SPDR® S&P MidCap 400 ETF

Latest SPDR® S&P MidCap 400 ETF News and Updates

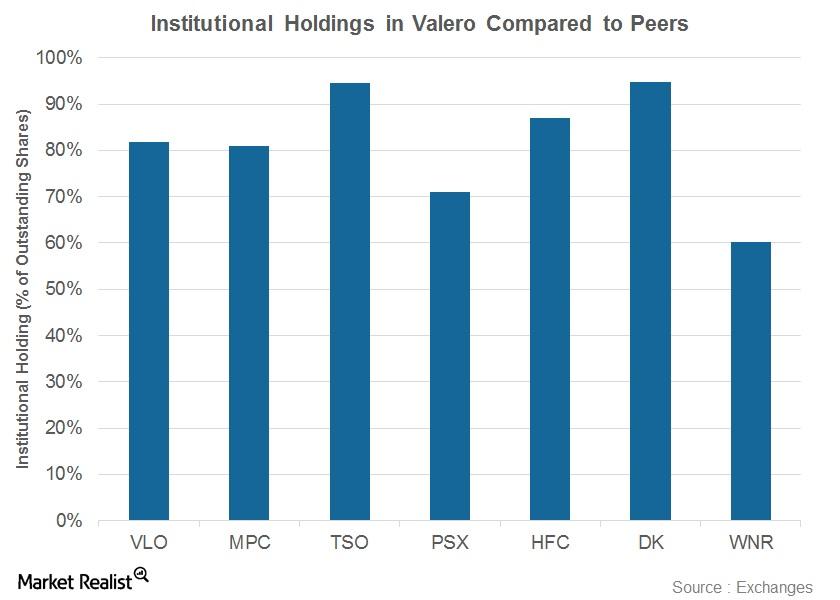

Valero’s Institutional Holdings before the 1Q17 Results

The institutional holdings in Valero Energy (VLO) are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR).

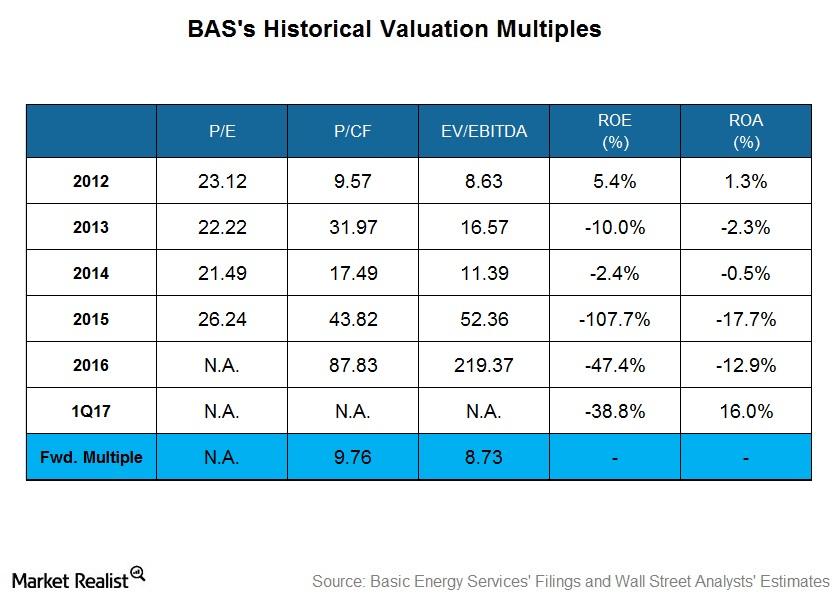

What Does Basic Energy Services’ Historical Valuation Suggest?

On March 31, 2017, Basic Energy Services’ (BAS) stock price had fallen 6% from December 30, 2016.

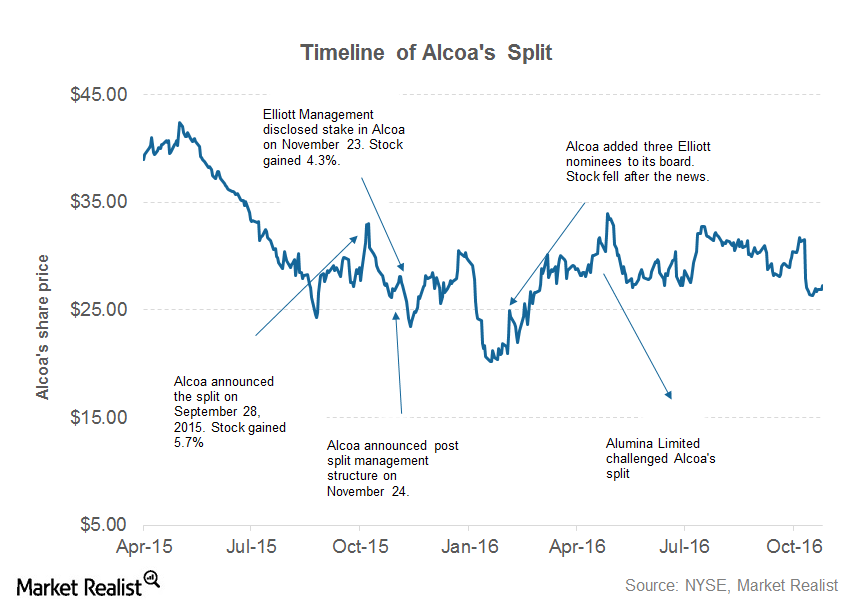

Arconic’s Tough Beginning: Controversies and Battles

Arconic is scheduled to release its 1Q17 earnings on April 25. ARNC was listed as a separate entity on November 1, 2016, when Alcoa split into two entities.

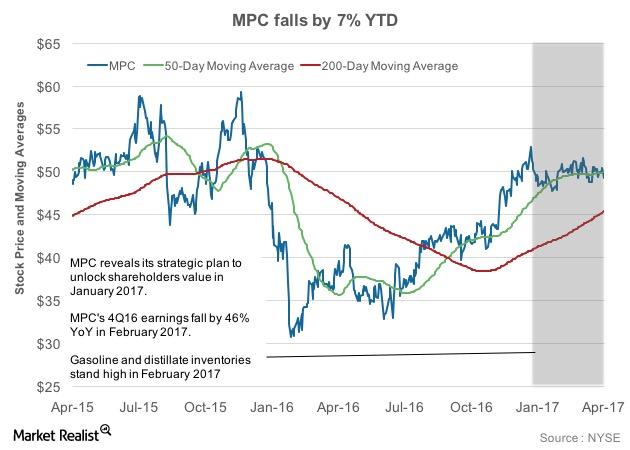

Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

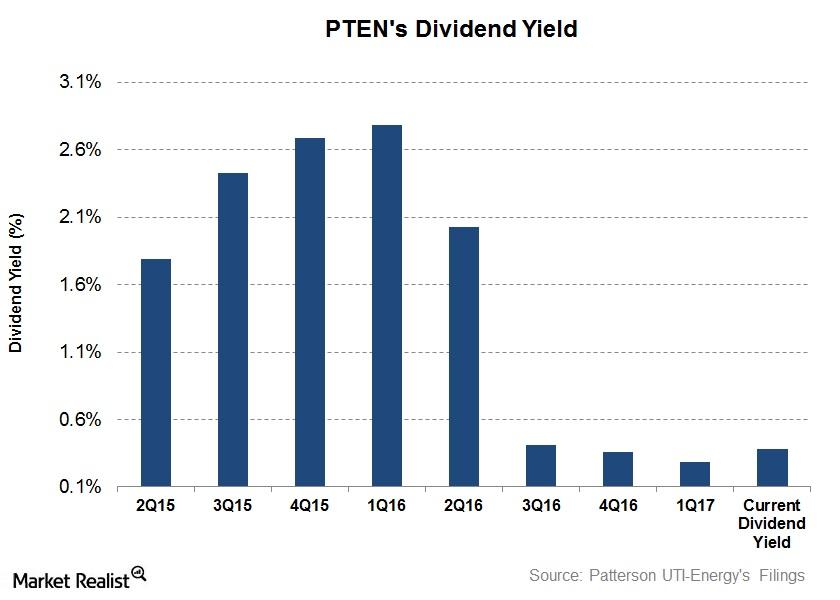

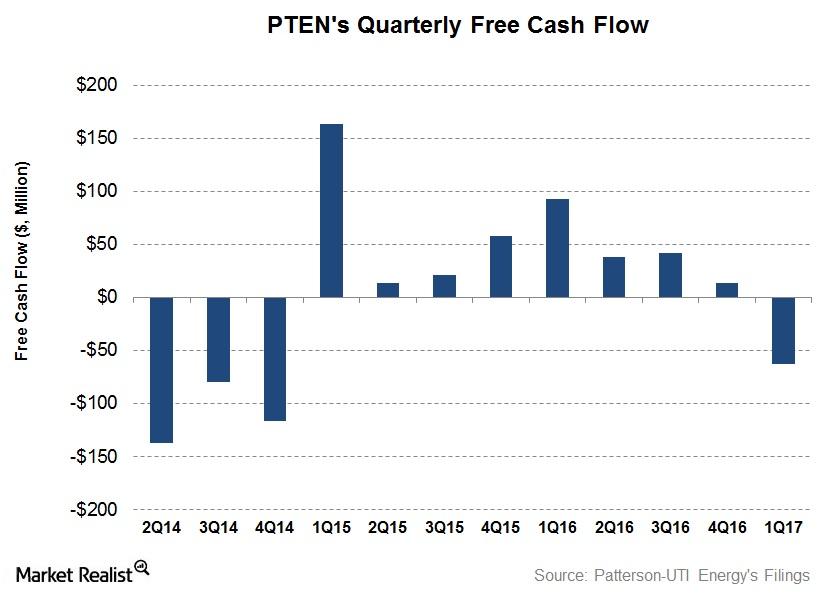

Patterson-UTI Energy’s Dividend Yield on June 2

Patterson-UTI Energy’s (PTEN) dividend yield fell to 0.29% on March 31, 2017. Since then, its dividend yield has risen to 0.38% as of June 2, 2017.

Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

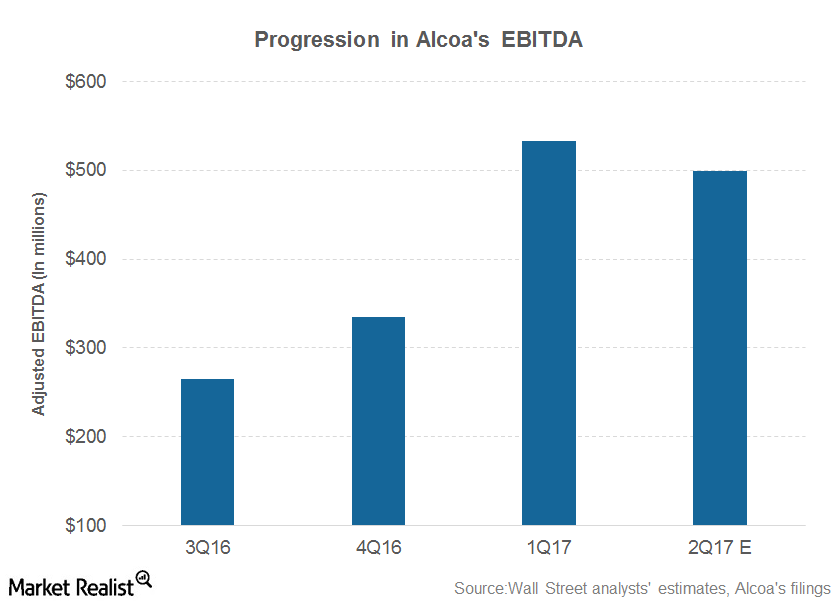

Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

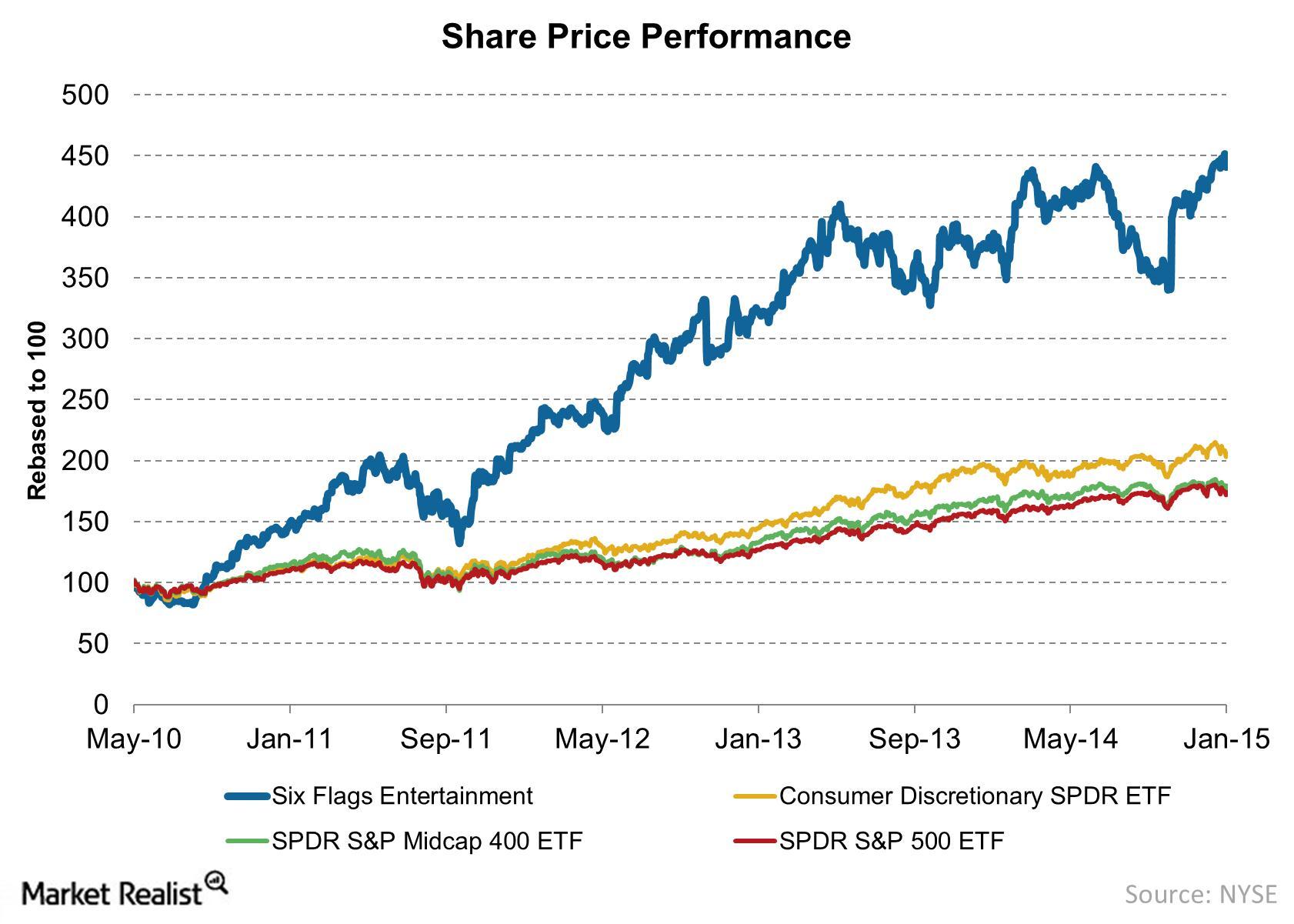

Share price performance for Six Flags since bankruptcy recovery

Six Flags’ share price on May 10, 2010, reflects $7.36 per share, the price of new common stock upon the company’s emergence from bankruptcy.

A Closer Look at Mednax’s Business Strategy

Mednax (MD) has a proven track record of expertise in the administration of physician services and a methodical approach to clinical data warehousing in fields such as research, education, and quality.

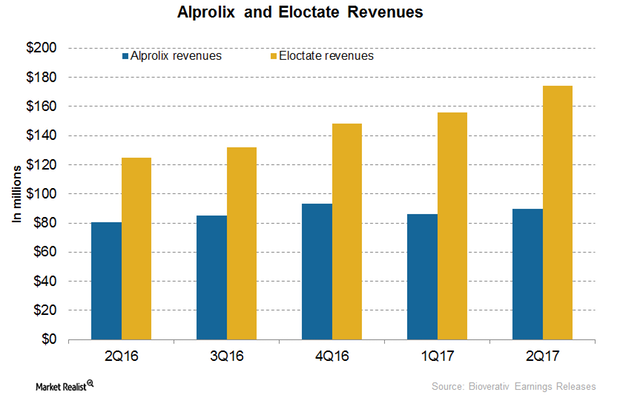

How Are Bioverativ’s Key Drugs Positioned after 2Q17?

In 2Q17, Bioverativ’s Alprolix generated revenues of ~$89.7 million, which represents ~12% growth YoY (year-over-year) and ~4% growth sequentially.

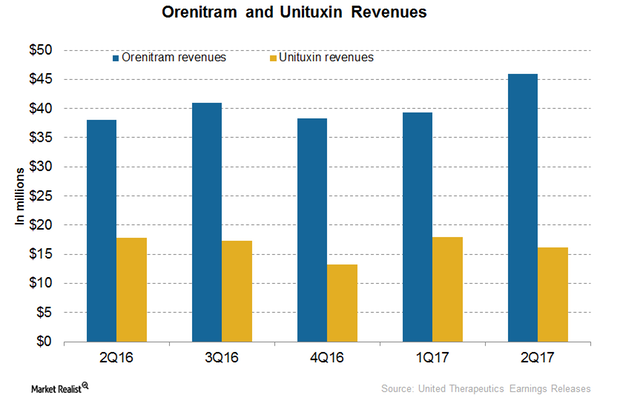

How Did United Therapeutics’ Orenitram and Unituxin Perform in 2Q17?

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis.

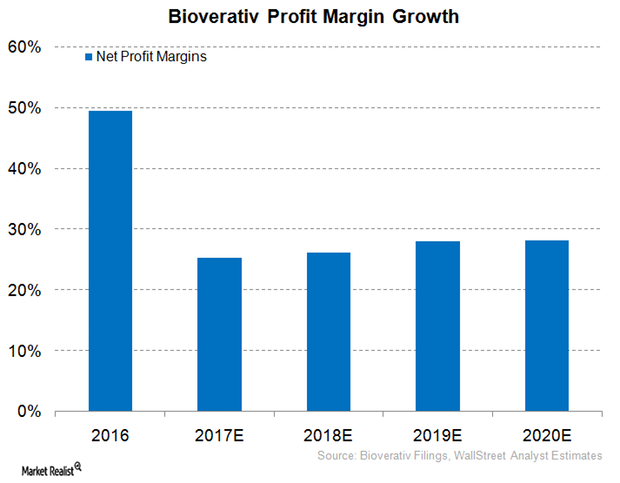

Bioverativ Expected to Report Healthy Profit Margins in 2017

Bioverativ (BIVV) expects its 2017 GAAP and non-GAAP operating margins to fall 38.0%–42.0% and 43.0%–47.0%, respectively.

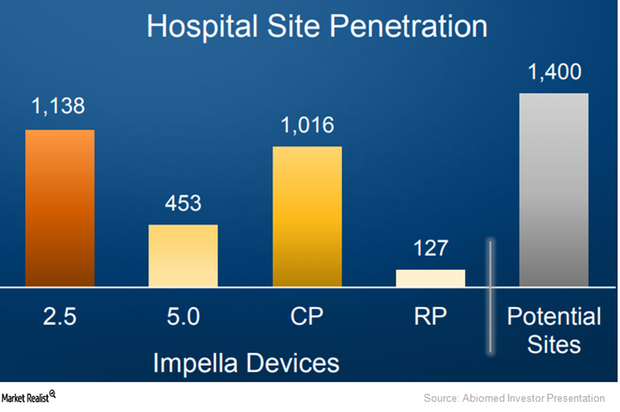

Behind Abiomed’s Plans to Create a Greater Awareness of Impella

To target patients across communities, Abiomed (ABMD) has been developing a hub-and-spoke model with hospitals.

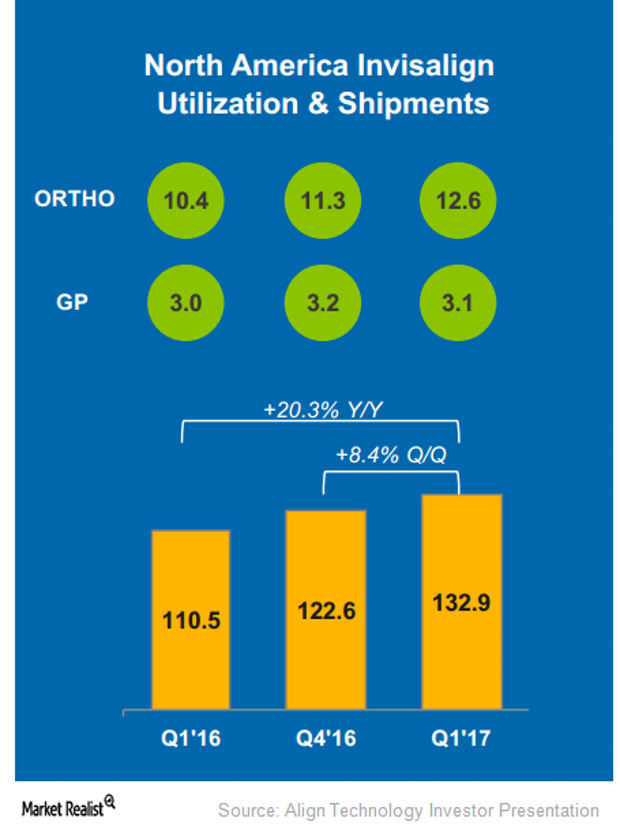

Behind Align Technology’s North American Expectations for 2017

In 1Q17, Align Technology’s (ALGN) Invisalign sales volumes in North American markets rose YoY by 20.3% and QoQ by 8.3%.

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

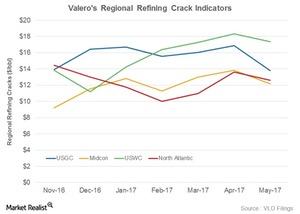

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

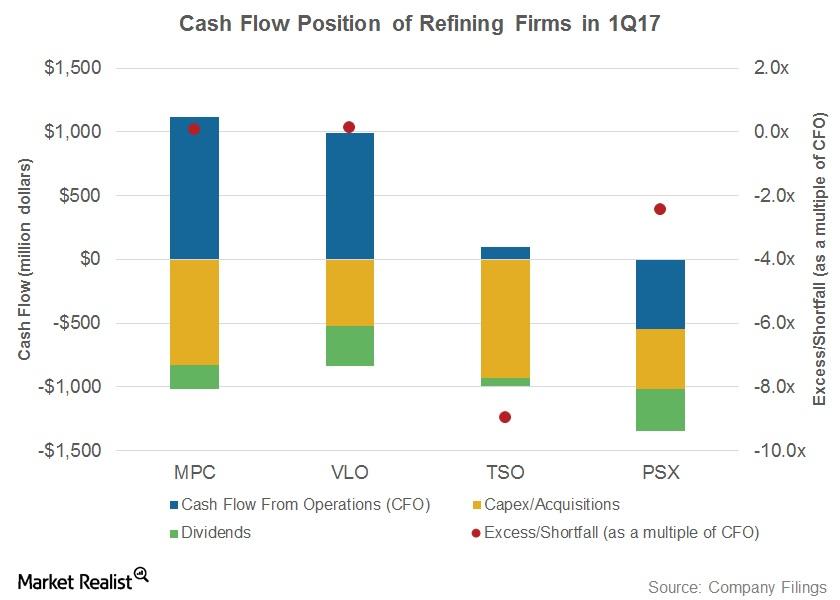

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

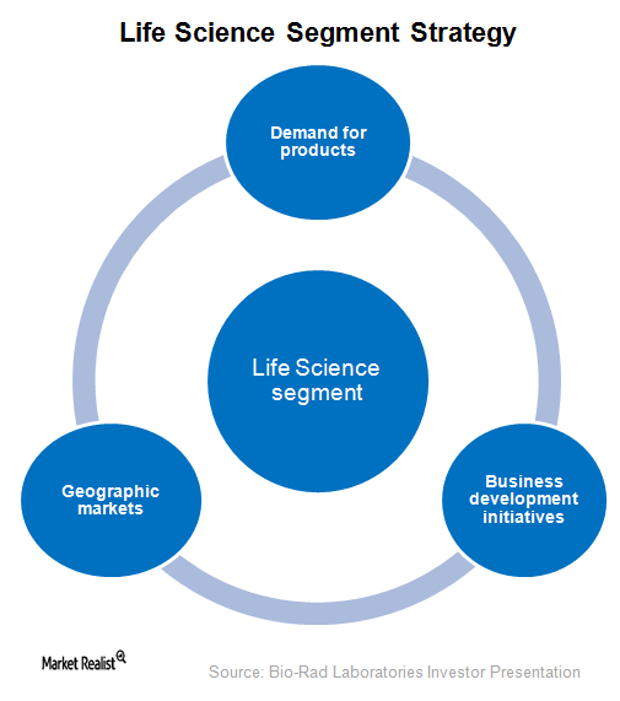

What Bio-Rad Laboratories Expects from Life Science

In 1Q17, Bio-Rad Laboratories’ (BIO) Life Science segment reported revenues of ~$174.3 million, which represents a YoY rise of ~5.1%.

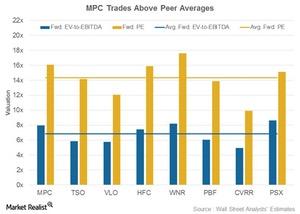

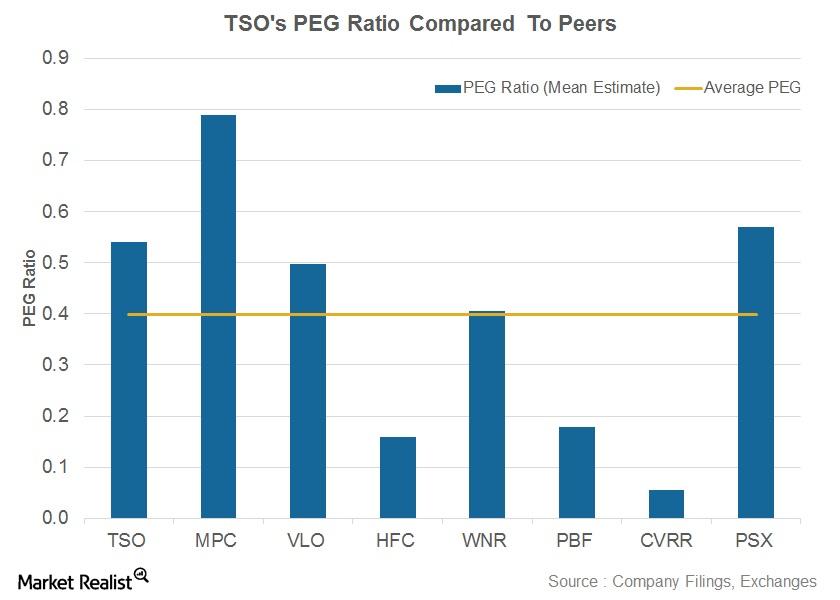

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

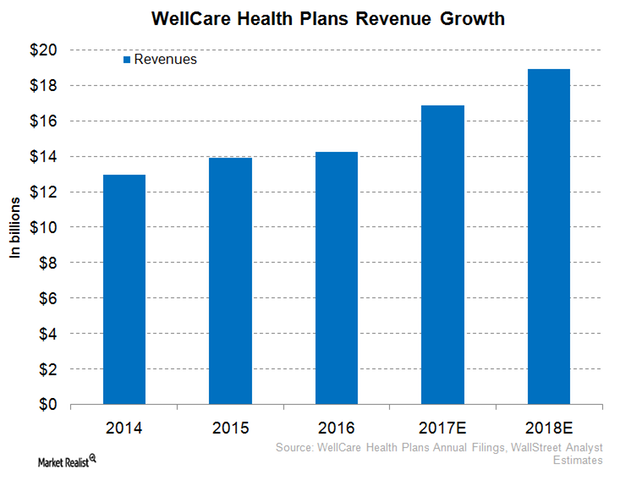

WellCare Health Plans Expects Robust Revenue Performance in 2017

In 1Q17, WellCare Health Plans (WCG) reported revenues of ~$3.9 billion, which totals year-over-year growth of around 11.7%.

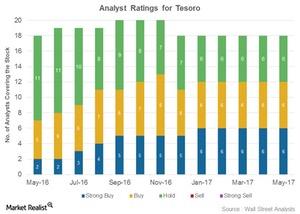

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

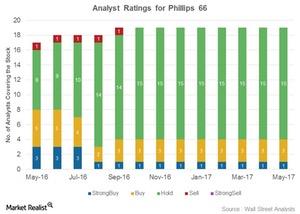

Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

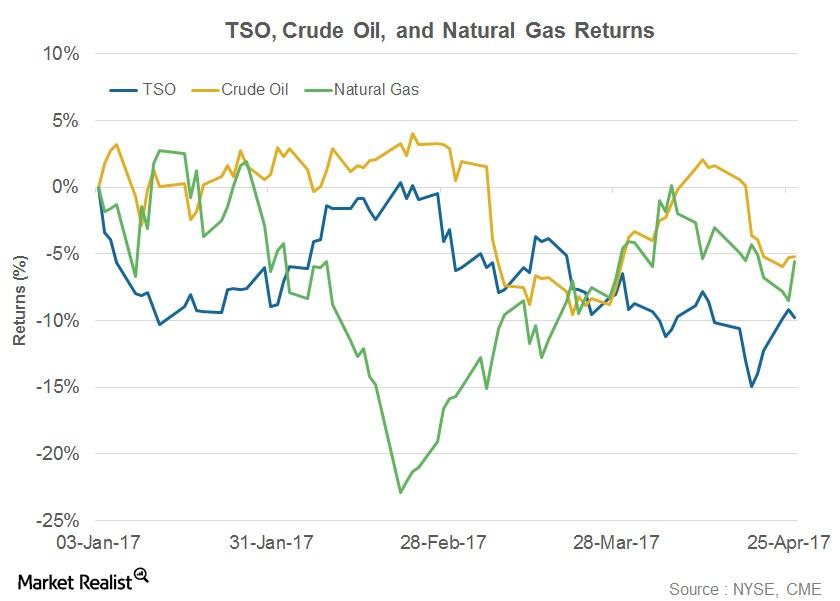

How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

Key Updates Markets Are Waiting for in U.S. Steel’s 1Q17 Call

In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

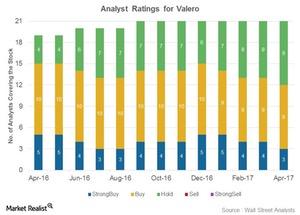

Are Valero’s Analyst Ratings Weaker or Stronger before the 1Q Results?

Of the 21 analysts covering Valero Energy (VLO), 12 (57%) analysts have assigned “buy” or “strong buy” ratings, while nine (43%) have assigned “hold” ratings.

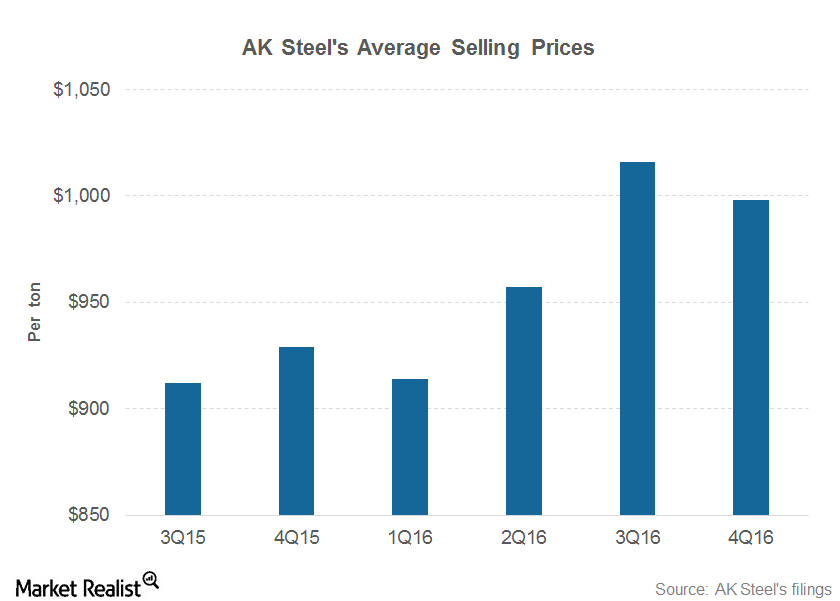

Can AK Steel Regain Its Lost Mojo in 1Q17?

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

Why Short Interest in Valero Soared in 2017

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

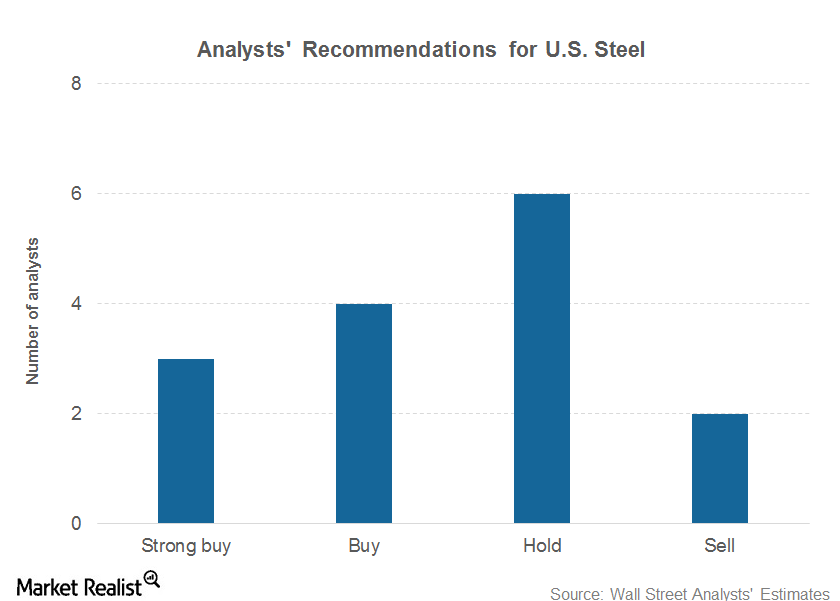

Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

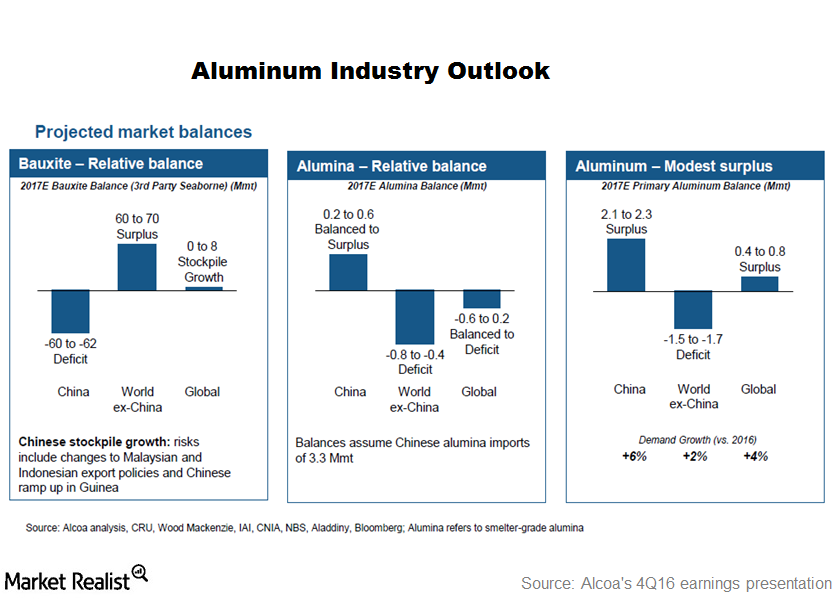

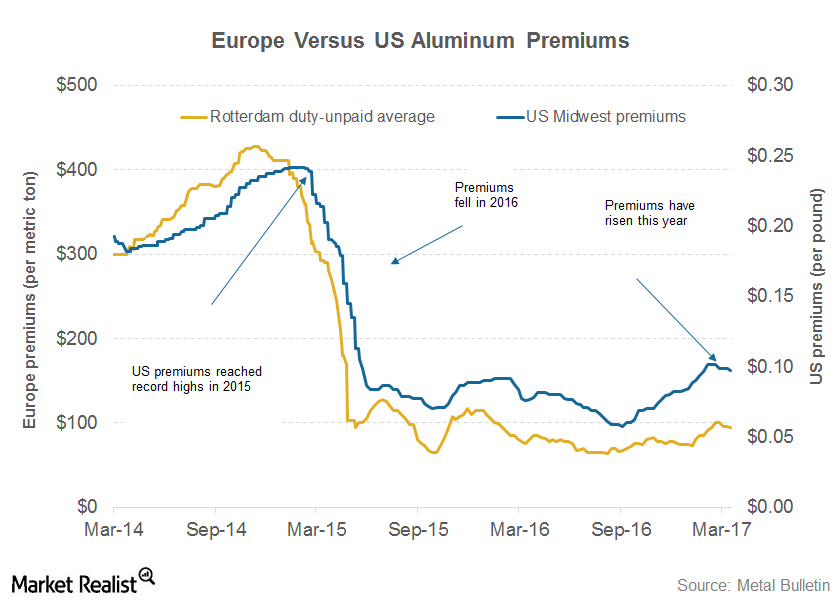

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

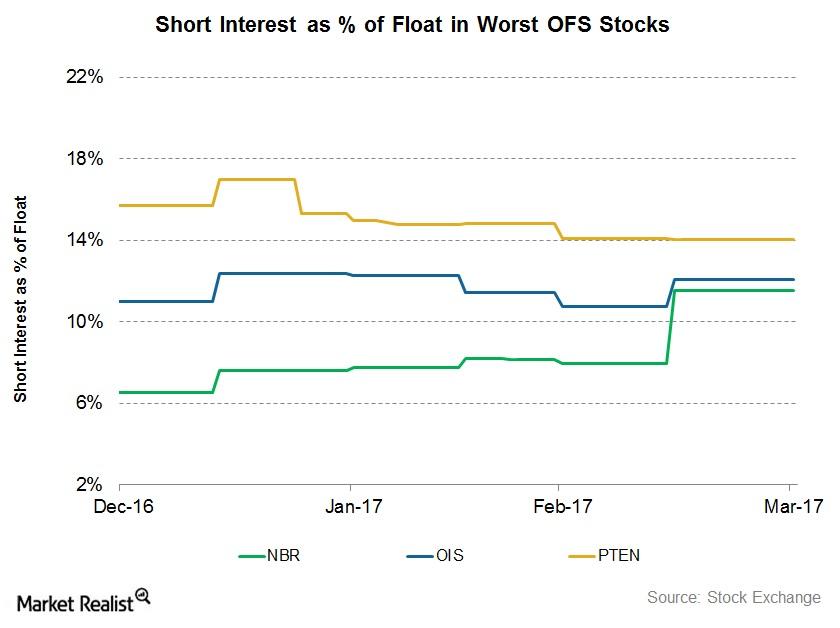

Short Interest: OFS Stocks with the Lowest Returns in 1Q17

Short interest in Nabors Industries (NBR), as a percentage of its float, rose to 11.5% as of March 31, 2017—compared to 6.5% as of December 30, 2016.

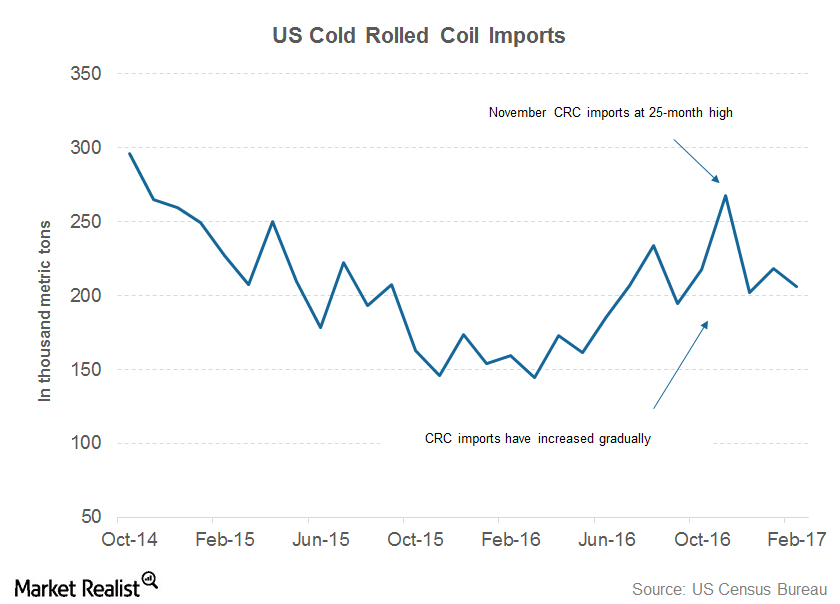

What the Divergence in Flat Rolled Steel Imports Tells Us

In this article, we’ll look at February 2017’s flat rolled steel imports and study whether there’s a divergence in the imports of these products.

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

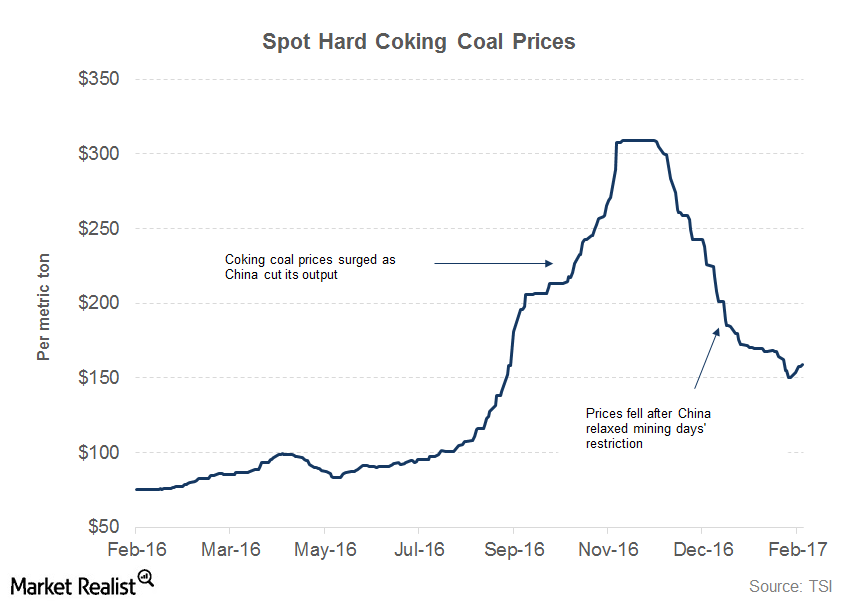

How Raw Material Prices Could Impact U.S. Steel’s Performance

ArcelorMittal’s mining operations generated an operating income of $203 million in 4Q16, almost double what they generated in 3Q16.

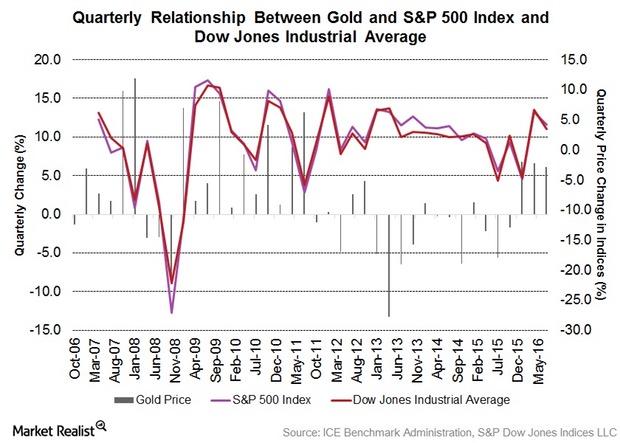

Gold Prices Recover amid Sell-Off

Demand for Gold Withstood Recent Selloff Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but […]

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

How Marathon Oil’s Stock Has Reacted to Past Earnings Reports

After losing ~84% of its market capitalization between September 2014 and February 2016, Marathon Oil’s stock price has begun to show signs of new uptrends.

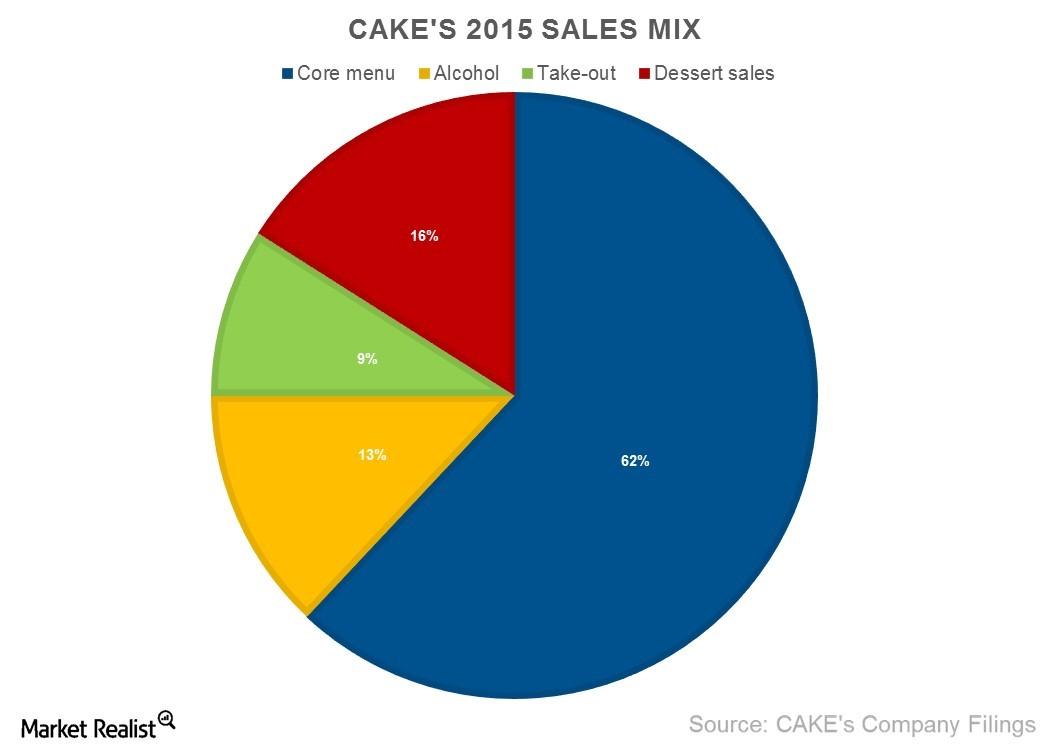

The Cheesecake Factory Is Not Just about Desserts

The Cheesecake Factory has positioned itself as an upscale casual dining concept that focuses on providing a distinctive, high-quality dining experience.

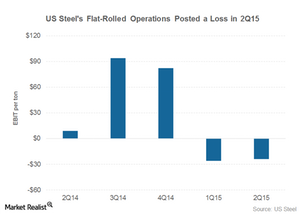

U.S. Steel’s Flat Rolled Segment Posts a Loss in 2Q15

U.S. Steel’s Flat-Rolled segment posted negative EBIT of $24 per ton in 2Q15. This represents a slight improvement over 1Q15 results.