What to Expect from the Weather Forecast and Natural Gas Prices

On July 21, the EIA announced a 34 Bcf (billion cubic feet) addition to natural gas (UNG) (GASL) (GASX) (BOIL) inventory levels for the week ending July 15.

Nov. 20 2020, Updated 11:38 a.m. ET

What’s the weather forecast?

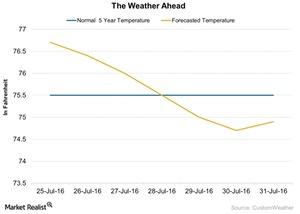

The weather forecast for July 25 to July 31, 2016, indicates that temperatures in the US could remain higher than the mean five-year normal temperature between July 25 and July 27. For the rest of the days up to July 31, the temperature could fall below the mean five-year normal temperature.

Higher temperatures increase the use of natural gas (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes during the summer. However, the weather forecast suggests mild weather ahead.

EI Niño anomalies

Natural gas usage for heating in the 2015–2016 winter season was low due to mild weather. El Niño’s intensity kept temperatures warmer than normal. As a result, at the end of March 2016, US natural gas inventories were at 2.5 trillion cubic feet—67% higher than their 2015 levels and 53% higher than their five-year average.

In the week ending July 22, 2016, temperatures were higher than the forecasts for the week—except on July 21. However, natural gas prices were under pressure due to production and demand concerns.

On July 21, the EIA (U.S. Energy Information Administration) announced a 34 Bcf (billion cubic feet) addition to natural gas (UNG) (GASL) (GASX) (BOIL) inventory levels for the week ending July 15. Analysts expected an addition of 38 Bcf, according to a survey by the Wall Street Journal.

The above analysis could be important for natural gas–weighted stocks such as EXCO Resources (XCO), Ultra Petroleum (UPL), WPX Energy (WPX), and Antero Resources (AR). It also impacts natural gas–tracking commodity ETFs such as the ProShares Ultra Bloomberg Natural Gas (BOIL), the Direxion Daily Natural Gas Related Bear 3X ETF (GASX), and the Direxion Daily Natural Gas Related Bull 3X ETF (GASL).

In the next part of this series, we’ll take a look at the price performances of natural gas, crude oil, and the S&P 500 Index (SPY) (SPXL).