Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”

Aug. 18 2020, Updated 6:32 a.m. ET

Fox Business Network’s ‘biggest business story of 2016’

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about what they called their “biggest business story of 2016.”

What’s their biggest stories?

According to Asman, the comeback of carbon energy was the biggest business story of 2016. President-elect Donald Trump’s proposed energy policy would aim to increase the production of crude oil (USO) and the output of natural gas (UNG). According to Asman, the comeback of carbon energy will be positive for the energy sector.

According to McDowell, the post-election market rally was the biggest business story of 2016. The S&P 500 Index (SPY), the Nasdaq Composite Index, and the Dow Jones Industrial Average Index (DIA) rose nearly 6.0%, 5.8%, and 7.8%, respectively, from November 9–December 9, 2016. The one-month Trump rally resulted in a huge rise in these indexes. An optimistic view of the economy (QQQ) (IVV) and improving business sentiment are driving the market movement.

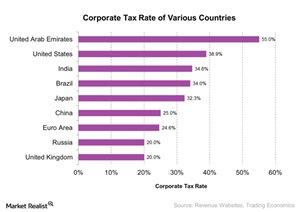

According to many market participants, Trump’s proposed changes in policy, mainly the proposed change in the corporate tax rate, will be an important driver for the economy in 2017.

In the next part of this series, we’ll look at these Fox Business members’ outlook for the US economy in 2017.