Mylan Inc

Latest Mylan Inc News and Updates

How's Senator Joe Manchin Tied to the EpiPen Scandal?

Senator Joe Manchin's daughter is Heather Bresch, the former CEO of EpiPen maker Mylan. A class action lawsuit against Mylan starts in January 2022.

Teva Can Benefit by Acquiring Allergan Generics

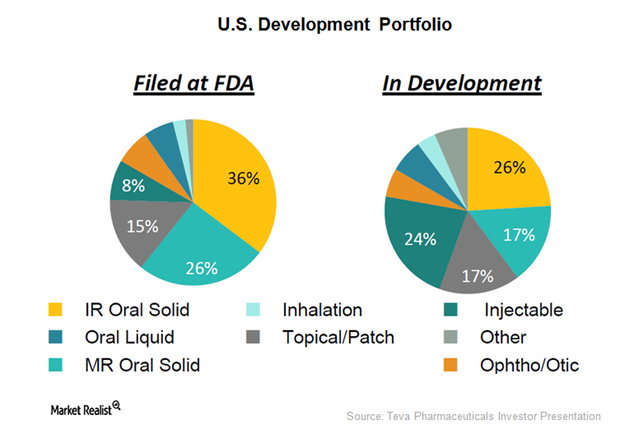

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

Teva Pharmaceutical: Earnings Trends and Recent Developments

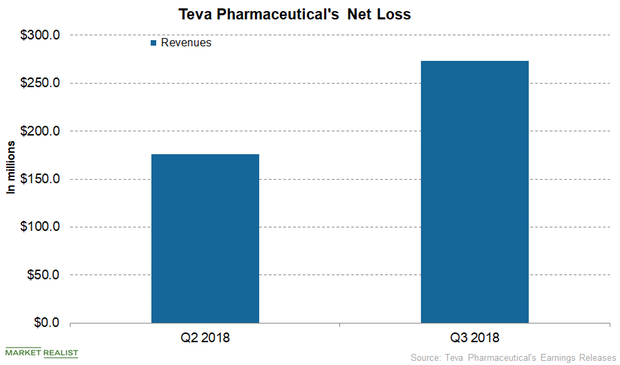

Teva Pharmaceutical’s net income and diluted EPS in the first nine months of 2018 amounted to $541.0 million and $0.53, respectively.

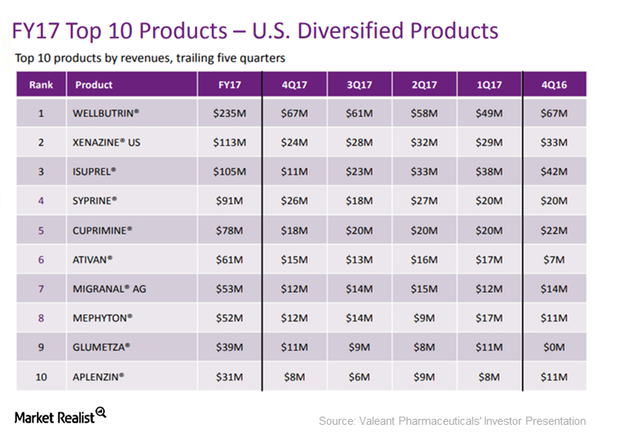

This Space Presents a Market Opportunity for Valeant

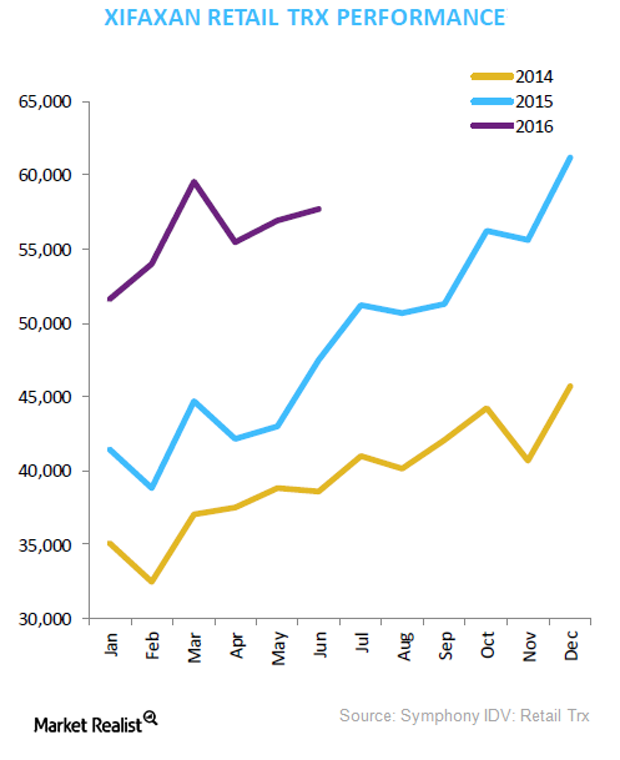

In Valeant’s 2Q16 earnings, Xifaxan reported a year-over-year (or YoY) increase in monthly prescriptions of about 28.0%.

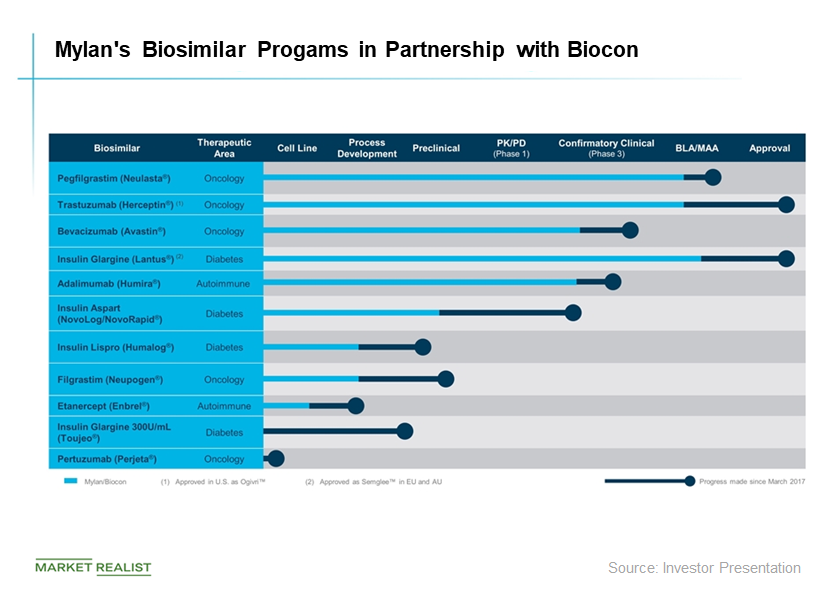

Wall Street Looks at Sales Forecasts for Mylan’s Fulphila

According to Leerink analyst Amy Fadia, Fulphila is expected to generate sales of $73.0 million in 2018. Fadia expects Fulphila’s sales to reach $260.0 million in 2019.

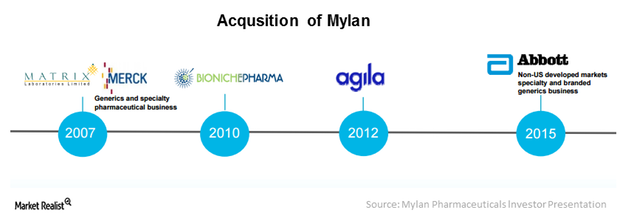

Mylan’s Recent Acquisitions Continue to Strengthen Its Position in International Markets

Mylan takes an M&A strategy to save time related to compliance activities for obtaining regulatory approvals across various international markets.

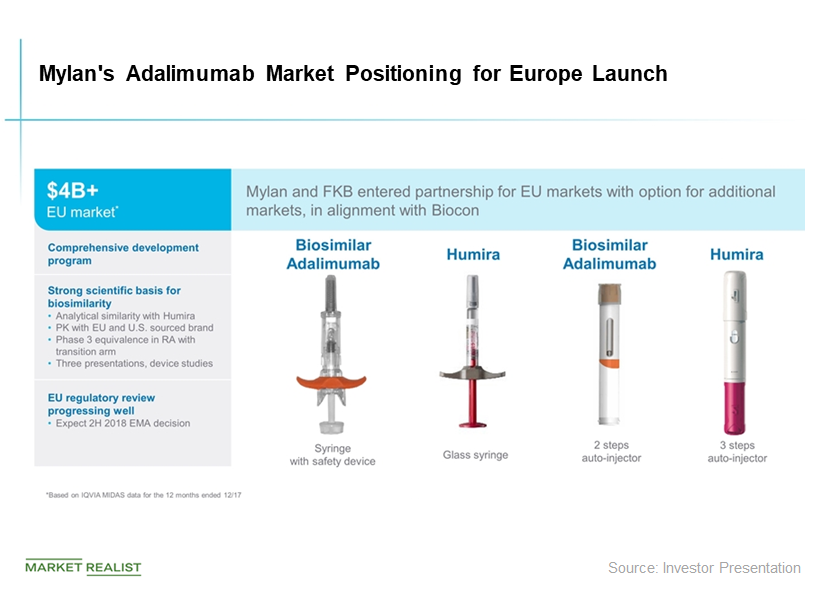

Mylan’s Humira Biosimilar Opportunity in Europe

On September 20, Mylan and its partner, Fujifilm Kyowa Kirin Biologics, received the marketing authorization from the European Commission for Hulio.

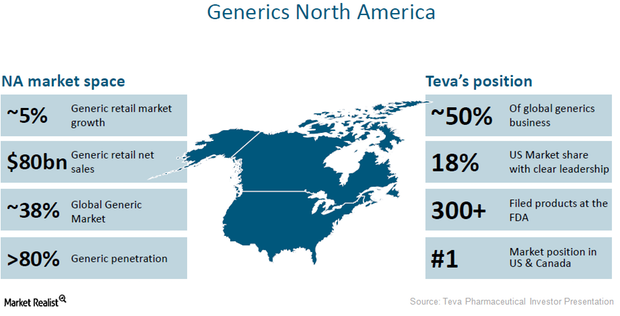

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

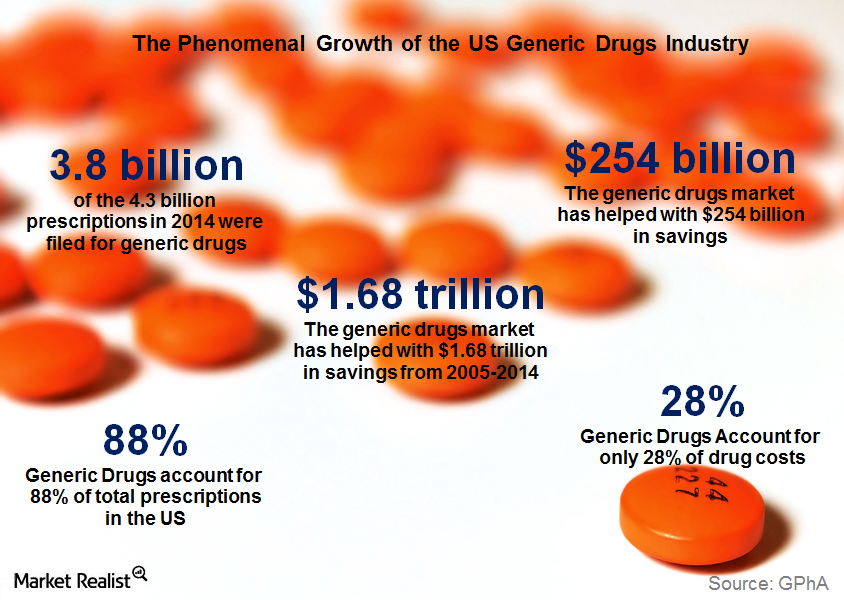

Rx for Growth? Why Generic Drugs Are Gaining Traction

Rx for Growth? The trillion-dollar pharmaceutical industry has historically been dominated by a few major companies that create and supply the most important branded prescriptions on the market. Recent trends, however, point to the growth of the newest pharma blockbusters: generics. Today, approximately 60% of Americans take prescription drugs;[1. “Trends in Prescription Drug Use Among […]

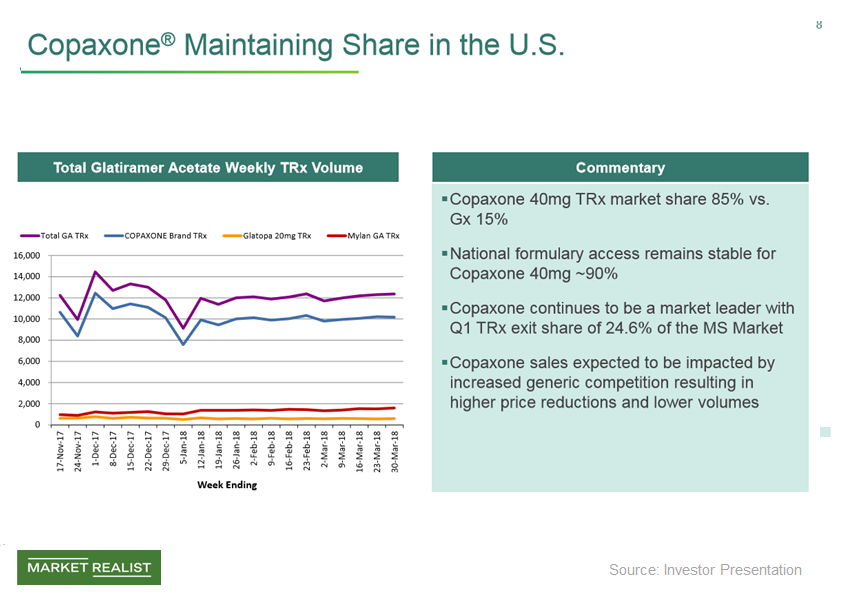

Teva’s Copaxone Maintains Market Share amid Intense Competition

In fiscal 1Q18, Teva (TEVA) reported sales of $645 million for its multiple sclerosis drug, Copaxone, a sequential decline of ~21%.

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 2)

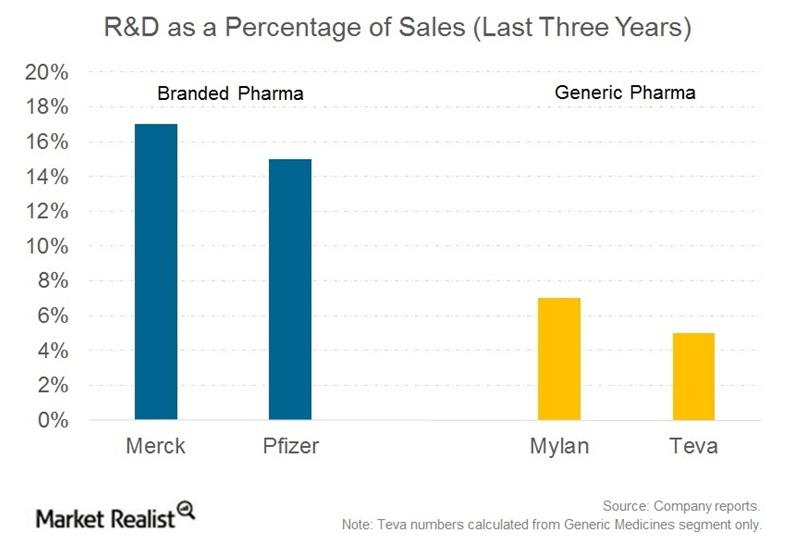

(continued from Part 1) 4. What is the nature of the cash flows for generics companies? Stable, driven by a constant demand for prescription drugs? Or lumpy, driven by growth from drugs coming off patent? The larger companies in this sector tend to have stable, steadier cash flows due to established lineups of approved products. […]

Why Pfizer Stock Continues to Tank after Mylan Deal

Pfizer stock (PFE) has fallen 10% in the past two days on its deal with Mylan (MYL) and its lower earnings guidance.

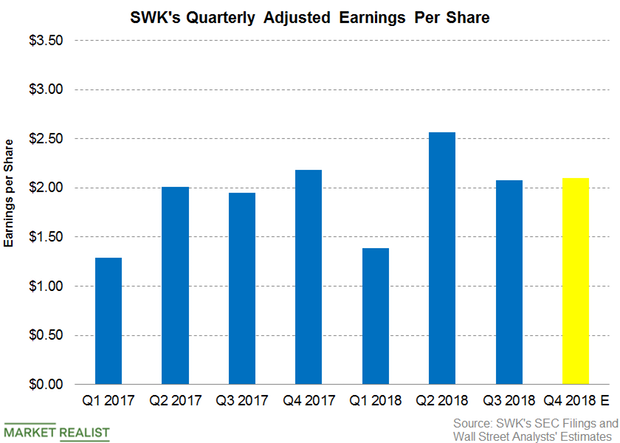

Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

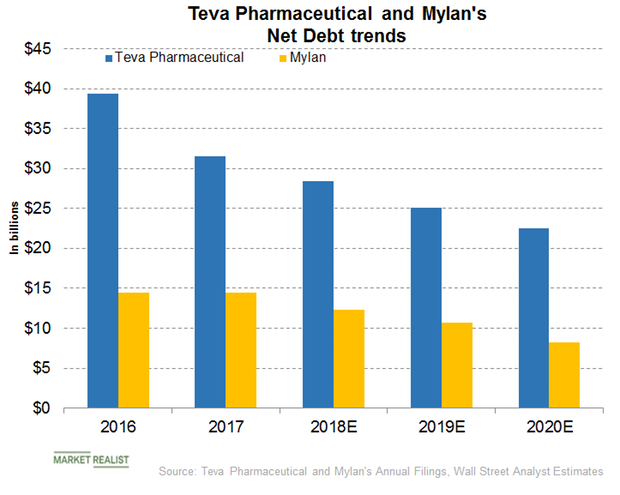

Teva Pharmaceutical or Mylan: Which Has the Better Debt Profile?

In the first nine months of 2018, Teva Pharmaceutical (TEVA) reduced its net debt level by $3.9 billion to $27.6 billion.

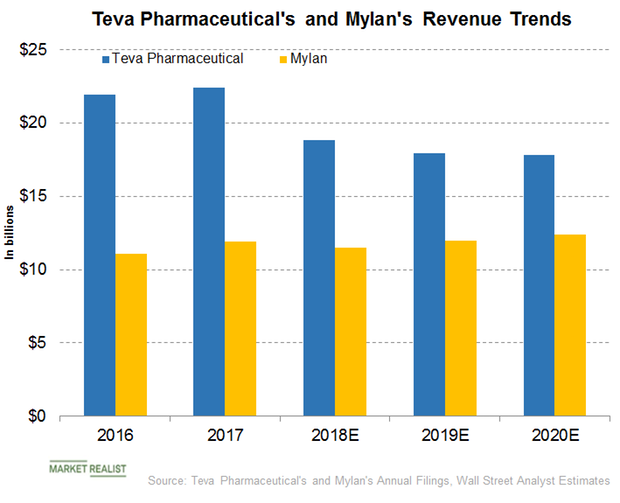

Teva or Mylan: Who Has the More Promising Revenue Trajectory?

In its third-quarter earnings investor presentation, Teva Pharmaceutical (TEVA) forecast total 2018 revenue in the range of $18.6 billion–$19.0 billion.

What Are Pfizer’s Revenue Drivers?

Pfizer reported revenues of $13.5 billion during the second quarter—4% growth YoY compared to $12.9 million during the second quarter of 2017.

How the Market Reacted to Teva’s Pricing of Its Generic Syprine

On February 9, 2018, Teva Pharmaceuticals (TEVA) announced the US launch of its generic version of 250 mg Syprine capsules.

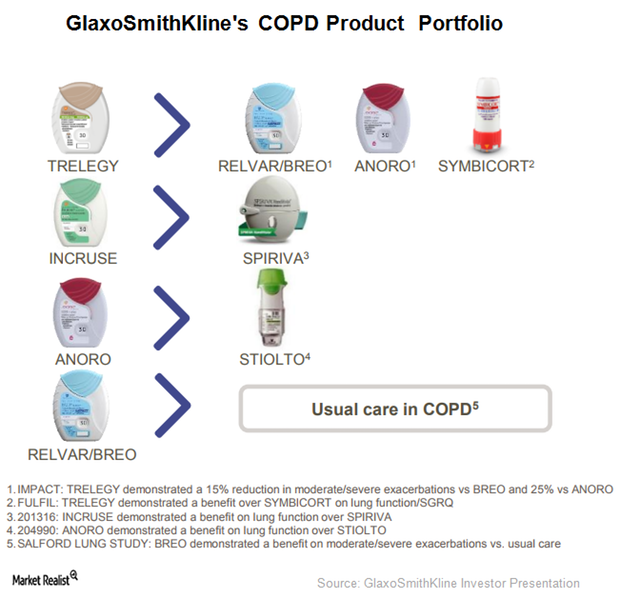

Trelegy Ellipta May Emerge as Major Growth Driver for GlaxoSmithKline

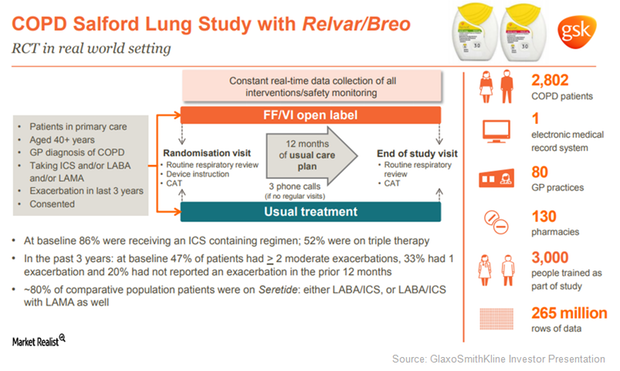

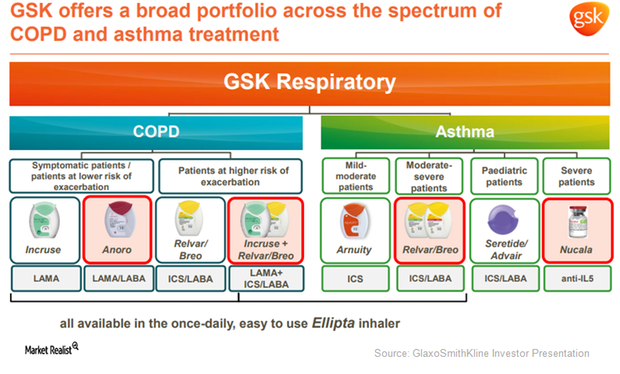

Trelegy Ellipta could enable GlaxoSmithKline to compete aggressively with other respiratory players such as Novartis (NVS).

Anoro Ellipta May Boost GlaxoSmithKline’s Respiratory Franchise Revenues

Anoro Elipta earned revenues of close to 233 million pounds in the first nine months of 2017, which is 77% year-over-year (or YoY) growth on a reported basis and 63% YoY growth on a constant exchange rate (or CER) basis.

GlaxoSmithKline Is Focused on Maintaining Leadership in This Segment

To maintain its leadership in the chronic obstructive pulmonary disease (or COPD) segment, GlaxoSmithKline (GSK) has focused on shifting patients away from LAMA monotherapy to its LAMA/LABA bronchodilators.

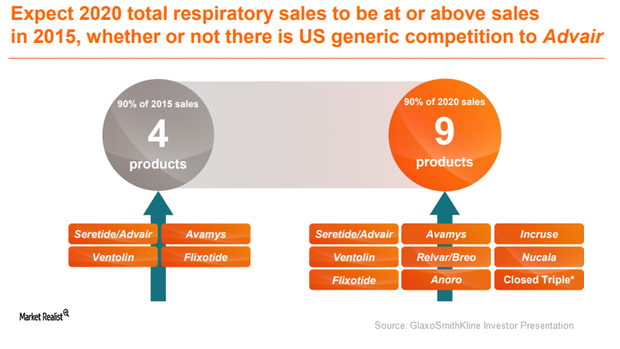

GlaxoSmithKline Has Developed a Broad Respiratory Portfolio

In 3Q17, GlaxoSmithKline (GSK) reported revenues close to 1.6 billion pounds from the sale of its respiratory products, which is year-over-year (or YoY) growth of 1% on a reported basis.

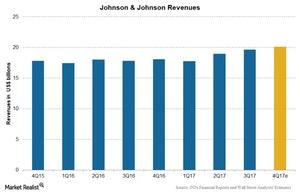

Johnson & Johnson’s Revenue Estimates for 4Q17

Johnson & Johnson’s (JNJ) Pharmaceutical segment contributes more than 45% to total revenues. In 4Q17, it’s expected to report growth in operating revenues.

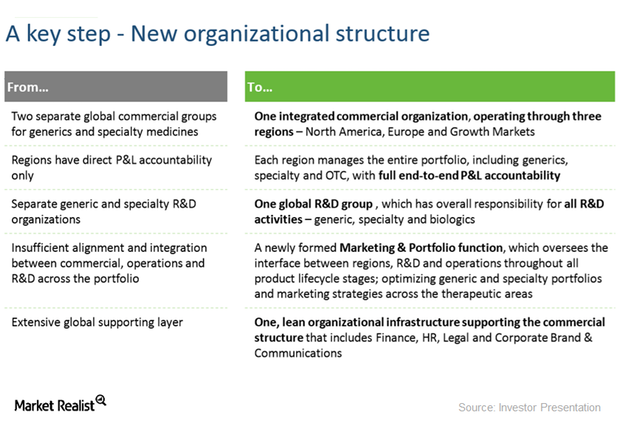

How Teva Pharmaceutical Is Realigning Organizational Structure

On December 14, 2017, Teva Pharmaceutical Industries (TEVA) announced its restructuring plan to cut costs by ~$3 billion over the next two years.

Wall Street Recommendations for Mylan in January 2018

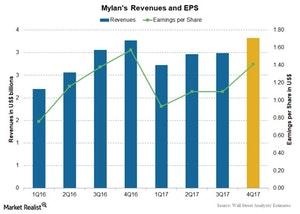

As we discussed earlier in this series, Mylan (MYL) reported revenues of $2.98 billion in 3Q17, a 2.3% decline in revenues compared to $3.06 billion in 3Q16.

Mylan’s Valuation in January 2018

Mylan (MYL) is a leading pharmaceutical company with over 1,400 generic and specialty pharmaceutical products in its portfolio.

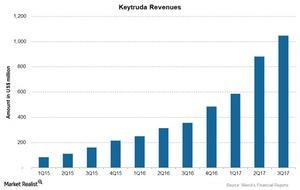

Keytruda: Driving Merck’s Growth

For 3Q17, Keytruda reported revenues of ~$1.1 billion, a 194% growth compared to revenues of $356 million in 3Q16.

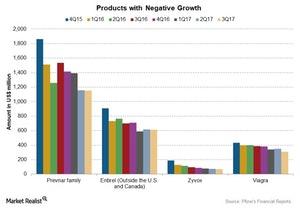

These Pfizer Products Lost Market Share in 3Q17

BeneFIX revenues fell 14% to $151 million during 3Q17, driven by a 16% fall in international sales to $87 million.

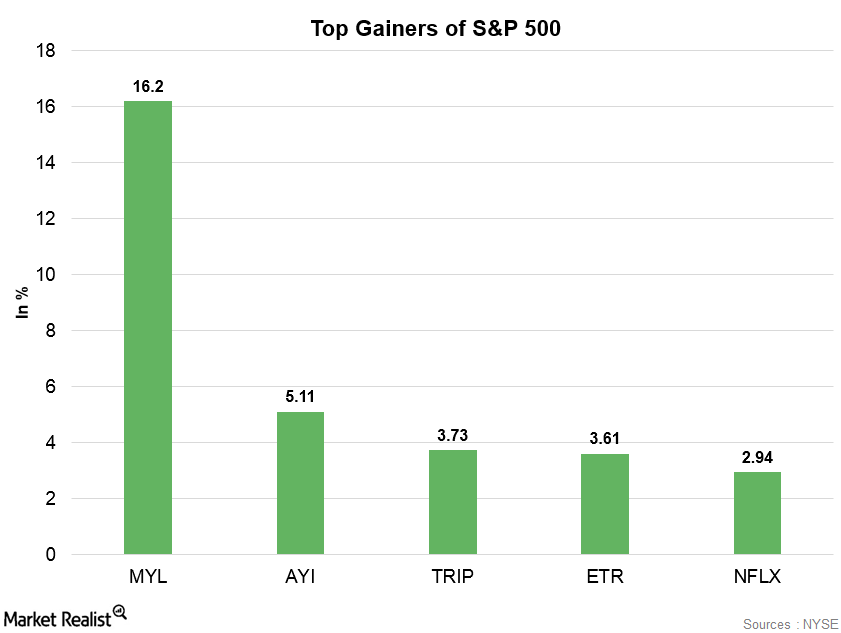

Mylan: S&P 500’s Top Gainer on October 4

Mylan, which is one of the leading global pharmaceutical companies in the world, was the S&P 500’s top gainer on October 4.

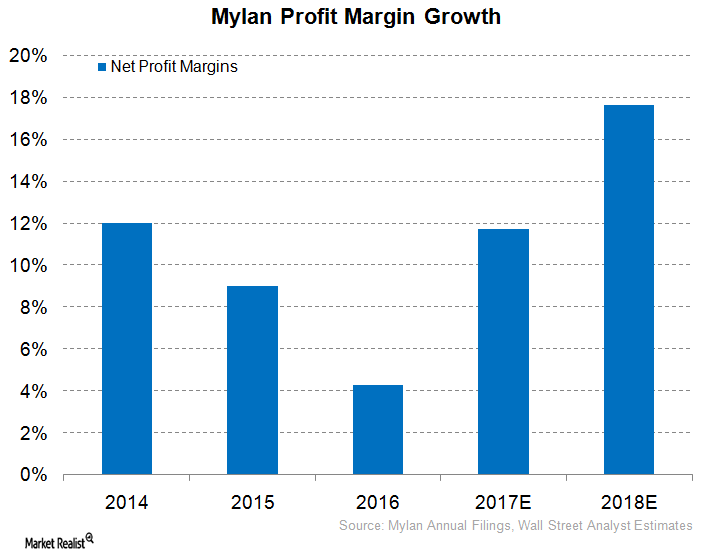

Could Mylan See a Rise in Net Profit Margins in 2017?

In 2Q17, Mylan (MYL) reported gross profit margins of 54.0%, which was lower than 56.0% reported in 2Q16.

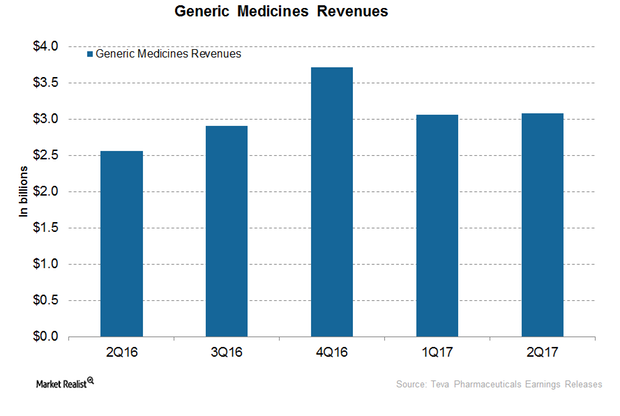

How TEVA’s Generic Medicines Franchise Is Positioned after 1H17

In 1H17, Teva Pharmaceutical’s (TEVA) generic medicines business generated revenues of ~$6.1 billion, or ~22% higher YoY (year-over-year).

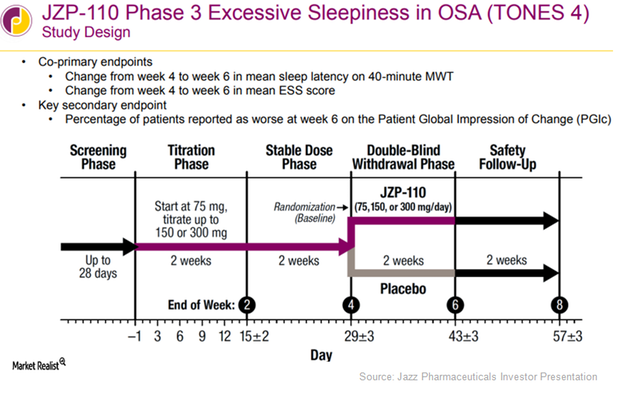

Inside the Efficacy of JAZZ’s JZP-110 in Obstructive Sleep Apnea Trials

This trial demonstrated the efficacy and safety of JAZZ’s JZP-110 in both the MWT and sleep latency tests at all dosages at the end of weeks 4 and 12.

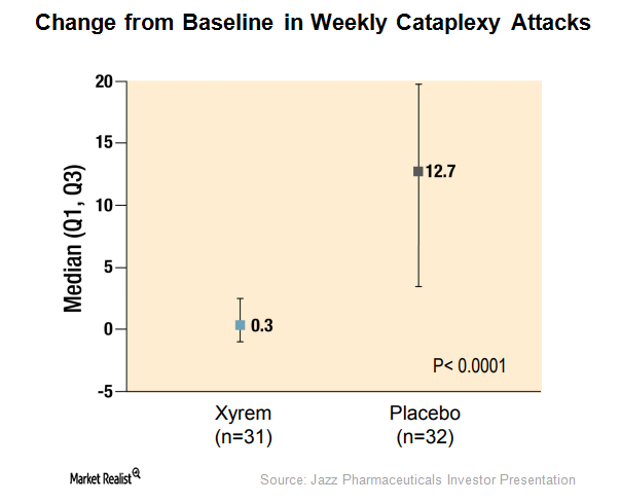

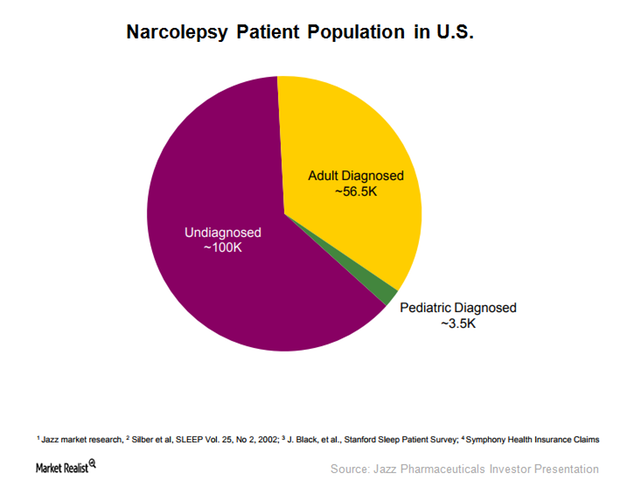

This Alone Could Boost Xyrem’s Addressable Market in 2018

To expand Xyrem’s addressable market, JAZZ has been evaluating the efficacy of Xyrem in pediatric narcolepsy patients with cataplexy and excessive sleepiness.

Behind Xyrem’s Solid Demand Trends in 2017

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Xyrem reported revenues of ~$298 million, which represented a YoY (year-over-year) growth of ~6% and sequential growth of ~9%.

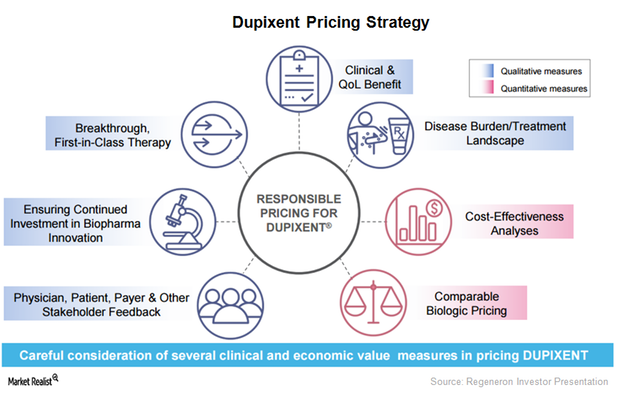

Dupixent May Be a Major Growth Driver for Regeneron in 2017

After Dupixent’s commercial launch, Regeneron has been involved in creating awareness for the drug among physicians who have been treating AD patients.

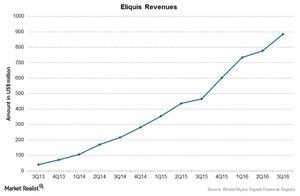

Bristol-Myers Squibb Saw Improved Eliquis Sales in 3Q16

Bristol-Myers Squibb’s (BMY) cardiovascular segment consists of key drug Eliquis. This segment contributed nearly 18% of total revenues for 3Q16.

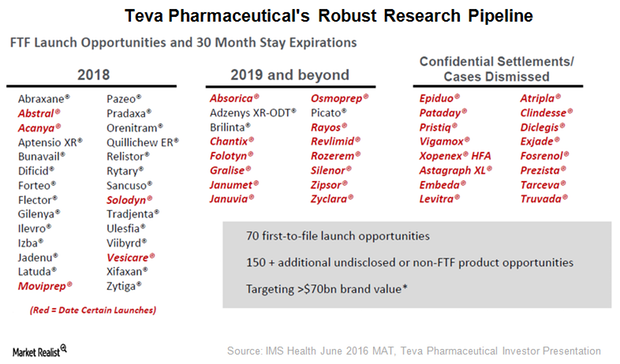

Teva’s Research Pipeline to Culminate in Many New Drug Launches?

Teva Pharmaceutical’s (TEVA) generic research pipeline is expected to result in more than 30 first-to-file (or FTF) launches in 2016 and 2017.

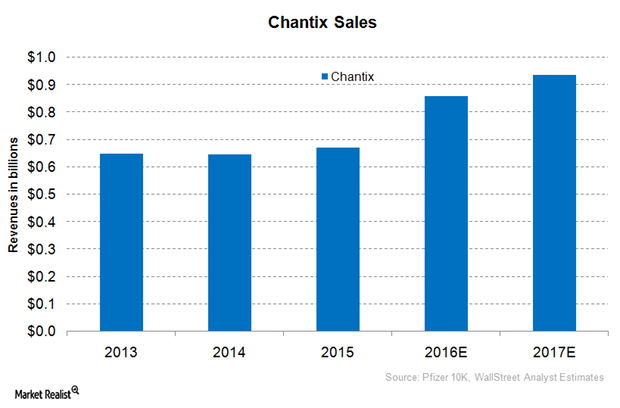

Pfizer Has a Revenue-Boosting Treatment to Help Smokers Quit

Approved by the FDA on May 11, 2006, Chantix, also known as Champix, is used as an aid to help cigarette smokers quit the habit of smoking.

Teva Has a Targeted Strategy to Expand in Major Growth Markets

In Russia, Teva Pharmaceutical has created a strong portfolio of about 300 products and has been extensively developing its research pipeline.

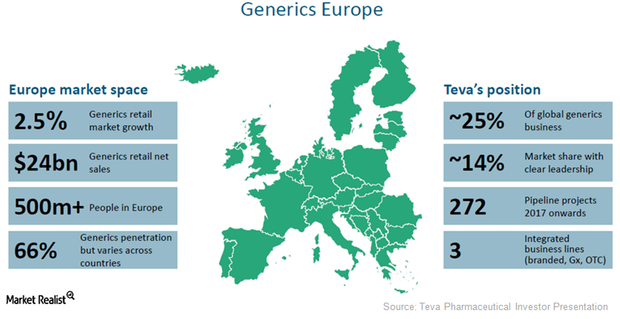

Teva Pharmaceutical Still Dominates the Generic Market in Europe

With a share of about 14%, Teva Pharmaceutical Industries (TEVA) is currently the top-ranking player in the European generic pharmaceutical market.

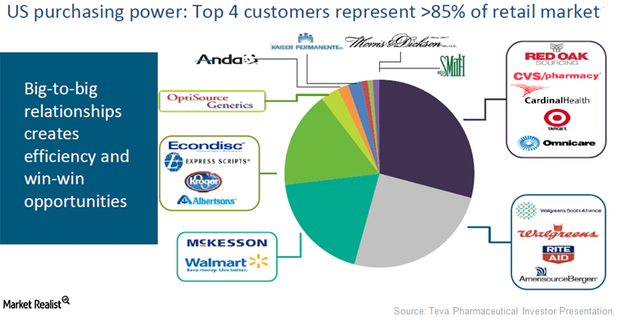

Teva Is Well Positioned for New Trends in the US Generic Market

Because of its drug portfolio, manufacturing operations, and customer relationships, Teva expects to benefit from new trends in the US generic market.

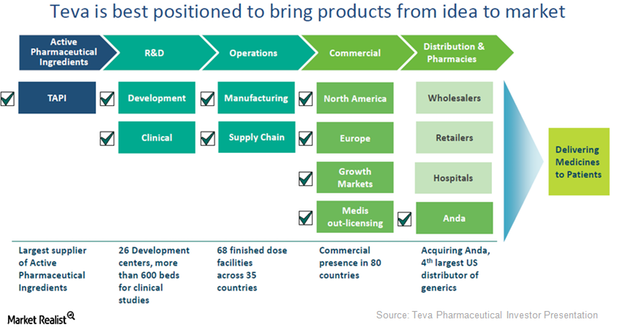

Teva’s Generic Value Chain Differentiates It from Its Peers

In addition to its robust strategy, Teva Pharmaceutical also boasts of an extensive presence across all levels of the value chain for its generics business.

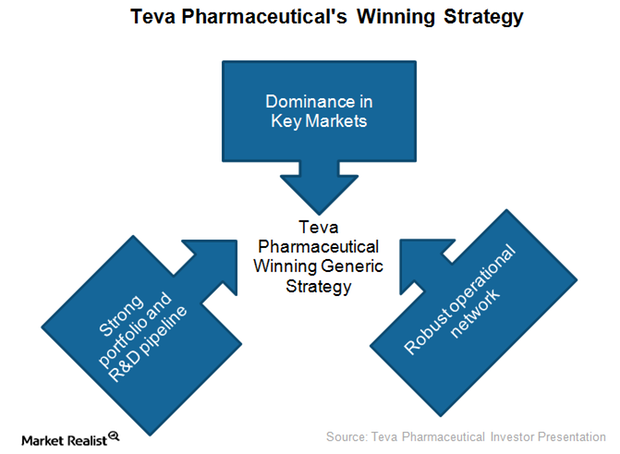

Winning? We Review How Teva Dominates Generic Drug Space

Teva Pharmaceutical Industries plans to take advantage of market dynamics and unmet demand in generic pharmaceuticals by enacting a three-pronged strategy.

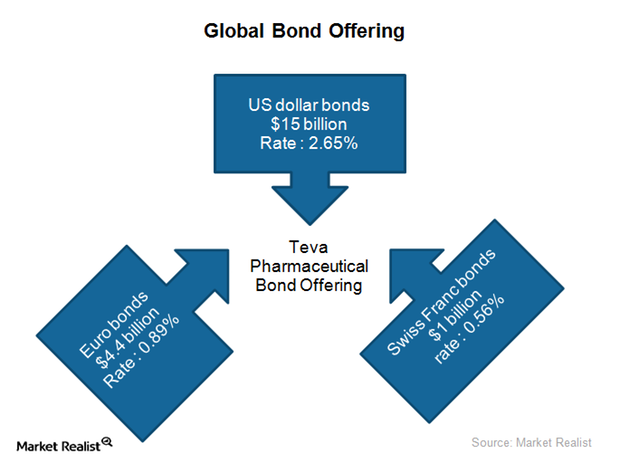

Teva Pharmaceutical: A Successful Bond Financing Program in 2016

To finance the acquisition of Allergan Generics (AGN), Teva Pharmaceutical (TEVA) successfully completed a global bond offering on July 21, 2016.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

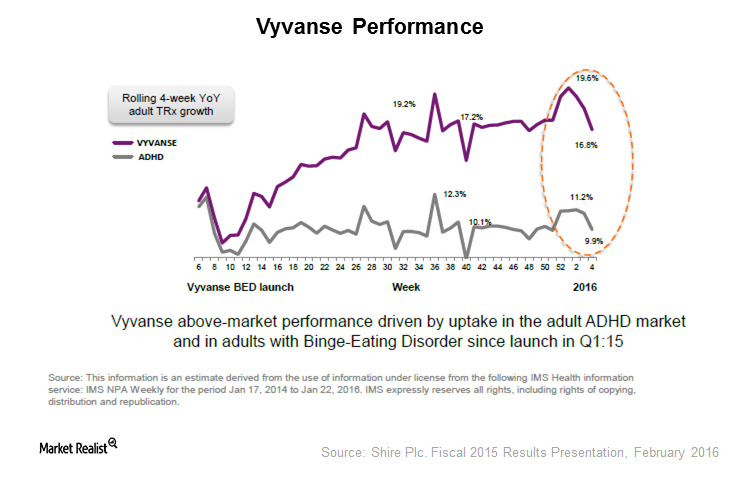

What’s Happening with a Generic Version of Vyvanse?

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

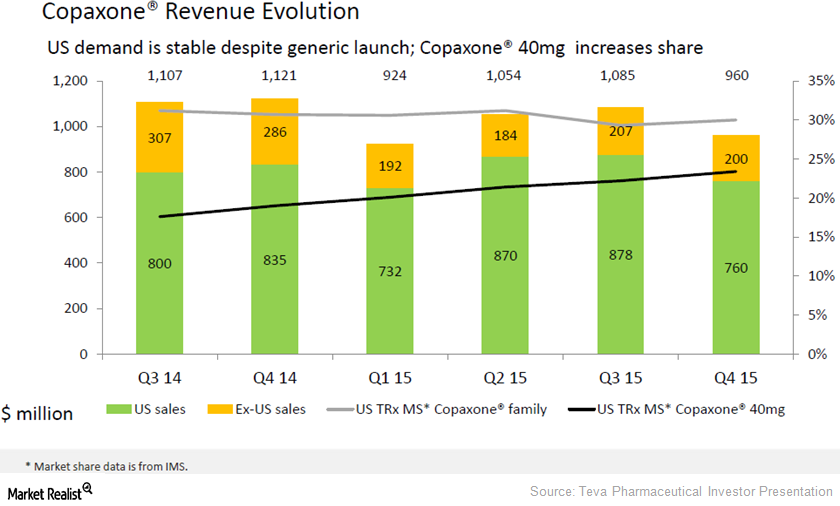

How Could Generic Competition Affect Copaxone’s Revenues in 2016?

Wall Street analysts have projected that Teva Pharmaceutical Industries (TEVA) will earn about $3.5 billion in revenues from Copaxone sales in 2016

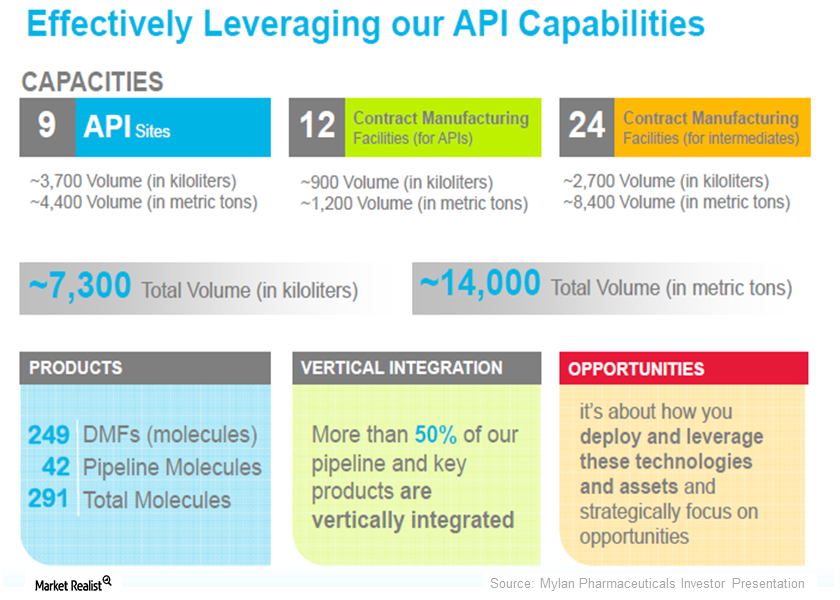

How Has Manufacturing Its Own Active Pharmaceutical Ingredients Helped Mylan?

Mylan is one of largest API (active pharmaceutical ingredient) manufacturers in the world, with nine API and intermediate manufacturing facilities.

Mylan Product Portfolio across Key Therapeutic Areas

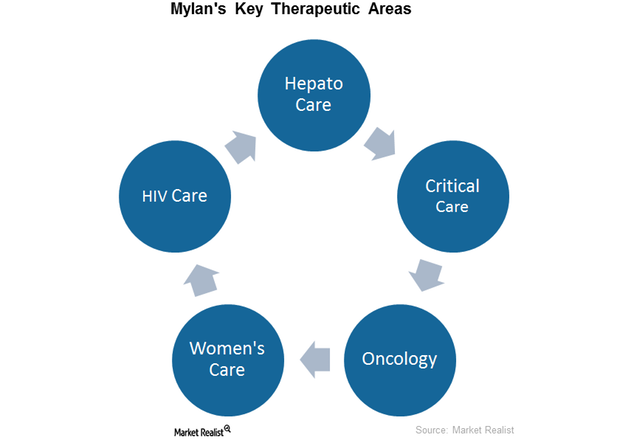

Mylan is a leading pharmaceutical company that operates in more than 140 countries and operates across five different therapeutic areas.

Mylan’s Business Model: A Key Investor Rundown

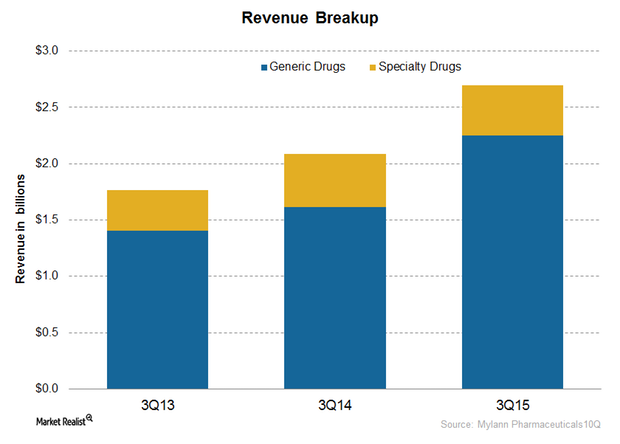

In 2014, Mylan earned about 85% of its total revenues from the US generic market, which is the largest generic market in the world.

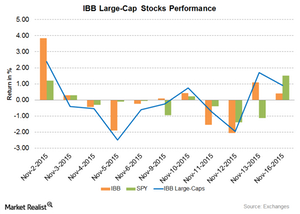

Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.