First Trust Nasdaq Pharmaceuticals ETF

Latest First Trust Nasdaq Pharmaceuticals ETF News and Updates

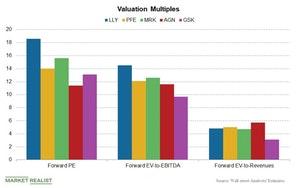

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

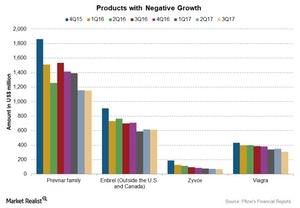

Pfizer’s 4Q17 Estimates: Products with Lower Sales

In Pfizer’s (PFE) portfolio, a few of the products reported a lower sales trend due to competition from other products in the markets.

Wall Street Recommendations for Mylan in January 2018

As we discussed earlier in this series, Mylan (MYL) reported revenues of $2.98 billion in 3Q17, a 2.3% decline in revenues compared to $3.06 billion in 3Q16.

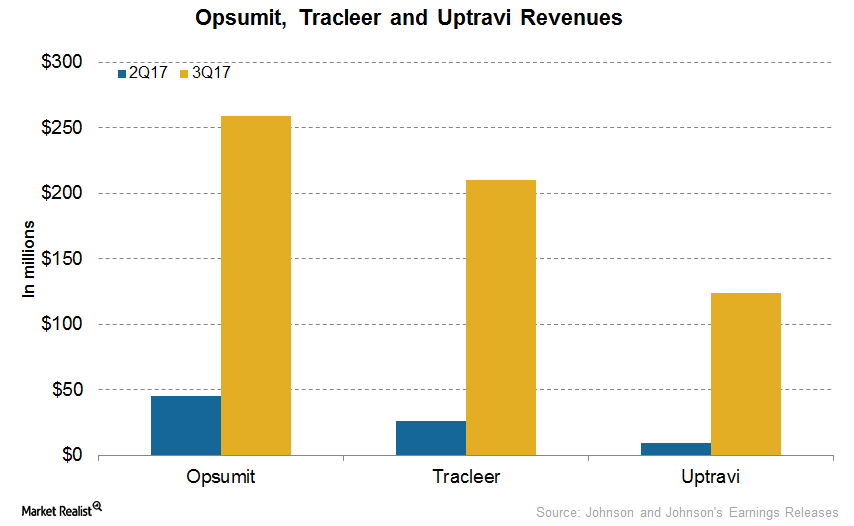

How JNJ’s Pulmonary Hypertension Portfolio Performed in 3Q17

In 3Q17, in the US and outside the US (international markets), JNJ’s pulmonary hypertension portfolio generated revenues of $357 million and $283 million, respectively.

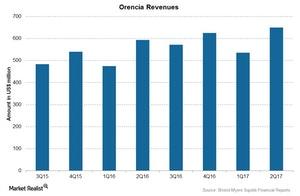

Bristol-Myers Squibb’s Immunoscience Products

Bristol-Myers Squibb’s (BMY) Immunoscience franchise includes Orencia, which is a fusion protein used for the treatment of rheumatoid arthritis and aligned problems.

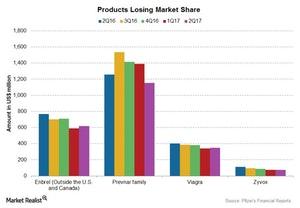

These Pfizer’s Products Are Now Losing Market Share

Pfizer’s (PFE) Essential Health segment reported a fall in overall revenues in 2Q17, driven by the loss of exclusivity of Celebrex and Zyvox.

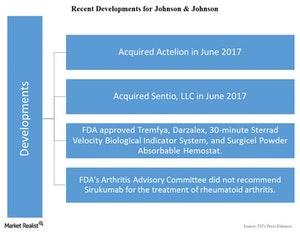

Major Developments for Johnson & Johnson in 2Q17

Major developments All of Johnson & Johnson’s (JNJ) segments performed positively in 2Q17. In this part. we’ll look at some developments that occurred during the quarter. Pharmaceuticals On August 21, 2017, Johnson & Johnson presented new data for its COMPASS study, a phase III study evaluating Xarelto as a treatment for coronary and peripheral artery disease. […]

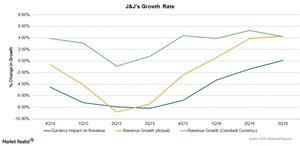

Johnson & Johnson’s Revenue Trend in 3Q16

In 3Q16, Johnson & Johnson’s (JNJ) top line rose 4.2% to ~$17.8 billion, driven by 4.3% operational growth in revenues.