These Pfizer’s Products Are Now Losing Market Share

Pfizer’s (PFE) Essential Health segment reported a fall in overall revenues in 2Q17, driven by the loss of exclusivity of Celebrex and Zyvox.

Sept. 22 2017, Updated 7:37 a.m. ET

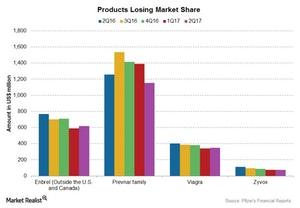

PFE products losing market share

Pfizer’s (PFE) Essential Health segment includes products that are reporting lower sales due to competition or other factors. These products have had a negative impact on Pfizer’s overall growth.

The Essential Health segment reported a fall in overall revenues in 2Q17, driven by the loss of exclusivity of Celebrex and Zyvox.

Negative growth products

BeneFIX, a rare disease drug, reported sales of $153 million in 2Q17, or 15% lower YoY (year-over-year) than its sales of $183 million during 2Q17. This fall in sales was due to lower demand.

BMP2 reported sales of $57 million in 2Q17, or 6% lower than its sales of $61 million in 2Q16, while Enbrel reported sales of $617 million in 2Q17, or 17% lower YoY at constant exchange rates, compared with its sales of $766 million in 2Q16.

EpiPen, a key product from Mylan (MYL), contains a drug manufactured by Pfizer. Pfizer reported related sales of $90 million in 2Q17—a 3% YoY fall.

Other negative growth products

Lipitor reported sales of $445 million in 2Q17, or 3% lower than its sales of $461 million in 2Q16. This fall was driven by lower sales in US markets and the negative impact of foreign exchange, partially offset by a rise in sales in international markets.

Inylta, a drug for advanced renal cell carcinoma, reported sales of $88 million during 2Q17, a 17% decline in revenues, compared with $108 million during 2Q16.

The Prevnar family reported sales of ~$1.2 billion in 2Q17, or 7% lower than its ~$1.3 billion in 2Q16, due to lower sales of Prevnar 13 in US markets. Viagra reported sales of $349 million in 2Q17, which was 12% lower YoY, compared with $401 million in 2Q16, following patent expiry and pricing pressures due to competition.

Zyvox, an antibiotic, reported sales of $75 million in 2Q17, which represents a 32% fall in sales, compared with $114 million in 2Q16, driven by patent expiry and competition since 2Q15.

Notably, the First Trust NASDAQ Pharmaceuticals ETF (FTXH) has 8.3% in Pfizer (PFE). FTXH also has 9.0% in Abbott Laboratories (ABT), 4.1% in Eli Lilly (LLY), and 4.6% in Bristol-Myers Squibb (BMY).