What the Natural Gas Futures Spread Tells Us about the Current Sentiment

On September 6, 2017, the futures spread was at a discount of $0.06, but on September 8, 2017, the futures spread shifted to a premium.

Nov. 20 2020, Updated 12:03 p.m. ET

Futures spread

On September 13, 2017, natural gas (BOIL) October 2018 futures closed $0.08 below the October 2017 futures. On September 6, 2017, the futures spread was at a discount of $0.06, but on September 8, 2017, the futures spread shifted to a premium.

Then, on September 12, 2017, the futures spread flipped to a discount. Natural gas futures rose 1.9% in the trailing week.

Futures spread at a discount

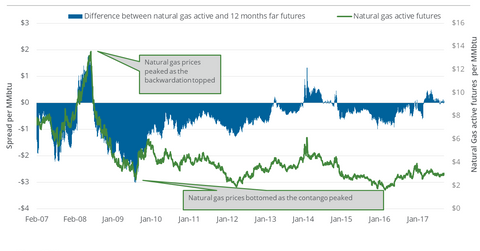

When the discount expands, as in the trailing week, normally natural gas prices move upward. For example, the discount was at $0.5 on May 12, 2017. On the same day, natural gas active futures settled at their 2017 high, but a contraction in the discount could erode any gains in natural gas.

Futures spread at a premium

When the premium expands, natural gas prices normally move downward. For example, the premium was at $0.84 on March 3, 2016. On the same day, natural gas active futures settled at their 17-year low, but a fall in the premium could add gains to natural gas prices.

Last week

In the seven calendar days leading up to September 13, 2017, the discount spread rose, and natural gas futures advanced. Now that LNG (liquefied natural gas) tankers that were struck in the US Gulf Coast due to Hurricanes Harvey and Irma have begun to leave, it could help diminish the excess supply of natural gas on the market, and so the expansion of the futures spread discount is likely reflecting this change in sentiment in the market.

Energy stocks

Remember, US natural gas producers (XOP) (DRIP) track the futures forward curve for their hedging activity. Midstream companies (AMLP) also track it for their natural gas storage and transportation decisions.

The difference between active futures and the futures deliverable in the following month could drive the returns of ETFs like the United States Natural Gas Fund (UNG).

For more on natural gas prices, visit Market Realist’s Energy and Power page.