Tesoro Logistics LP

Latest Tesoro Logistics LP News and Updates

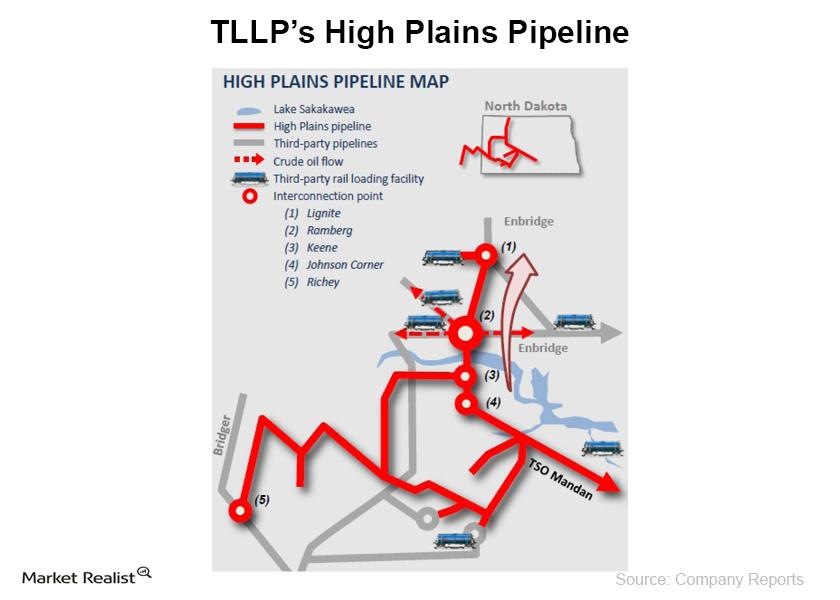

Why Tesoro’s crude oil gathering and pipeline segment is positive

Tesoro Logistics’ (TLLP) operations are organized into the Crude Oil Gathering segment and the Terminalling and Transportation segment.

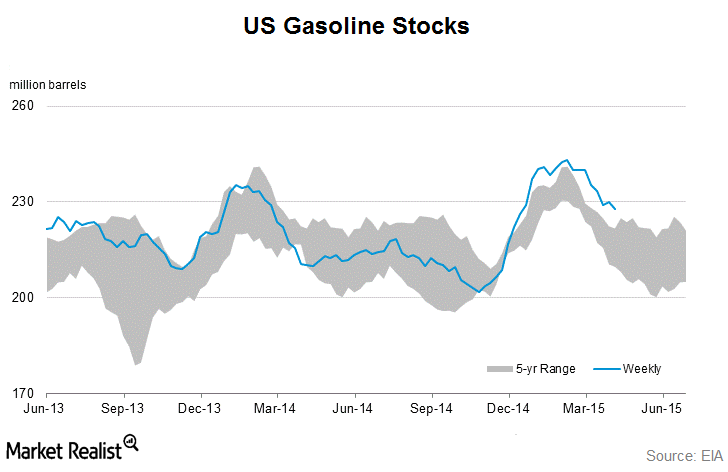

Gasoline Inventories Returned to Downtrend Last Week

Gasoline demand increased from ~8.61 MMbpd to ~8.91 MMbpd last week. Gasoline inventories remain outside the five-year range despite the draw in inventories reported on Wednesday.

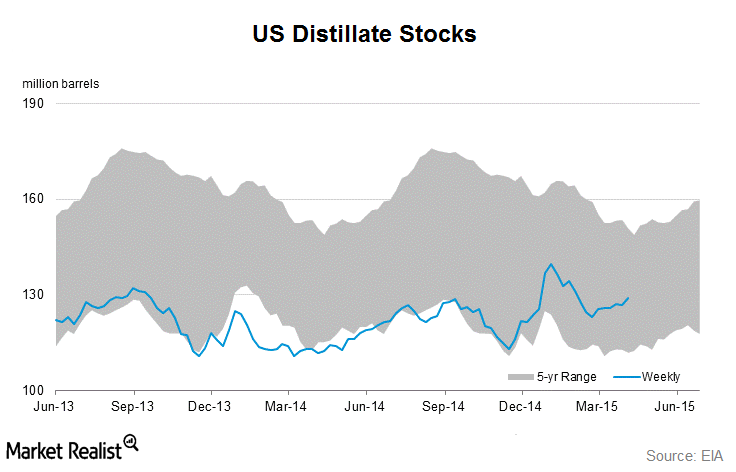

Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

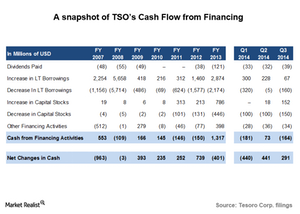

Tesoro’s cash flow from financing activities

Tesoro’s activities at the cash flow from financing level have been both a source and a destination for Tesoro’s cash over the years.