iShares Russell 1000 Value

Latest iShares Russell 1000 Value News and Updates

Real Estate Why the housing market impacts consumption and equity investors

This article considers the importance of investment, including residential investment, in the support of U.S. consumption data and the implications for investors.

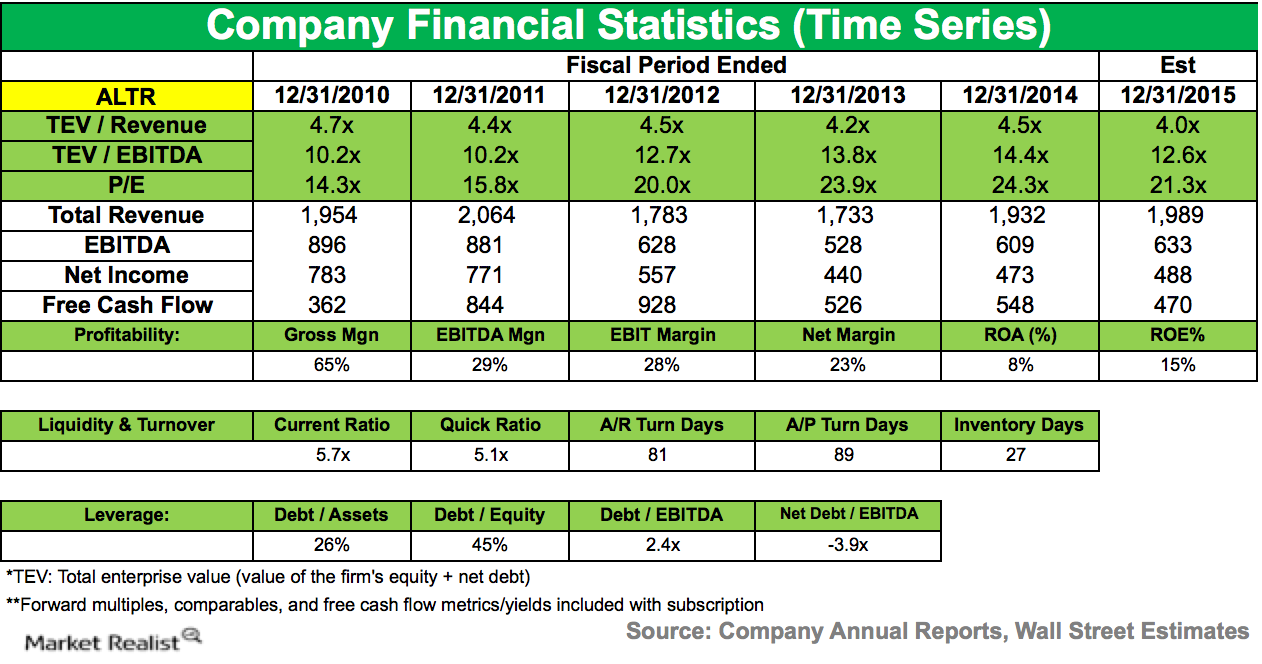

Citadel Advisors Starts a New Position in Altera Corporation

During 4Q14, Citadel Advisors started a new position in Altera Corporation (ALTR).

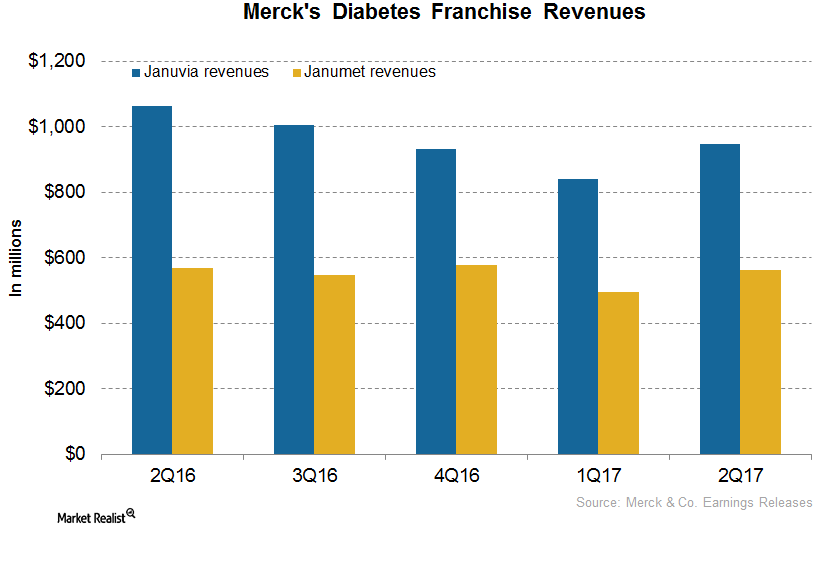

Januvia and Janument: An Update on Merck’s Diabetes Franchise after 2Q17

In 2Q17, Merck’s (MRK) Januvia generated revenues of around $948 million, which reflected an ~11% decline on a year-over-year basis and 13% growth on a quarter-over-quarter basis.

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”

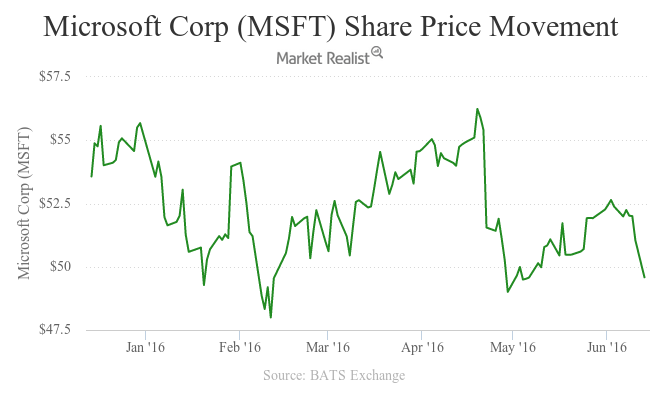

Why Did Microsoft’s Stock Fall after LinkedIn Offer?

After Microsoft’s announcement, LinkedIn’s stock rose 47% to $192.21 while Microsoft’s stock fell 2.6% to $50.14 on June 13, 2016.

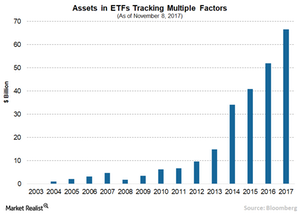

Can Smart Beta Go Wrong?

The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

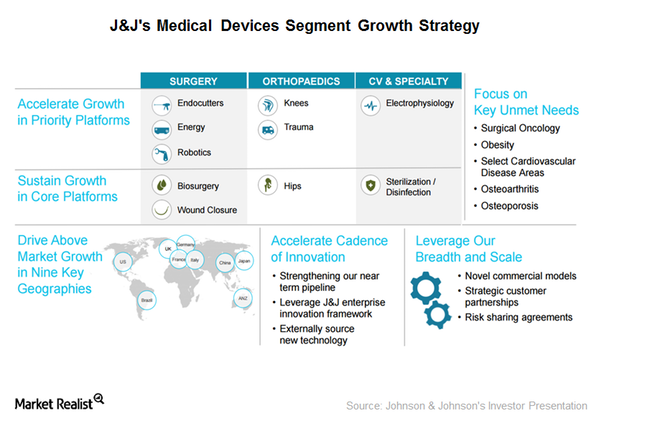

J&J Completed the Divestiture of Its Neurosurgery Business

Johnson & Johnson’s (JNJ) medical device business has been restructuring in order to focus on higher growth areas with potential expansion opportunities.

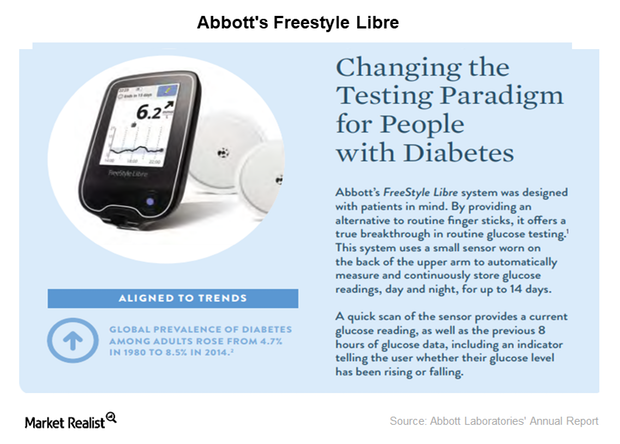

Abbott’s Breakthrough CGM Device Freestyle Libre Wins FDA Approval

On September 27, Abbott Laboratories (ABT) announced the FDA approval of its Flash CGM (continuous glucose monitoring) device, Freestyle Libre.

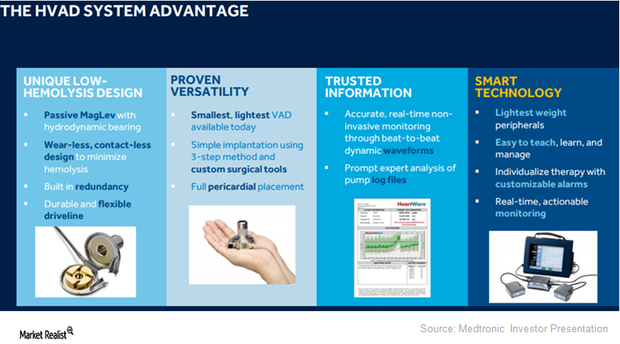

HVAD Expected to Expand Medtronic’s Presence in LVAD Segment

On September 27, 2017, the FDA approved Medtronic’s HVAD (HeartWare ventricular assist device) system as a destination therapy for advanced heart failure patients.

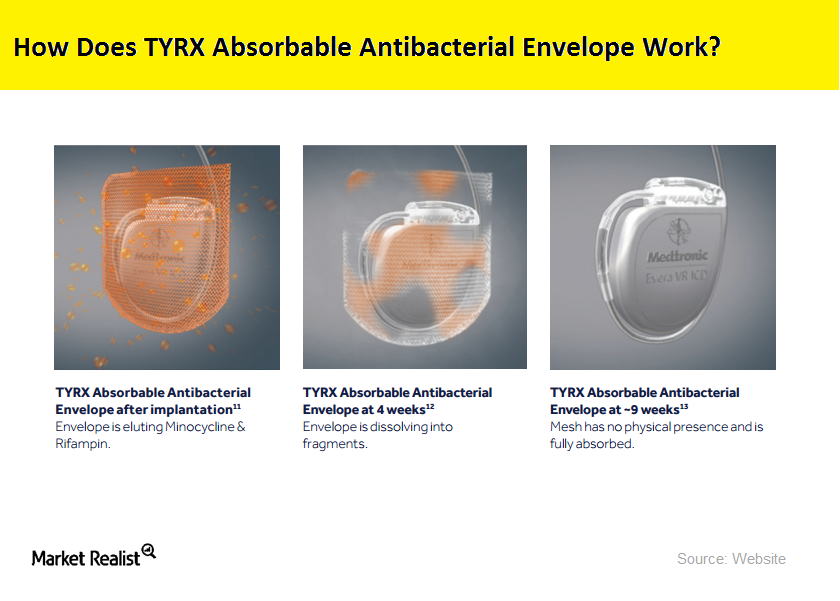

Medtronic’s Agreement Will Expand the Use of Its Tyrx Envelopes

Medtronic’s (MDT) Tyrx envelope is an antibacterial and fully-absorbable device that helps prevent surgical site infections.

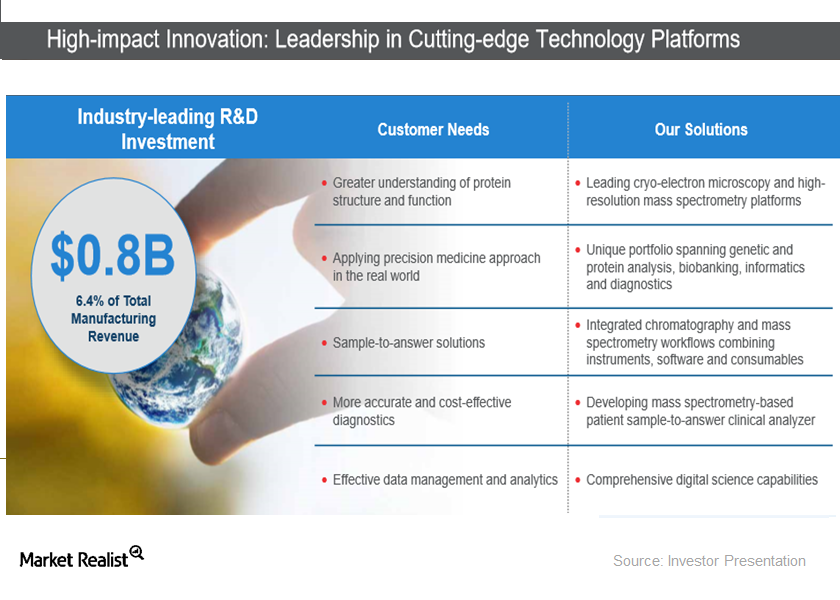

Understanding Thermo Fisher’s Growth Strategy

Thermo Fisher Scientific (TMO) has always focused on innovation as a key growth strategy.

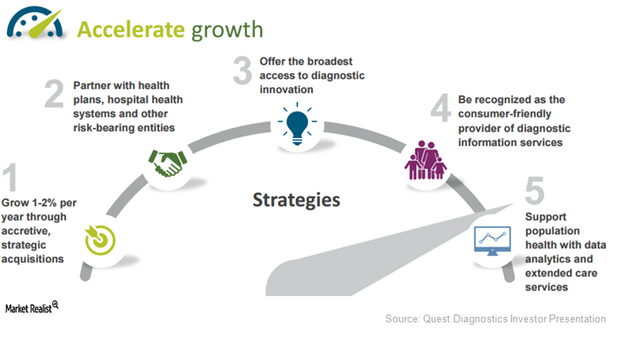

Quest Diagnostics’ Multi-Pronged Strategy to Accelerate Growth

Quest Diagnostics (DGX) expects to witness a 3.0%–5.0% long-term revenue growth rate in the future with earnings growth of 5.0%–9.0%.

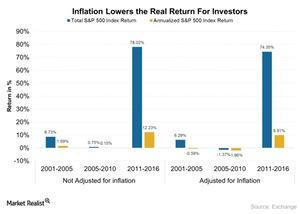

Ron Baron’s Investment Strategy to Beat Inflation in the Long Run

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

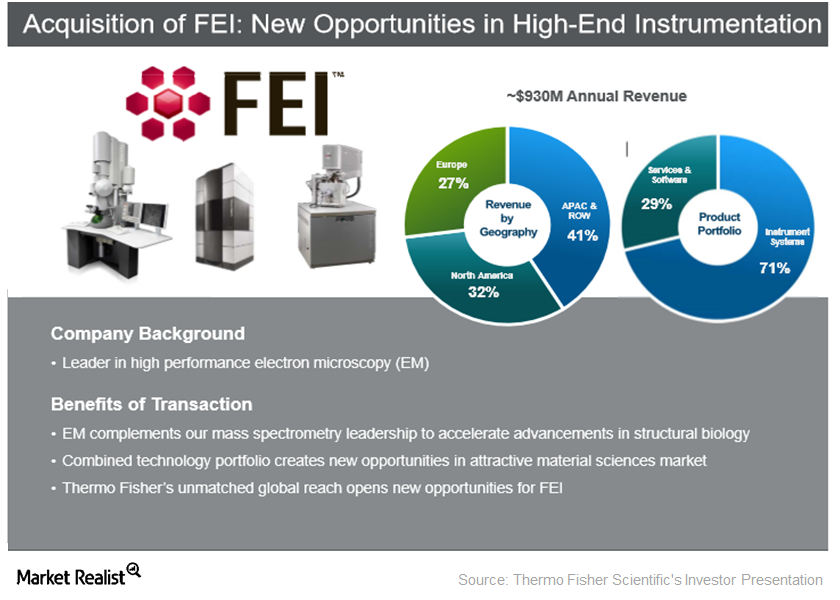

How Is Thermo Fisher Scientific’s FEI Integration Process Going?

Thermo Fisher Scientific (TMO) completed the acquisition of FEI Company on September 19, 2016.

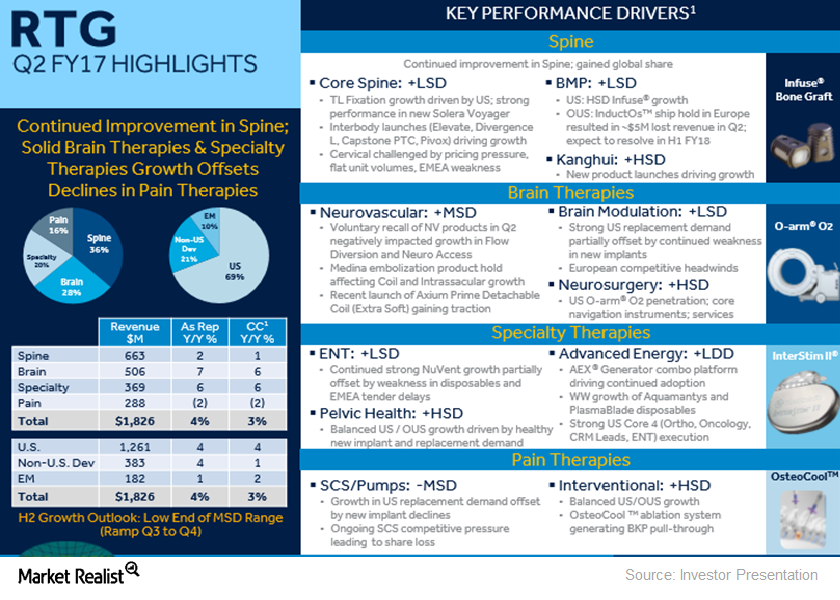

Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

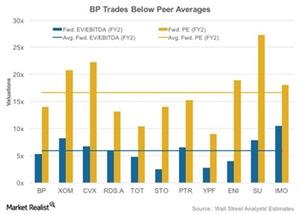

BP’s Forward Valuations: A Peer Comparison

In this article, we’ll consider BP’s forward valuations compared to those of its peers. BP’s market cap stands at ~$105 billion.

A Forward Valuation Comparison of BP’s Competitors

BP’s market cap stands at ~$100 billion. Among the company’s peers, ExxonMobil (XOM) has the highest market cap of ~$371 billion.

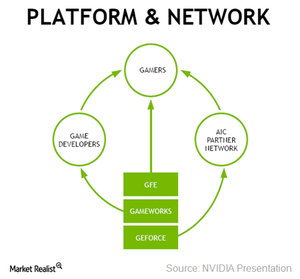

NVIDIA’s Strategy to Reach Out to a Larger User Base

NVIDIA (NVDA) reported a 7% year-over-year revenue growth in 2015, a time when the semiconductor industry revenues fell by 2.3% YoY. At its 2016 Investor Conference, NVIDIA’s executives highlighted the company’s growth opportunities in terms of geography and new technology.

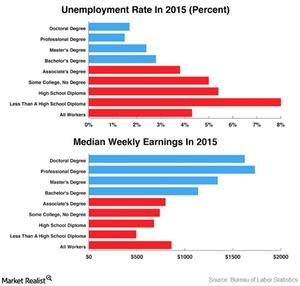

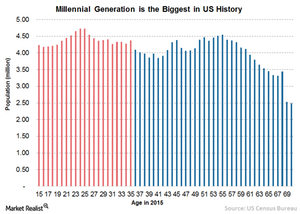

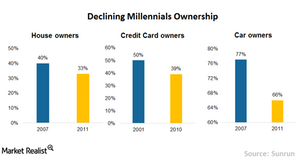

Why Millennials Are Often Called ‘the Unluckiest Generation’

A population of 80 million strong in the U.S., millennials – those born between 1980 and 1999 – are breaking with tradition.

How Millennials Are Driving the Sharing Economy

Millennials resonate with the idea of the sharing economy since it perfectly fits their budgets. Millennials took longer than expected to enter the job market—and at lower wages.

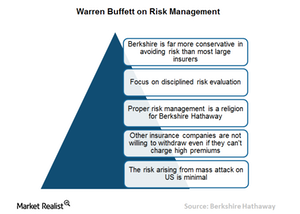

Why Buffett Thinks Risk Management Should Be a Disciplined Affair

Berkshire Hathaway has reported an underwriting profit for 13 straight years, showing a pre-tax gain of $26.2 billion for the period. Buffett states that this was due to Berkshire’s insurance manager’s daily focus on disciplined risk evaluation.

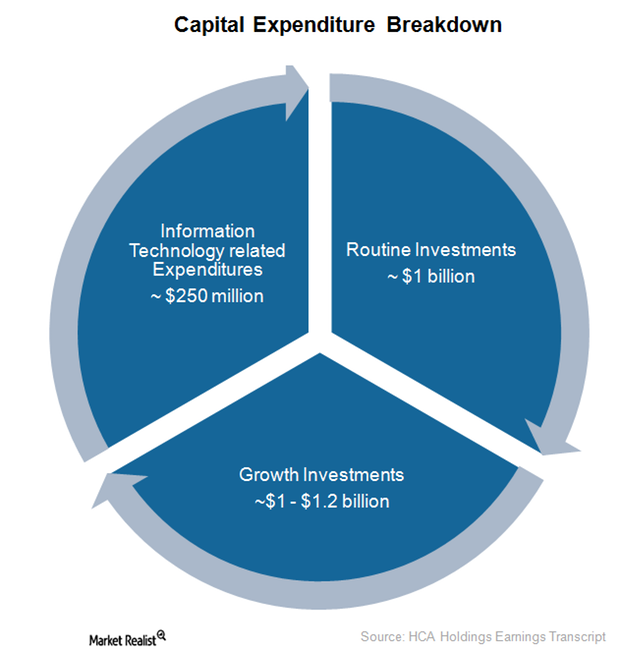

HCA Holdings’s Strong Capital Expenditure Strategy for 2016

In 2015, HCA Holdings deployed ~$2.4 billion in capital expenditure. It planned to increase capital spending to $2.7 billion in 2016.

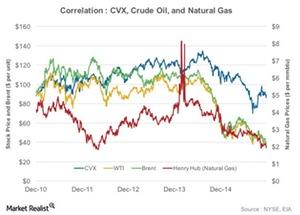

The Correlation of Chevron’s Stock to Oil and Natural Gas Prices

The integrated energy model provides Chevron’s insulation from oil and natural gas price volatility. This is reflected in the results of the correlation test.

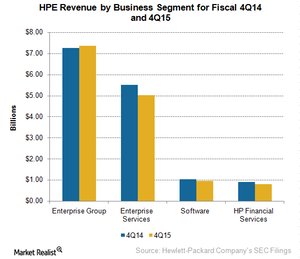

Hewlett Packard Enterprise’s Revenues Continue to Fall

In fiscal 4Q15, Hewlett Packard Enterprise (HPE) revenue fell 4% YoY to $14.1 billion, above analysts’ expectation of $13.5 billion.

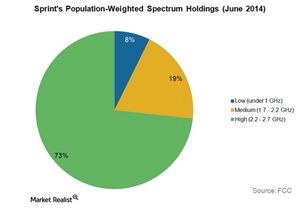

CEO Claure Plans to Harness Sprint Capacity Spectrum Holdings

Sprint plans to implement a considerable densification program to harness its capacity spectrum holdings, making capital expenditures of ~$5 billion in fiscal 2015.