SM Energy Co

Latest SM Energy Co News and Updates

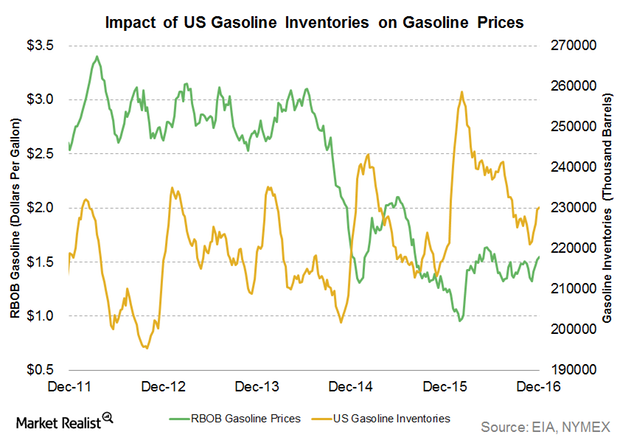

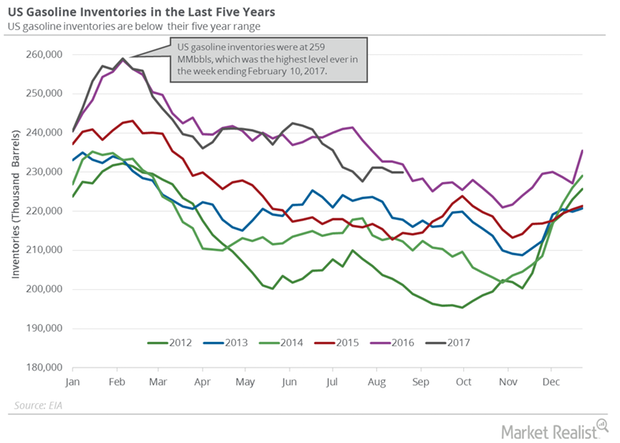

Will Gasoline Inventories Impact Gasoline and Crude Oil Prices?

The API released its weekly inventory report on December 28, 2016. It estimates that US gasoline inventories fell by 2.8 MMbbls from December 16–23, 2016.

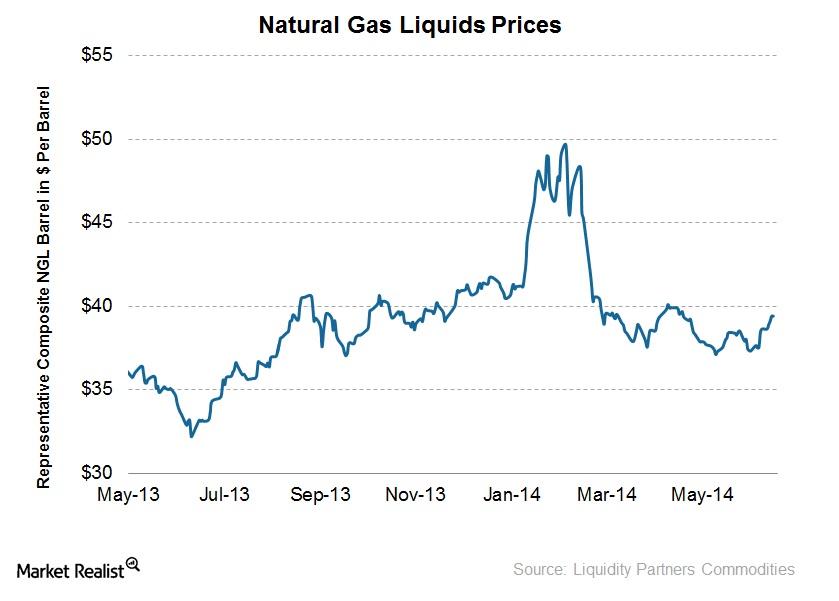

Natural gas liquids prices rise, boosted by propane prices

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up.

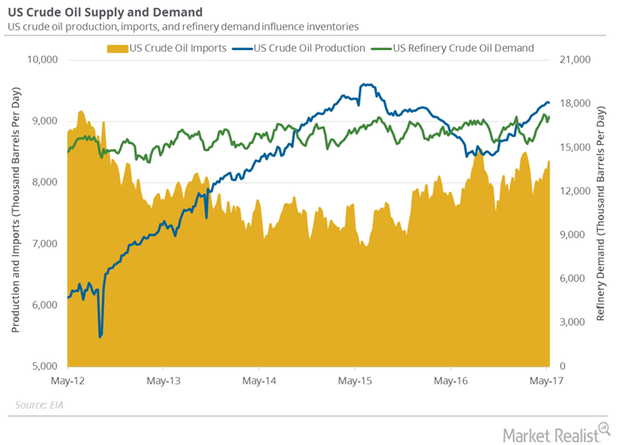

US Refinery Demand Impacts Crude Oil Inventories

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil prices.

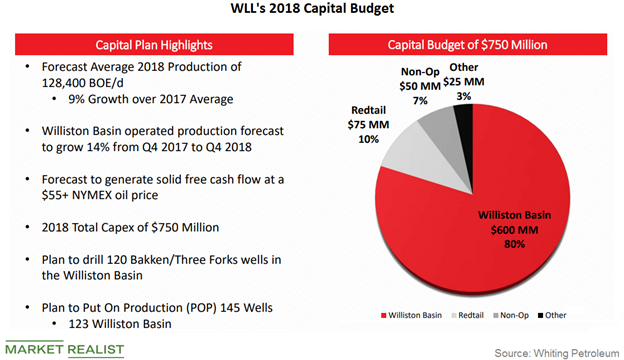

Whiting Petroleum’s Capex Plans for 2018

Whiting Petroleum’s (WLL) 2018 capital expenditure forecast is $750 million, compared to its capex of $912 million in 2017.

Hedge Funds’ Net Long Positions in US Natural Gas

Hedge funds decreased their net bullish positions in US natural gas futures and options 1.9% to 186,799 on June 12–19.

Hedge Funds’ Net Bullish Positions on US Crude Oil

Hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017.

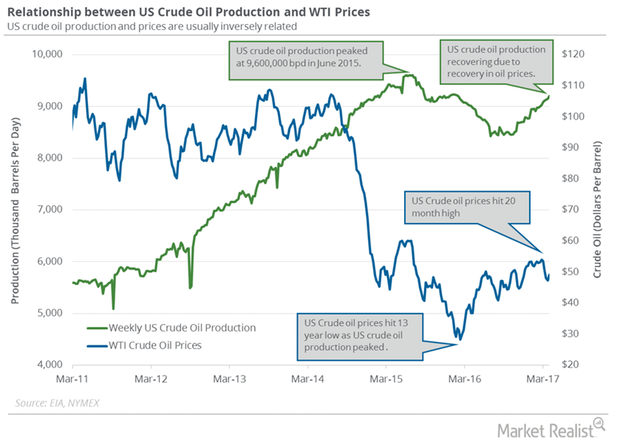

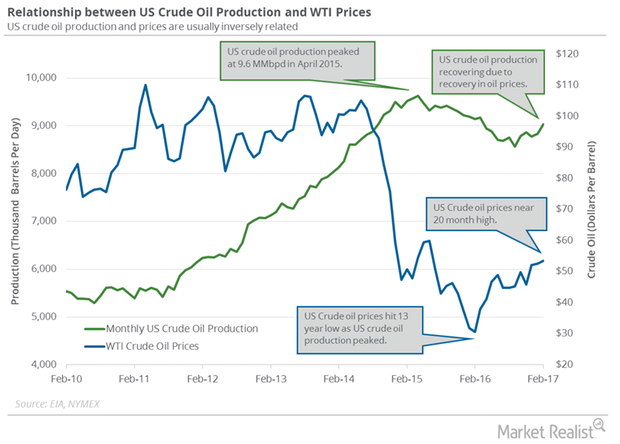

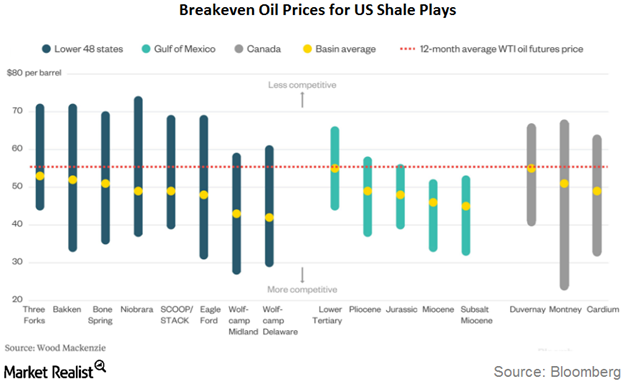

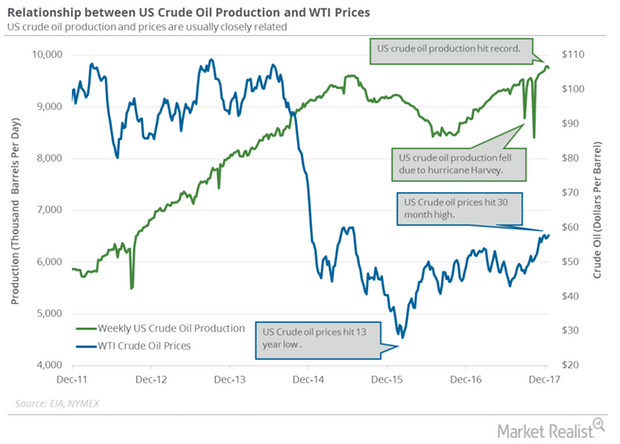

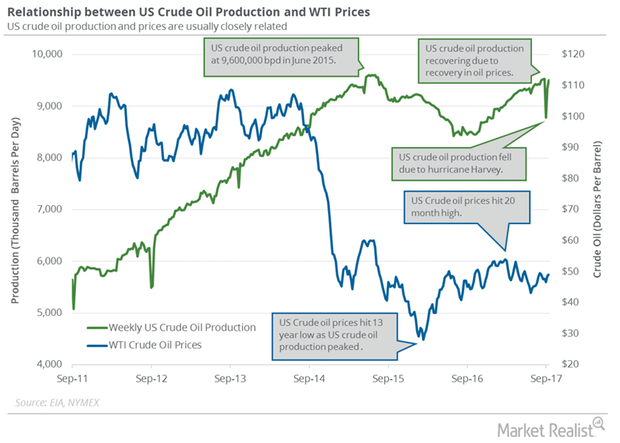

Why US Crude Oil Output Hit a High from January 2016

US crude oil output is at the highest level since January 25, 2016. The rise in crude oil output is the biggest bearish driver for crude oil prices in 2017.

Could US Crude Oil Production Push Production Cut Deal Past 2017?

The EIA reported that monthly US crude oil production rose 196,000 bpd to 9.0 MMbpd in February 2017.

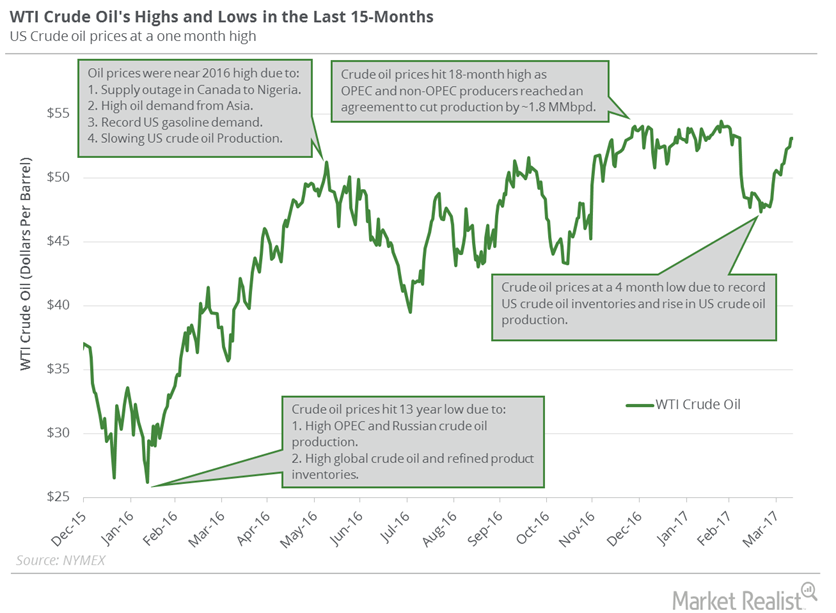

Will Crude Oil Prices Hit a New High?

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

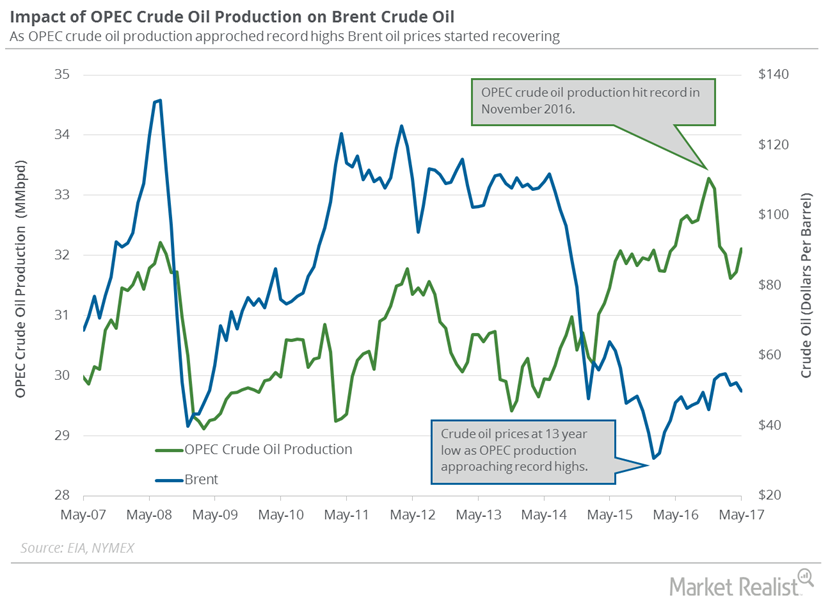

OPEC’s Monthly Report Could Pressure Oil Prices

OPEC will release its Monthly Oil Market Report on July 12, 2017. OPEC’s crude oil production rose in June 2017.

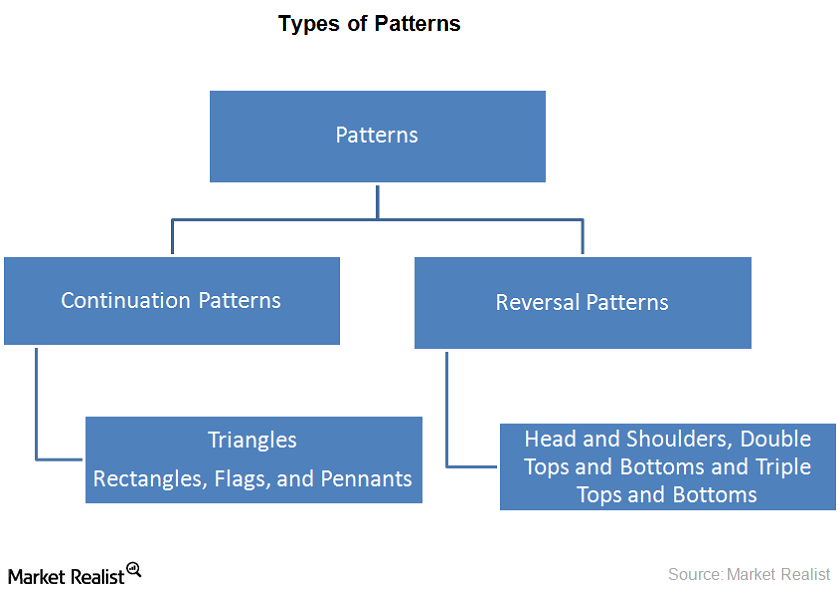

Why technical analysis uses price patterns

Price patterns are trends that occur in stock charts. The charts are used in technical analysis. The pattern forms recognizable shapes. Price patterns are used to forecast the prices.

A Look at Breakeven Prices and Trends i n Eagle Ford Well

According to IHS, the top quintile wells are dominated by EOG Resources (EOG), Marathon Oil (MRO), and ConocoPhillips (COP).

Weekly US Crude Oil Production Fell for the 1st Time since October

US crude oil production declined by 35,000 bpd (barrels per day) or 0.4% to 9,754,000 bpd from December 15 to 22, 2017, per the EIA.

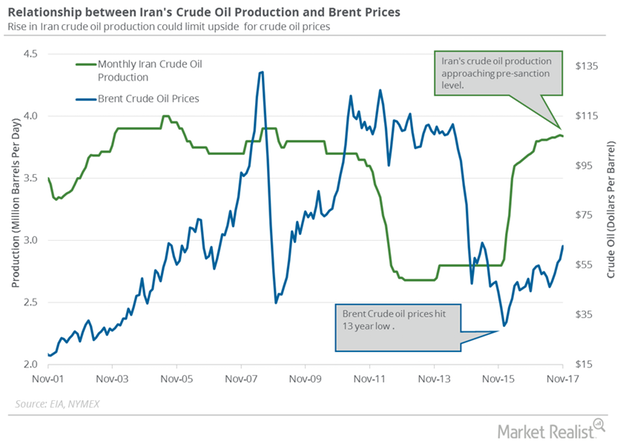

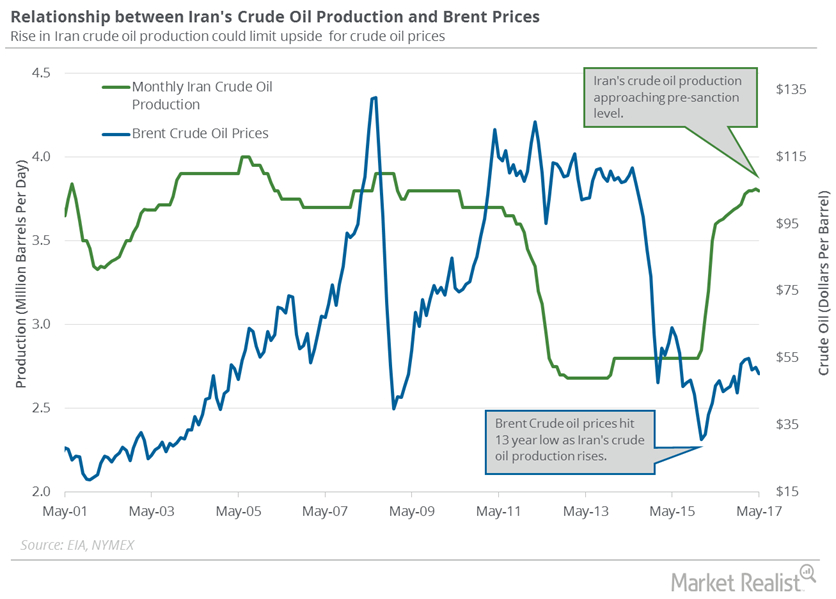

Iran’s Crude Oil Production Is near a 9-Year High

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month.

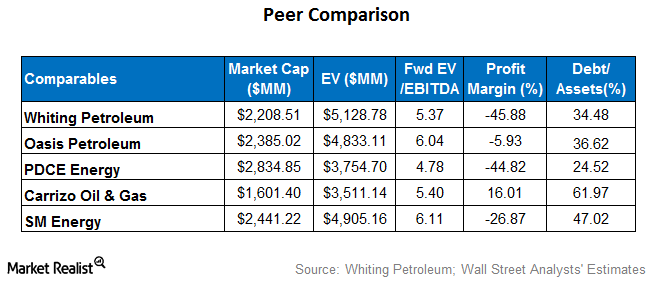

Where Whiting Petroleum Stands Next to Peers

Whiting Petroleum’s (WLL) forward EV-to-EBITDA multiple of ~5.4x is mostly in line with the peer average of 5.5x.

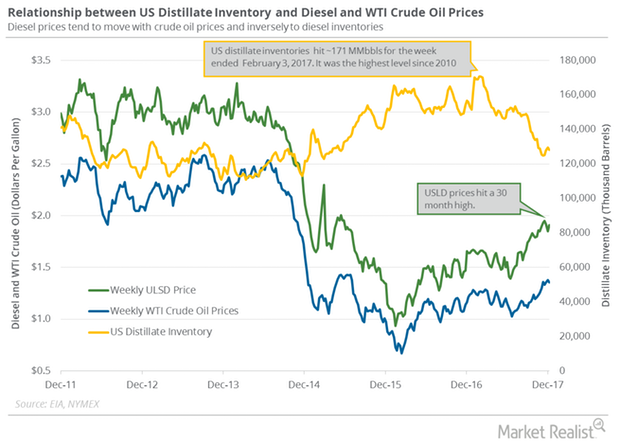

US Distillate Inventories Fell for the First Time in 4 Weeks

US distillate inventories fell by 1.3 MMbbls (million barrels) to 128.1 MMbbls on December 1–8, 2017, according to the EIA.

US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

US Gasoline Futures Hit 2-Year High despite Inventory Rise

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

Analyzing Iran’s Crude Oil Production and Export Plans

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016.

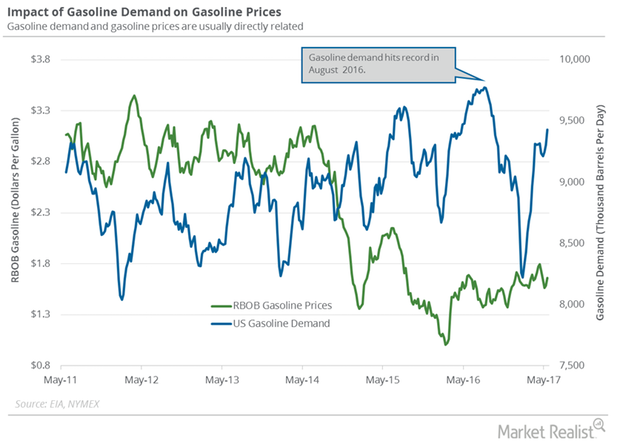

US Gasoline Consumption Rose in May

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

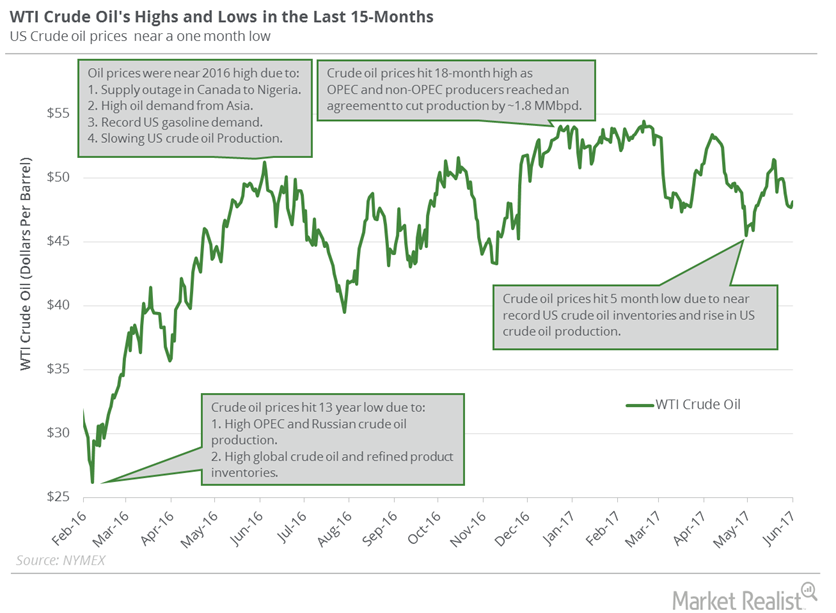

What to Expect from Crude Oil Futures This Week

US crude oil (USO) (IXC) (IYE) (PXI) prices are near their one-month low. Lower crude oil prices have a negative impact on oil producers’ earnings.

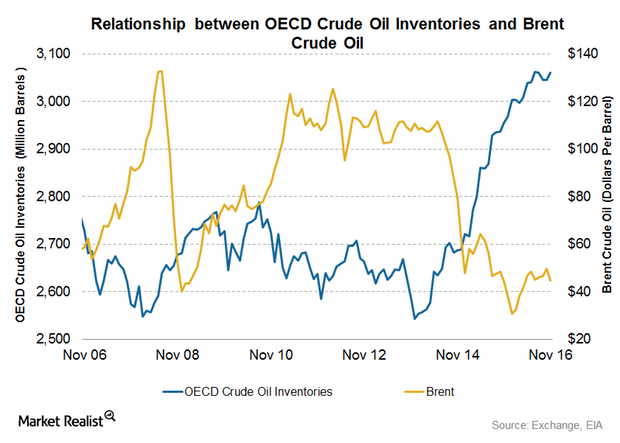

Will OECD Crude Oil Inventories Impact Crude Oil Prices in 2017?

The EIA estimates that OECD crude oil inventories rose by 15.9 MMbbls to 3,061 MMbbls in November 2016—compared to the previous month.

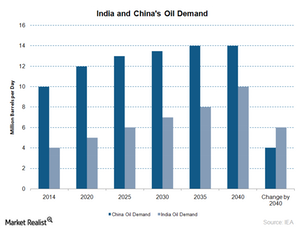

India’s Crude Oil Demand Will Likely Drive the Crude Oil Market

The EIA reported that India produced 1 MMbpd (million barrels per day) of crude oil in 2014 and 2015. It’s expected to increase marginally in 2016 and 2017.