Antero Resources Corp

Latest Antero Resources Corp News and Updates

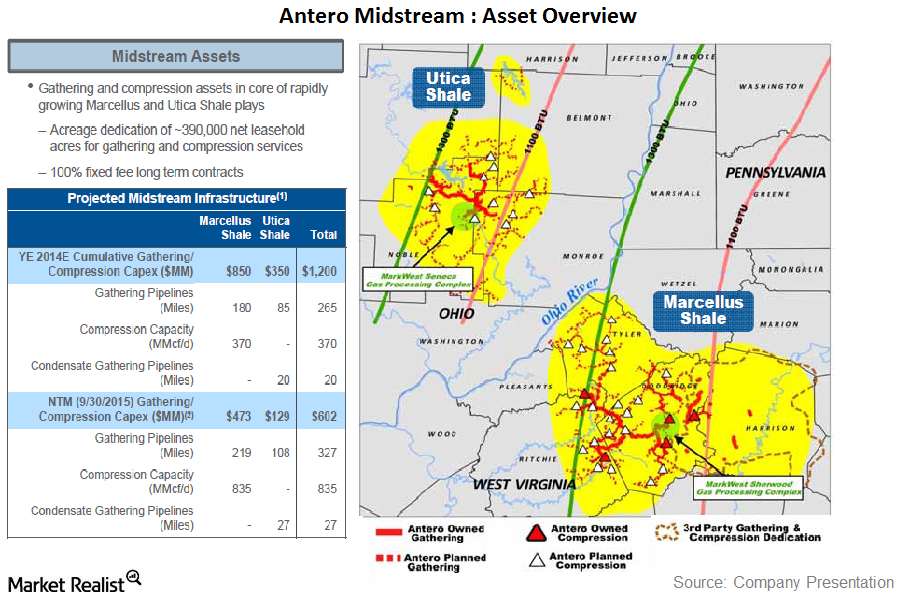

Must-know: A quick look into the Antero Midstream IPO

On October 27, Antero Resources Corporation announced the initial public offering of Antero Midstream Partners LP.

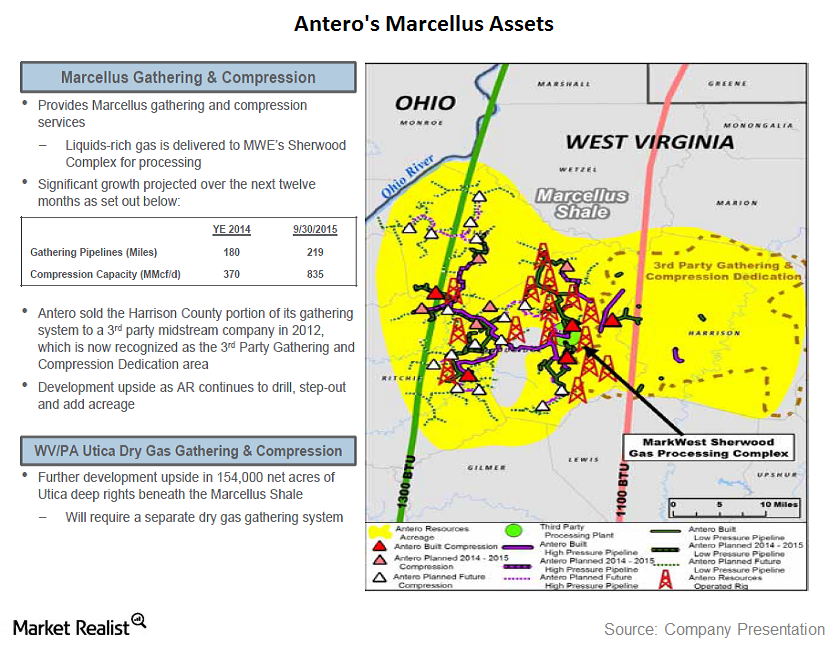

Key update on Antero Midstream’s assets

Antero Resources’ current acreage is focused in the Marcellus Shale in West Virginia and the Utica Shale in Ohio.Materials Must-know: Why onshore rig counts are at a 2-year high

The U.S. onshore, or land-based, rig count increased by four rigs—from 1,865 to 1,869—during the week ending September 19. Land-based rigs include 13 inland water rigs. This is the highest onshore rig count in the past two years. It’s the highest rig count since August 17, 2012. This marks the eighth increase in the past ten weeks.

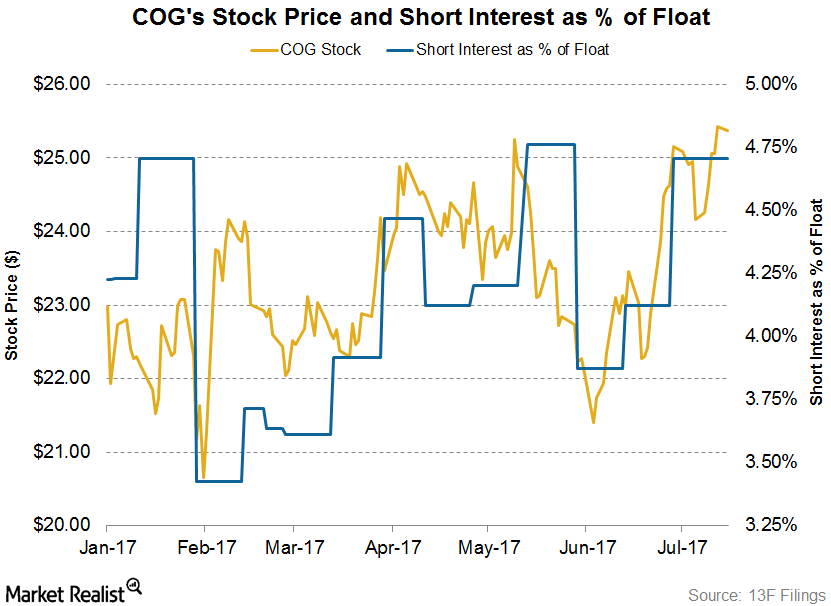

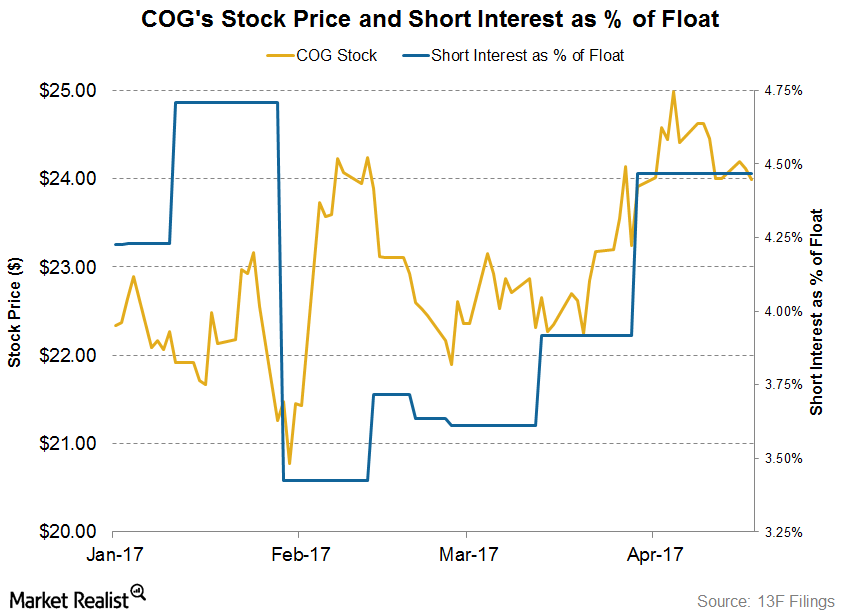

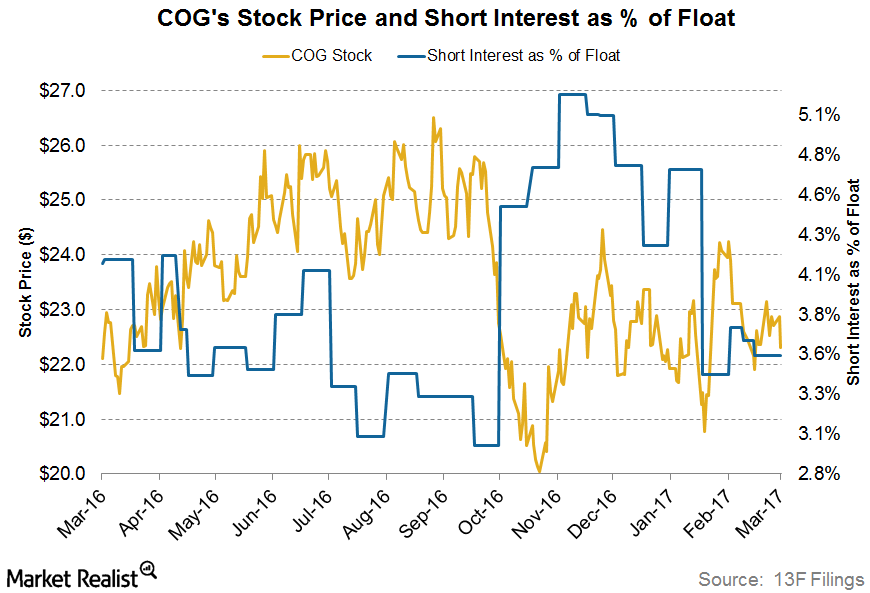

Cabot Oil & Gas: Short Interest Trends in Its Stock

On July 18, 2017, Cabot Oil & Gas’s (COG) short interest ratio was ~4.7%. At the beginning of the year, its short interest ratio was 4.2%.

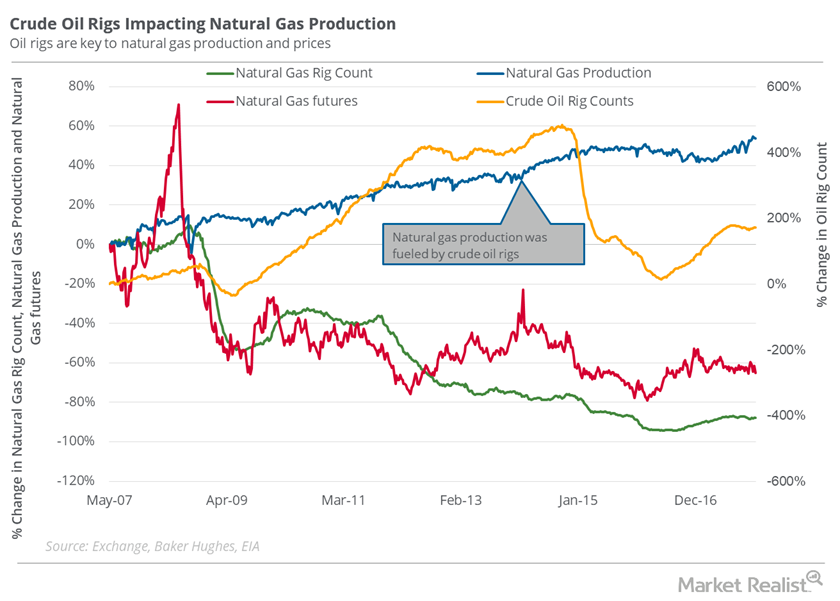

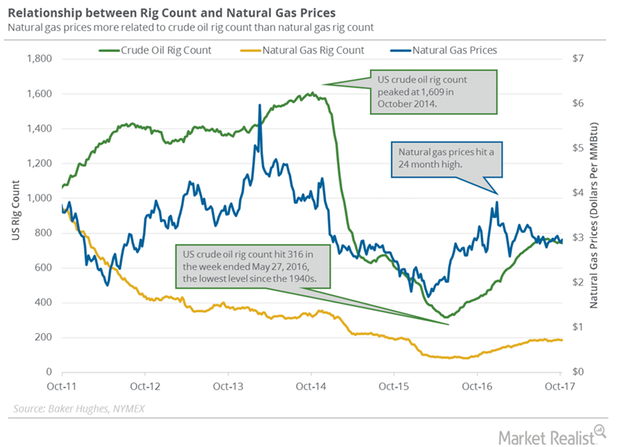

Natural Gas Traders Should Stay Cautious of Oil Rigs

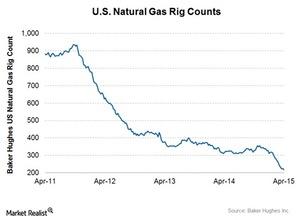

On December 29, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

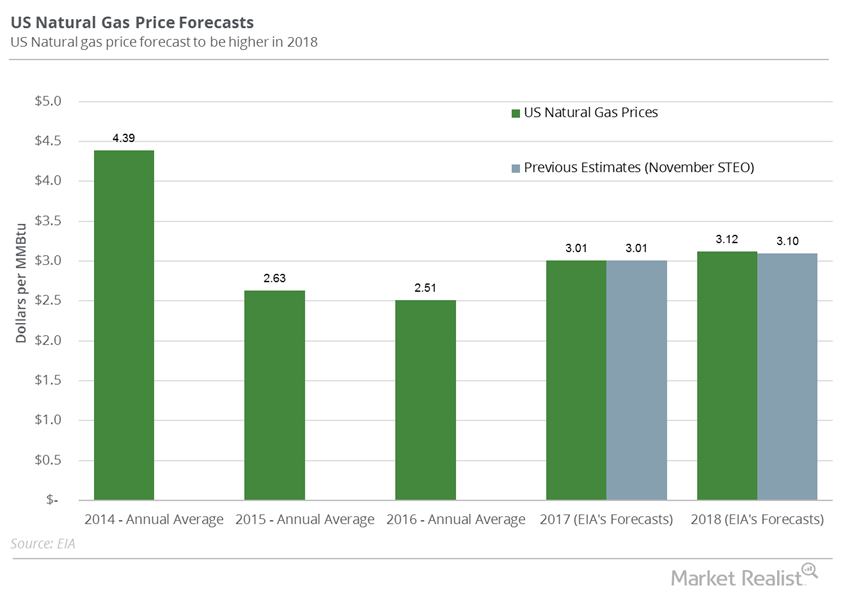

How Natural Gas Prices Have Supported Chesapeake Energy

2016 has been good for natural gas prices (UGAZ). Prices have risen ~34% year-over-year.

Will Natural Gas Rise This Week?

On April 18–26, natural gas active futures rose 1.8%. Natural gas to closed at $2.58 per MMBtu on April 26.

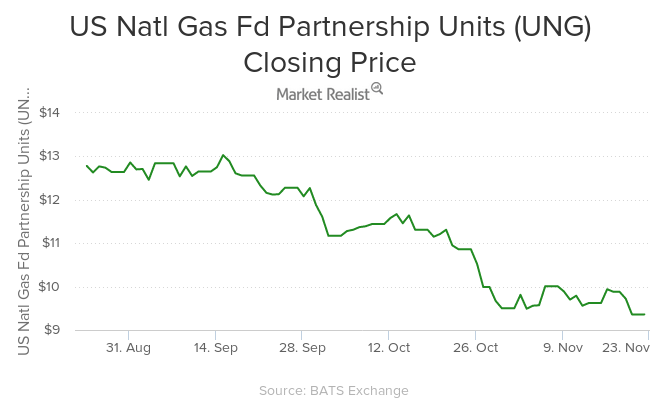

Natural Gas Prices Slump 9.4% for the Week

ETFs like the United States Natural Gas—UNG—ETF fell in the direction of natural gas prices on November 20, 2015. UNG fell by 4.7% on the day.

What to Expect from the Weather Forecast and Natural Gas Prices

On July 21, the EIA announced a 34 Bcf (billion cubic feet) addition to natural gas (UNG) (GASL) (GASX) (BOIL) inventory levels for the week ending July 15.

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

Unexpected Rise in US Natural Gas Inventories

The EIA estimated that US natural gas inventories rose by 2 Bcf (billion cubic feet) to 3,695 Bcf on November 24–December 1, 2017.

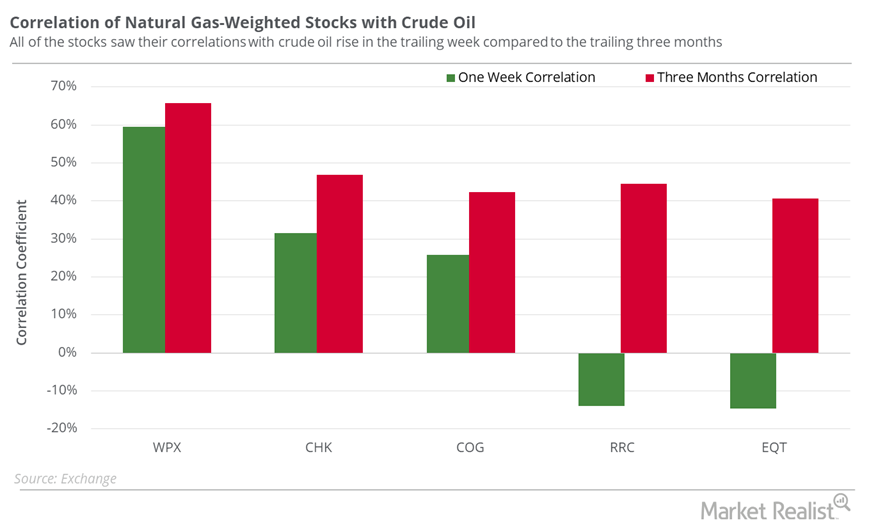

Which Natural Gas–Weighted Stocks Could Take Cues from Oil?

Antero Resources (AR) and Gulfport Energy (GPOR) are among the natural gas–weighted stocks that had the highest correlations with natural gas prices in the trailing week.

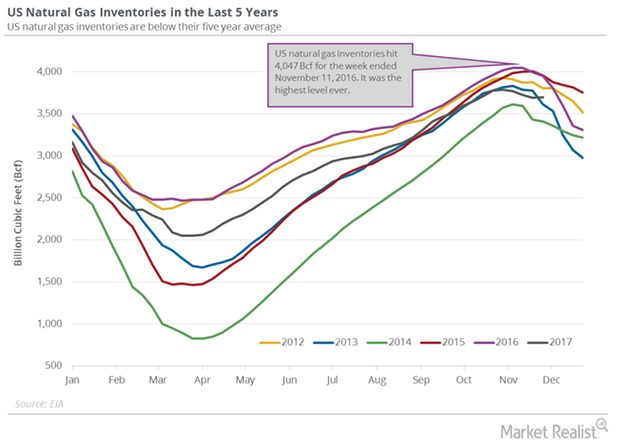

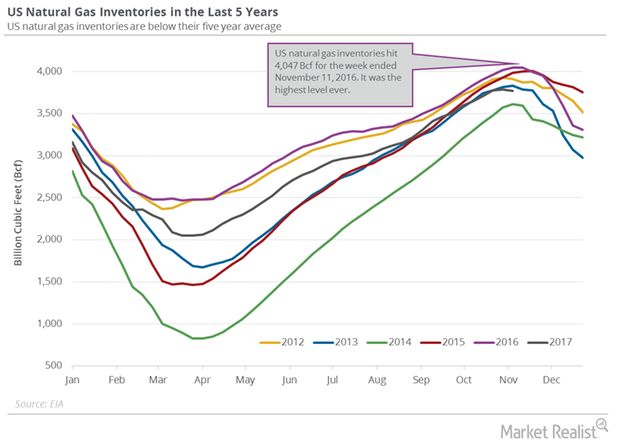

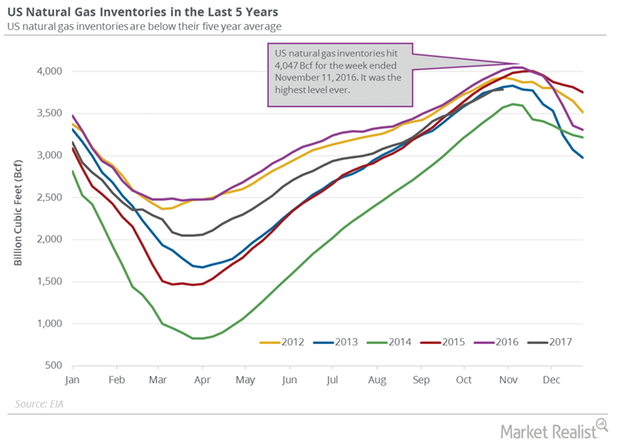

Traders Are Tracking US Natural Gas Inventories

The EIA reported that US gas inventories fell by 18 Bcf (billion cubic feet) to 3,772 Bcf on November 3–10, 2017.

Are US Natural Gas Inventories Bullish for Natural Gas Futures?

The EIA estimates that US gas inventories rose by 15 Bcf (billion cubic feet) or 0.4% to 3,790 Bcf on October 27–November 3, 2017.

US Gas Rigs Hit 5-Month Low: Good or Bad for Natural Gas Futures?

Baker Hughes is scheduled to release its weekly US oil and gas rig report on October 27, 2017.

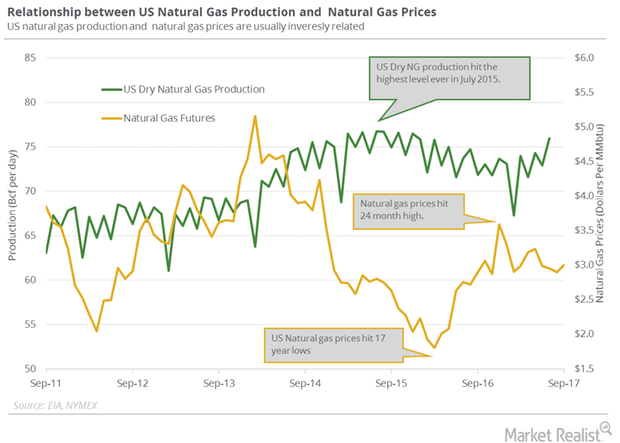

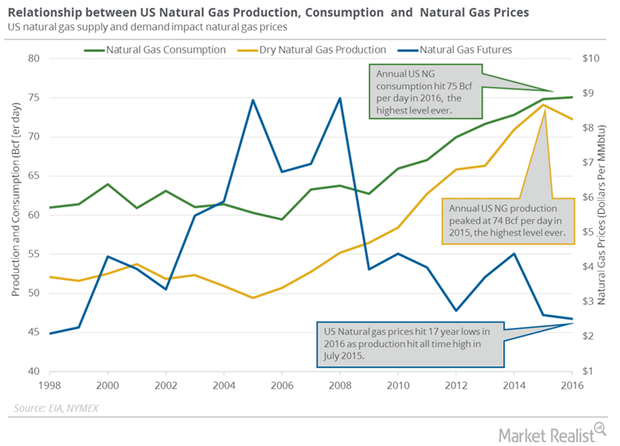

How Is US Natural Gas Production and Consumption Trending?

PointLogic estimates that weekly US dry natural gas production rose by 0.9 Bcf (billion cubic feet) per day to 74.6 Bcf per day between October 19 and October 25, 2017.

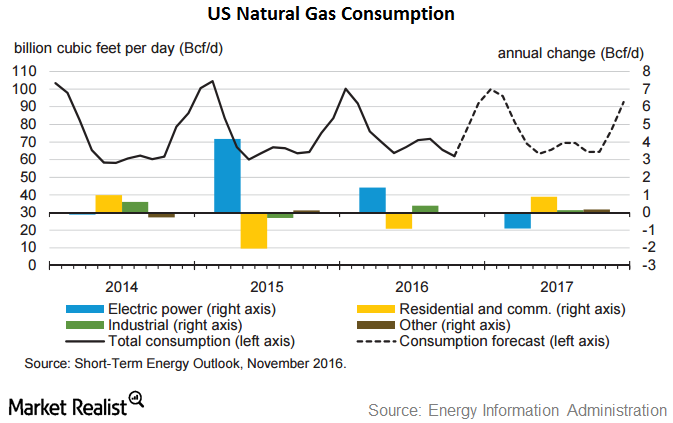

Will US Natural Gas Consumption Outweigh Production?

PointLogic estimates that weekly US natural gas consumption fell 6.6% to 52 Bcf per day from September 7 to 13. Consumption fell 13% year-over-year.

Short Interest Trends in Cabot Oil & Gas Stock

On April 19, Cabot Oil and Gas’s short interest as a percentage of its float was ~4.5%. At the beginning of the year, its short interest ratio was 4.2%.

How Short Interest in COG Stock Has Been Trending

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%.

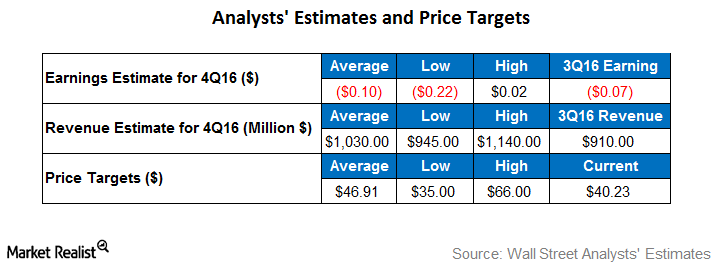

What Are Analysts’ Recommendations and Forecasts for NBL?

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share.

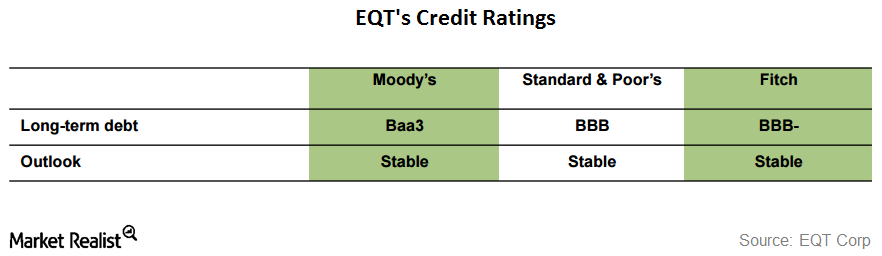

What Are Credit Rating Agencies Saying about EQT?

For EQT (EQT), Moody’s has provided a Baa3 rating. Standard & Poor’s has given it a BBB credit rating, and Fitch has given it a BBB- rating.

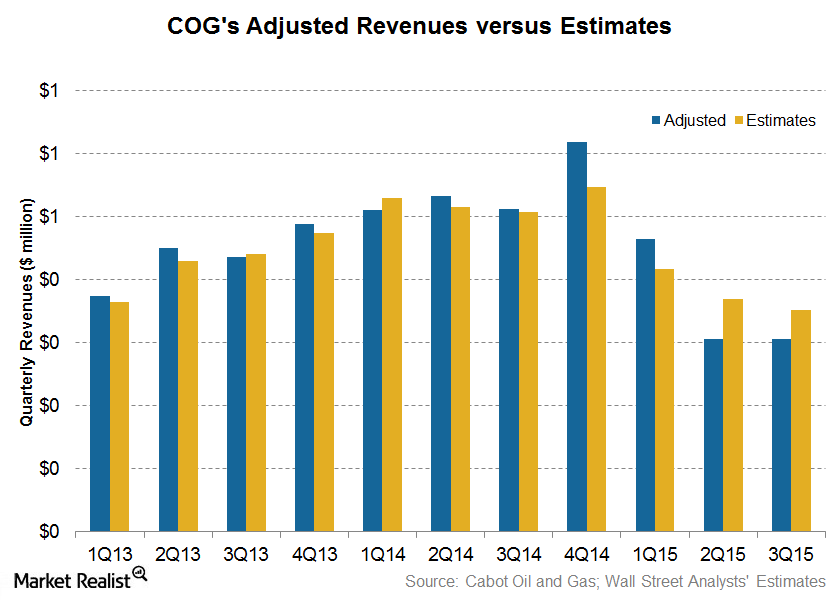

3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

Natural Gas Rig Count Back to Downtrend in Week Ended April 17

There were 217 natural gas rigs operating in the week ended April 17, a loss of eight from the previous week. Natural gas rig count increased by three the previous week.

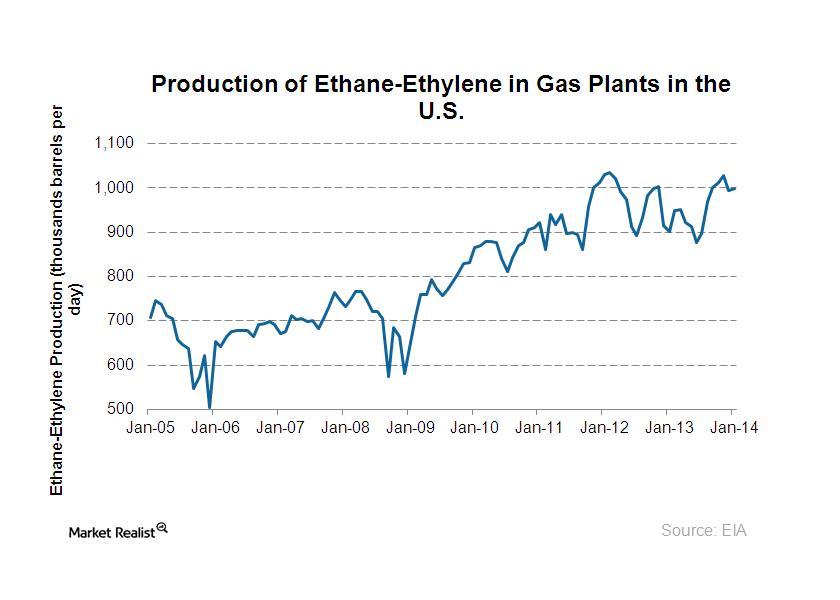

Why ethane production has increased a lot over the past few years

Ethane is the largest component of the natural gas liquids stream, and the increased wet gas production caused a large increase in ethane production.