Eli Lilly and Co

Latest Eli Lilly and Co News and Updates

Forecast for Eli Lilly Stock as FDA Approves Alopecia Drug

Eli Lilly and Co. stock is on the move. What’s the forecast for LLY stock as the FDA approves its alopecia drug? Here's what investors can expect.

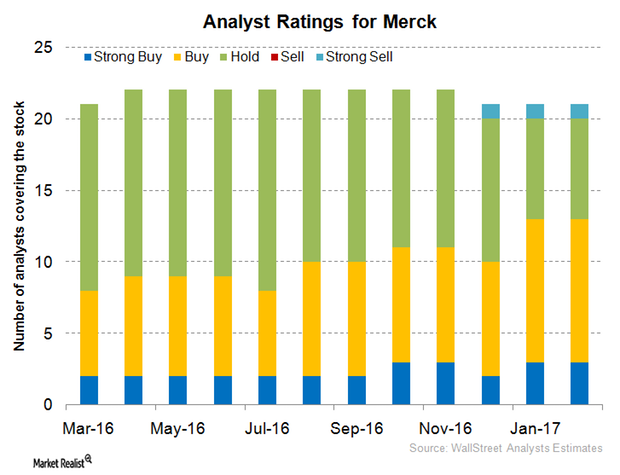

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

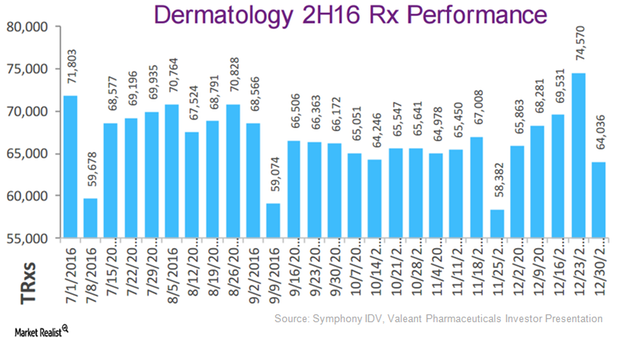

Valeant’s Dermatology Business Felt Pricing Pressure in 2016

Dermatology pricing trends Valeant Pharmaceuticals’ (VRX) dermatology business witnessed intense pricing pressure in 2016, due to a change in the company’s distribution model in 4Q15. While Valeant previously marketed its dermatology drugs through specialty pharmacies, the company now distributes its products through Walgreens. To learn about the company’s current distribution model, please refer to How Valeant Plans […]

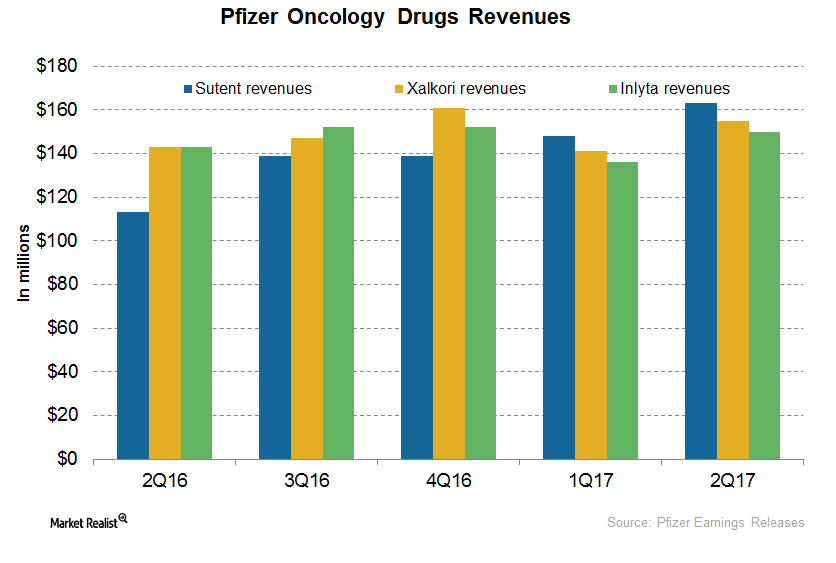

A Post-2Q17 Update on Pfizer’s Oncology Drugs: Sutent, Xalkori, and Inlyta

In 2Q17, Inlyta generated revenues of ~$88 million, which represents an ~19% decline on a YoY basis and ~4% growth on a quarter-over-quarter basis.

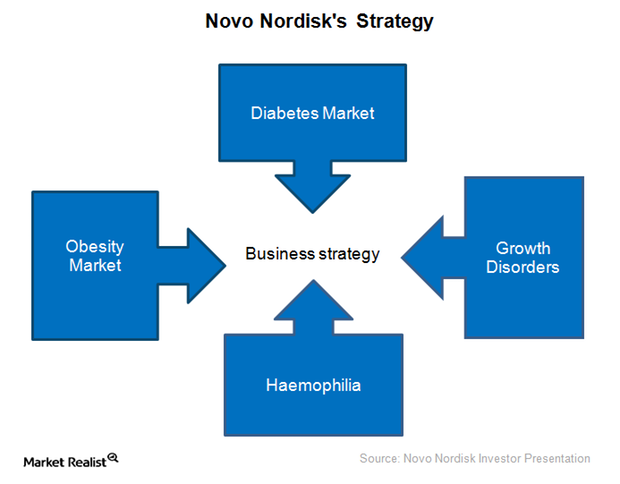

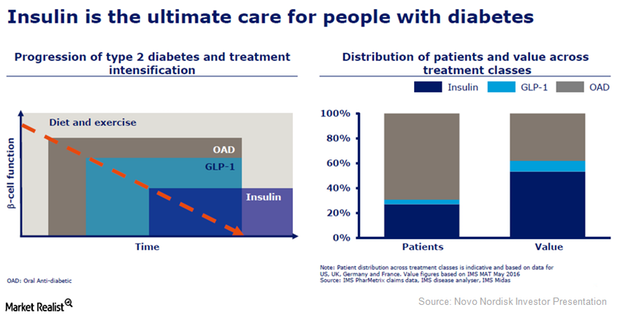

Novo Nordisk Is Focusing on These Strategic Areas in 2016

With 642 million people expected to suffer from diabetes globally by 2040, the disease is expected to offer multiple growth opportunities for Novo Nordisk.

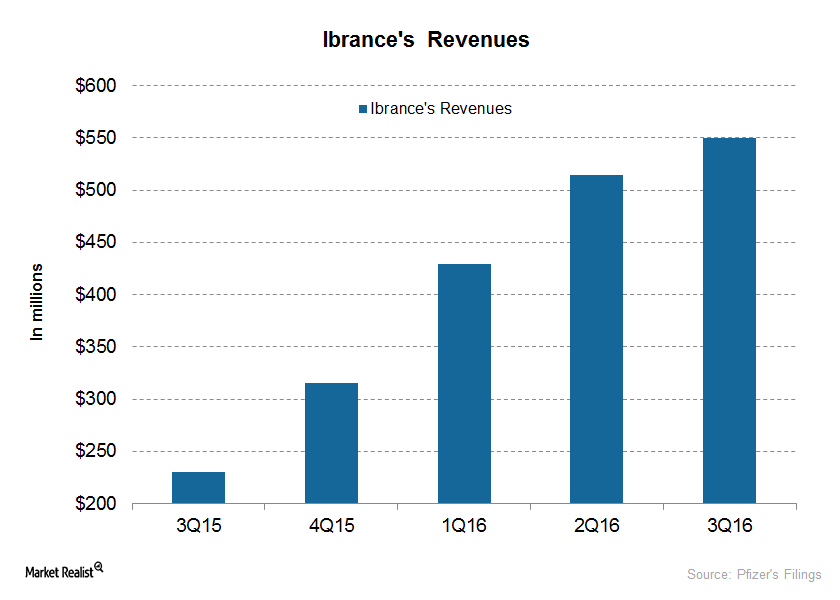

Ibrance Is the Only Registered CDK 4/6 Inhibitor for Breast Cancer

Since its launch in February 2015, Pfizer’s Ibrance has quickly captured the advanced breast cancer market and has reached more than 40,000 patients.

GlaxoSmithKline Increases Top Line in 2Q16

GlaxoSmithKline (GSK) reported a 10.9% increase in its top line in its 2Q16 earnings on July 27, 2016. It met Wall Street analysts’ estimates for revenues and EPS.

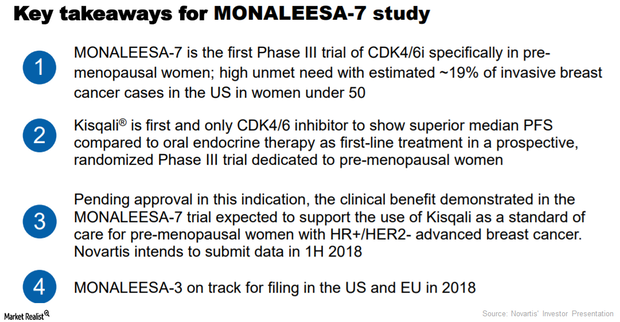

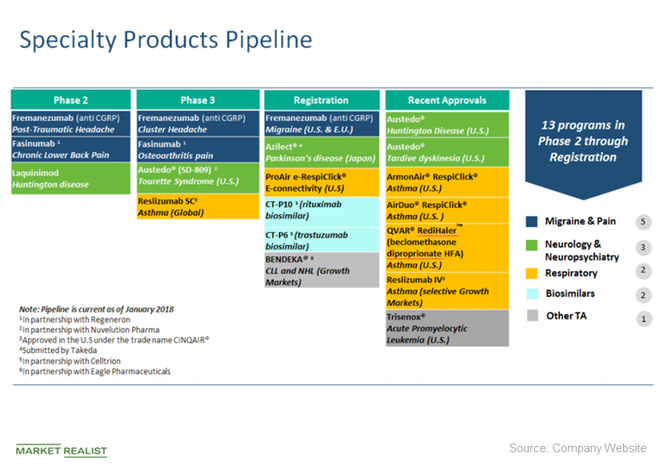

Novartis Receives 2 Breakthrough Therapy Designations in January

In January 2018, the FDA granted a BTD to Novartis’s (NVS) Promacta for use along with standard immunosuppressive therapy.

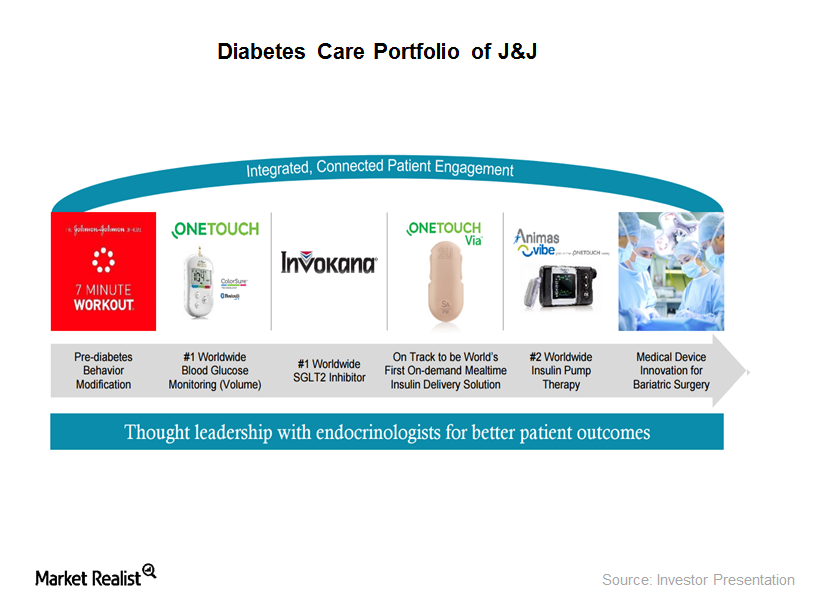

Johnson & Johnson Gets FDA Approval for Type 2 Diabetes Drug

On September 21, 2016, the FDA approved Jannsen Pharmaceuticals’ Invokamet XR for the treatment of adults suffering from Type 2 diabetes.

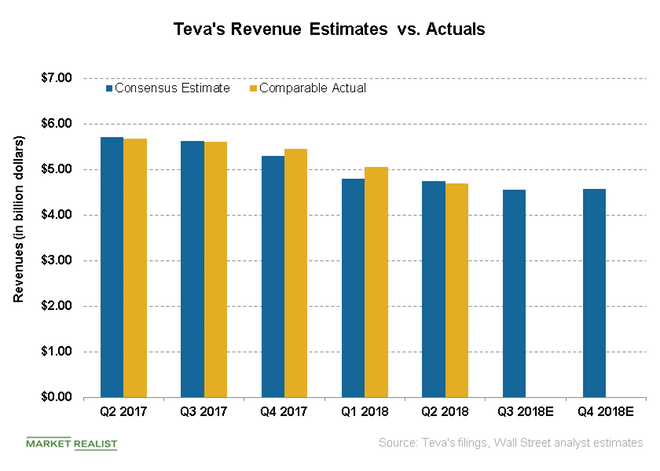

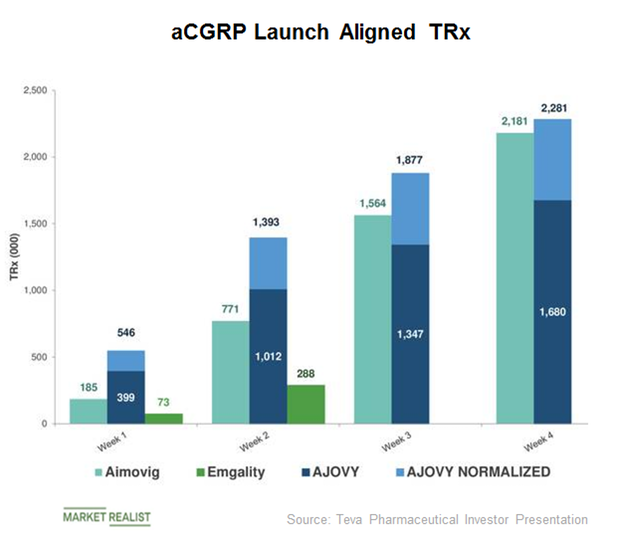

Competition Dynamics for Ajovy—Teva’s Migraine Drug

Approved by the FDA on September 14, Teva’s Ajovy has multiple competitors set to enter the market.

Non-Opioid Pain Therapy Market Opportunity for Teva

The Trump administration proposed production cuts in some of the most abused opioid compounds by 10% next year.

Pfizer’s Growth Rate and Estimates

Pfizer (PFE) reported an EPS of $0.74 on revenues of ~$13.5 billion during the second quarter, which beat analysts’ estimate of ~$13.3 billion.

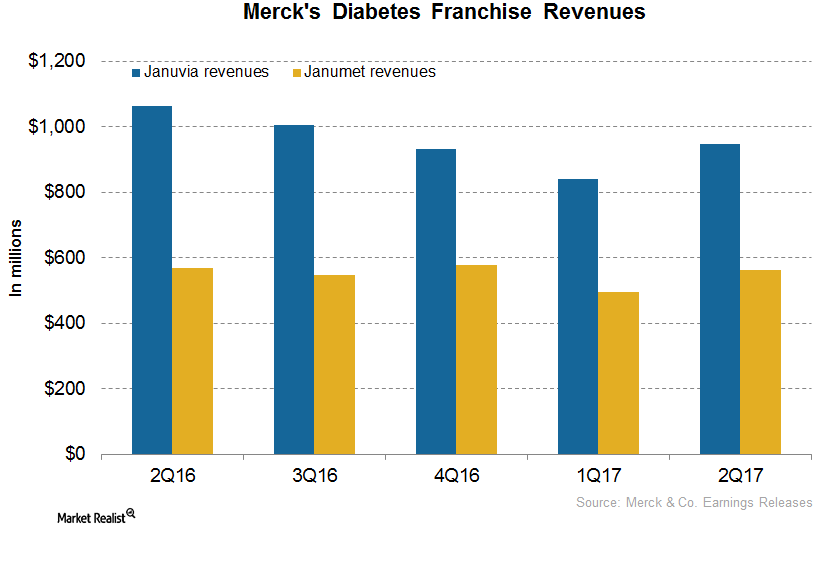

Januvia and Janument: An Update on Merck’s Diabetes Franchise after 2Q17

In 2Q17, Merck’s (MRK) Januvia generated revenues of around $948 million, which reflected an ~11% decline on a year-over-year basis and 13% growth on a quarter-over-quarter basis.

Novo Nordisk Continues to Be a Leader in the Global Insulin Market

Accounting for a ~46% market share, Novo Nordisk (NVO) is expected to continue to benefit from the positive trends in the global insulin market

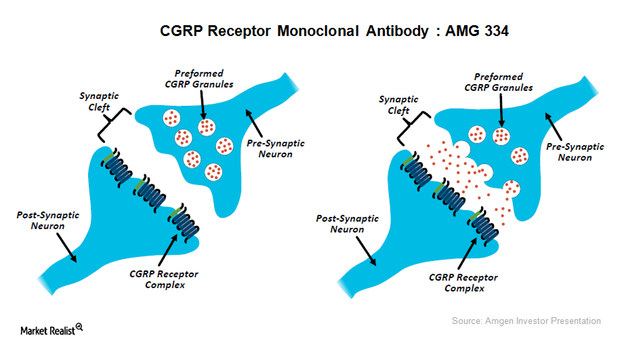

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

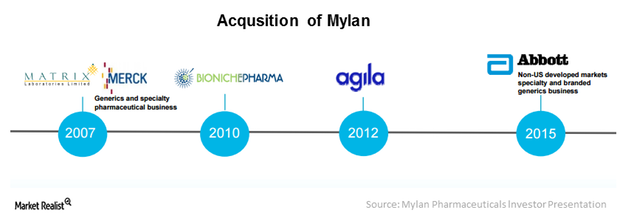

Mylan’s Recent Acquisitions Continue to Strengthen Its Position in International Markets

Mylan takes an M&A strategy to save time related to compliance activities for obtaining regulatory approvals across various international markets.

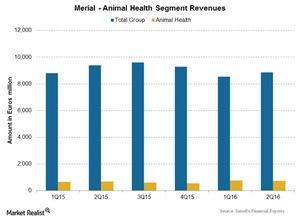

How Merial Contributes to Sanofi’s Growth

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase over 2Q15.

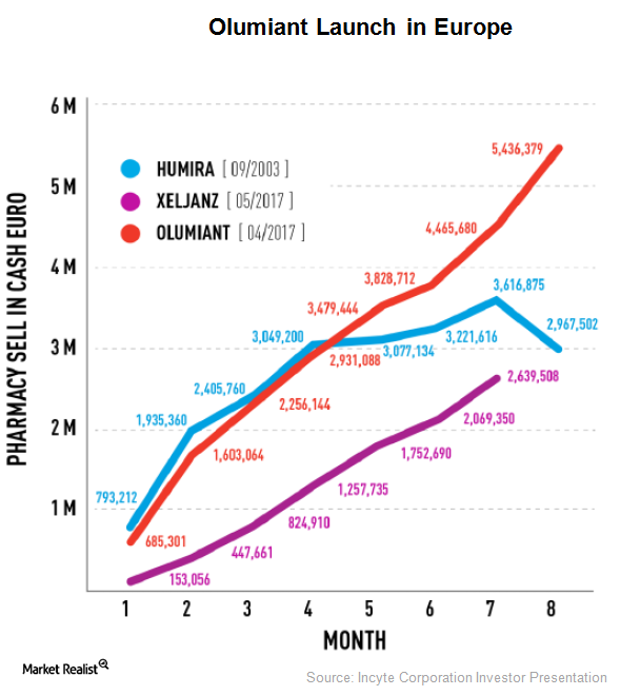

Olumiant Could Boost Incyte’s Revenues

In February 2017, Eli Lilly (LLY) secured approval for Olumiant (baricitinib) from the European Medicines Agency (or EMA) for patients suffering from moderate-to-severe rheumatoid arthritis.

Pfizer Reports 1Q18 Earnings and Revenue Growth

Pfizer (PFE) released its 1Q18 earnings today, reporting another strong quarter for the Innovative health business.

Teva Announces First-to-File Launch of Generic Cialis

Yesterday, Teva Pharmaceutical Industries (TEVA) announced the exclusive FTF (first-to-file) launch of the generic Cialis1 tablets in the US.

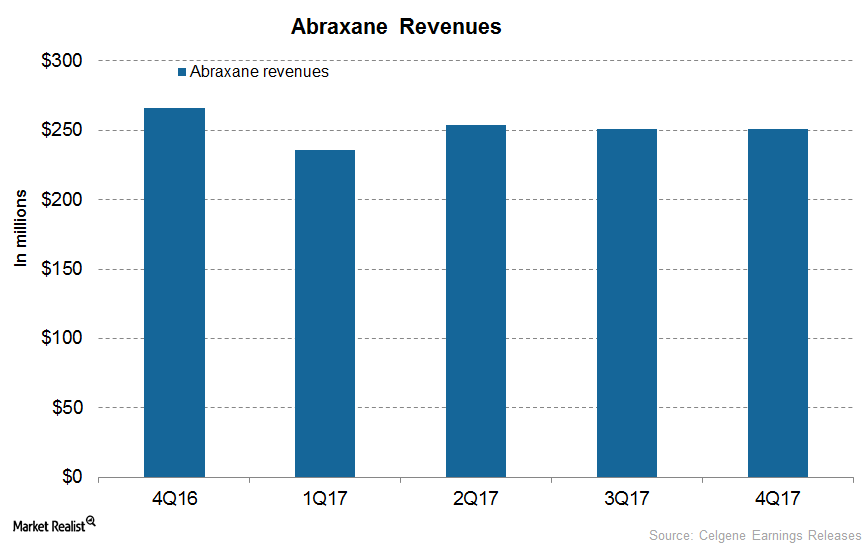

How’s Celgene’s Abraxane Positioned after 4Q17?

In 4Q17, Celgene’s (CELG) Abraxane generated revenues of $251 million, which reflected a decline of ~6% on a YoY (year-over-year) basis.

Why the US Moat Index Beat the S&P 500 Index in July

Domestic moat companies, as represented by the Morningstar® Wide Moat Focus IndexSM (MWMFTR, or “U.S. Moat Index”), once again posted strong results in July.

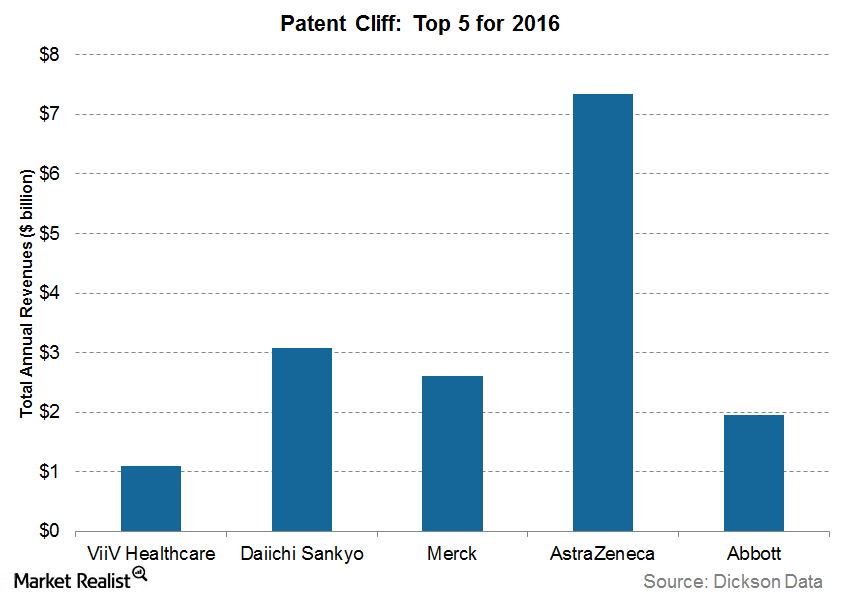

Why the Patent Cliff Is a Key Driver of Generic Drug Growth

Over the last several years, patent cliffs have led to steep revenue losses for traditional pharmaceuticals as well as created a gateway for smaller companies to come to market with generics.

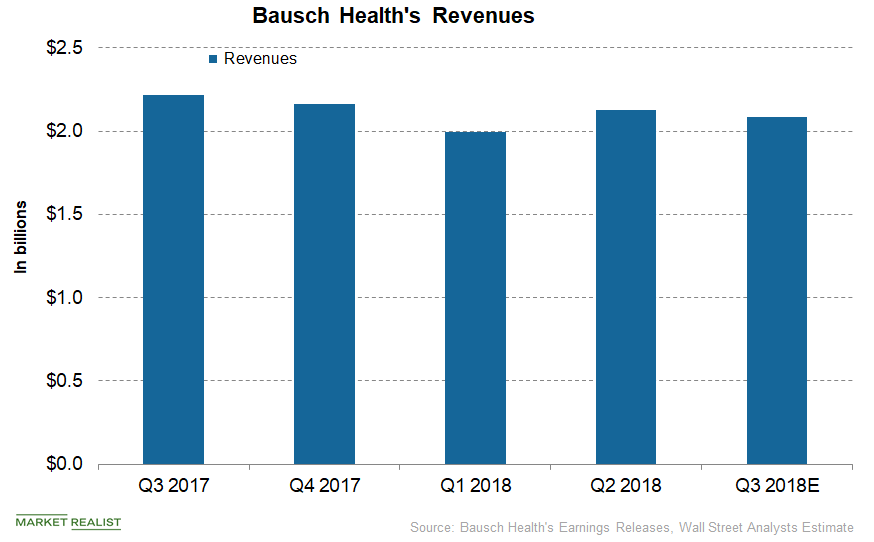

A Financial Overview of Bausch Health in October

Bausch Health’s (BHC) net revenues declined from $4.3 billion in H1 2017 to $4.1 billion in H1 2018, reflecting an ~5.0% year-over-year decline.

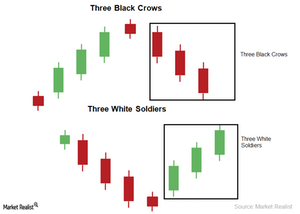

Three Black Crows And Three White Soldiers Candlestick Pattern

The Three White Soldiers candlestick pattern is also a reversal pattern. It forms at the bottom of a downtrend. The pattern has three candles. All three of the candles are long and bullish.

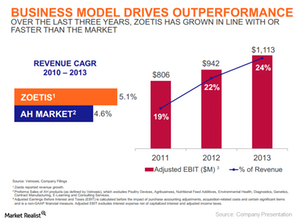

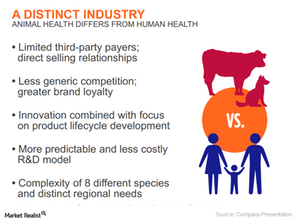

Zoetis: An attractive business model

Zoetis said in a recent statement that “its unique characteristics have established the company as the world leader in animal health, growing revenue faster than the market for the last three years.”

Must-know trends that drive Zoetis’ growth

Demand for Zoetis’ products is driven by a growing population coupled with a rising middle class in emerging markets and increased relocation from rural to urban areas.

How Are Citadel Advisors Hedging their Portfolio?

Kenneth Cordele Griffin is the CEO of investment management firm Citadel Advisors LLC. He is the hedge fund manager and he founded Citadel in 1990.

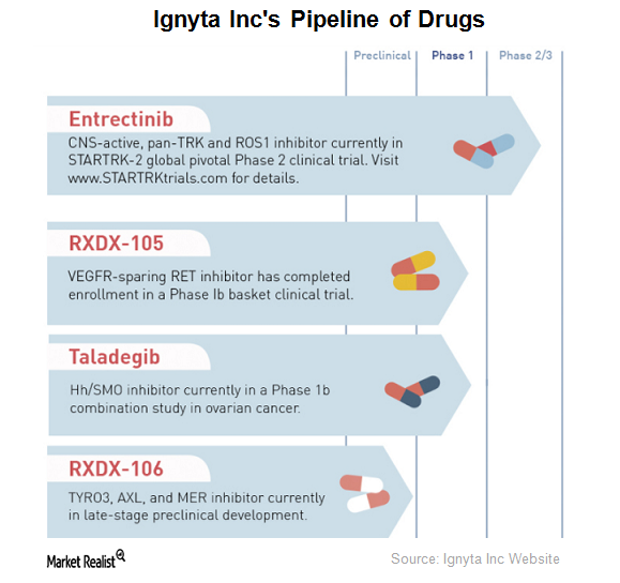

Ignyta’s Drug Pipeline

Ignyta (RXDX) has completed enrollment for a Phase 1 clinical trial of RXDX-105, an orally bioavailable small molecule tyrosine kinase inhibitor.

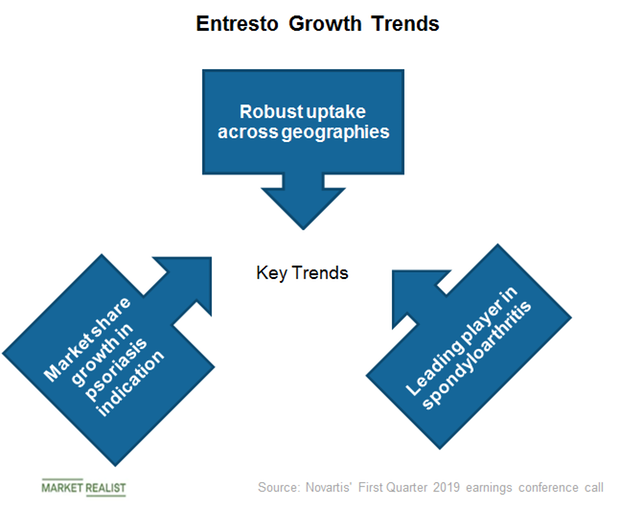

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

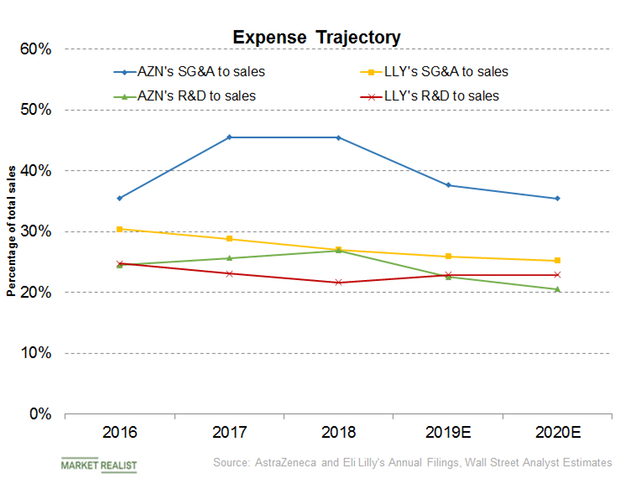

AstraZeneca or Eli Lilly: Which Is Controlling Expenses Better?

In its fourth-quarter earnings press release, AstraZeneca (AZN) guided for a low single-digit YoY (year-over-year) rise in core operating expenses in fiscal 2019.

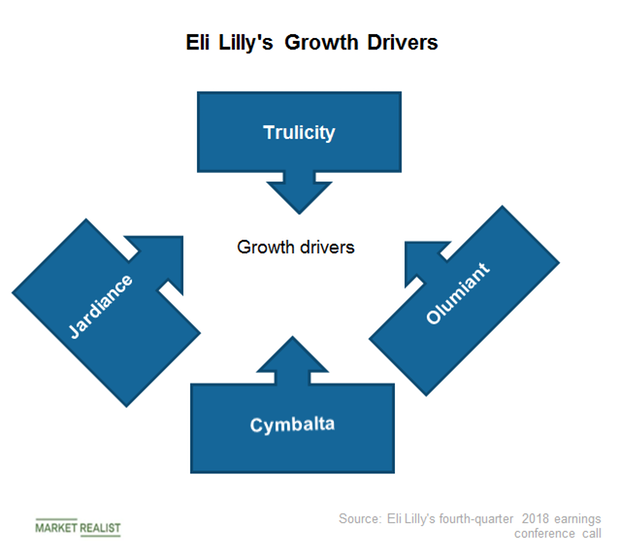

What Are the Key Growth Drivers for Eli Lilly in Fiscal 2019?

In its fourth-quarter earnings investor presentation, Eli Lilly (LLY) highlighted its newer products such as Emgality, Verzenio, Olumiant, Lartruvo, Taltz, Basaglar, Jardiance, Trulicity, and Cyramza as its key drivers.

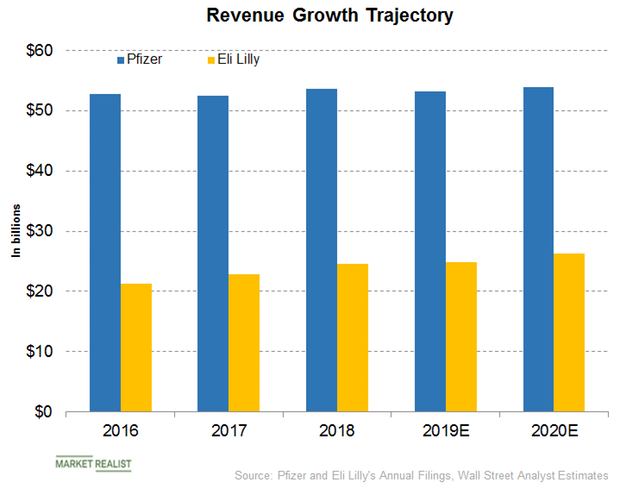

Pfizer or Eli Lilly: Who Will Report Better Revenue Growth?

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019.

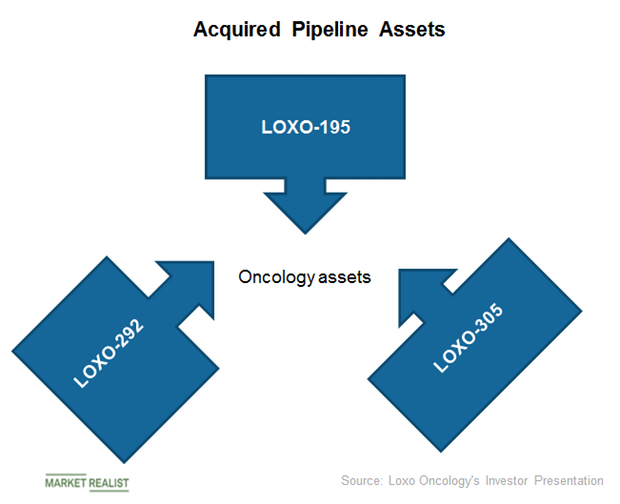

Eli Lilly and Loxo: A Robust Oncology Pipeline for Future Years

Eli Lilly’s acquisition of Loxo has added the FDA approved asset VITRAKVI and the early- and mid-stage oncology pipeline assets LOXO-305, LOXO-195, and LOXO-292.

Ajovy Is a New Growth Driver for Teva Pharmaceutical

On September 14, Teva Pharmaceutical (TEVA) issued a press release announcing FDA approval of humanized monoclonal antibody and anti-calcitonin gene-related peptide (or CGRP) therapy.

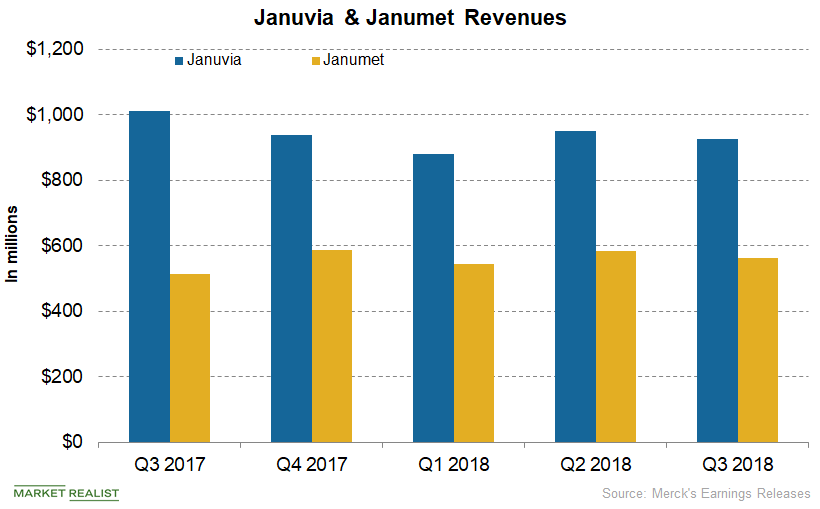

A Look at Merck’s Diabetes and Women’s Health Business

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline.

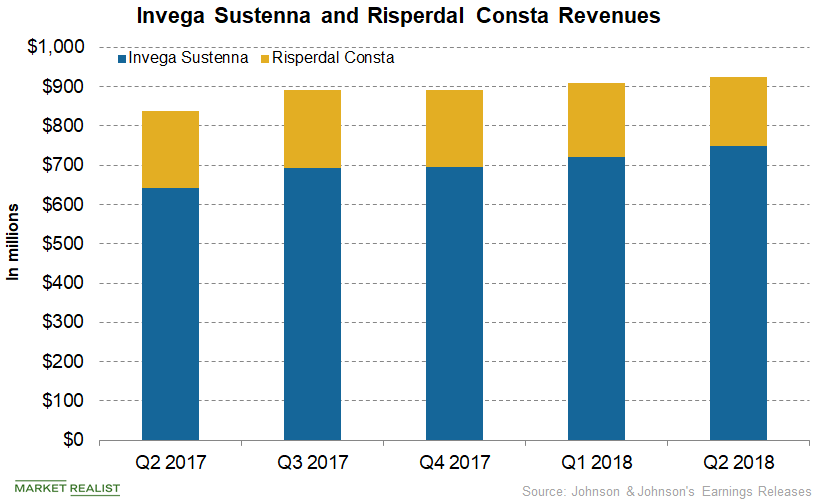

How JNJ’s Invega Sustenna and Risperdal Consta Performed

Johnson & Johnson’s (JNJ) Invega Sustenna, Xeplion, Trinza, and Trevicta combined witnessed solid growth in the third quarter.

A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

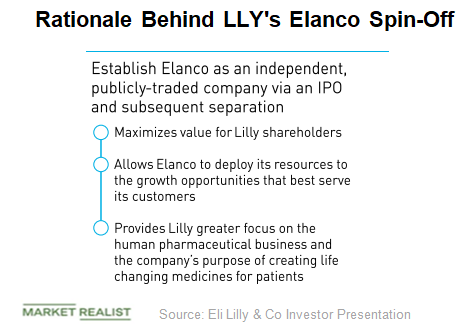

A Look at Eli Lilly’s Elanco Spin-Off

Eli Lilly (LLY) is expected to post revenues of $24.33 billion in fiscal 2018 and $24.8 billion in fiscal 2019.

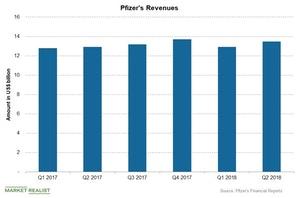

Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

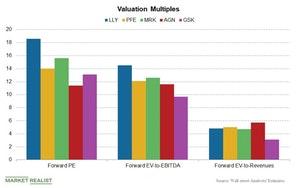

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

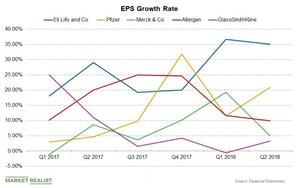

A Review of Pharma Stocks’ EPS Growth Rates

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

What Does Nektar Therapeutics’ Valuation Trend Indicate?

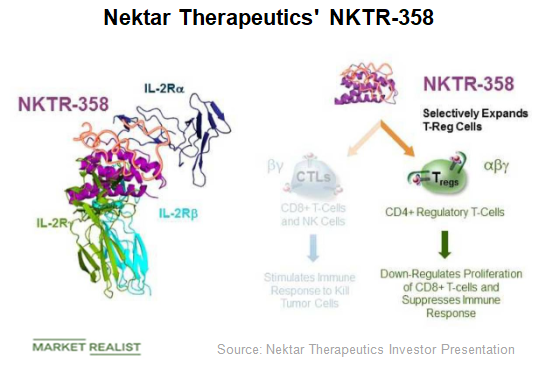

Under its immunology program, Nektar Therapeutics (NKTR) is developing NKTR-358 in collaboration with Eli Lilly and Company (LLY).

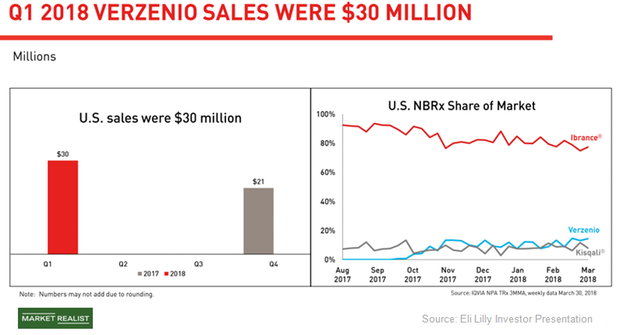

Verzenio: Major CDK4/6 Inhibitor in the Future

Verzenio has demonstrated double-digit growth in new patient usage in patient segments targeted by the drug’s first two approved indications.

How Celgene Performed in 1Q18

In 1Q18, Celgene’s (CELG) revenue grew 20% year-over-year to $3.5 billion from $3.0 billion, boosted by Revlimid, Pomalyst, and Otezla sales.

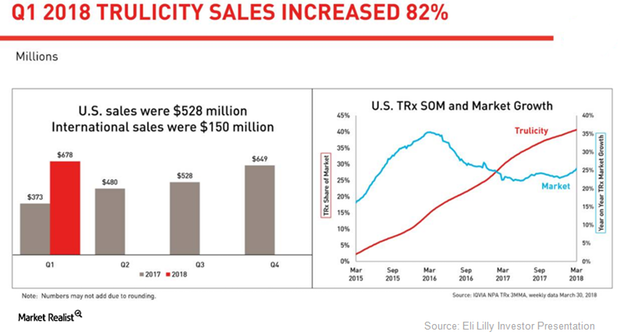

Factors that Could Drive Trulicity’s Revenue Growth in 2018

In 1Q18, Trulicity reported $678.3 million in revenues for YoY growth of ~82.0%.

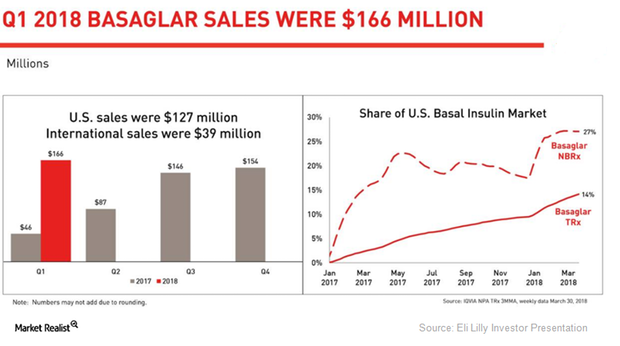

Humalog and Basaglar: Major Growth Drivers for Eli Lilly in 2018

The highest-earning asset in Eli Lilly’s (LLY) portfolio is its fast-acting insulin, Humalog, which reported revenues of ~$791.7 million in 1Q18.

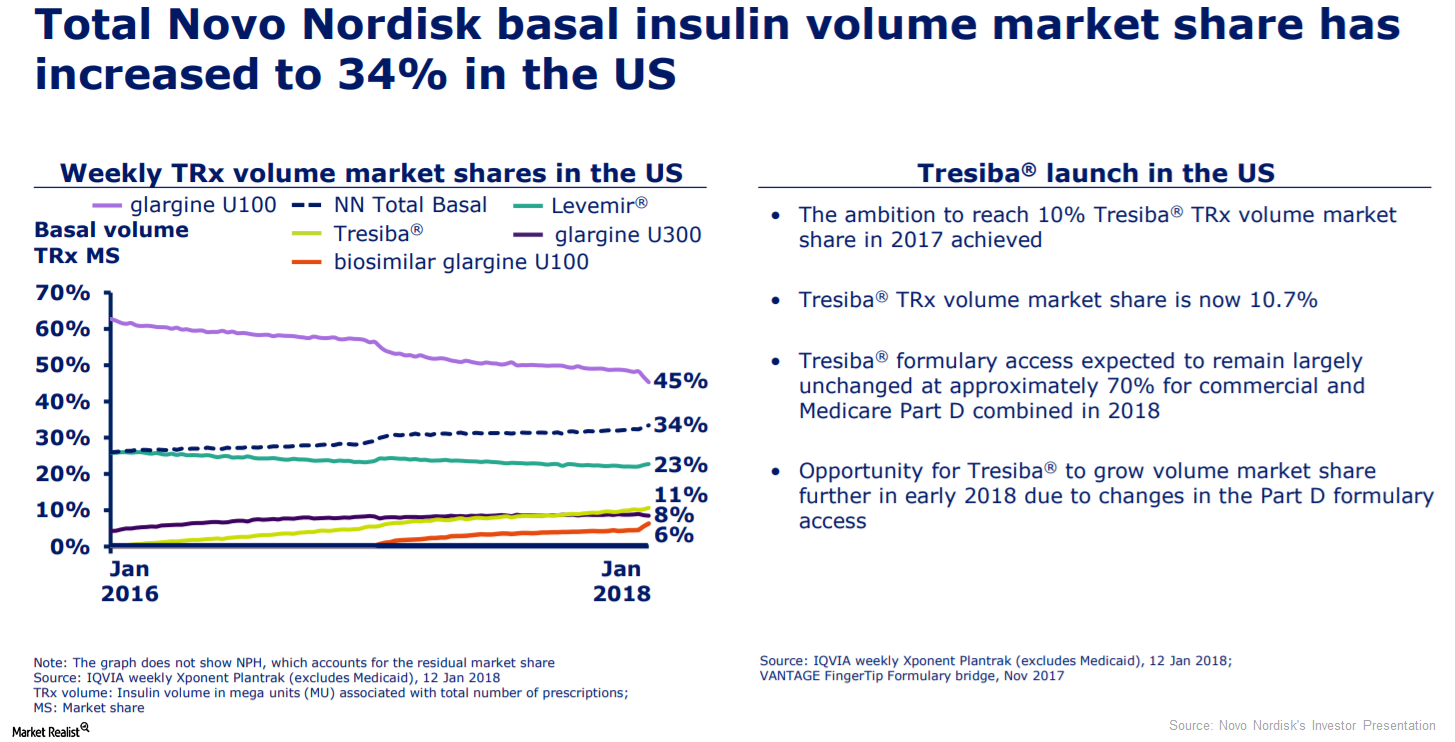

Tresiba Could Significantly Drive Novo Nordisk’s Revenue in 2018

In 4Q17, Novo Nordisk’s (NVO) Tresiba generated revenues of 1.9 billion Danish kroner, which is a ~48% YoY growth in local currencies.

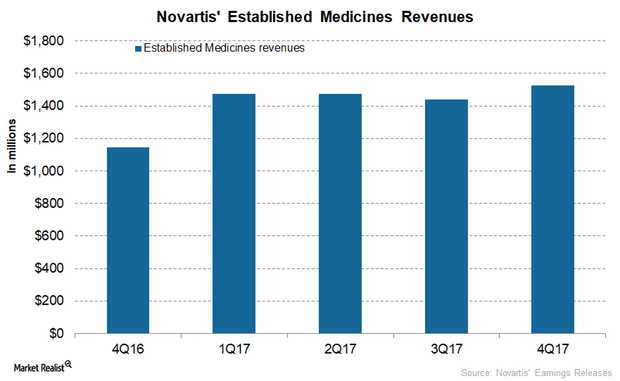

How Did Novartis’s Established Medicines Segment Perform in 2017?

In 4Q17, Novartis’s (NVS) Galvus generated revenues of $327 million, which is ~10% growth on a year-over-year (or YoY) basis and 5% growth quarter-over-quarter.