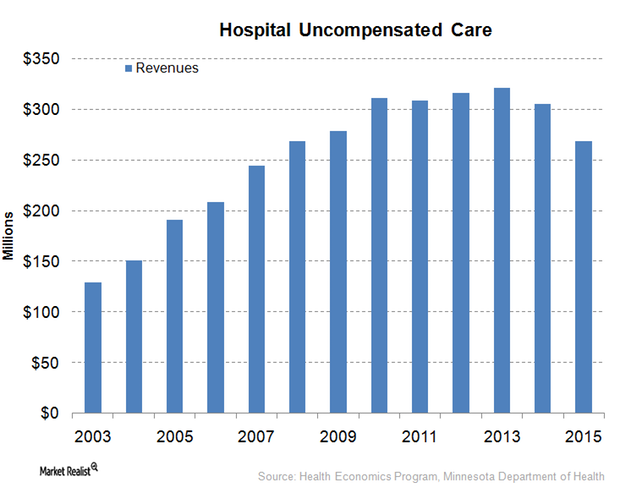

Hospital Industry Reacts to the Failed Healthcare Bill

On March 24, 2017, House Speaker Paul Ryan pulled back the American Health Care Act, also known as “Trumpcare,” before votes were cast.

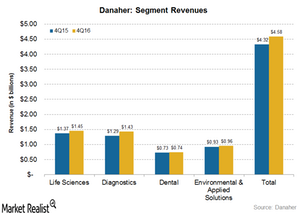

How Did Danaher’s Operating Segments Fare in 4Q16?

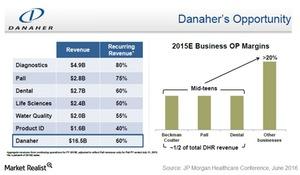

Currently, Danaher (DHR) reports its revenue under four operating segments: Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions.

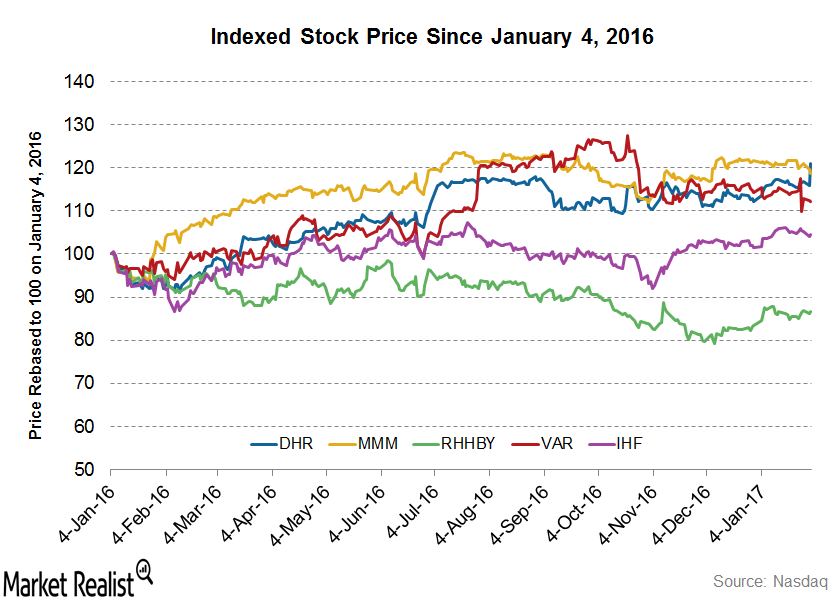

Why Danaher Stock Rose after Its 4Q16 Results

Danaher Corporation (DHR) announced its 4Q16 and 2016 earnings results before the market opened on January 31, 2017. Let’s take a look.

What Made Cepheid Attractive to Danaher?

On September 6, 2016, Danaher (DHR) announced that it has entered into a definitive agreement to acquire Cepheid (CPHD) for $4 billion.

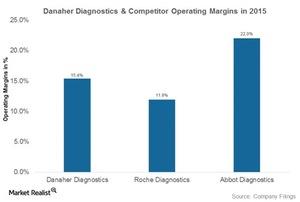

How Danaher Diagnostics Fares against Its Competition

Danaher’s Diagnostics unit had operating margins of 15.4% in 2015 and 17.2% in 1H16.

The Key Product Lines That Make Up Danaher’s Diagnostics Business

Danaher’s (DHR) Diagnostics unit, established through the acquisition of Radiometer in 2004, earned $4.9 billion in sales in 2015.

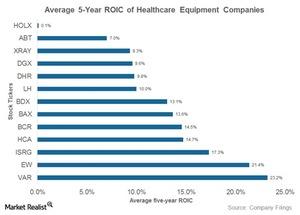

How Are Danaher’s Returns Compared to Its Industry Peers’?

Danaher’s ROIC fell steadily from 15.5% in 2006 to 8.5% in 2015, indicating that it has probably had fewer high return reinvestment opportunities since then.