Abraxas Petroleum Corp

Latest Abraxas Petroleum Corp News and Updates

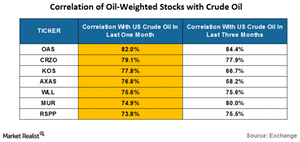

Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

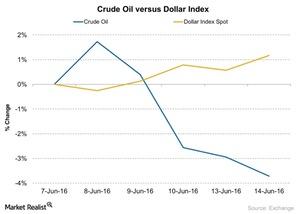

Will the Dollar’s Recovery Affect Crude Oil?

Between June 7 and June 14, 2016, crude oil (USO) fell by ~3.7% while the US dollar index (UUP) rose by around 1.2%.

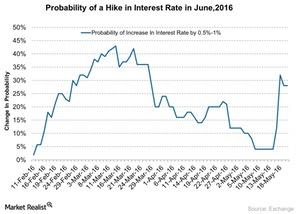

How Did the Consumer Price Index Affect Crude Oil Prices?

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016.

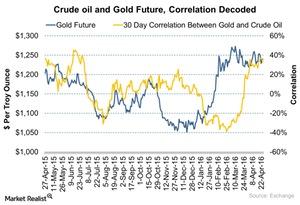

Gold and Crude Oil: How Does the Correlation Work?

Gold (GLD) can be considered an indicator of economic fear and inflation expectations. Driven by these fears, gold gains during equity market turmoil.