A Post-2Q17 Look at Pfizer’s Internal Medicines

In 2Q17, Chantix/Champix generated revenues of ~$248 million, which represents ~16% growth on a YoY basis and 4% growth on a quarter-over-quarter basis.

Sept. 1 2017, Updated 7:36 a.m. ET

Viagra’s revenue trends

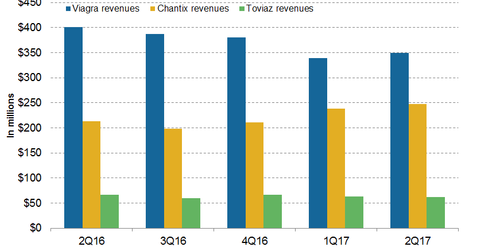

In 2Q17, Pfizer’s (PFE) Viagra generated revenues of ~$349 million, which represents an ~13% decline on a year-over-year (or YoY) basis and 3% growth on a quarter-over-quarter basis. In 1H17, Viagra generated revenues of ~$687 million, which is an ~14% decline on a YoY basis.

In the US and Canada, Viagra generated revenues of around $255 million in 2Q17 compared to $300 million in 2Q16. Lower market demand led to the decline in revenues in 2Q17 and 1H17. In 1H17, Pfizer reported that its international revenues fell 3% operationally compared to 1H16.

Decreasing demand in the international market coupled with the reduction of prices in China attributed to the decline in international revenues in 2Q17 and 1H17. Pfizer’s Viagra competes with Eli Lilly’s (LLY) Cialis and Bayer’s (BAYZF) Staxyn and Levitra.

The chart above represents the revenue curve of Pfizer’s internal medicines from 2Q16 to 2Q17. To learn more about Pfizer’s internal medicines, please read How Pfizer’s Internal Medicines Is Positioned in 2017.

Chantix/Champix’s revenue trends

In 2Q17, Chantix/Champix generated revenues of ~$248 million, which represents ~16% growth on a YoY basis and 4% growth on a quarter-over-quarter basis. In 1H17, Chantix/Champix reported revenues of ~$487 million, which reflects ~12% growth on a YoY basis.

In 2Q17, Chantix/Champix reported 24% growth on a YoY basis. In the US market, Chantix witnessed 18% growth in 1H17 on a YoY basis.

Toviaz’s revenue trends

In 2Q17, Pfizer’s Toviaz reported revenues of ~$62 million for an ~7% decline on a YoY basis and a 3% decline on a quarter-over-quarter basis. In 1H17, Toviaz reported revenues of ~$125 million, which is an ~5% decline on a YoY basis.

Growth in sales of Pfizer’s internal medicine products could boost the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP). Pfizer comprises ~5.0% of PJP’s total portfolio holdings. PJP also invests ~5.2% of its total portfolio in Bristol-Myers Squibb (BMY).