Problems for Crude Oil Bulls as OPEC Production Hits 2017 High

September US crude oil futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017.

Aug. 1 2017, Published 10:21 a.m. ET

Crude oil futures

September US crude oil (RYE) (VDE) (UCO) futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017. Prices are at a two-month high due to the bullish drivers we looked at in the previous part of this series.

Higher crude oil prices have a positive impact on oil and gas producers such as Carrizo Oil & Gas (CRZO), Chevron (CVX), and Denbury Resources (DNR).

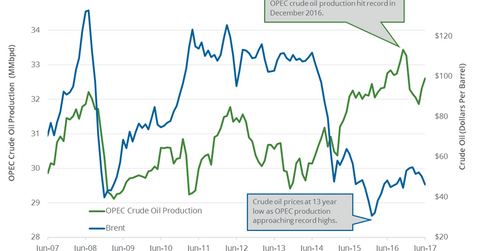

OPEC crude oil production hit 2017 high

On July 31, 2017, a Reuters survey showed that OPEC‘s (Organization of the Petroleum Exporting Countries) crude oil production rose 90 Mbpd (thousand barrels per day) to 33.0 MMbpd (million barrels per day) in July 2017 compared to June 2017. It’s the highest production level in 2017 despite the production cut deal.

According to the production cut deal, OPEC and non-OPEC producers have to cut production by 1.8 MMbpd from January 2017 to March 2018.

OPEC’s production rose due to the rise in crude oil production from Libya. Libya’s crude oil production rose 180 Mbpd to 1.0 MMbpd in July 2017, the highest level in more than three years. Libya is exempt from the production cut deal.

Compliance with production cut deal

OPEC’s compliance with the production cut deal rose to 84.0% in July 2017. It was at 77.0% in June 2017. However, it was above 90.0% in early 2017. An expectation of higher compliance with the production cut deal in the second half of 2017 could support crude oil prices. Higher crude oil prices have a positive impact on oil and gas producers such as Carrizo Oil & Gas (CRZO) and Denbury Resources (DNR).

But the rise in US crude oil production in 2017 and 2018 could weigh on oil prices.

In the next part, we’ll look at the relationship between crude oil and the US dollar.