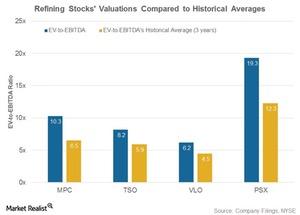

How Refining Stocks’ Historical Valuation Compares

Refining stocks’ valuation In this part, we’ll compare refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios with their three-year averages. Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading higher than their historical valuation. MPC was trading at a 10.3x EV-to-EBITDA ratio in 1Q17, compared […]

Nov. 20 2020, Updated 3:24 p.m. ET

Refining stocks’ valuation

In this part, we’ll compare refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios with their three-year averages. Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading higher than their historical valuation. MPC was trading at a 10.3x EV-to-EBITDA ratio in 1Q17, compared with its historical average of 6.5x.

Why the higher valuation?

MPC, VLO, PSX, and TSO are trading at a higher valuation than their historical average because investors are holding onto their stock despite volatile performance. MPC is aiming to unlock shareholder value, PSX is ardently working towards creating a diversified earnings model, and TSO is following an inorganic growth path with its ongoing acquisition of Western Refining (WNR). For exposure to small-cap stocks, you could consider the iShares Russell 2000 Value ETF (IWN), which has a ~5% exposure to energy sector stocks, including WNR.