VelocityShares 3x Lng Crude Oil ETN New

Latest VelocityShares 3x Lng Crude Oil ETN New News and Updates

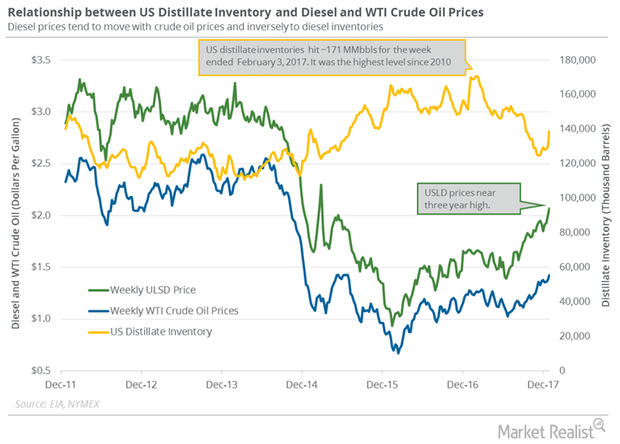

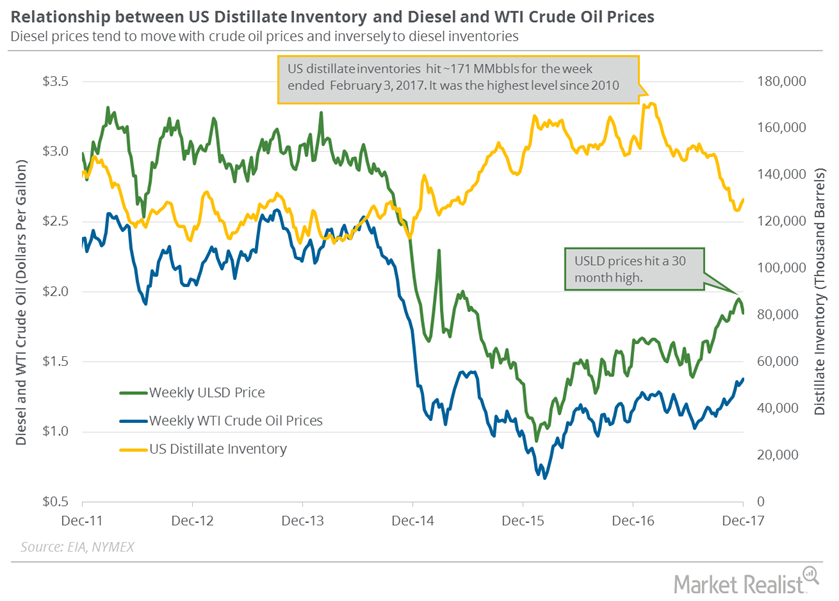

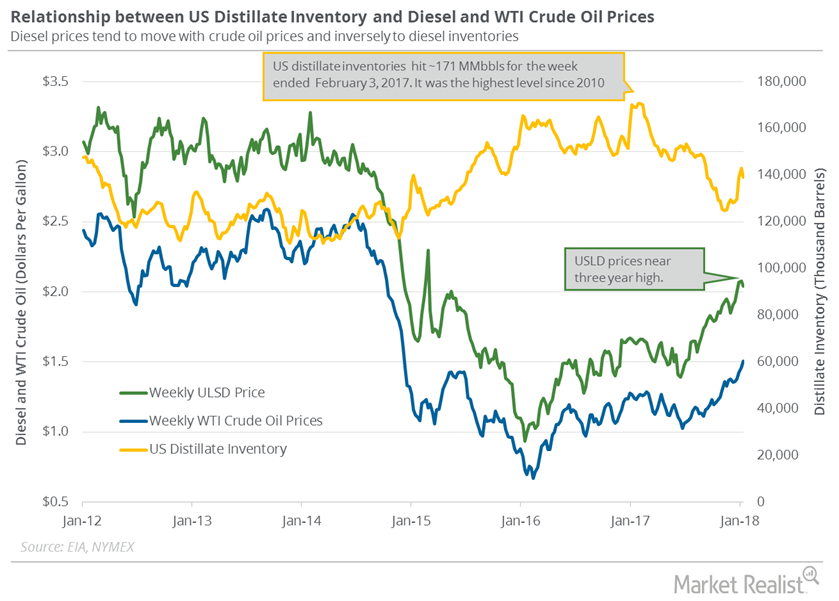

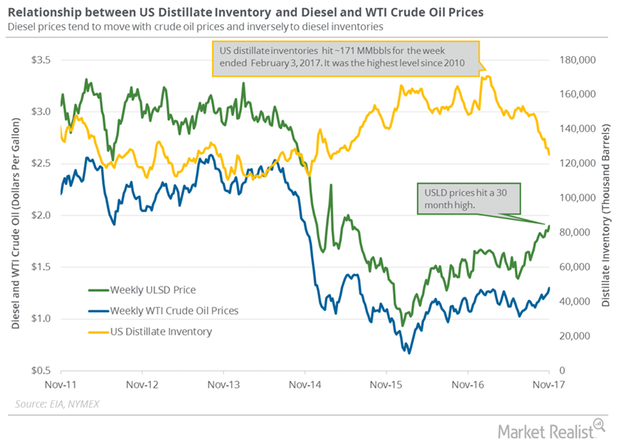

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

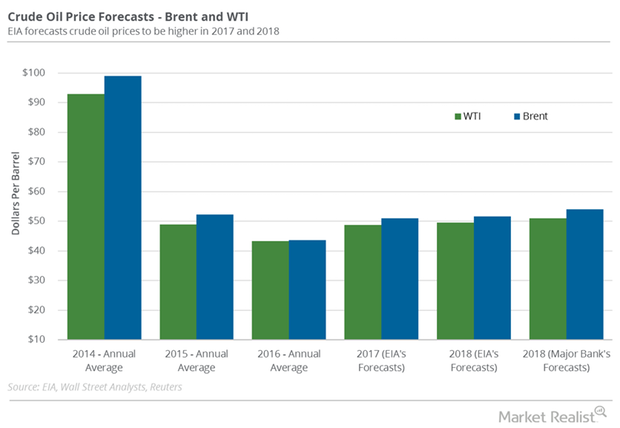

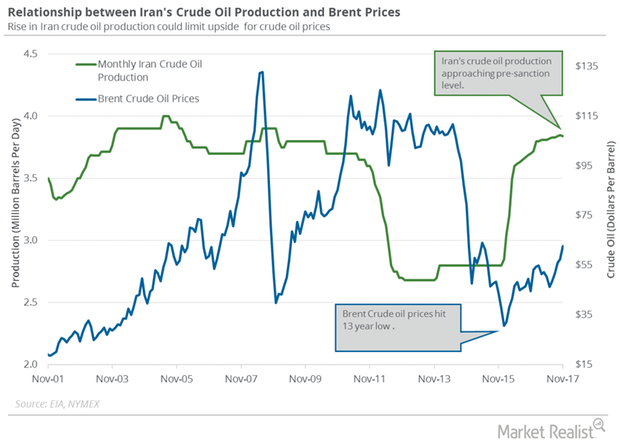

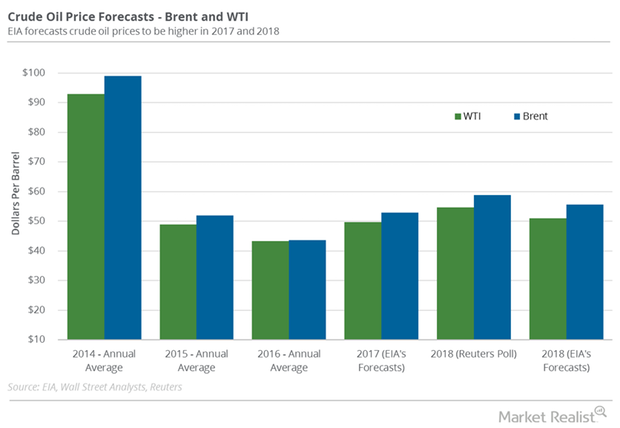

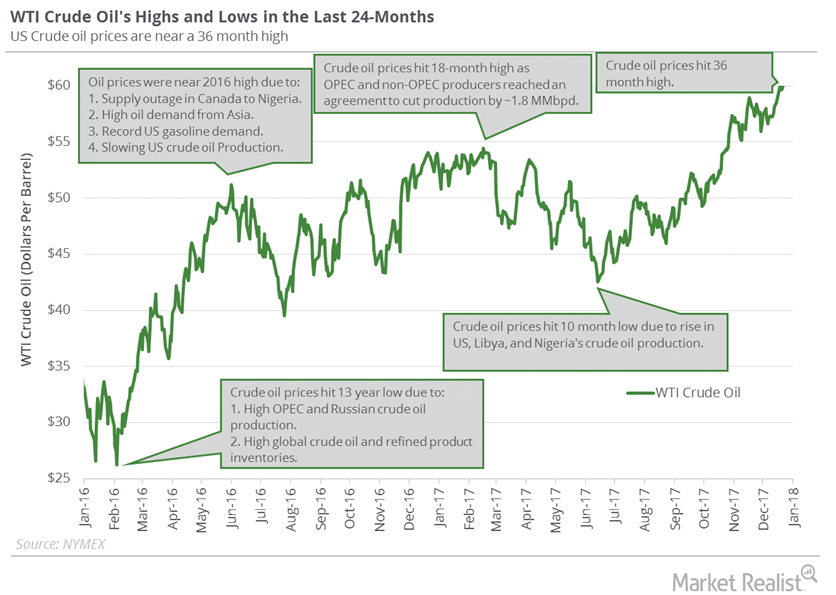

Will Brent and US Crude Oil Prices Rise in 2018?

November US crude oil (DWT)(UWT)(USO) futures are above their 20-day, 50-day, and 100-day moving averages at $49.25, $48.77, and $48.11 per barrel as of September 25.

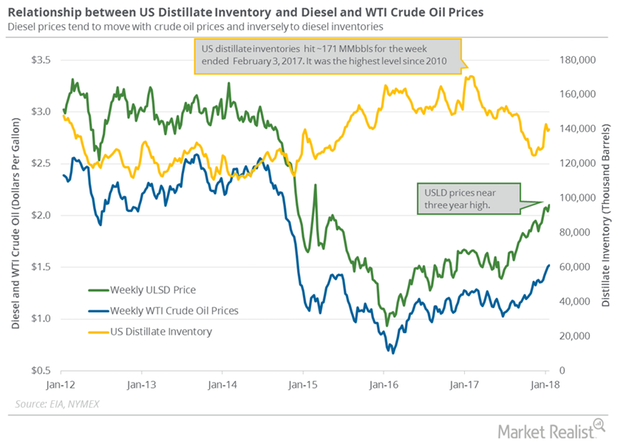

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

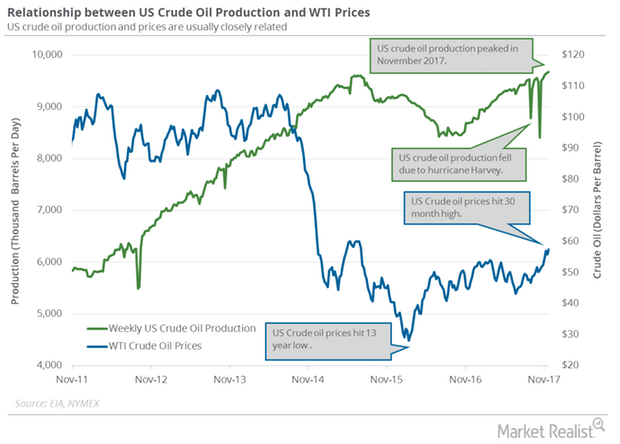

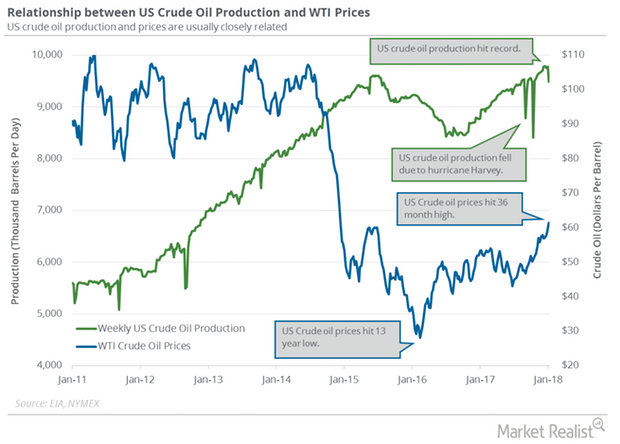

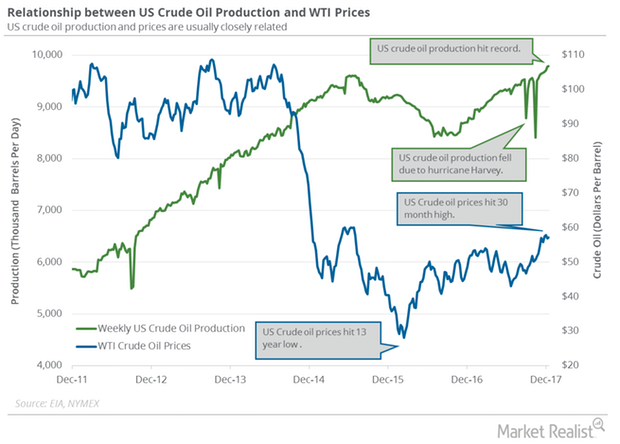

Traders Track US Crude Oil Production and Exports

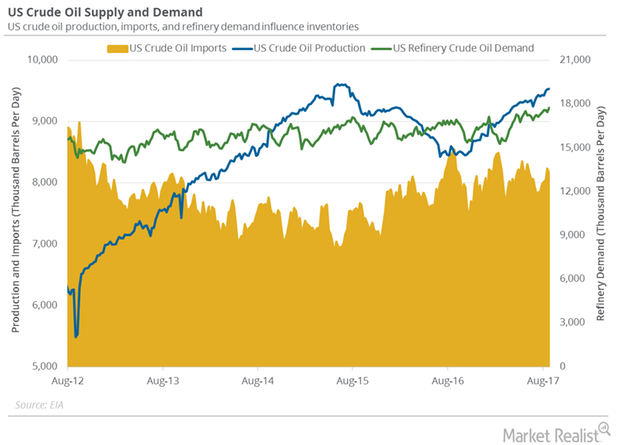

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

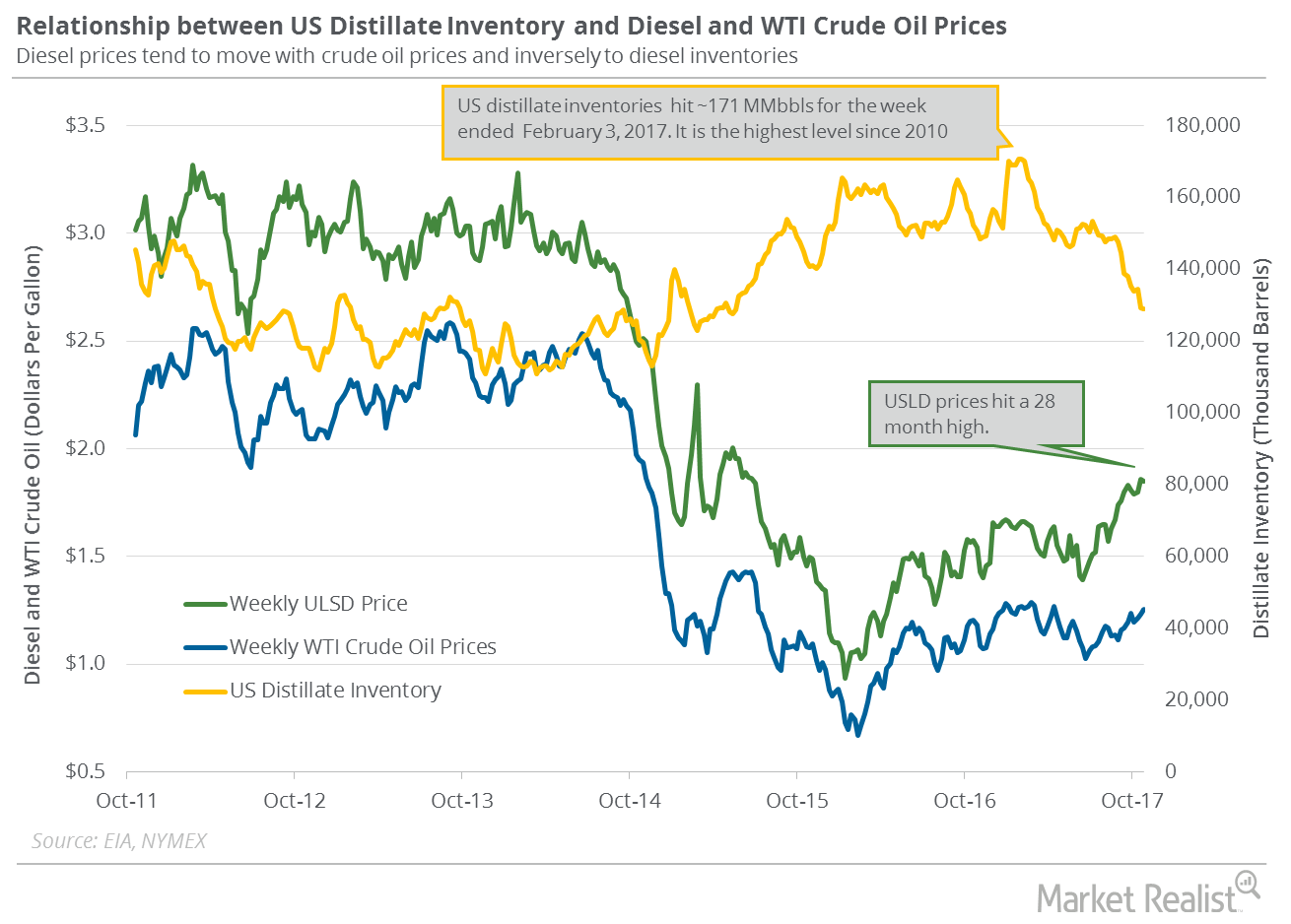

Are US Distillate Inventories Bearish for Oil Prices?

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

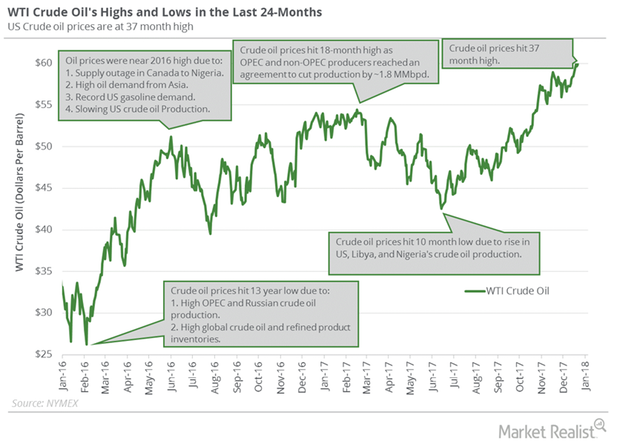

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

Will Crude Oil Futures Rise or Fall This Week?

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.

US Distillate Inventories Are near a 3-Year Low

US distillate inventories fell by 302,000 barrels to 128.9 MMbbls (million barrels) on October 20–27, 2017. It’s the lowest level since April 10, 2015.

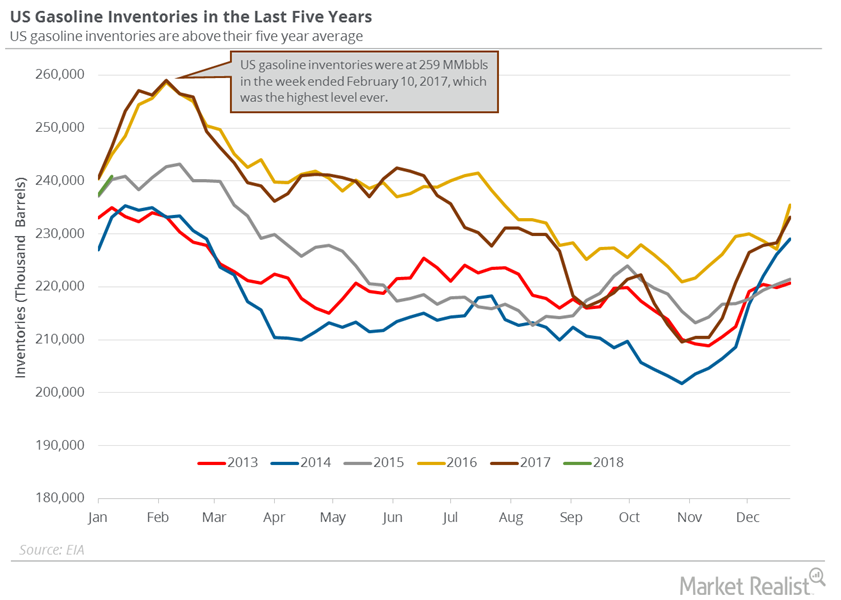

Gasoline Inventories Could Cap the Upside for Oil Prices

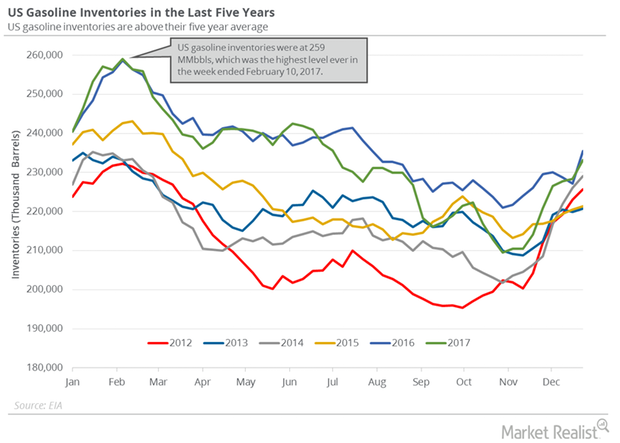

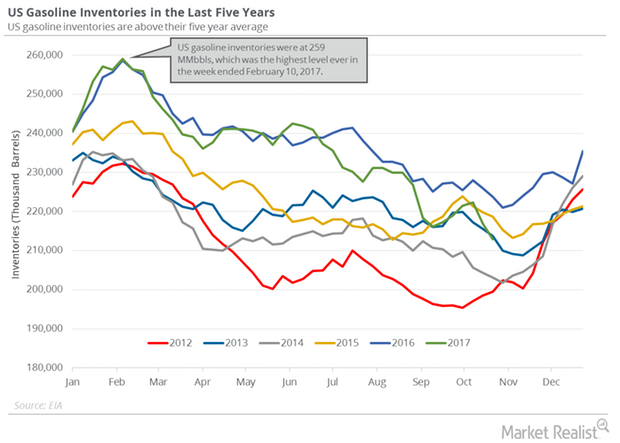

On January 23, 2018, the API released its crude oil inventory report. US gasoline inventories increased by 4.1 MMbbls on January 12–19, 2018.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

US Distillate Inventories Are at 32-Month Low

The EIA reported that US distillate inventories fell by 3,359,000 barrels to 125.5 MMbbls (million barrels) or 2.6% between October 27, 2017, and November 3, 2017.

Crude Oil Prices Could End 2017 on a High Note

A Reuters poll estimated that WTI crude oil (USL) prices could average $54.78 per barrel in 2018 after extending the production cuts.

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

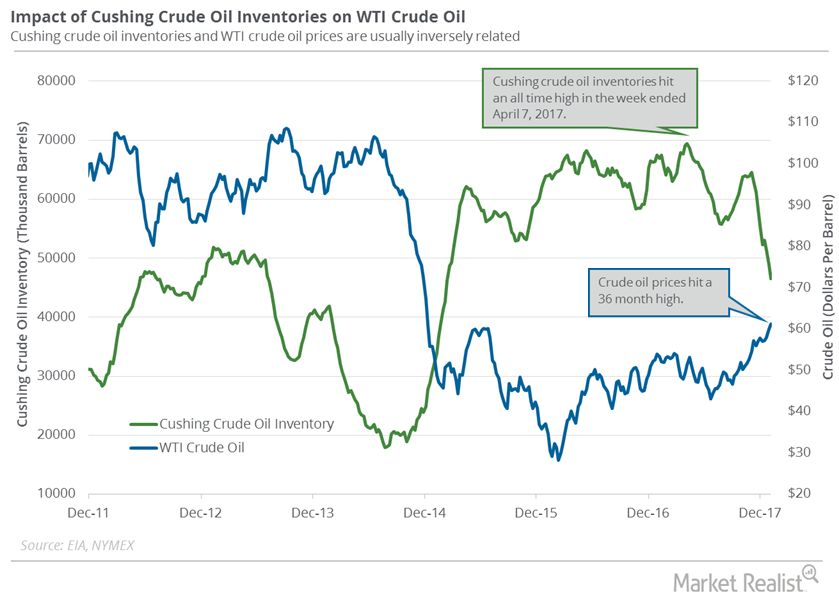

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

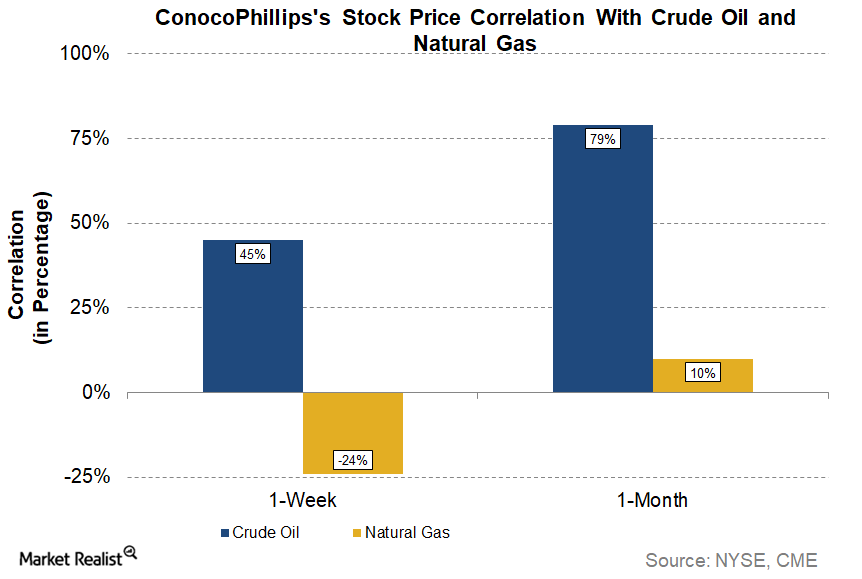

Understanding ConocoPhillips Stock’s Correlation with Crude Oil

ConocoPhillips’s stock performance As we saw in the previous part of this series, ConocoPhillips’s (COP) stock price rose ~2% in the week ended March 9, while crude oil (UWT) (SCO) (DWT) rose ~1%, suggesting that COP stock followed crude oil. In this part, we’ll try to quantify this correlation between COP stock and crude oil. ConocoPhillips’s stock […]

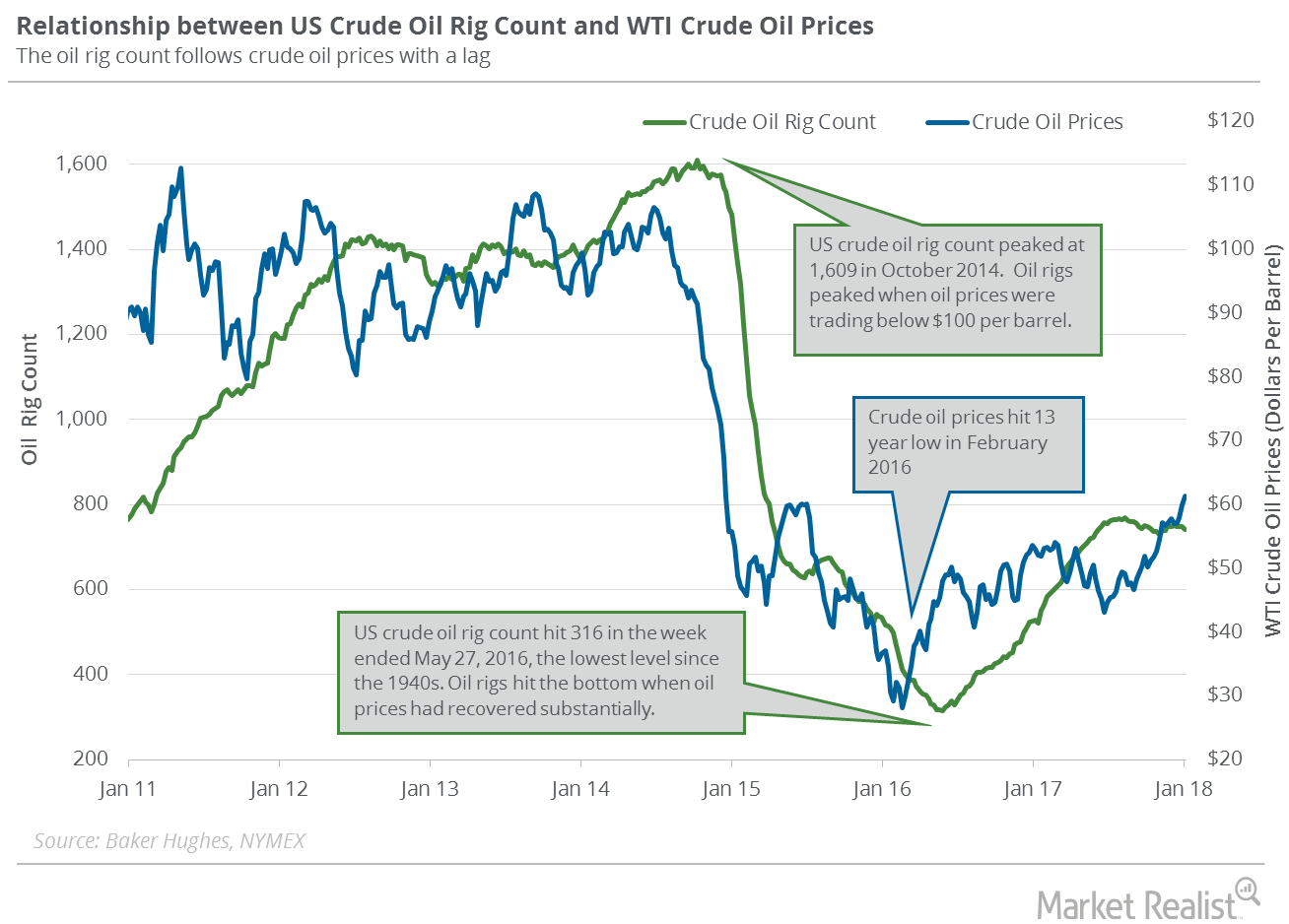

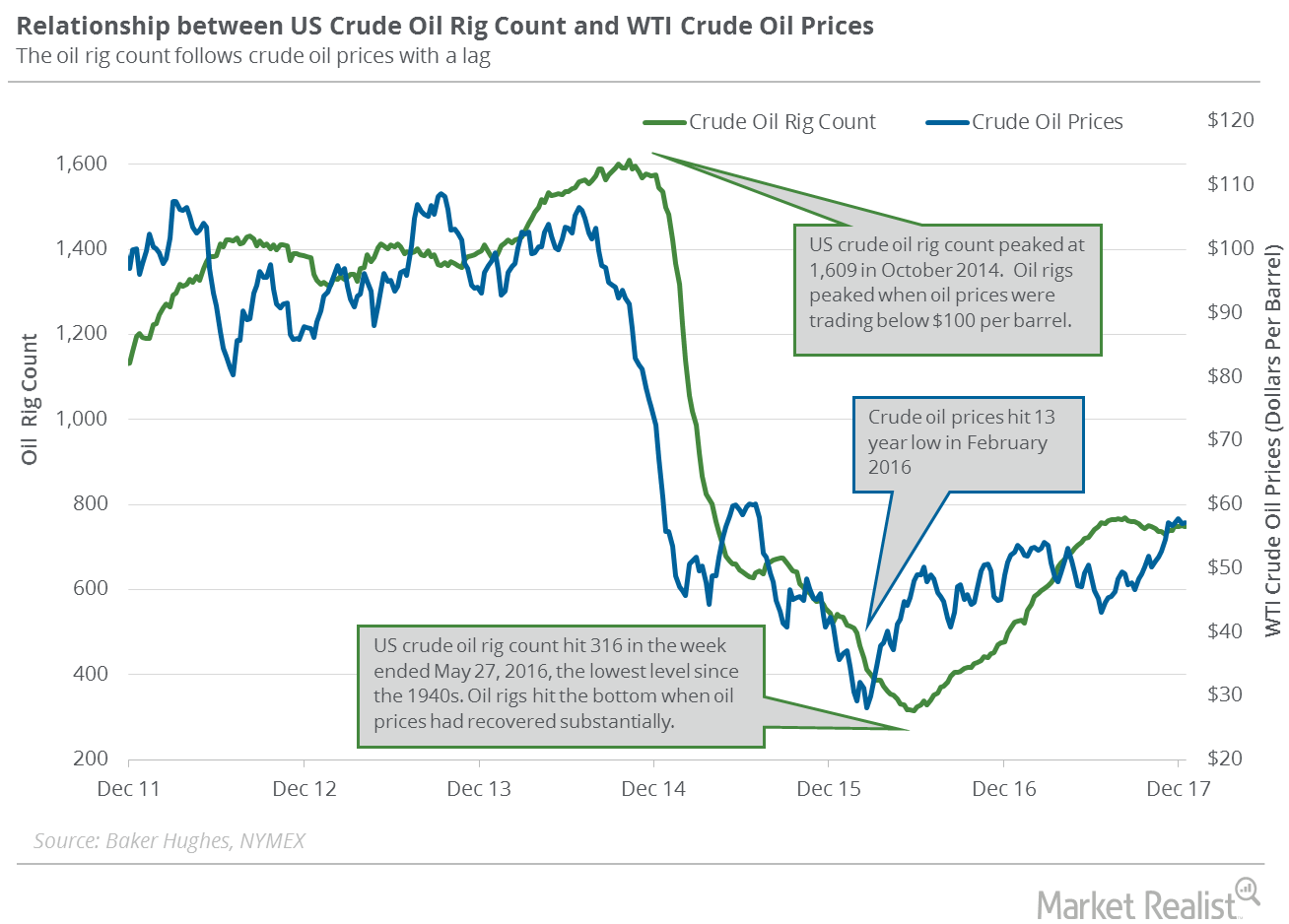

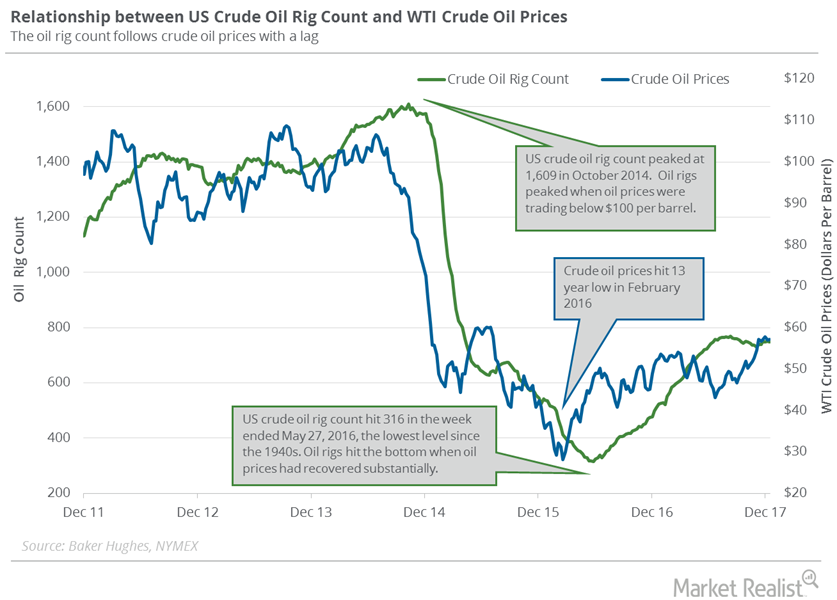

Are US Crude Oil Rigs Indicating a Slowdown in Oil Production?

On January 19, 2018, Baker Hughes released its weekly US crude oil rigs report. US crude oil rigs decreased by five to 747 on January 12–19, 2018.

Massive Fall in Crude Oil Inventories Pushed Oil Prices Higher

US crude oil inventories fell by 4.9 MMbbls (million barrels) to 419.5 MMbbls between December 29, 2017, and January 5, 2018.

US Gasoline Inventories Could Pressure Crude Oil Prices

The EIA estimated that US gasoline inventories increased by 4.8 MMbbls (million barrels) or 2.1% to 233.1 MMbbls on December 22–29, 2017.

US Crude Oil Rigs Could Impact Crude Oil Prices in 2018

Baker Hughes released its US crude oil rig count report on December 29. It reported that US crude oil rigs were flat at 747 on December 22–29, 2017.

Crude Oil Prices: Which Factor Could Change the Trend?

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017.

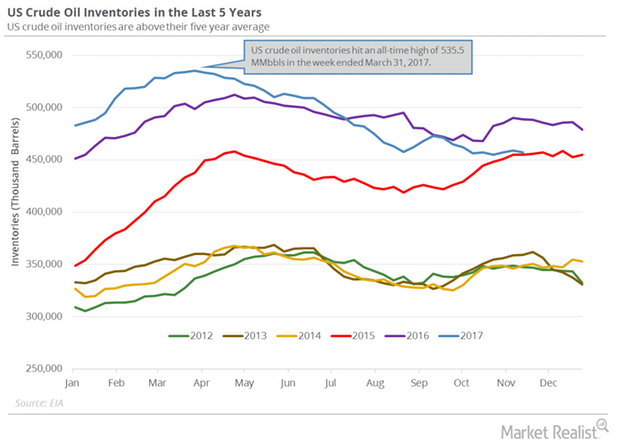

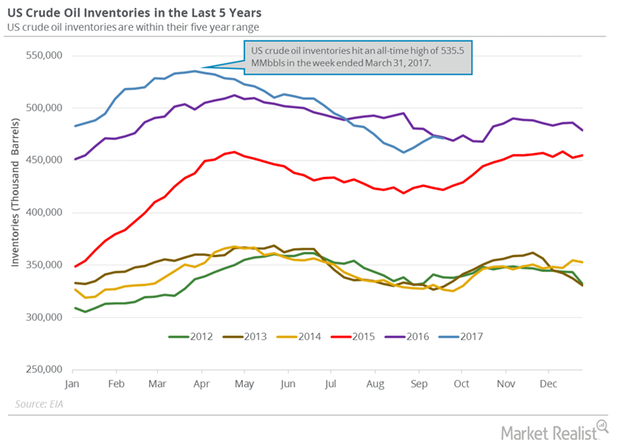

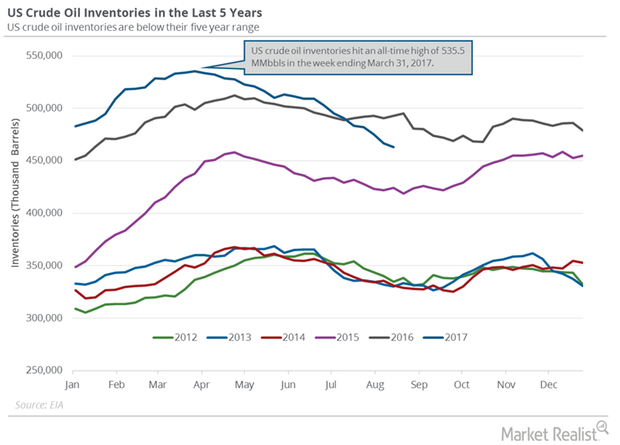

Will US Crude Oil Inventories Push Crude Oil Prices Higher?

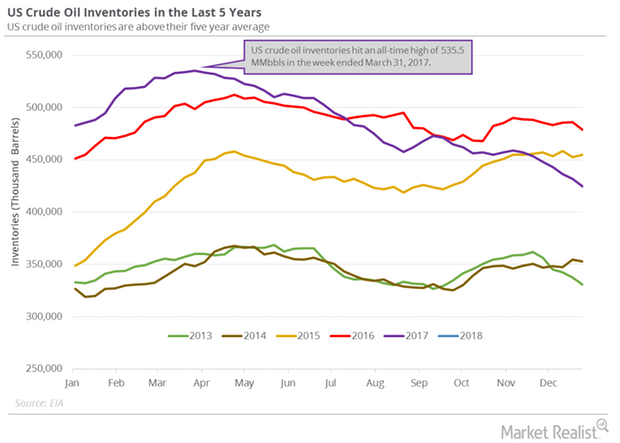

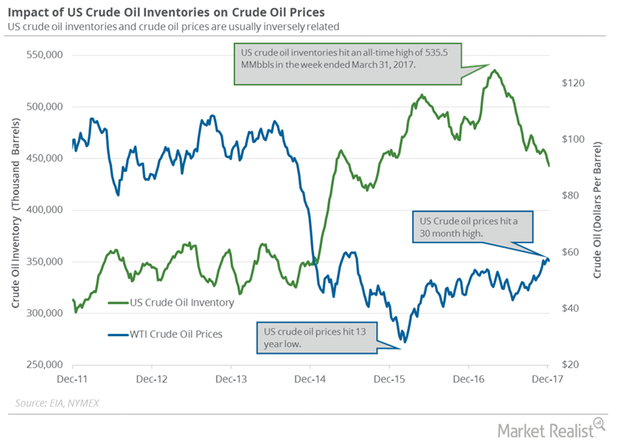

US crude oil inventories fell 17.3% from their peak. So far, they have fallen 8.3% in 2017. Similarly, oil (DWT) (UCO) prices have risen ~9% in 2017.

US Crude Oil Rigs Indicate Future US Crude Oil Production

Baker Hughes released its weekly US crude oil rig report on December 15, 2017. US crude oil rigs fell by four to 747 or 0.5% on December 8–15, 2017.

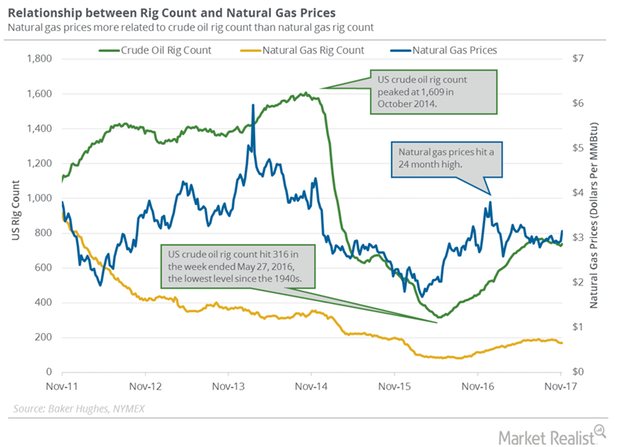

Production Cut Extension Could Influence US Natural Gas Rigs

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017.

The Relationship between US Crude Oil Inventories and Oil Prices

Estimates for US crude oil inventories The EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report on November 22, 2017. It reported that US crude oil inventories fell 1.9 MMbbls (million barrels) to 457.1 MMbbls between November 10 and 17, 2017. Inventories were 31.8 MMbbls (6.5%) lower than in the same period in 2016. The market anticipated […]

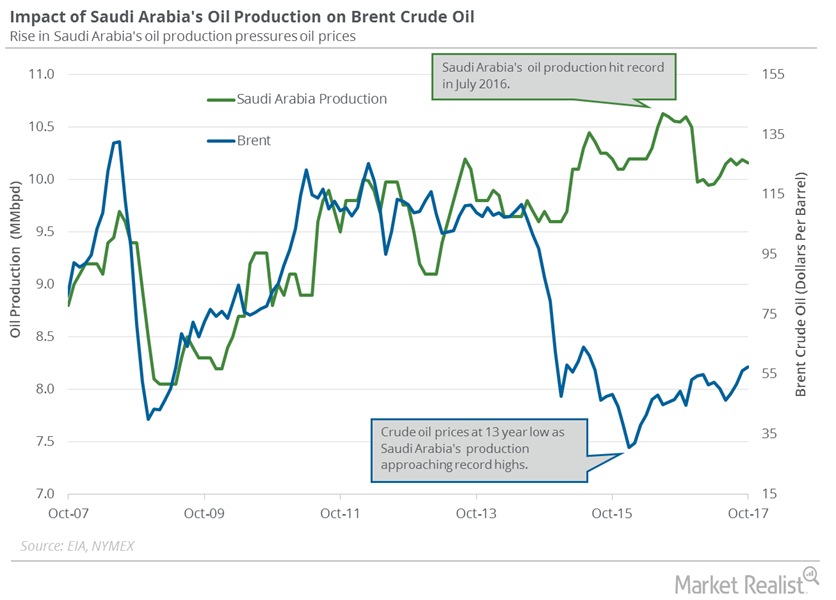

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

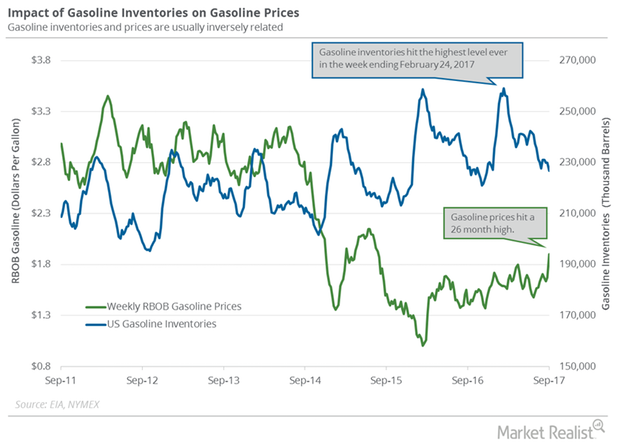

Understanding the Rising US Gasoline Inventories

The EIA estimated on September 27 that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017.

Are Crude Oil Futures Signaling a Breakout?

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trading at 2:10 AM EST on September 20, 2017.

Pre-Hurricane Harvey, US Crude Oil Demand Hit a Record High

US refinery crude oil demand The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is […]

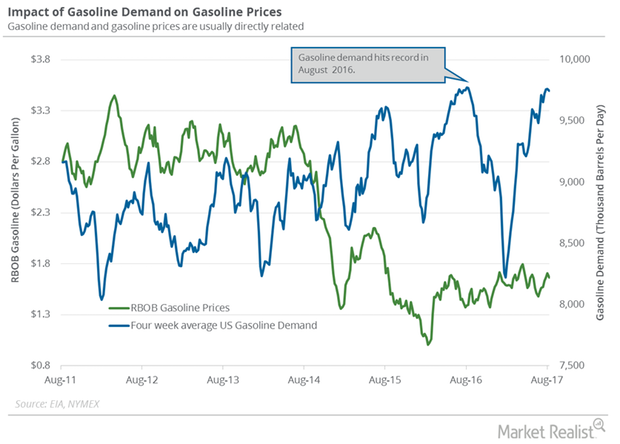

Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

US Crude Oil Inventories Fall in Line with Market Expectations

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017.