Synergy Resources Corp

Latest Synergy Resources Corp News and Updates

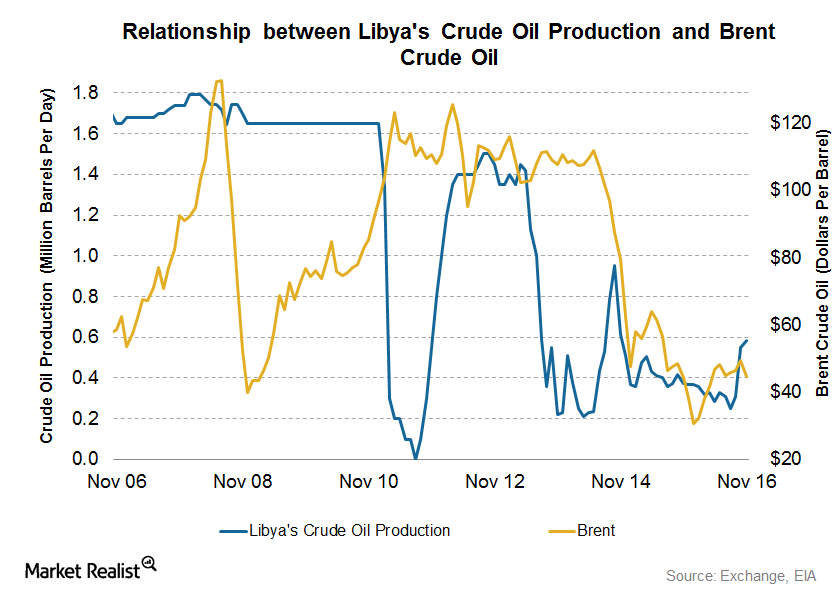

Libya, Iran, and Nigeria Could Impact Crude Oil Prices in 2017

Libya’s crude oil production On December 20, 2016, Libya’s National Oil Corporation reported that pipelines leading from the Sharara and El Feel fields were reopened. The pipelines were closed for two years due to militant attacks. The pipelines are expected to add 270,000 bpd (barrels per day) of crude oil supply over the next three months. The […]

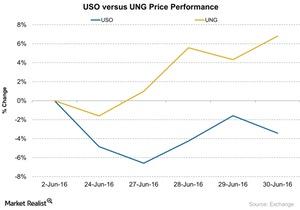

Why Did UNG Outperform USO?

From June 23—30, the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO). UNG rose ~6.8%, while USO fell ~3.4%.

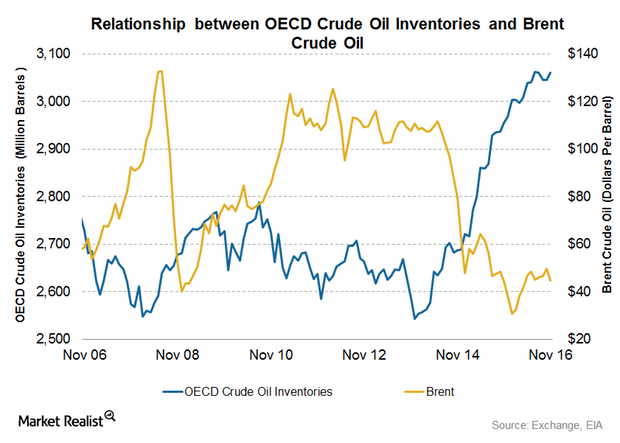

Will OECD Crude Oil Inventories Impact Crude Oil Prices in 2017?

The EIA estimates that OECD crude oil inventories rose by 15.9 MMbbls to 3,061 MMbbls in November 2016—compared to the previous month.

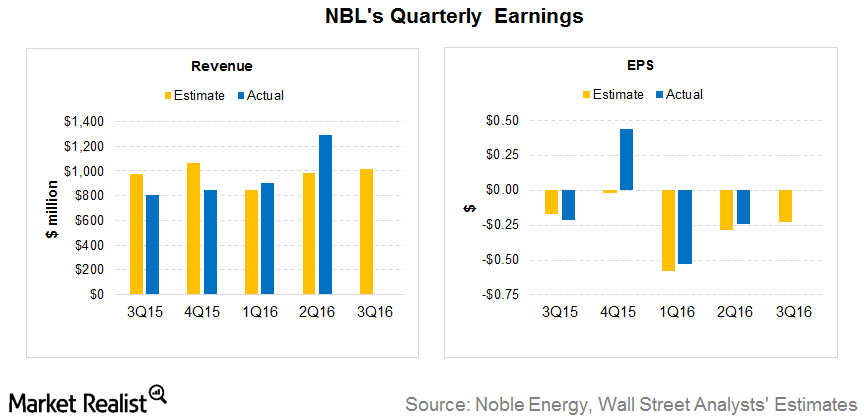

Noble Energy Sets the Stage for Another Earnings Beat in 3Q16

Noble Energy (NBL) is expected to release its 3Q16 earnings results on November 2, 2016. What can investors expect?

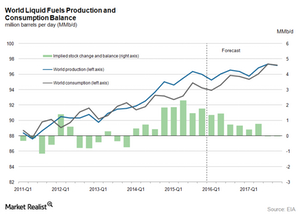

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.