Tresiba Could Significantly Drive Novo Nordisk’s Revenue in 2018

In 4Q17, Novo Nordisk’s (NVO) Tresiba generated revenues of 1.9 billion Danish kroner, which is a ~48% YoY growth in local currencies.

April 24 2018, Updated 6:00 p.m. ET

Tresiba’s revenue trends

In 4Q17, Novo Nordisk’s (NVO) Tresiba generated revenues of 1.9 billion Danish kroner, which is a ~48% YoY (year-over-year) growth in local currency.

In fiscal 2017, Tresiba saw an 81% growth and generated revenues of 7.3 billion Danish kroner, which is an ~85% YoY growth in local currency.

In 2017 in the US market, Tresiba reported revenues of 1.2 billion Danish kroner which is a ~34% YoY growth in local currency.

In 2017 in Europe, AAMEO (Asia, Africa, the Middle East, and Oceania), Japan and Korea, and Latin America, Tresiba reported revenues of 249 million Danish kroner, 77 million Danish kroner, 199 million Danish kroner, and 108 million Danish kroner, respectively. That’s a ~20%, ~42%, ~10%, and ~48% YoY growth, respectively, in local currency.

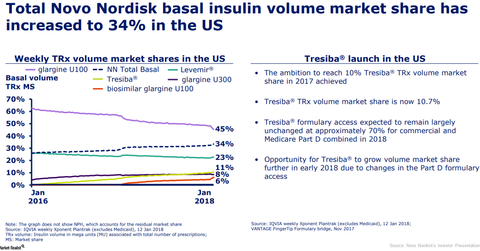

In fiscal 2017, Tresiba achieved 10.7% of the total prescription volume in the basal-insulin prescription volume market share in the US market. Novo Nordisk’s target for making Tresiba reach a 10% basal-insulin prescription volume market share in the United States was achieved in 2017.

Presently, Tresiba has been launched in 62 countries. In 2018, it’s expected to witness a further boost in volume share growth.

Recent developments

In March 2018, the FDA approved an update for the US prescribing information for Tresiba. It will now include data from the DEVOTE trial. In the trial, Tresiba demonstrated non-inferiority compared to insulin glargine in adult individuals with Type 2 diabetes and high cardiovascular risk.

In the trial, Tresiba also demonstrated a 40% lower rate of severe hypoglycemia versus insulin glargine, which was statistically significant.

Novo Nordisk also conducted the SWITCH 1 and SWITCH 2 trials, both Phase 3b trials, to evaluate the safety and efficacy of Tresiba in the treatment of individuals with Type 1 and Type 2 diabetes, respectively, compared to insulin glargine. In both trials, Tresiba demonstrated fewer episodes of hypoglycemia compared to individuals receiving insulin glargine U100.

In December 2017, Novo Nordisk announced the results of the post hoc analysis of data from the EU-TREAT trial. According to its press release on December 5, 2017, the EU-TREAT trial concluded that individuals switching to Tresiba treatment from another basal insulin showed clinical benefits in individuals with diabetes, irrespective of whether their blood sugar levels were controlled.

In the marketplace, Tresiba, a long-acting insulin, competes with Eli Lilly’s (LLY) Basaglar and Sanofi’s (SNY) Lantus.