Bayer AG

Latest Bayer AG News and Updates

Must-know trends that drive Zoetis’ growth

Demand for Zoetis’ products is driven by a growing population coupled with a rising middle class in emerging markets and increased relocation from rural to urban areas.

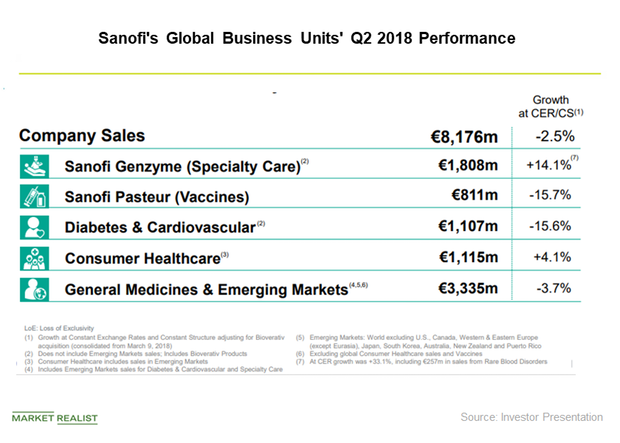

Sanofi’s Organizational Restructuring: Investor Insights

On September 13, Sanofi announced a change in two of its GBUs to enable focused operations across emerging markets and mature markets.

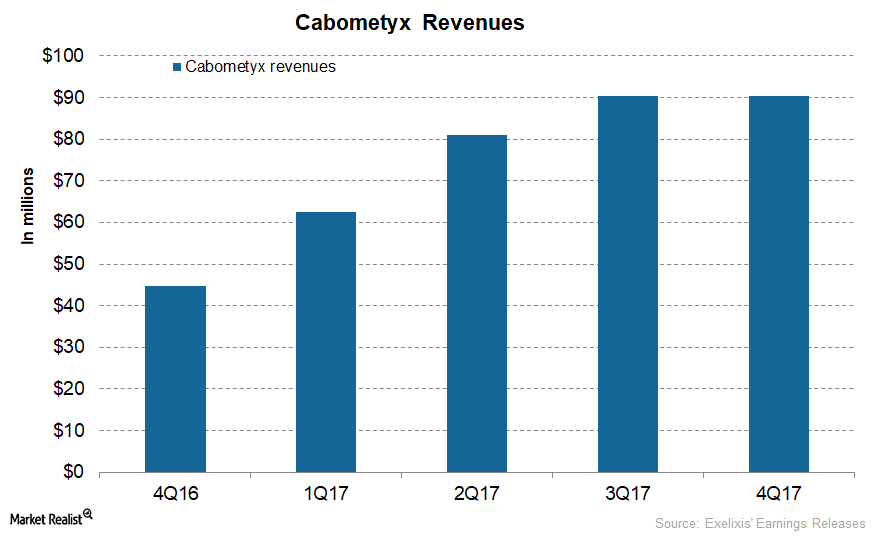

Cabometyx Could Be Exelixis’s Long-Term Growth Driver

In March 2018, the FDA accepted Exelixis’s (EXEL) supplemental New Drug Application (or sNDA) for Cabometyx.

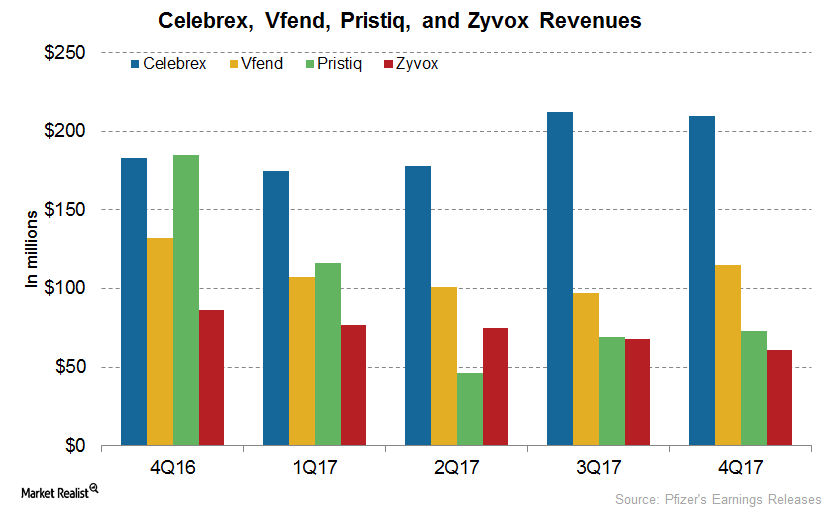

How Pfizer’s Peri-LOE Products Performed in 2017

Pfizer’s (PFE) Peri-LOE products refer to those products that lost patient protection recently or are expected to lose patient protection soon.

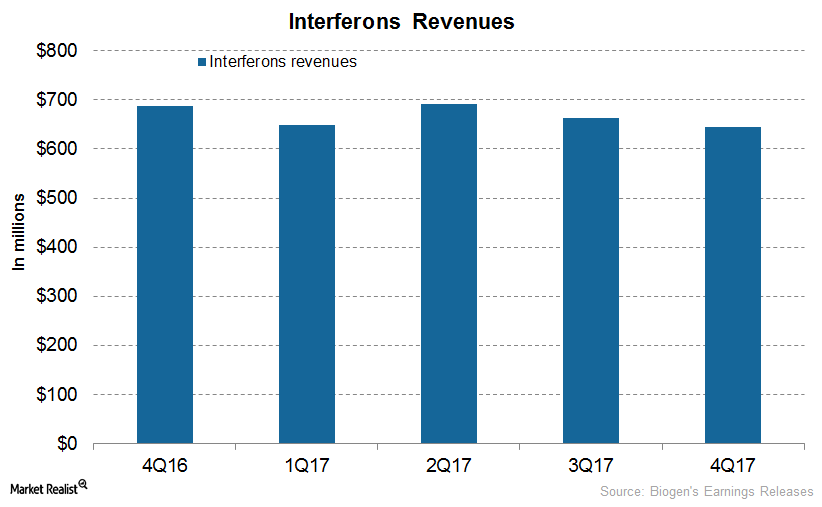

How Biogen’s Biosimilars and Interferons Performed in 4Q17

In 4Q17, Biogen’s (BIIB) interferons generated revenues of $645 million, which reflected a 6% decline YoY and a 3% decline on a quarter-over-quarter basis.

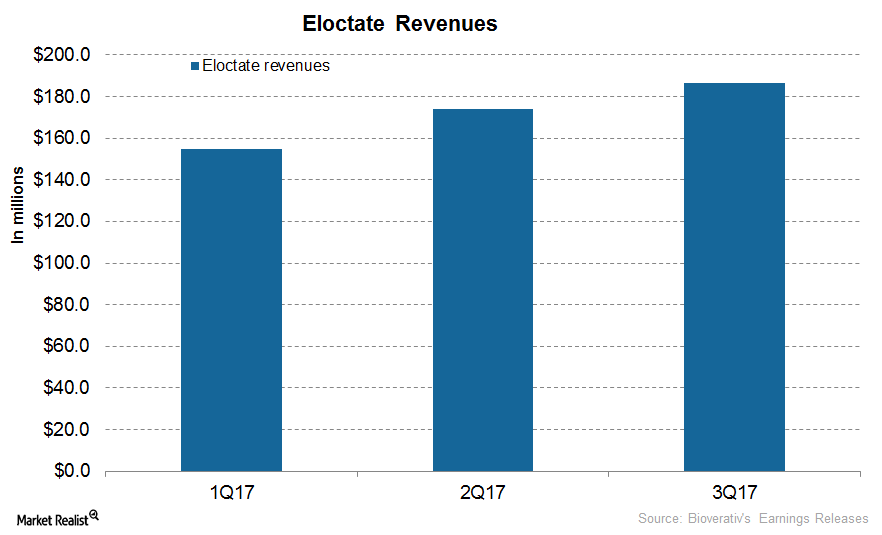

How Is Bioverativ’s Eloctate Positioned Now?

In 3Q17, Bioverativ’s (BIVV) Eloctate generated revenue of $186.3 million, reflecting a 41% rise on a year-over-year (or YoY) basis.

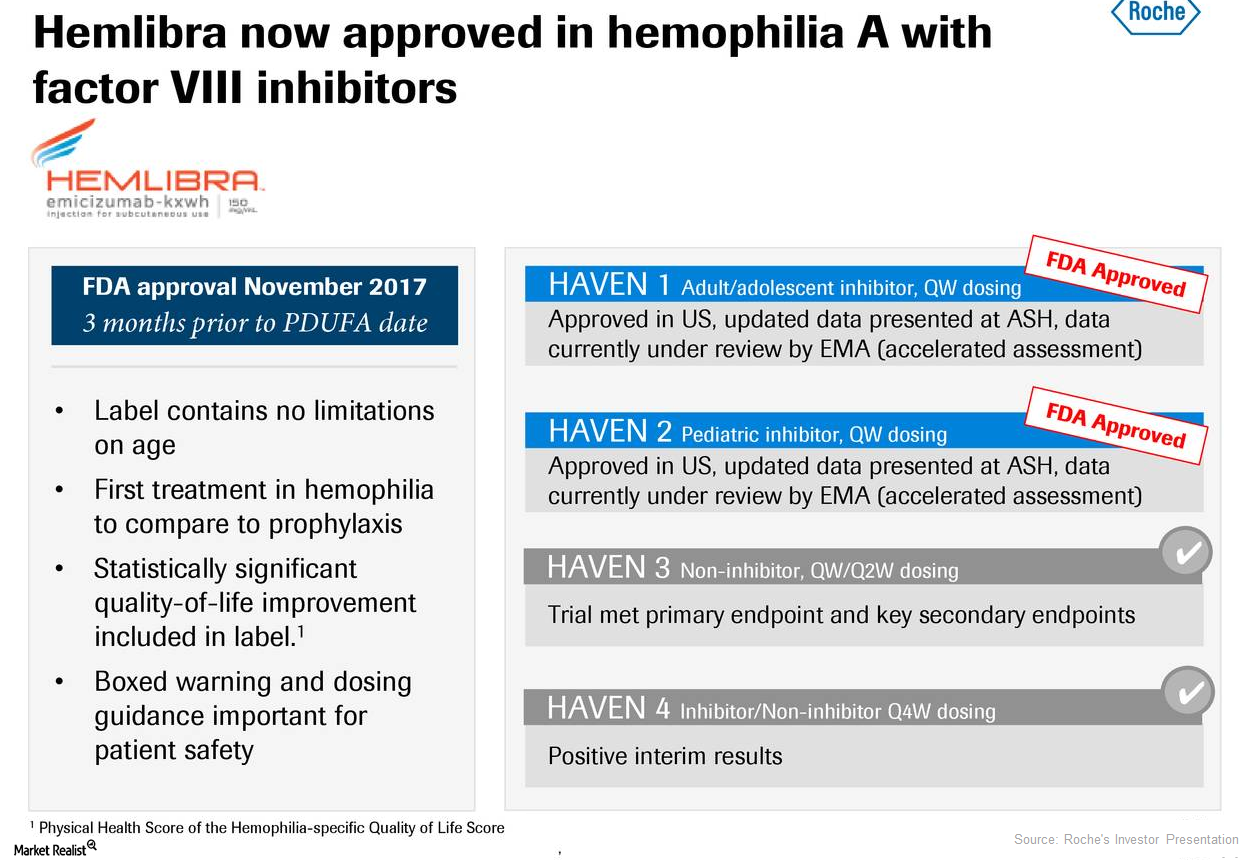

How Is Roche’s Hemlibra Positioned for 2018?

Roche’s (RHHBY) Hemlibra is used for the prevention and reduction of the frequency of bleeding episodes in individuals with hemophilia A with factor VIII inhibitors.

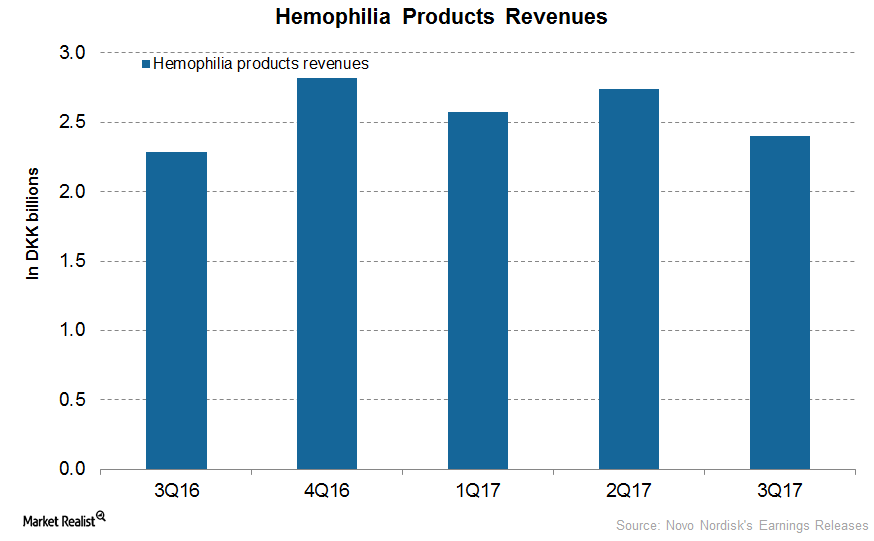

How Novo Nordisk’s Biopharmaceuticals Segment Performed in 3Q17

In 3Q17, Novo Nordisk’s (NVO) hemophilia segment reported revenues of 2.4 billion Danish krone (or DKK), a ~10% increase on a YoY basis.

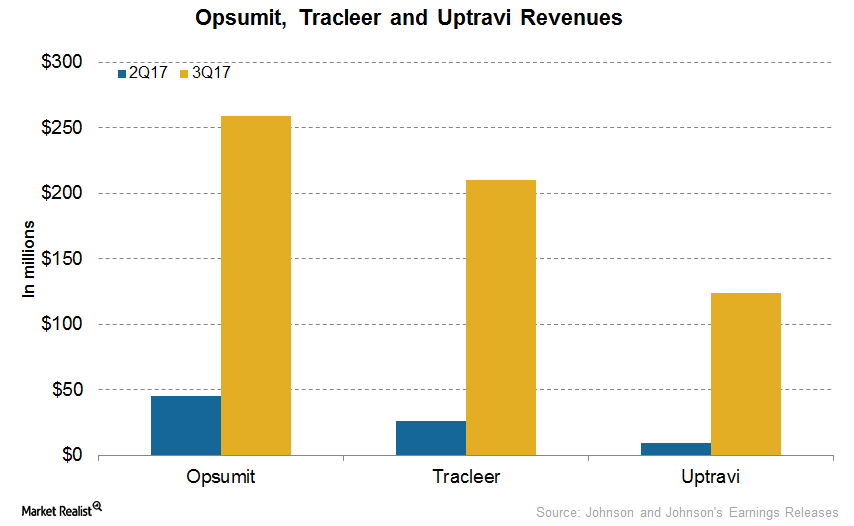

How JNJ’s Pulmonary Hypertension Portfolio Performed in 3Q17

In 3Q17, in the US and outside the US (international markets), JNJ’s pulmonary hypertension portfolio generated revenues of $357 million and $283 million, respectively.

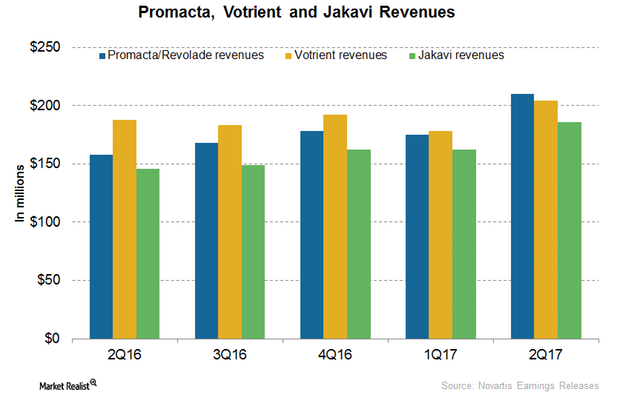

How Novartis’s Promacta, Votrient, and Jakavi Performed in 1H17

In 1H17, Novartis’s (NVS) Promacta/Revolade reported revenues of around $385 million, which reflected ~33% growth on a year-over-year (or YoY) basis.

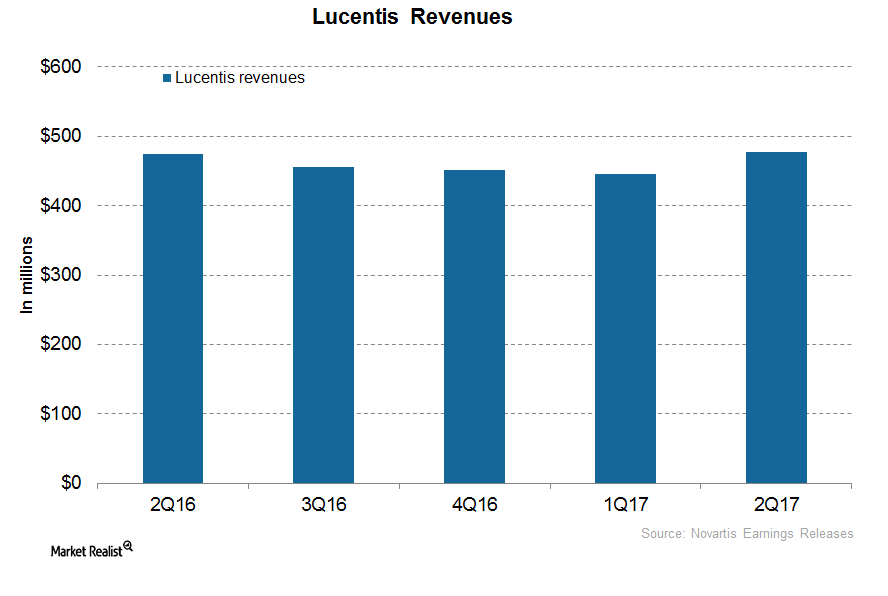

How Is Novartis’s Lucentis Positioned after 1H17?

In 1H17, Novartis’s (NVS) Lucentis reported revenues of around $922 million, which is a ~1% decline on a year-over-year (or YoY) basis.

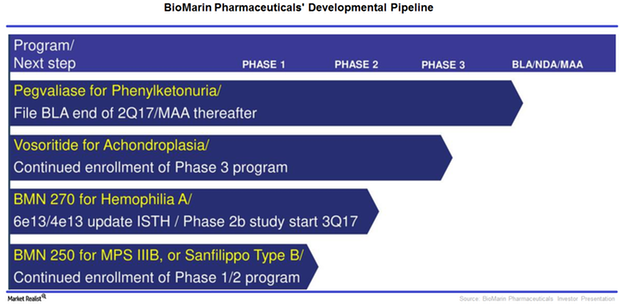

BioMarin’s Strong Pipeline Could Be a Long-Term Growth Driver

After success in the company’s phase 1/2 trial with BMN 270, an investigational gene therapy for hemophilia A, BioMarin Pharmaceuticals (BMRN) is expected to start phase 3 trials.

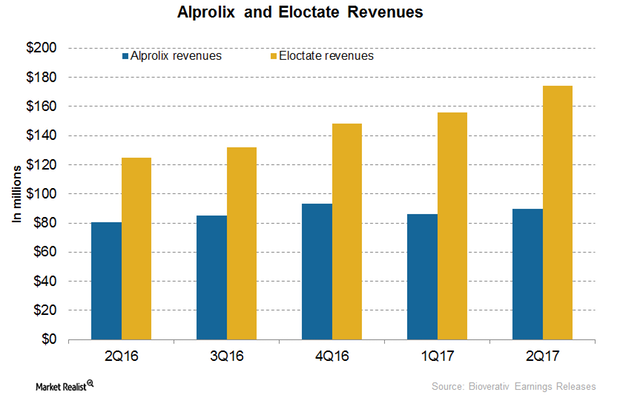

How Are Bioverativ’s Key Drugs Positioned after 2Q17?

In 2Q17, Bioverativ’s Alprolix generated revenues of ~$89.7 million, which represents ~12% growth YoY (year-over-year) and ~4% growth sequentially.

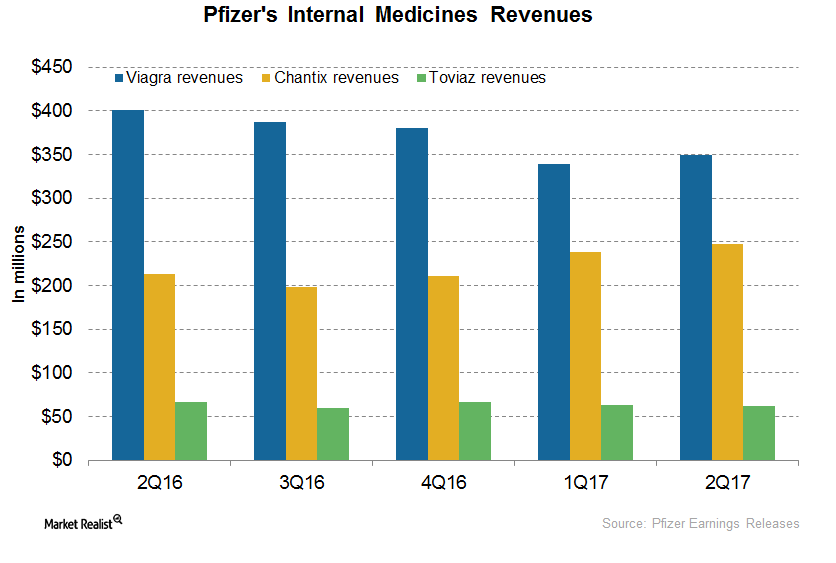

A Post-2Q17 Look at Pfizer’s Internal Medicines

In 2Q17, Chantix/Champix generated revenues of ~$248 million, which represents ~16% growth on a YoY basis and 4% growth on a quarter-over-quarter basis.

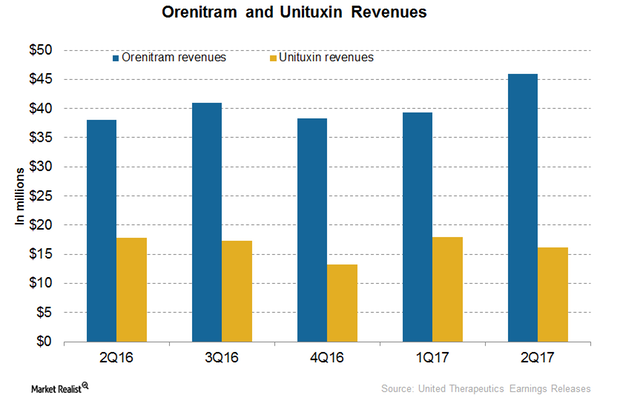

How Did United Therapeutics’ Orenitram and Unituxin Perform in 2Q17?

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis.

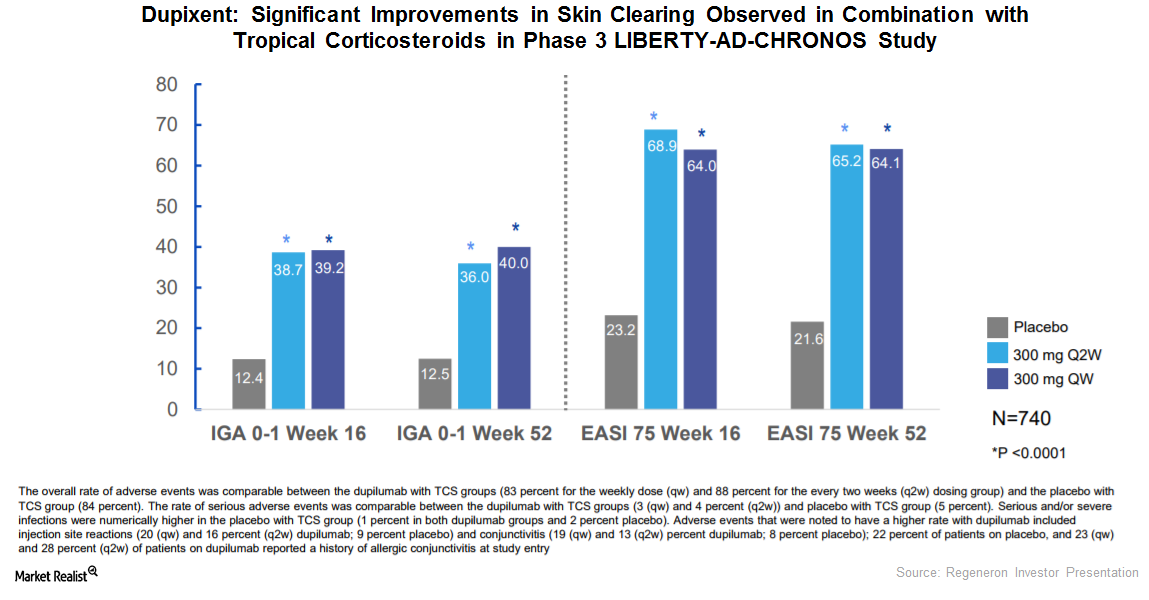

Dupixent Could Substantially Drive Regeneron’s Growth

In March 2017, the FDA approved Regeneron and Sanofi’s Dupixent injection for the treatment of adult individuals with moderate to severe atopic dermatitis.

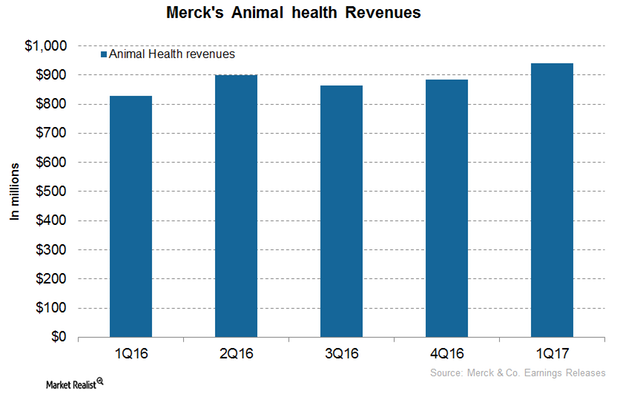

How Merck’s Animal Health Business Is Expected to Perform in 2017

In 2016, Merck’s (MRK) Animal Health segment reported revenues of ~$3.5 billion, which reflected ~4% growth year-over-year.