Will Gasoline Inventories Impact Gasoline and Crude Oil Prices?

The API released its weekly inventory report on December 28, 2016. It estimates that US gasoline inventories fell by 2.8 MMbbls from December 16–23, 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

API gasoline inventories

The API (American Petroleum Institute) released its weekly inventory report on December 28, 2016. It estimates that US gasoline inventories fell by 2.8 MMbbls (million barrels) from December 16–23, 2016. However, US distillate inventories rose by 1.7 MMbbls during the same period.

EIA’s gasoline inventories

On December 29, 2016, the EIA (U.S. Energy Information Administration) will release its crude oil inventory report for the week ending December 16, 2016.

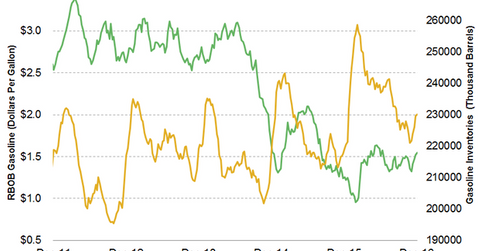

For the week ending December 16, 2016, the EIA reported that US gasoline inventories fell by 1.3 MMbbls (million barrels) to 228.7 MMbbls. US distillate inventories fell by 2.4 MMbbls to 153.5 MMbbls during the same period. US gasoline and distillate inventories were above their five-year upper range.

To learn more, read US Gasoline Inventories Impact Gasoline and Crude Oil Prices, US Distillate Inventories Fell for the Ninth Time in 13 Weeks, and Refined Product Inventories Impact US Crude Oil Prices.

Impact of gasoline inventories

A larger-than-expected rise in distillate and gasoline inventories could pressure gasoline and crude oil prices. However, a fall in inventories could support gasoline and crude oil prices.

The ups and downs in crude oil prices could impact oil and gas producers’ earnings such as Bonanza Creek Energy (BCEI), Comstock Resources (CRK), Goodrich Petroleum (GDP), Marathon Oil (MRO), Continental Resources (CLR), and SM Energy (SM).

The rollercoaster ride in crude oil (USO) (RYE) (BNO) prices could also impact ETFs and ETNs such as the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the Vanguard Energy ETF (VDE), the SPDR S&P Oil & Gas Equipment & Services ETF (XES), the PowerShares DWA Energy Momentum ETF (PXI), and the United States 12 Month Oil ETF (USL).

In the next part of this series, we’ll take a look at gasoline demand. We’ll discuss how it impacts gasoline and crude oil prices.