SPDR® S&P Pharmaceuticals ETF

Latest SPDR® S&P Pharmaceuticals ETF News and Updates

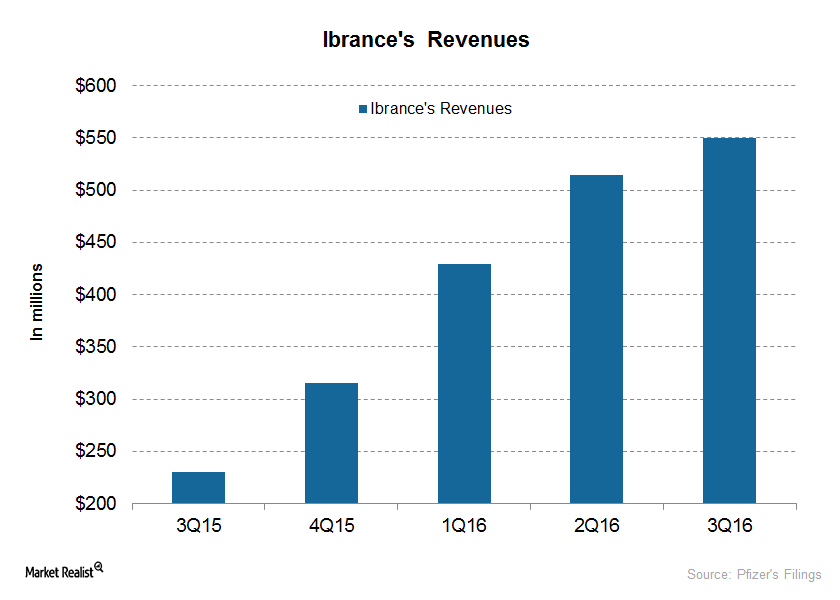

Ibrance Is the Only Registered CDK 4/6 Inhibitor for Breast Cancer

Since its launch in February 2015, Pfizer’s Ibrance has quickly captured the advanced breast cancer market and has reached more than 40,000 patients.

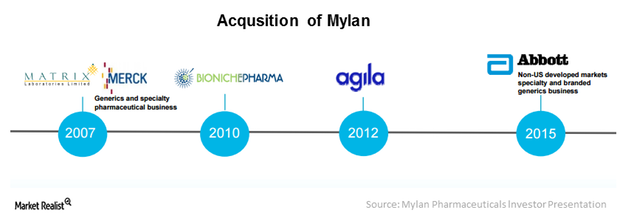

Mylan’s Recent Acquisitions Continue to Strengthen Its Position in International Markets

Mylan takes an M&A strategy to save time related to compliance activities for obtaining regulatory approvals across various international markets.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

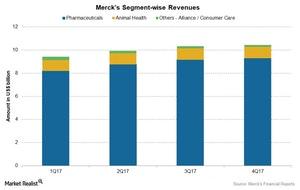

How Merck’s Business Segments Performed

Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

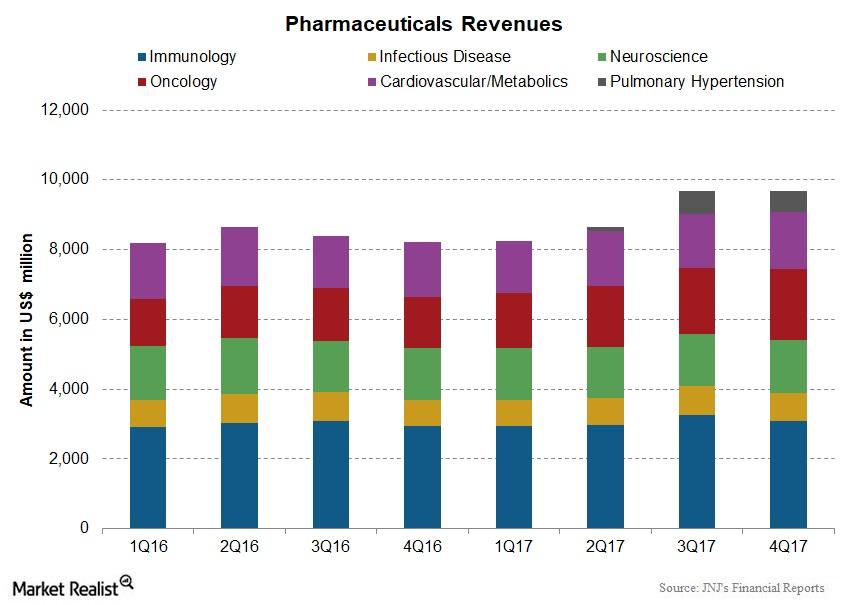

Johnson & Johnson’s Pharmaceuticals Business in 4Q17

Johnson & Johnson (JNJ) reported ~48.0% of its total revenues from the Pharmaceuticals business during 4Q17, making it the company’s largest revenue contributor.

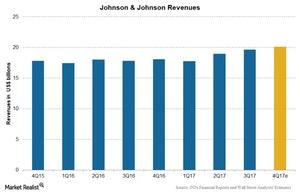

Johnson & Johnson’s Revenue Estimates for 4Q17

Johnson & Johnson’s (JNJ) Pharmaceutical segment contributes more than 45% to total revenues. In 4Q17, it’s expected to report growth in operating revenues.

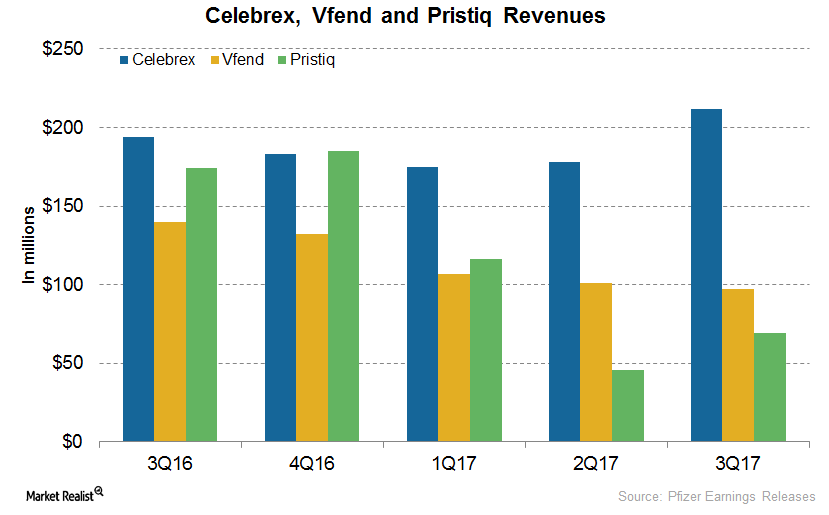

A Look at How These Pfizer Drugs Have Performed in 2017

In 3Q17, Pfizer’s (PFE) Celebrex generated revenues of $212 million, a ~9% increase on a year-over-year (or YoY) basis and a 19% increase on a quarter-over-quarter basis.

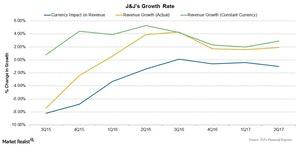

These Factors Affected Johnson & Johnson’s Revenues in 2Q17

Johnson & Johnson (JNJ) reported a 2.9% increase in its revenues at constant exchange rates in 2Q17.

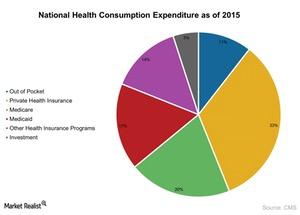

The Hybrid US Healthcare System: An Overview

The US healthcare system is unique in the developed world as it lacks a uniform system and, according to Emanuel, had been largely inefficient before Obamacare.

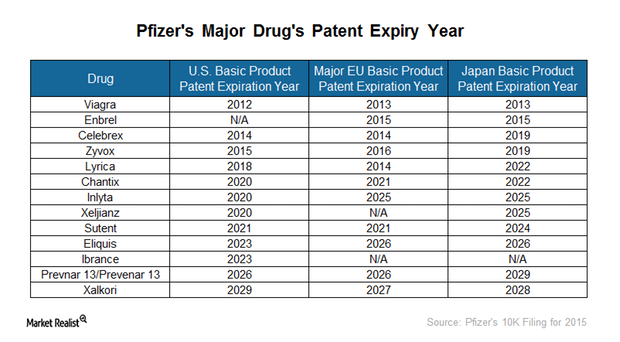

Loss of Patent Protection to Drag Pfizer’s Top Line

With the loss of patent protection for its flagship drug, Lipitor, Pfizer’s revenue fell to $48.8 billion in 2015, compared to $67 billion in 2010.

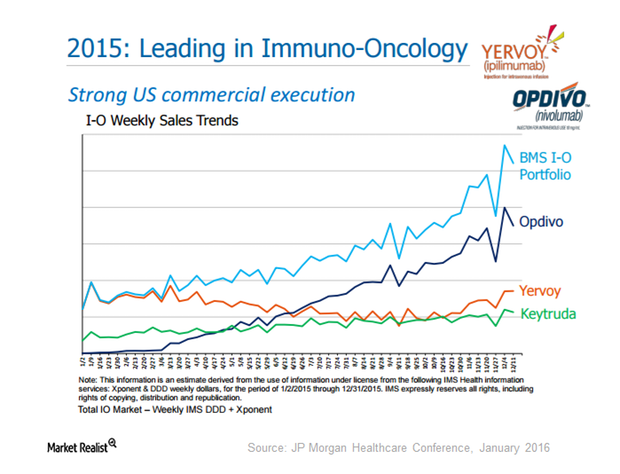

Keytruda Leads over Opdivo in Head and Neck Cancer Treatment

CheckMate-141 Bristol-Myers Squibb’s (BMY) CheckMate-141 evaluated Opdivo for the treatment of squamous cell carcinoma of the head and neck. The study was stopped after meeting the primary endpoint in January 2016. The drug is under priority review by the FDA with an action date set for November 11, 2016. With similar approved indications, Opdivo and Merck’s (MRK) […]

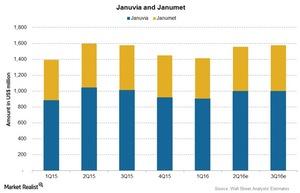

What Are Merck’s Key Diabetes Products?

Januvia and Janumet are two blockbuster drugs in Merck’s (MRK) diabetes franchise.

Januvia and Janumet: Merck’s Blockbuster Diabetes Drugs

Januvia and Janumet are Merck & Co.’s (MRK) blockbuster diabetes drugs. They’re are used to lower blood sugar levels in patients with Type 2 diabetes.

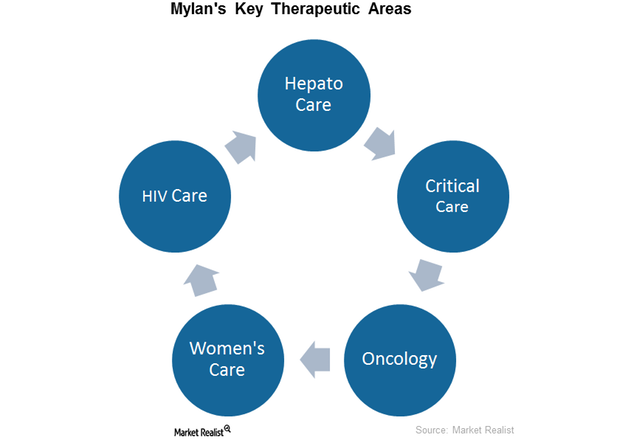

Mylan Product Portfolio across Key Therapeutic Areas

Mylan is a leading pharmaceutical company that operates in more than 140 countries and operates across five different therapeutic areas.