Glaukos Corp

Latest Glaukos Corp News and Updates

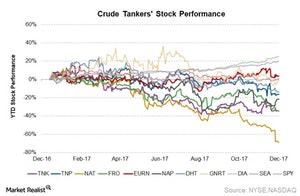

Crude Tanker Stocks and the BDTI Index in Week 39

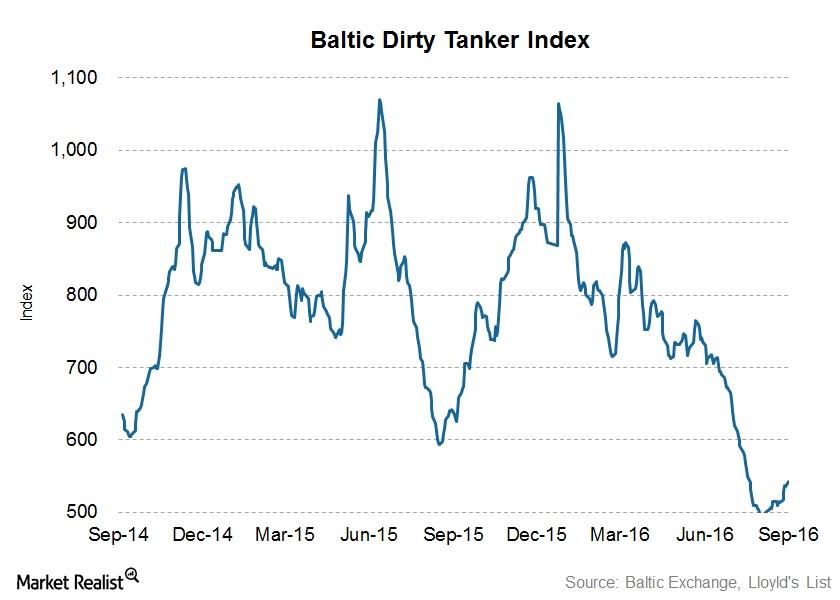

In week 39, the week ending September 29, the BDTI rose to 776 from 772. In week 38, the index rose by 28 points. It rose for the fifth consecutive week.

China’s April Trade Data and the Crude Oil Tanker Industry

China, which has the second-largest economy in the world, has a significant impact on the crude tanker industry.

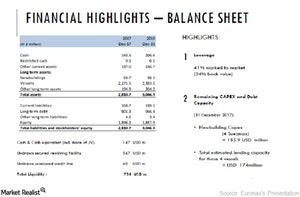

Euronav and Gener8 Maritime Partners’ Merger

On December 21, 2017, Euronav (EURN) and Gener8 Maritime Partners (GNRT) announced a stock-for-stock merger.

China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

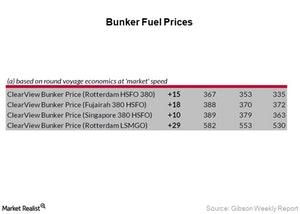

Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

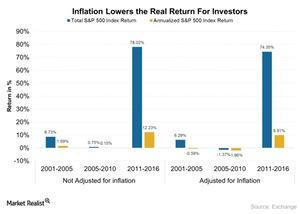

Ron Baron’s Investment Strategy to Beat Inflation in the Long Run

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.