Oil Traders Should Watch US Oil Exports

On December 5, 2017, Brent crude oil (BNO) active futures were priced $5.24 higher compared to WTI crude oil (USO) (UCO) active futures.

Nov. 20 2020, Updated 12:48 p.m. ET

The spread

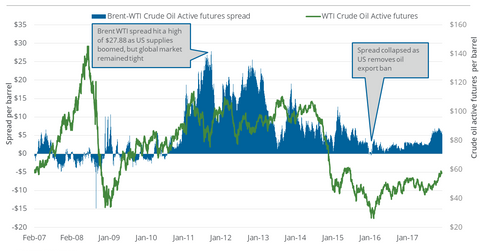

On December 5, 2017, Brent crude oil (BNO) active futures were priced $5.24 higher compared to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures. The price difference between Brent and WTI grades of oil can be termed as the “Brent-WTI spread.” On November 28, 2017, the Brent-WTI spread was $5.81. On November 28–December 5, 2017, US crude oil active futures and Brent crude oil futures fell 0.6%.

US oil exports

For the week ending November 24, 2017, US crude oil exports stood at ~1.4 MMbpd (million barrels per day). Compared to the same period last year, US crude oil exports have risen by 0.9 MMbpd.

A rise of ~$2.1 in the Brent-WTI spread during this period could have aided US crude oil exporters. In Part 2, we highlighted the possible upside in US crude oil production. Higher production along with higher international Brent prices could encourage US crude oil producers to ship oil to foreign markets. Over a long-term period, it would increase US dominance over the oil market as a major oil supplier.

A positive spread (Brent pricing higher than WTI) wouldn’t be a good situation for US oil producers (XOP) (DRIP) selling in the domestic market because their output receives lower WTI crude oil prices. They miss out on the higher revenues that their international peers earn by selling at higher Brent prices.

However, US refiners (CRAK) could increase their profits by using cheaper US crude oil to feed their refineries and sell their refined products overseas at prices that track stronger Brent oil prices.

For important energy updates, visit Market Realist’s Energy and Power page.