Eli Lilly and Co

Latest Eli Lilly and Co News and Updates

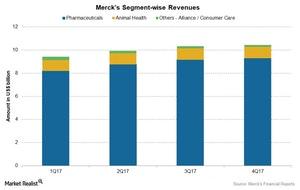

How Merck’s Business Segments Performed

Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

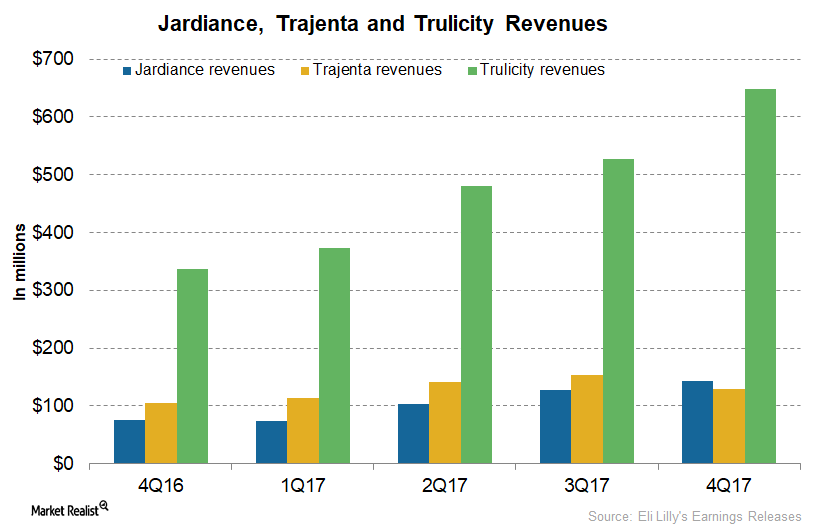

Eli Lilly’s Jardiance, Trajenta, and Trulicity in 2017

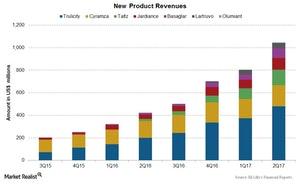

In 4Q17, Eli Lilly’s (LLY) Jardiance generated revenues of $143.2 million compared to $76.1 million in 4Q16.

Label Expansion May Boost Xultophy’s Sales in 2018

In November 2017, Novo Nordisk (NVO) submitted an application to European regulatory authorities to update Xultophy’s label.

Xultophy May Prove a Strong Growth Driver for NVO in 2018

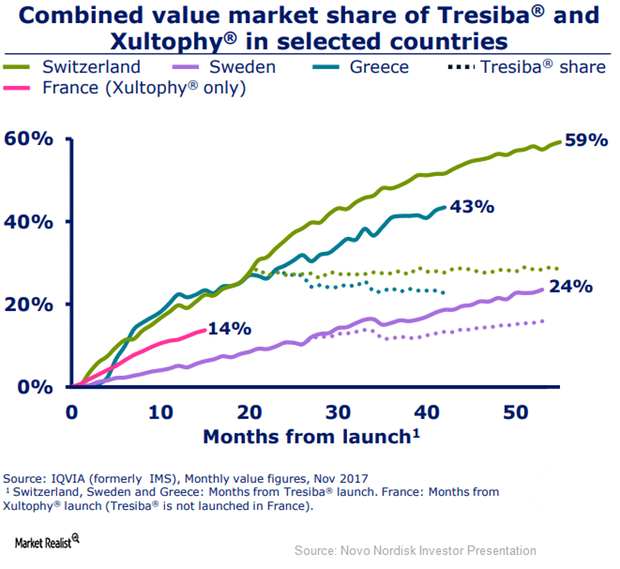

Novo Nordisk’s (NVO) Xultophy reported sales close to 729 million Danish kroner in 2017.

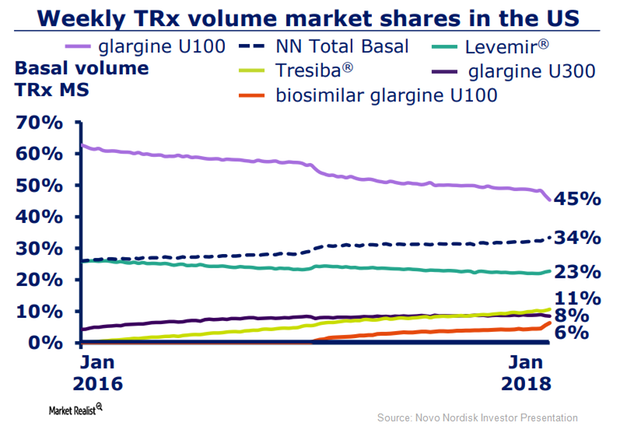

Novo Nordisk Has Developed a Portfolio of New-Generation Insulins

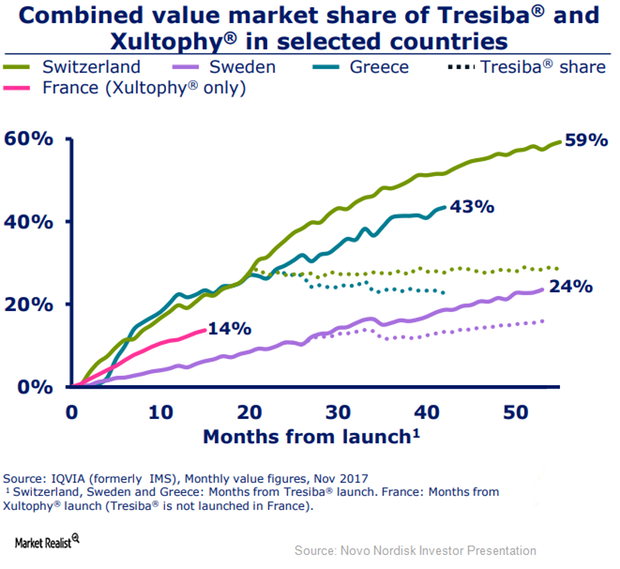

Novo Nordisk has been creating awareness about the risks of hypoglycemia and the benefits of Tresiba among general practitioners and primary care physicians.

Tresiba Emerged as a Blockbuster Therapy in 2017

In 2017, Novo Nordisk’s (NVO) basal insulin therapy, Tresiba, reported revenue of nearly 7.3 billion Danish kroner and attained blockbuster status.

Novo Nordisk Has a Broad Portfolio for Type 2 Diabetes Care

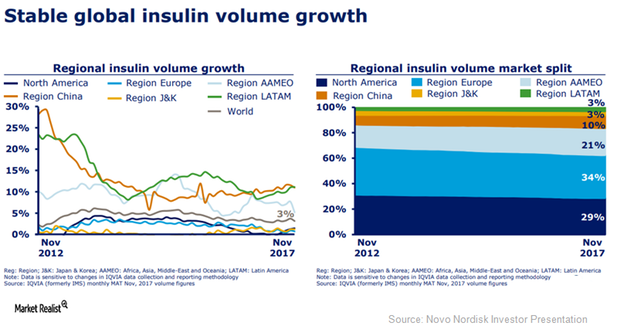

According to IQVIA, the global insulin market value grew at a compound average growth rate (or CAGR) of 16.8% from November 2012 to November 2017.

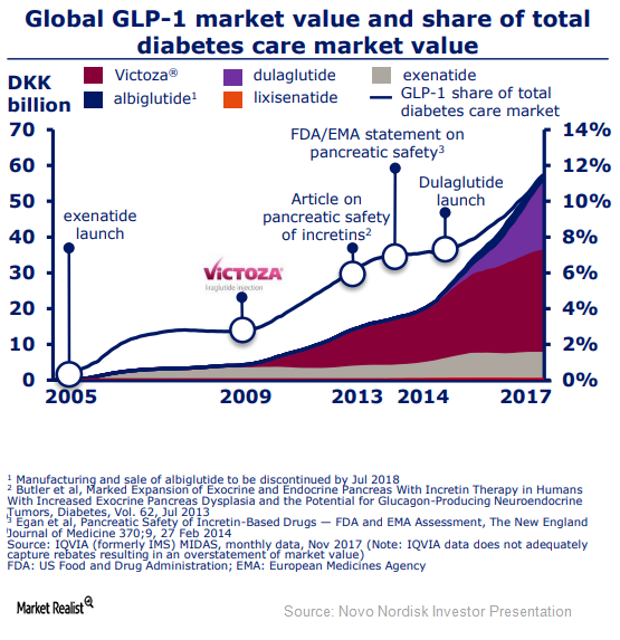

Victoza Continues to Lead in the GLP-1 Segment in 2018

In 3Q17, Novo Nordisk managed to update Victoza’s label in the United States and Europe.

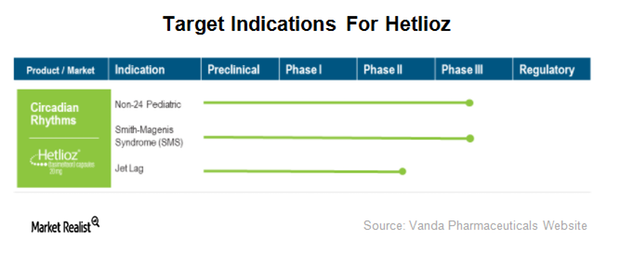

A Look at Vanda Pharmaceuticals’ Product Portfolio

Vanda Pharmaceuticals’ (VNDA) Hetlioz was approved by the FDA in January 2014 for the treatment of Non-24-Hour Sleep Wake Disorder.

How Pfizer’s Peri-LOE Products Performed in 2017

Pfizer’s (PFE) Peri-LOE products refer to those products that lost patient protection recently or are expected to lose patient protection soon.

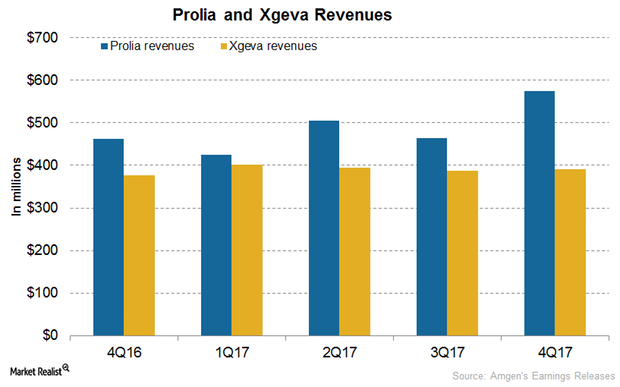

How Amgen’s Xgeva and Prolia Performed in 4Q17

In 4Q17, Xgeva generated revenues of $391 million, which reflected a 4% growth on a YoY (year-over-year) basis and a 1% growth quarter-over-quarter.

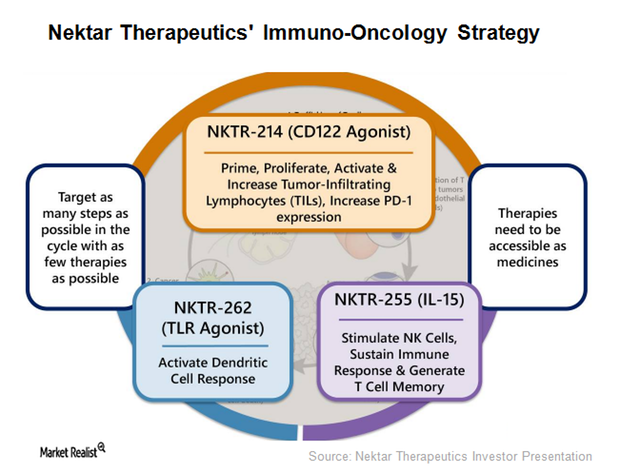

A Deeper Look at Nektar Therapeutics’ Licensing Agreements

License and collaboration agreements Nektar Therapeutics (NKTR) has entered into a number of licensing and collaboration agreements for research, development, and commercialization with various healthcare companies, including Eli Lilly (LLY), AstraZeneca (AZN), and Amgen (AMGN). Under these agreements, Nektar is entitled to receive license fees, milestone payments, royalties, and payments for manufacturing and supplying Nektar’s […]

Wall Street Recommendations for Mylan in January 2018

As we discussed earlier in this series, Mylan (MYL) reported revenues of $2.98 billion in 3Q17, a 2.3% decline in revenues compared to $3.06 billion in 3Q16.

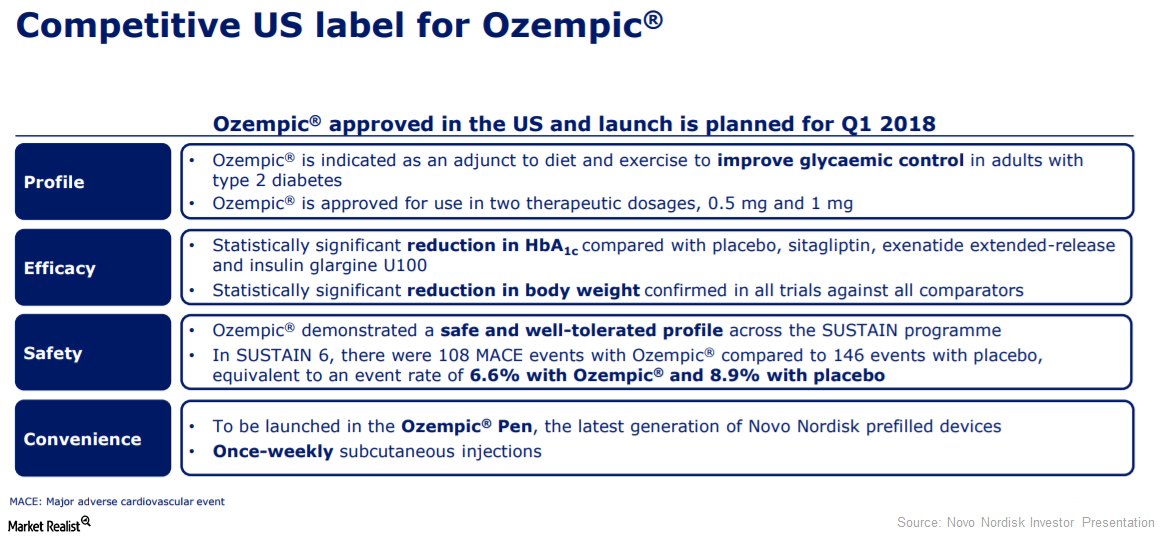

Ozempic Could Boost Novo Nordisk’s Revenue Growth in 2018

In December 2017, the U.S. FDA (Food and Drug Administration) approved Novo Nordisk’s (NVO) Ozempic as an addition to diet and exercise for the improvement of blood sugar levels in individuals with type two diabetes mellitus.

A Look at Pfizer’s Valuation

Pfizer (PFE) reported revenue of $13.2 billion in 3Q17, ~1% growth from its 3Q16 revenue of $13.0 billion.

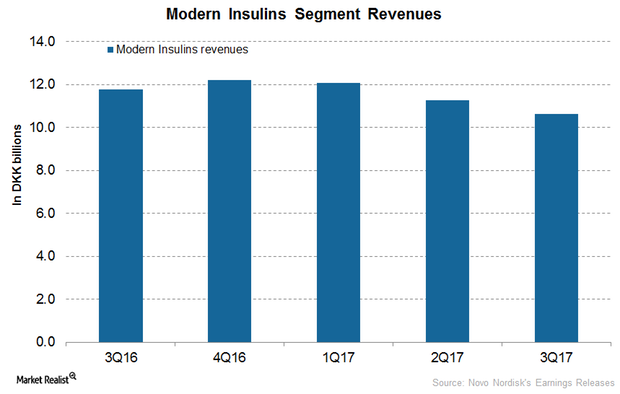

How Did Novo Nordisk’s Modern Insulin Segment Perform in 3Q17?

In 3Q17, Novo Nordisk’s (NVO) NovoRapid reported revenues of 5.0 billion Danish krone (or DKK), which reflected ~9% growth on year-over-year (or YoY) basis.

Novo Nordisk’s Xultophy, Ryzodeg, and Fiasp Could Boost Revenue Growth in 2018

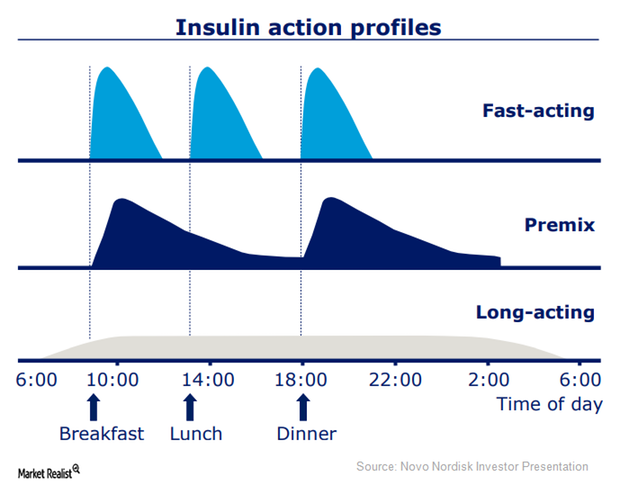

Novo Nordisk’s (NVO) Xultophy (insulin degludec and liraglutide combination) is used as an addition to diet and exercise for improvement of blood sugar levels in adults with type-2 diabetes mellitus whose blood sugar level could not be controlled adequately with basal insulin.

How Is Novo Nordisk’s New Generation Insulin Segment Positioned after 3Q17?

In 3Q17, Novo Nordisk’s (NVO) new generation insulin generated revenues of 2.1 billion Danish krone (or DKK), which reflected ~93% growth on a year-over-year (or YoY) basis.

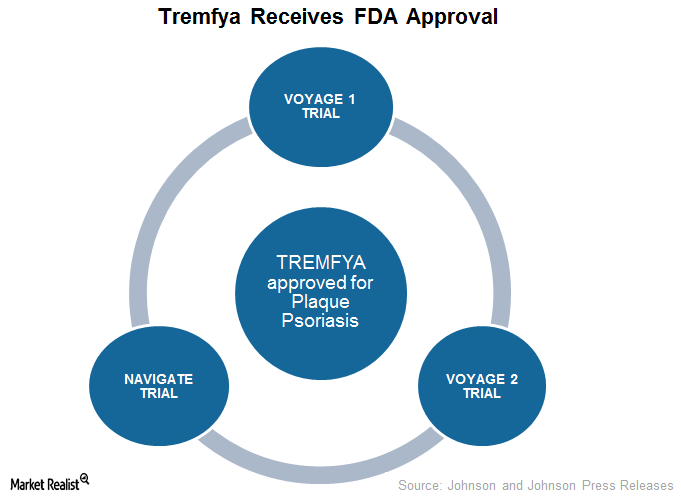

Johnson & Johnson’s Tremfya Approved to Treat Plaque Psoriasis

In July 2017, the US FDA (Food and Drug Administration) approved Johnson & Johnson’s (JNJ) Tremfya (guselkumab) for the treatment of individuals with moderate to severe plaque psoriasis.

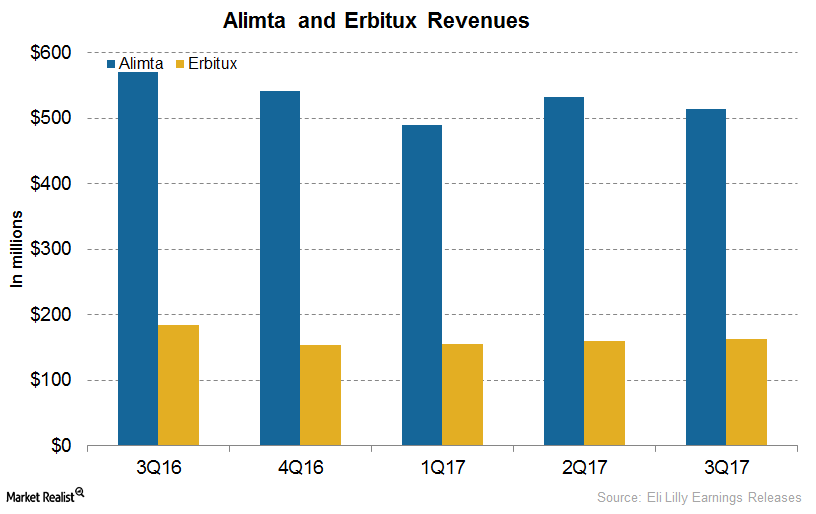

An Update on Eli Lilly’s Oncology Drugs: Alimta, Erbitux, and Gemzar

In 3Q17, Eli Lilly’s (LLY) Alimta generated revenues of $514.5 million, a ~10% increase on a year-over-year (or YoY) basis and a 3% decline on a quarter-over-quarter basis.

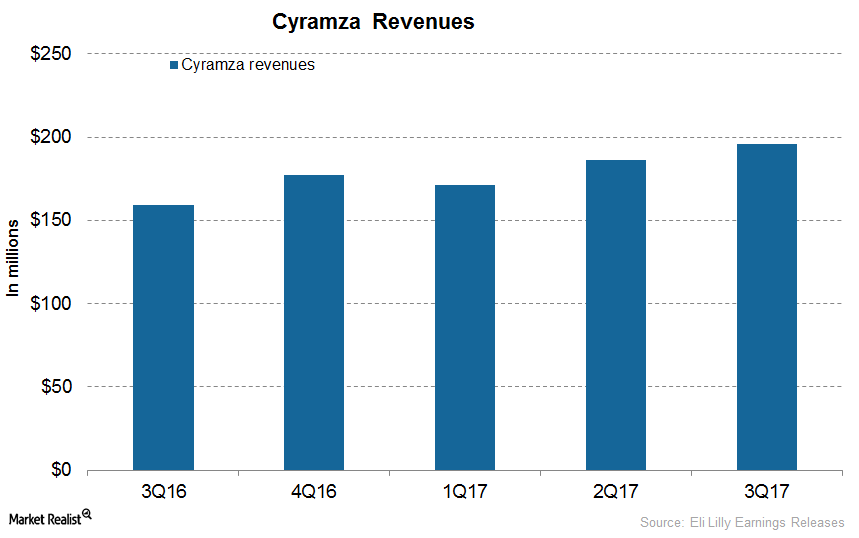

How Has Eli Lilly’s Cyramza Performed

In 3Q17, Eli Lilly’s (LLY) Cyramza generated revenues of $196 million, which reflected ~23% growth on a YoY basis and 5% growth on a quarter-over-quarter basis.

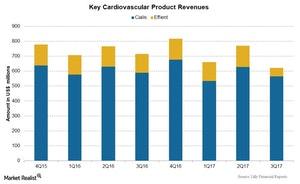

Eli Lilly’s Cialis and Other Cardiovascular Products in 3Q17

Eli Lilly’s cardiovascular franchise includes the drugs Cialis and Effient, but for 3Q17, both drugs reported lower sales.

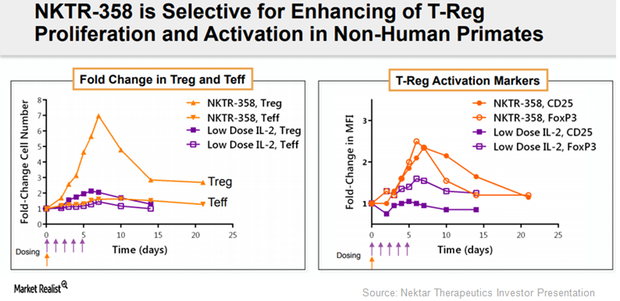

Nektar’s NKTR-358 Collaboration with Eli Lilly Boosted Revenues

Nektar Therapeutics (NKTR) recognized $128 million of the $150 million upfront payment from Eli Lilly (LLY) related to the development of investigational drug NKTR-358.

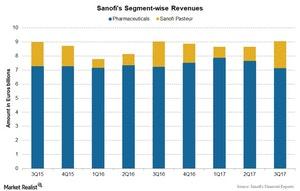

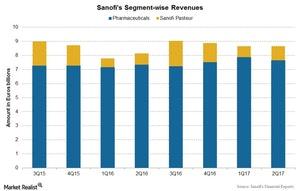

Understanding Sanofi’s Revenues by Segment in 3Q17

Sanofi reports its business in two segments: Human Pharmaceuticals and Sanofi Pasteur, or the Human Vaccines segment.

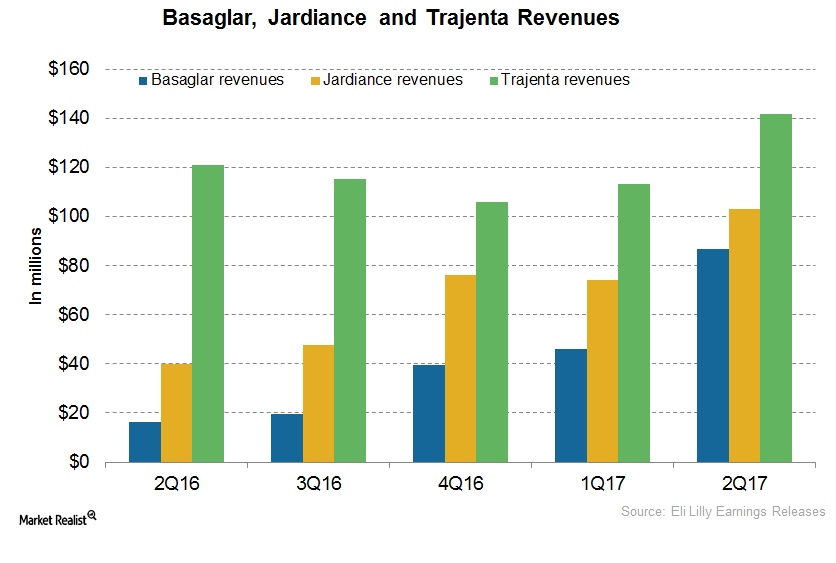

Why Eli Lilly’s Basaglar, Jardiance, and Trajenta Could Witness Steady Growth in 2018

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16.

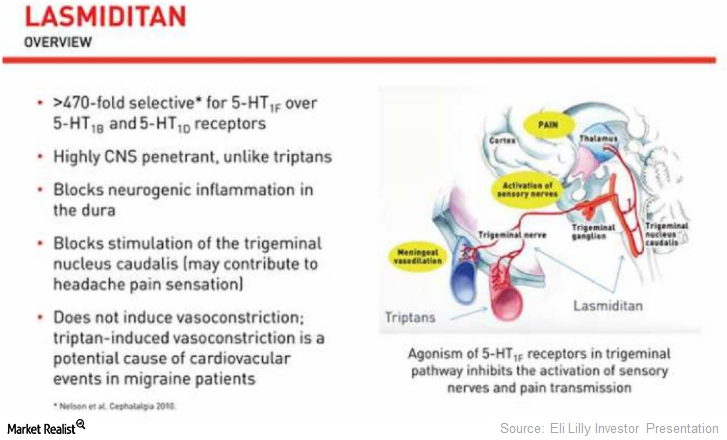

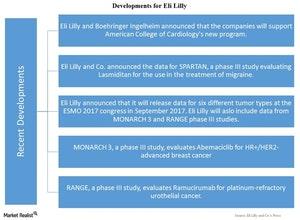

What Will Help Eli Lilly Build a Stronger Migraine Portfolio?

In September, Eli Lilly presented the results of its phase-3 Spartan trial, in which Lasmiditan demonstrated significant progress in the treatment of migraines.

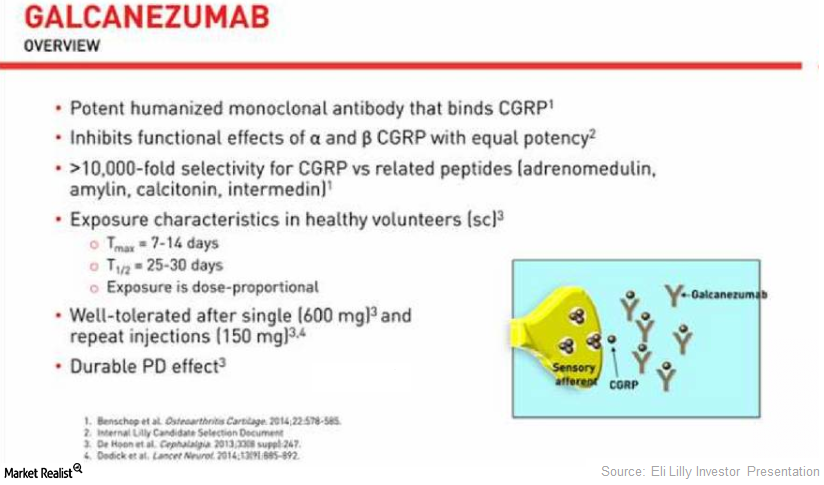

This Could Be Eli Lilly’s Long-Term Growth Driver

In September 2017, Eli Lilly announced that a 12-month open-label study showed a positive safety and tolerability profile of Galcanezumab for migraines.

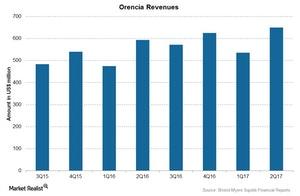

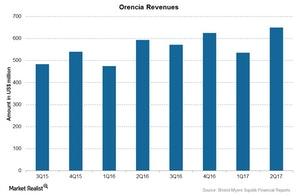

Bristol-Myers Squibb’s Immunoscience Products

Bristol-Myers Squibb’s (BMY) Immunoscience franchise includes Orencia, which is a fusion protein used for the treatment of rheumatoid arthritis and aligned problems.

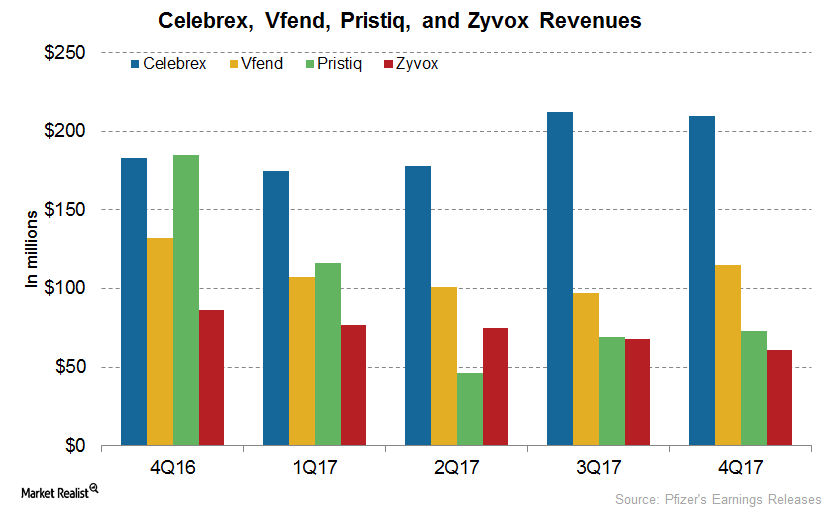

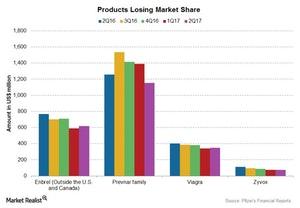

These Pfizer’s Products Are Now Losing Market Share

Pfizer’s (PFE) Essential Health segment reported a fall in overall revenues in 2Q17, driven by the loss of exclusivity of Celebrex and Zyvox.

Xultophy Could Substantially Boost Novo Nordisk’s Revenue Growth

In the first half of 2017, Novo Nordisk’s (NVO) Xultophy generated revenues of DKK (Danish kroner) 284.0 million.

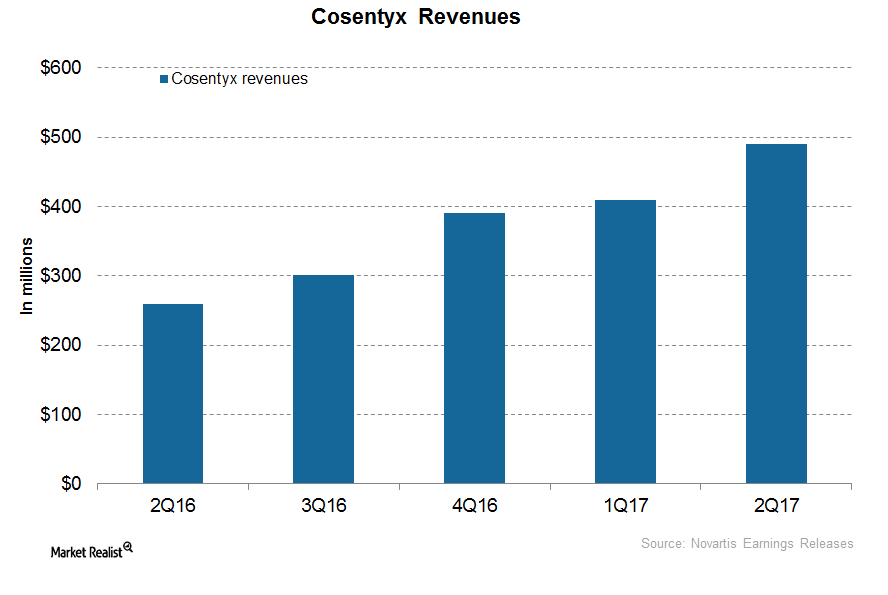

Why Cosentyx Could Significantly Drive Novartis’s Revenue Growth

In 1H17, Novartis’s (NVS) Cosentyx generated revenues of around $900 million compared to $436 million in 1H16.

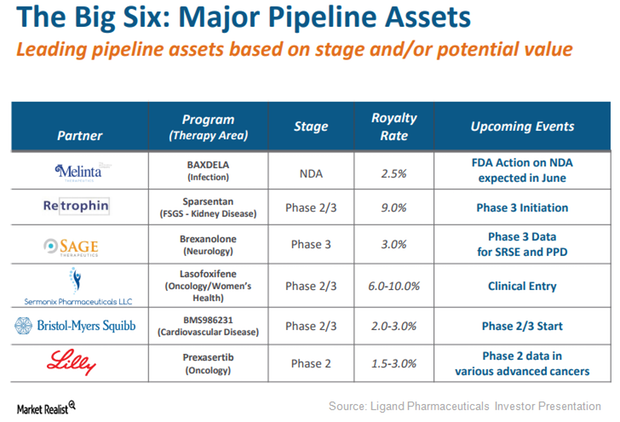

Captisol-Enabled Prexasertib May Be Major Growth Driver for Ligand

Eli Lilly’s (LLY) Captisol-enabled drug Prexasertib is currently being evaluated in multiple oncology indications such as head and neck cancer, small-cell lung cancer (or SCLC), and advanced metastatic cancer.

Eli Lilly & Co.’s Recent Developments after Its 2Q17 Earnings

On July 31, 2017, Eli Lilly and Boehringer Ingelheim announced that the companies would support one of the new programs by the American College of Cardiology.

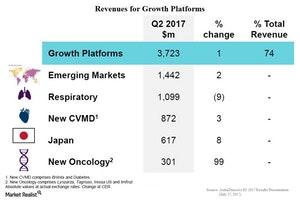

Performance of AstraZeneca’s Growth Platforms in 2Q17

Emerging markets such as China, Brazil, India, Russia, Mexico, and Turkey reported revenues of ~$1.4 billion during 2Q17, representing 2% growth at constant exchange rates from 2Q16.

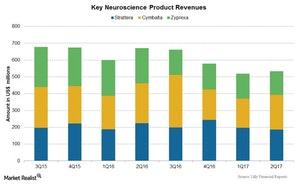

Performance of Eli Lilly’s Neuroscience Products in 2Q17

Cymbalta’s sales totaled $206.6 million during 2Q17, a 13.0% decline compared to sales of $236.5 million in 2Q16.

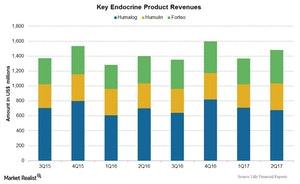

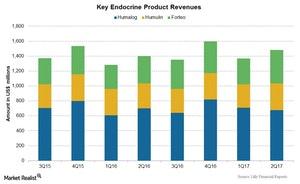

Performance of Eli Lilly’s Endocrine Franchise in 2Q17

Forteo is used for the treatment of osteoporosis. Forteo’s sales totaled $446.7 million during 2Q17, a 22.0% increase compared to $367.6 million in 2Q16.

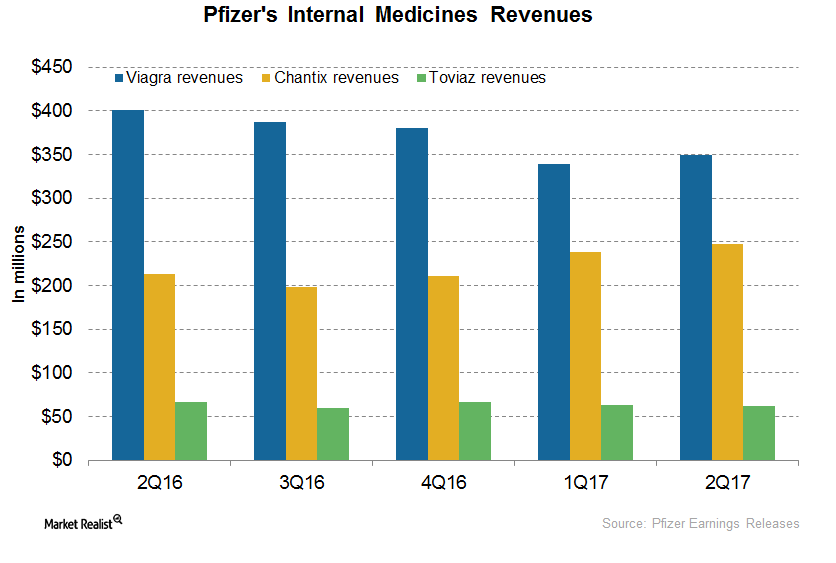

A Post-2Q17 Look at Pfizer’s Internal Medicines

In 2Q17, Chantix/Champix generated revenues of ~$248 million, which represents ~16% growth on a YoY basis and 4% growth on a quarter-over-quarter basis.

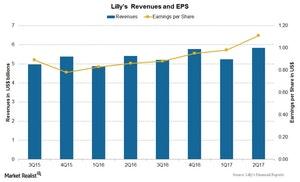

Eli Lilly’s Valuations after Its 2Q17 Earnings

Eli Lilly (LLY) surpassed Wall Street estimates in 2Q17, reporting earnings per share of $1.11 on revenues of ~$5.8 billion. Analysts estimated that the company would report EPS of $1.05 on revenues of $5.6 billion.

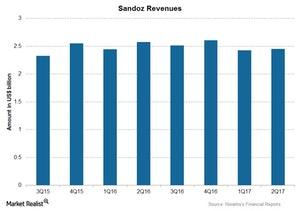

How Novartis’s Sandoz Performed in 2Q17

Novartis’s Sandoz reported revenues of nearly $2.5 billion in 2Q17, representing ~20% of NVS’s total revenues.

Bristol-Myers Squibb’s Immunoscience Products in 2Q17

Orencia revenues rose to $650.0 million in 2Q17, a 10.0% rise compared to $593 million in 2Q16.

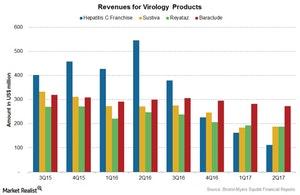

Bristol-Myers Squibb’s Virology Products in 2Q17

Bristol-Myers Squibb’s (BMY) virology products portfolio includes products for the treatment of chronic virus infections.

Bristol-Myers Squibb’s Valuation after 2Q17 Earnings

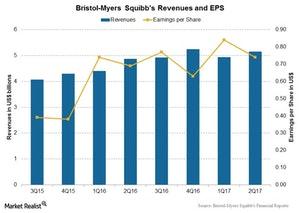

Bristol-Myers Squibb (BMY) met Wall Street analysts’ estimate for EPS at $0.74. It also surpassed the estimates for revenues.

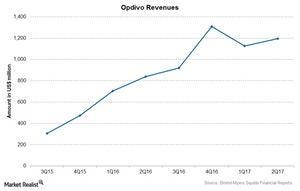

Opdivo Could Drive Bristol-Myers Squibb’s Revenue Growth in 2017

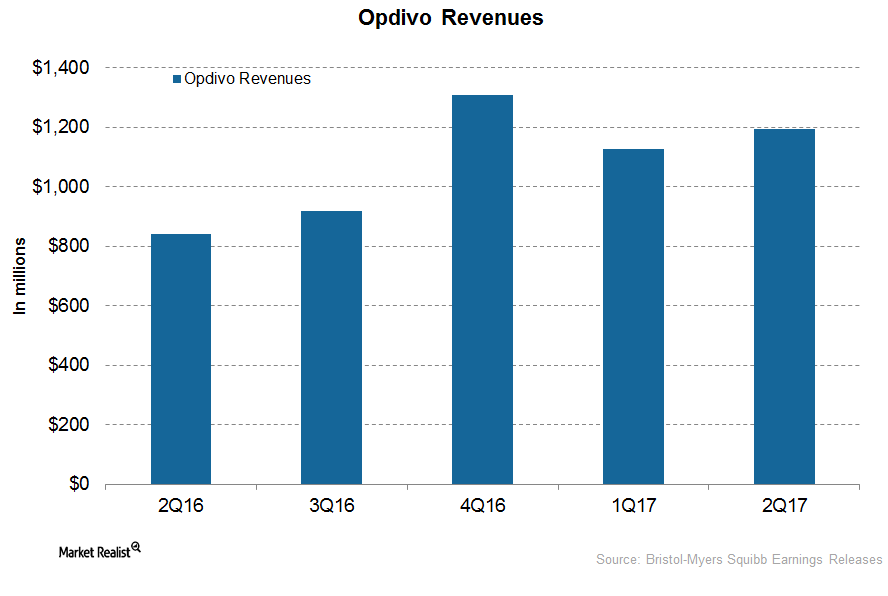

In 2Q17, Bristol-Myers Squibb’s (BMY) Opdivo generated revenues of around $1.2 billion, which reflected ~45% growth on a year-over-year basis.

Sanofi’s Revenue Growth in 2Q17

Sanofi’s revenue in 2Q17 At constant exchange rates, Sanofi (SNY) reported revenue growth of ~5.5% between 2Q16 and 2Q17, with revenue rising to 8.7 billion euros from 8.1 billion euros. Structure of the group The above chart shows Sanofi’s segment-wise revenue over the last few quarters. In 2016, Sanofi reorganized itself into five business units: Sanofi […]

Pfizer’s Corporate and Pipeline Developments in 2Q17

Apart from Pfizer’s (PFE) product developments, let’s take a look at some recent pipeline and corporate developments.

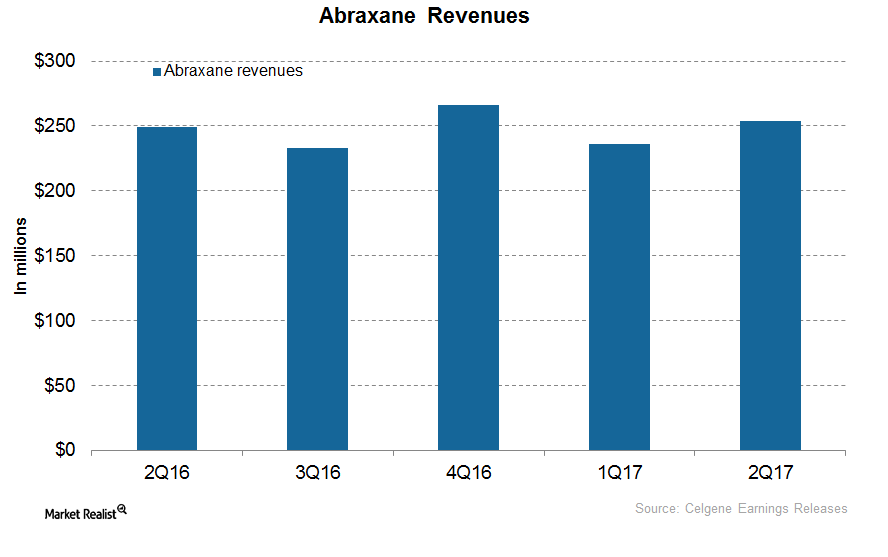

Celgene’s Abraxane Continued Steady Growth in 2Q17

In 2Q17, Celgene’s (CELG) Abraxane generated revenues of around $254 million, which reflected ~2% growth on a year-over-year basis.

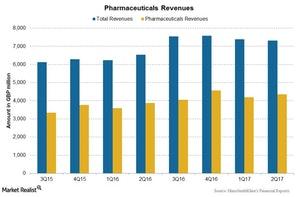

GSK’s 2Q17 Earnings: Pharmaceuticals Segment

GSK’s Pharmaceuticals segment’s contribution to the company’s total revenues was 59.5% in 2Q17.

Bristol-Myers Squibb’s 2Q17 Earnings: Opdivo

Bristol-Myers Squibb’s (BMY) blockbuster drug Opdivo reported revenue of $1.2 billion in 2Q17, a 42% rise compared to $840 million in 2Q16.

Eli Lilly in 2Q17: Humulin and Endocrine Products

Eli Lilly’’s (LLY) Human Pharmaceuticals segment reported a rise of ~11.0% to ~$5.0 billion for 2Q17 compared to ~$4.6 billion for 2Q16.

Eli Lilly in 2Q17: Performance of New Products

For 2Q17, Basaglar sales were $86.6 million. Of that, $60.0 million was from sales in the US markets, while $27.0 million was from international sales.