Will Non-OPEC Oil Supply Dominate Oil Prices in 2018?

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel.

Nov. 20 2020, Updated 2:58 p.m. ET

US crude oil

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel. News reports suggested that if the pipeline operations that were halted in the North Sea continue for three weeks, the global oil supply could fall 8 MMbbls (million barrels).

But rising US crude oil production is an impending threat to higher oil prices. The IEA (International Energy Agency) in its Oil Market Report estimated a rise of 0.6 MMbpd (million barrels per day) and 1.6 MMbpd in the non-OPEC oil supply for 2017 and 2018, respectively. The report was released on December 14, 2017.

The possible rise in non-OPEC (Organization of the Petroleum Exporting Countries) supply in 2018 could reduce the effects of the supply cuts on global oil inventories for participating OPEC and non-OPEC members.

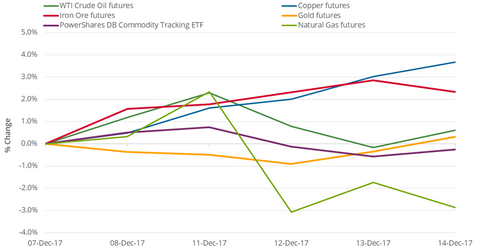

From December 7–14, 2017, US crude oil’s January 2018 futures rose 0.6%. Will higher oil prices benefit equity indexes such as the S&P 500 Index (SPY) (SPX-INDEX) and the Dow Jones Industrial Average Index (DIA-INDEX)? We’ll look at that in the next part.

Natural gas

On December 14, 2017, natural gas’s (UNG) (BOIL) January 2018 futures fell 1.1%. On the same day, natural gas futures closed at $2.68 per MMBtu (million British thermal unit), the second-lowest closing price since February 27, 2017. The EIA (U.S. Energy Information Administration) inventory data released that same day may have disappointed natural gas bulls. For the week ended December 8, 2017, natural gas inventories fell 69 Bcf (billion cubic feet). But the fall wasn’t sufficient to push inventories further below their five-year average. In the trailing week, natural gas prices fell 2.9%.