Ron Baron’s Investment Strategy to Beat Inflation in the Long Run

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

Feb. 21 2017, Published 9:57 a.m. ET

Long-term stock investment to outperform inflation

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

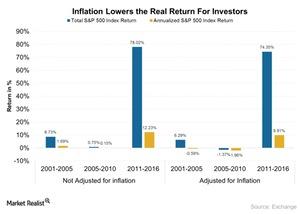

High inflation expectations for 2017 aren’t deterring investors from putting money in the stock market (VOO) (IWD), as we can see via the rally in the S&P 500 Index (SPX-INDEX) over the last few months. Let’s take a look at the S&P 500 Index’s performance over the last 16 years adjusted for inflation.

According to Ron Baron, an investment strategy with a long-term view needs to add stocks at regular intervals to reap higher returns. Baron also emphasizes stock selection by way of assessing the fundamentals and growth opportunities of the company under consideration.

Baron further states that so far, about ten to 15 stocks from his universe of stock investments have provided more than 50% returns on invested capital.

Long-term investment and stock selection with strong fundamentals

As stated by Baron, you always take a US dollar that’s falling in value due to the inflation and invest it in a business that’s increasing in value. The purpose of this method of continuous investment is to tap into opportunities when the market is down and to hold onto them until you get your expected return.

According to Baron, usually, when the market goes into panic mode, prices fall drastically, moving away from their fair values. So, long-term investors need to continuously invest and tap into these opportunities rather than investing everything at one point in time.

Investors need to add stocks to their portfolios every year when the market falls in order to lower prices and gain from market recovery as it happens. The strategy is to invest, hold, and rebalance one’s portfolio as and when the market provides the opportunity.

As we can see in the above chart, returns adjusted for inflation have impacted real returns on investments. Rebalancing can help investors select those companies that are better equipped to handle inflation. Rebalancing can be achieved when the investment horizon is long term.

The 2008 financial crisis saw a severe fall in stock prices, but even if it didn’t last very long, most investors panicked and sold their investments. However, as a recession is expected to continue for several years, the investment period needs to be long enough to implement rebalancing and reverse the downtrend.

Some of Baron Funds’ stock holdings, including Charles Schwab (SCHW), Kornit Digital (KRNT), Glaukos (GKOS), and YPF (YPF), have given phenomenal returns, as it has invested in these stocks for over 20 years.

Next, let’s look at Baron’s favorite stock picks for 2017.