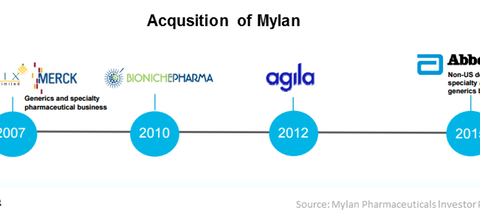

Mylan’s Recent Acquisitions Continue to Strengthen Its Position in International Markets

Mylan takes an M&A strategy to save time related to compliance activities for obtaining regulatory approvals across various international markets.

Nov. 20 2020, Updated 1:10 p.m. ET

Mylan’s recent acquisitions

In addition to diversifying across product portfolios, Mylan (MYL) has opted for an M&A (mergers and acquisitions) strategy in an effort to save time related to compliance activities for obtaining regulatory approvals across various international markets. This approach has also helped Mylan get leverage from its target company’s ongoing projects and marketing networks.

The Abbott Laboratories acquisition

As a part of its growth strategy, in 2015, Mylan acquired Abbott Laboratories’ EPP (established pharmaceutical products) business, a leader in specialty and branded generic medicine, for a consideration of approximately $5.3 billion. This acquisition has also strengthened the company’s footprint in the non-US generic market. The EPP business includes both branded generics and specialty pharmaceuticals business in Europe, Australia, Japan, New Zealand, and Canada.

The Agila acquisition

In the year 2013, Mylan acquired Agila for a consideration of approximately $1.6 billion, to strengthen its business in the injectable market. Agila’s injectable product portfolio and research pipeline have been an essential driving force of Mylan’s growth in the global injectable market.

Agila has added nine manufacturing facilities located in India, Brazil, and Poland to Mylan’s portfolio. To further grow in the injectable market, Mylan also acquired SMS Pharmaceuticals and Vivin Life Science in 2013.

Other acquisitions

Mylan has signed various deals to develop and commercialize products, such as Biocon’s Glargine, the generic version of Sanofi’s (SNY) Lantus, the generic versions of Eli Lilly & Company’s (LLY) Humalog and Aspart, and the generic version of Novo Nordisk’s NovoLog, Pfizer’s (PFE) respiratory drug.

In the year 2013, Mylan acquired Matrix Laboratory, a leading Active Pharmaceutical Ingredient (API) and solid oral dosage form manufacture, that supplies medicines to Clinton Foundation, for approximately $736 million. Mylan also acquired Famycare, a leader in women healthcare market in 2014.

Instead of directly investing in Mylan, investors can get diversified exposure to Mylan’s stock by investing in the SPDR S&P Pharmaceuticals ETF (XPH), which has 3.8% of its total holdings in Mylan stock.

Continue reading for a look at some of Mylan’s key risks moving forward.