United States Gasoline ETF

Latest United States Gasoline ETF News and Updates

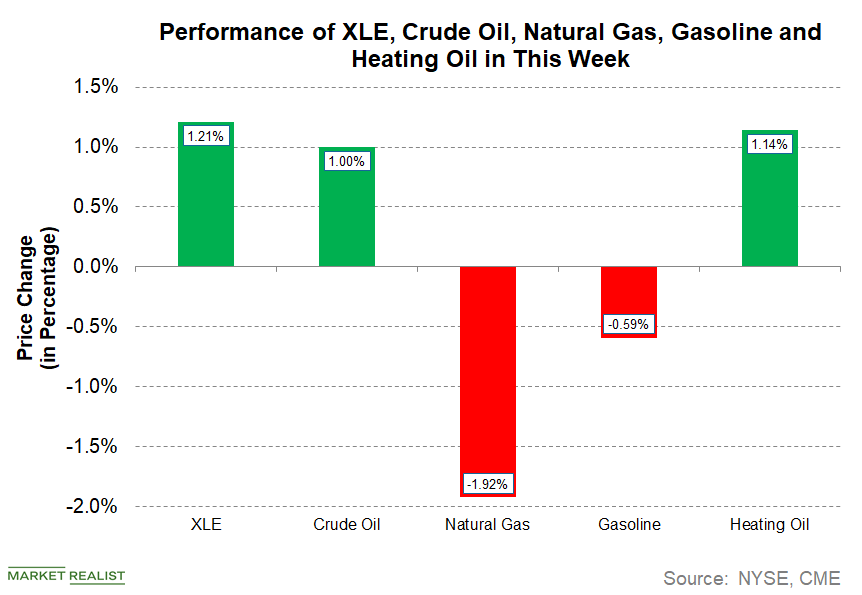

How Energy Commodities Performed from June 18–20

Energy stocks are rising this week. The Energy Select Sector SPDR ETF (XLE) has risen 1.2% from June 18–20.

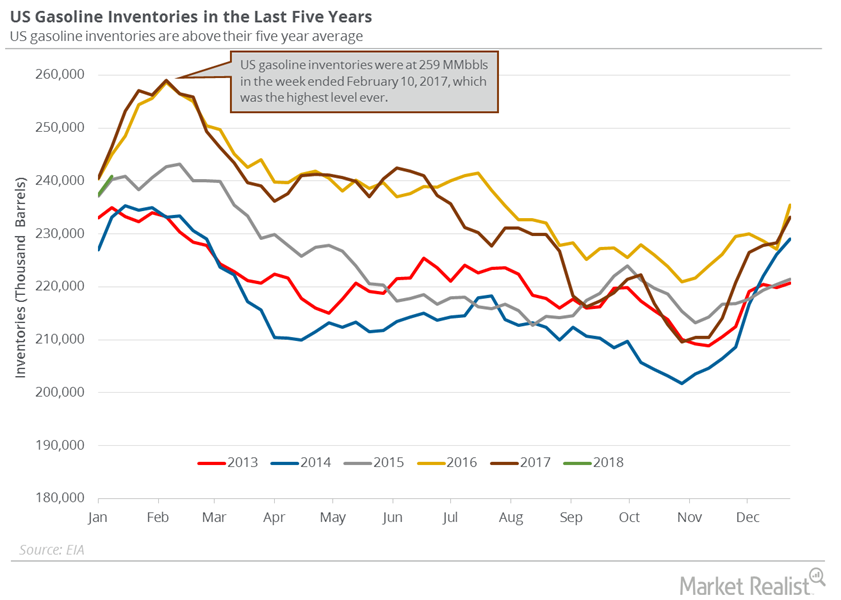

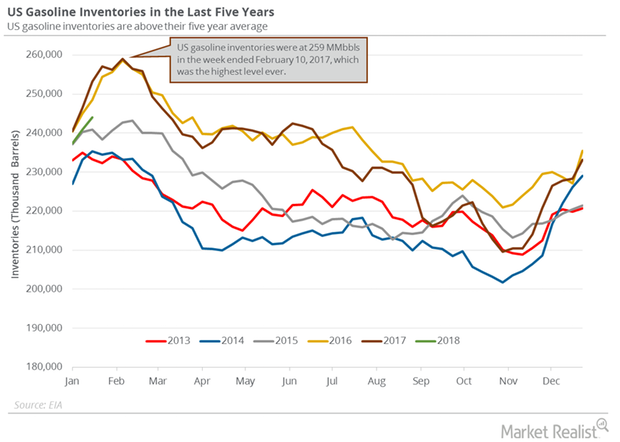

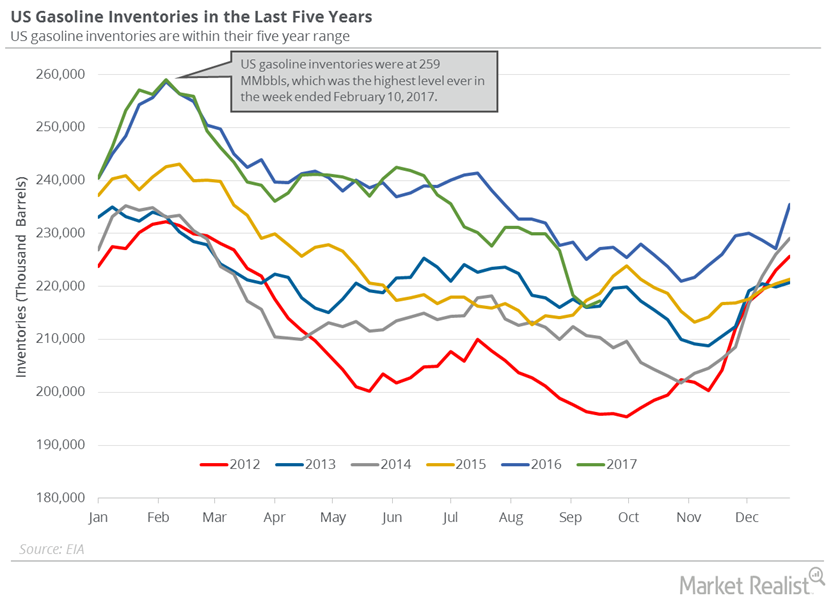

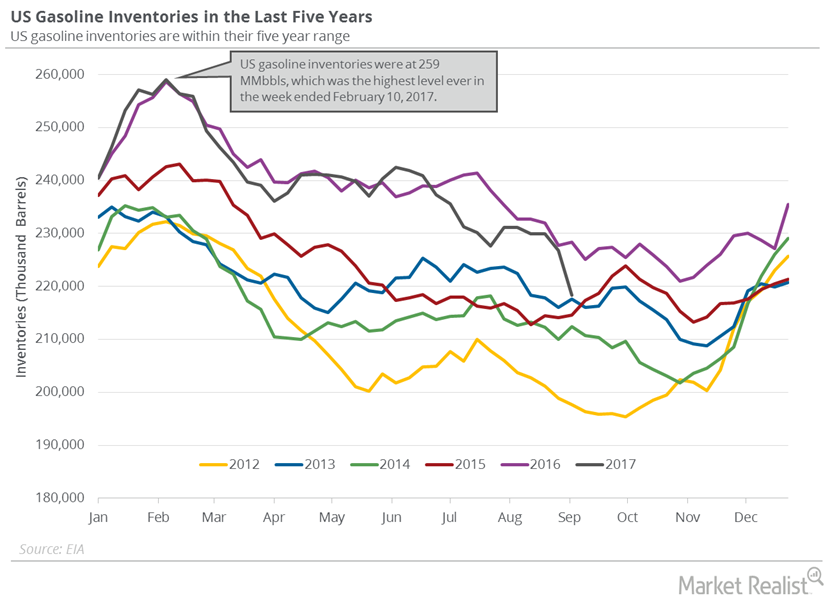

Gasoline Inventories Could Cap the Upside for Oil Prices

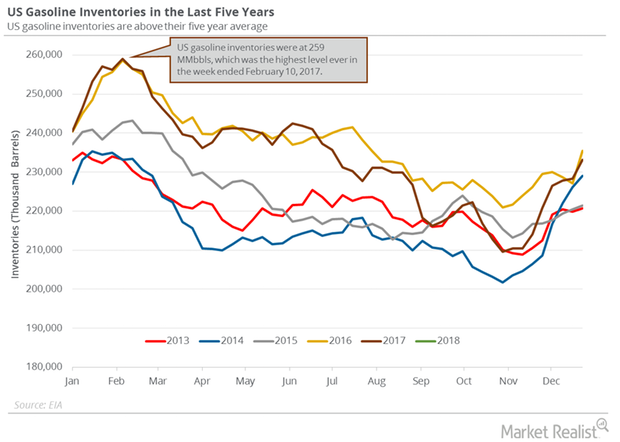

On January 23, 2018, the API released its crude oil inventory report. US gasoline inventories increased by 4.1 MMbbls on January 12–19, 2018.

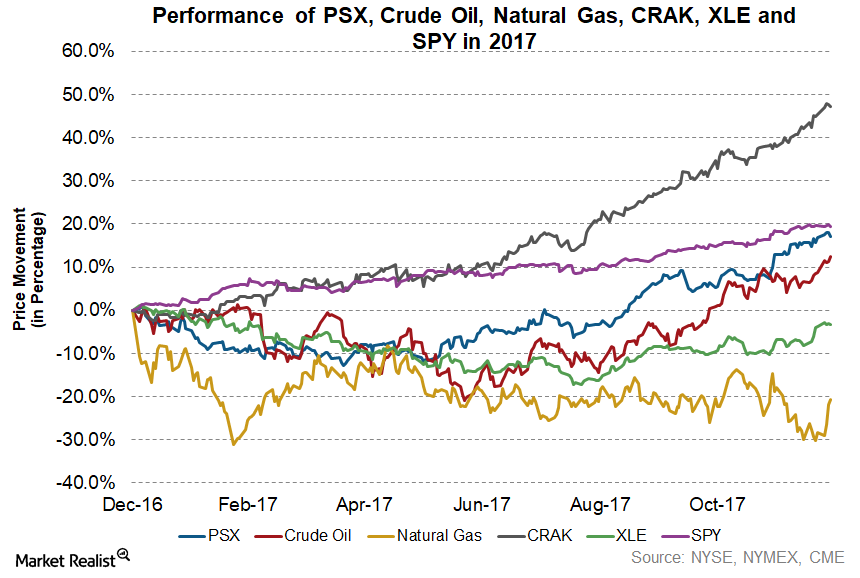

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

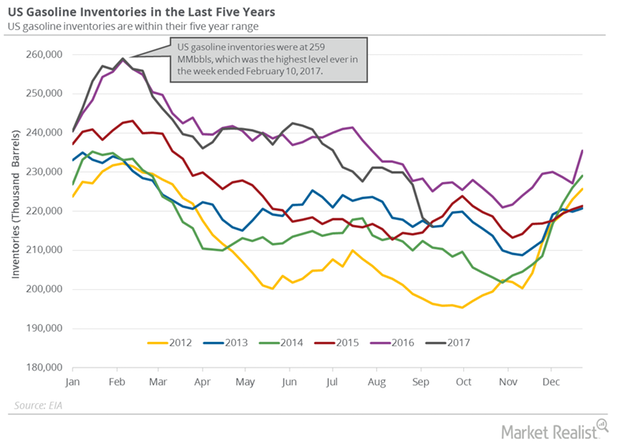

US Gasoline Inventories Could Threaten Crude Oil Prices

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

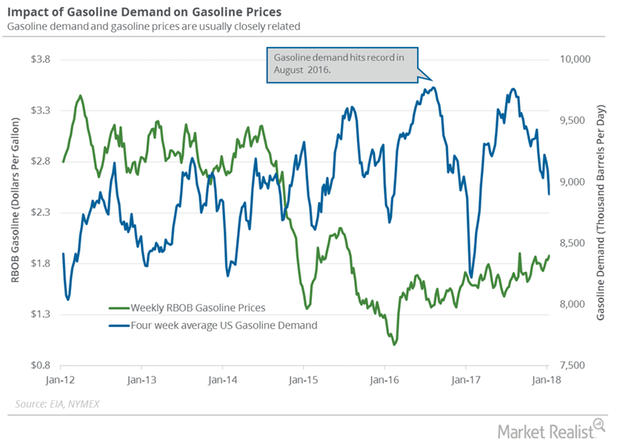

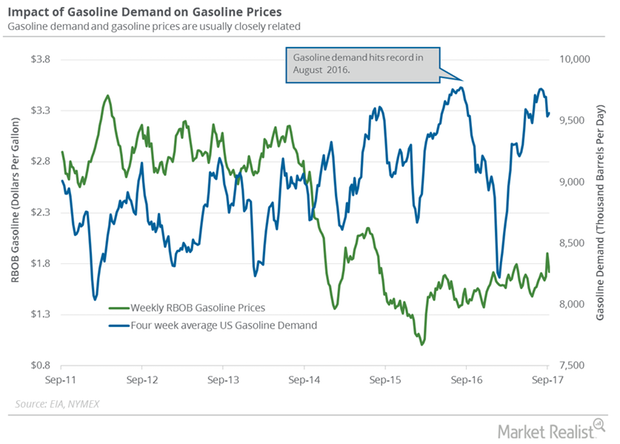

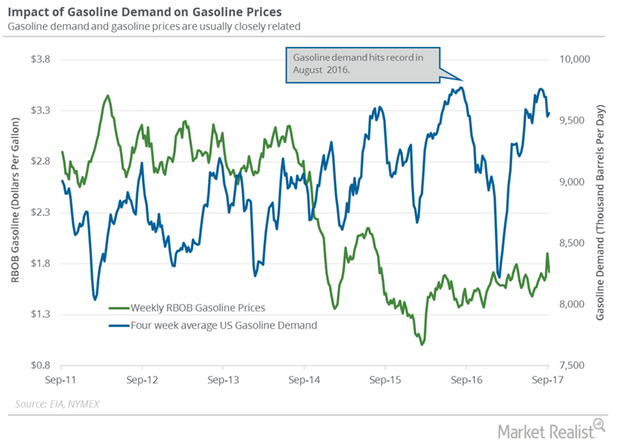

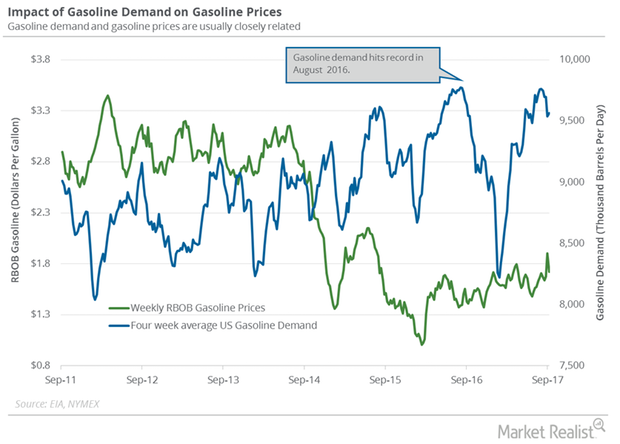

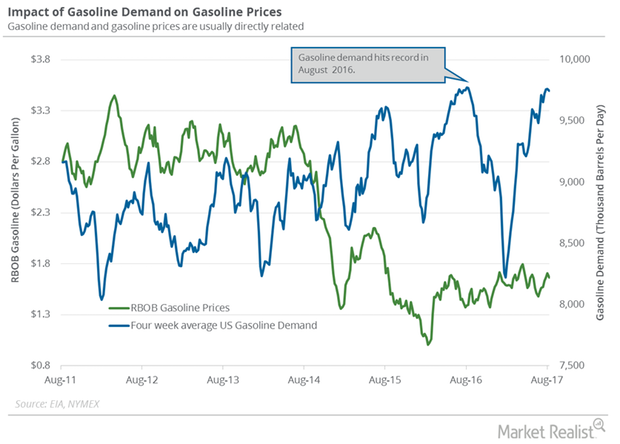

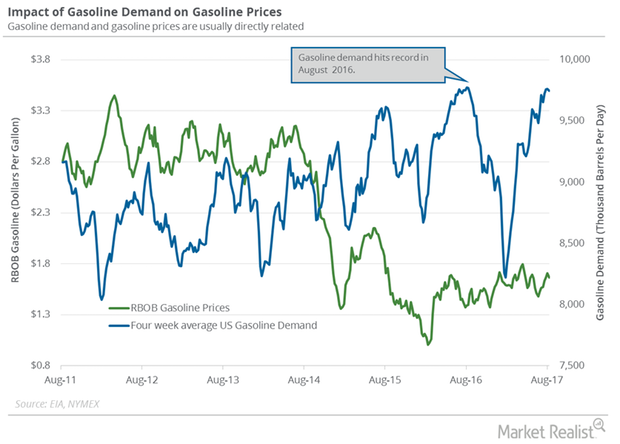

US Gasoline Demand Could Extend the Crude Oil Price Rally

The EIA estimated that four-week average US gasoline demand decreased by 190,000 bpd (barrels per day) to 8,904,000 bpd on January 5–12, 2018.

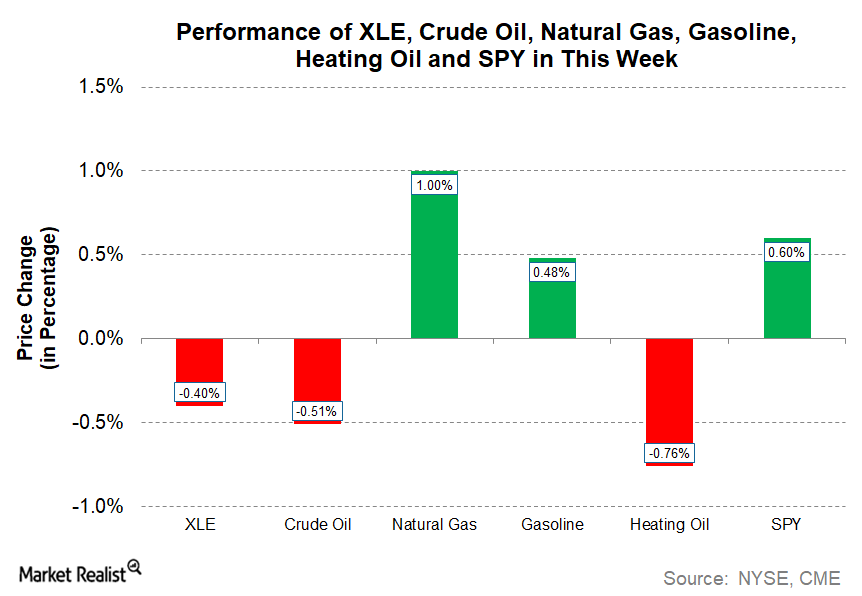

These Energy Commodities Rose This Week

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE) has fallen ~0.4% this week.

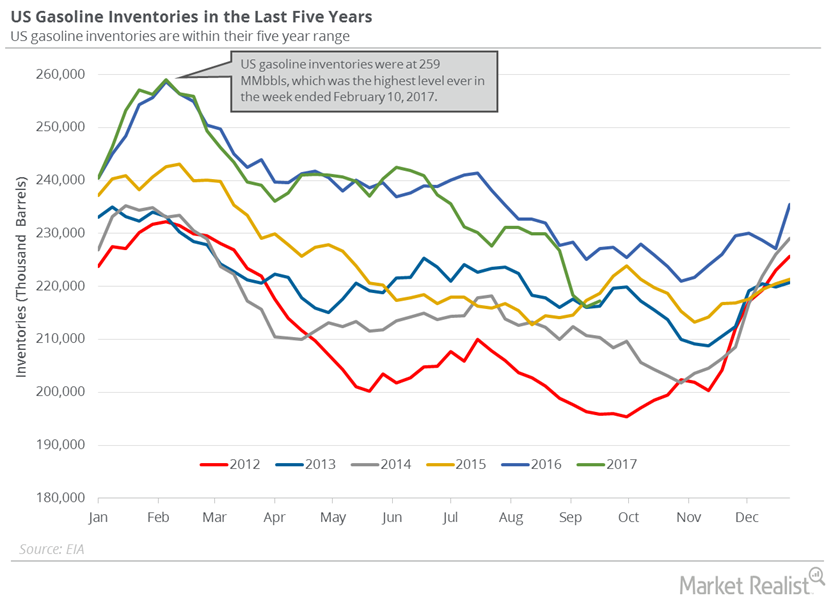

US Gasoline Inventories: More Concerns for Oil in 2018?

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018.

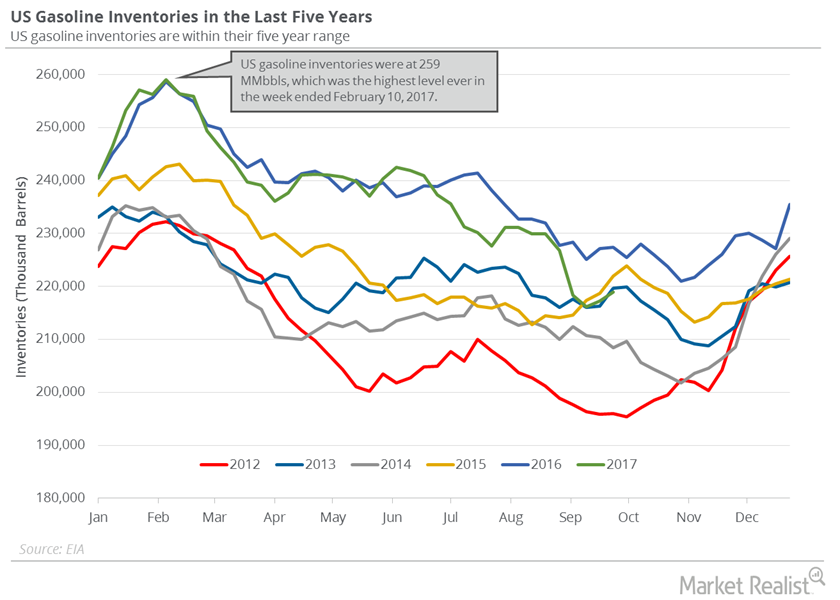

Are US Gasoline Inventories a Pain for Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls to 218.9 MMbbls on September 22–29, 2017.

Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

Understanding the Rising US Gasoline Inventories

The EIA estimated on September 27 that US gasoline inventories rose 1.1 MMbbls (million barrels) to 217.2 MMbbls from September 15–22, 2017.

US Gasoline Demand Today: Bullish or Bearish for Crude?

The EIA estimates that weekly US gasoline demand fell 178,000 bpd (barrels per day) to 9.4 MMbpd between September 8 and September 15.

US Gasoline Inventories Fell for 4th Time in 5 Weeks

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell 2.1 MMbbls (million barrels), or 1%, to 216.1 MMbbls between September 8, 2017, and September 15, 2017.

US Gasoline Demand Could Fall in 2018

The EIA estimates that weekly US gasoline demand rose by 456,000 bpd (barrels per day) to 9.6 MMbpd (million barrels per day) on September 1–8, 2017.

US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

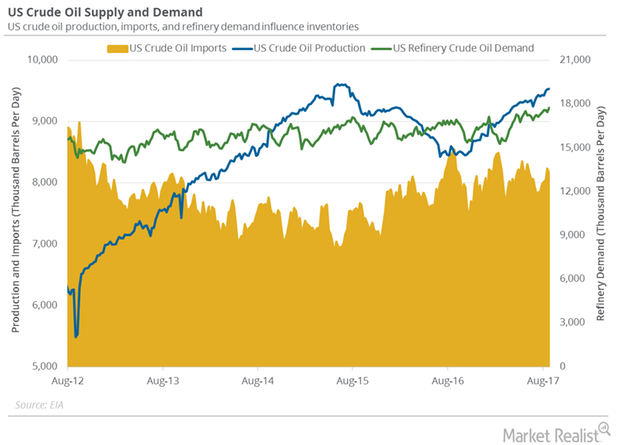

Pre-Hurricane Harvey, US Crude Oil Demand Hit a Record High

US refinery crude oil demand The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is […]

Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

Why September Gasoline Futures Hit a 2-Year High

September gasoline futures contracts rose 4% and closed at $1.78 per gallon on August 29, 2017—the highest settlement in more than two years.

Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.