Are Natural Gas Supplies Overtaking Demand?

Futures spread On September 27, 2017, natural gas (FCG) (GASL) (BOIL) 2018 November futures traded $0.04 lower than November 2017 futures. That is, the futures spread was at a discount of $0.04. On September 20, 2017, the futures spread was at a discount of $0.10. Between September 20 and 27, 2017, natural gas November futures […]

Nov. 20 2020, Updated 4:15 p.m. ET

Futures spread

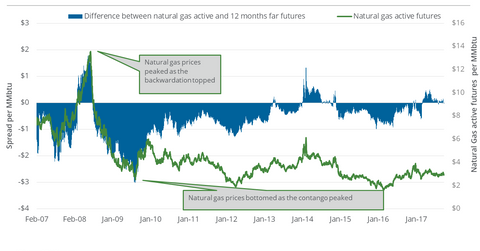

On September 27, 2017, natural gas (FCG) (GASL) (BOIL) 2018 November futures traded $0.04 lower than November 2017 futures. That is, the futures spread was at a discount of $0.04. On September 20, 2017, the futures spread was at a discount of $0.10. Between September 20 and 27, 2017, natural gas November futures fell 2.8%.

Futures spread at a discount

When the futures spread is at a discount, or its discount grows, natural gas prices could rise. The opposite is also true. In one such example, on May 12, 2017, natural gas active futures settled at their 2017 high. On the same day, the discount reached $0.50.

Futures spread at a premium

When the futures spread is at a premium, or the premium grows, natural gas prices could fall. The opposite is also true. In one such example, on March 3, 2016, natural gas active futures settled at their 17-year low. On the same day, the premium reached $0.84.

Last week, natural gas prices fell, and the discount contracted. Therefore, market participants may fear that supply is outpacing demand.

Energy stocks

When the futures spread is at a discount, natural gas producers’ (XOP) (DRIP) current market is more favorable than their future market. Also, the shape of futures’ forward curve influences hedging-related decisions. Midstream companies’ (AMLP) natural gas storage, processing, and transportation businesses are also affected by the shape of the futures forward curve. Furthermore, the spread between natural gas’s active futures and the following month’s futures influences the returns of funds such as the United States Natural Gas ETF (UNG). Visit our Energy and Power page for important updates on natural gas prices.