Libya, Iran, and Nigeria Could Impact Crude Oil Prices in 2017

Libya’s crude oil production On December 20, 2016, Libya’s National Oil Corporation reported that pipelines leading from the Sharara and El Feel fields were reopened. The pipelines were closed for two years due to militant attacks. The pipelines are expected to add 270,000 bpd (barrels per day) of crude oil supply over the next three months. The […]

Nov. 20 2020, Updated 1:50 p.m. ET

Libya’s crude oil production

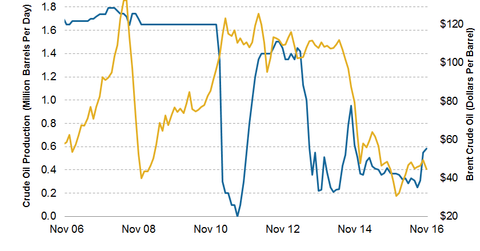

On December 20, 2016, Libya’s National Oil Corporation reported that pipelines leading from the Sharara and El Feel fields were reopened. The pipelines were closed for two years due to militant attacks. The pipelines are expected to add 270,000 bpd (barrels per day) of crude oil supply over the next three months. The expectation of a rise in production from Libya could pressure crude oil (BNO) (IEZ) (USO) (PXI) (USL) (ERX) (ERY) prices. For more on crude oil prices, read Part 1 of the series.

Resuming operations at the Es Sider port in Libya could also pressure crude oil prices. For more, read Libya’s Crude Oil Production Could Impact Crude Oil Prices.

Libya, Nigeria, and Iran’s crude oil production

Libya and Nigeria were exempt from a crude oil production cut at OPEC’s meeting on November 30, 2016. For details on the OPEC and non-OPEC meeting, read Crude Oil Prices Skyrocket as OPEC Agrees to Cut Production, How Will OPEC’s Production Cut Impact Crude Oil Prices, and How OPEC and Non-OPEC Producers Affect Crude Oil Prices.

A Reuters survey estimates that Nigeria’s crude oil production rose by 50,000 bpd to 1.7 million barrels per day in November compared to October.

Iran has been allowed to increase crude oil production by 90,000 bpd. Rises in crude oil production from Iran, Libya, and Nigeria could extend the crude oil oversupply. For more information, read Iran, Nigeria, and Libya Could Undo OPEC’s Historic Deal.

Impact on oil prices, stocks, and ETFs

The increased crude oil supply in 2017 could pressure crude oil prices. Lower crude oil prices could impact oil producers such as W&T Offshore (WTI), Synergy Resources (SYRG), Denbury Resources (DNR), Carrizo Oil & Gas (CRZO), ExxonMobil (XOM), Devon Energy (DVN), PDC Energy (PDCE), and Laredo Petroleum (LPI).

Moves in crude oil prices could influence ETFs and ETNs such as the ProShares UltraShort Bloomberg Crude Oil (SCO), the ProShares Ultra Oil & Gas (DIG), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and the SPDR S&P Oil & Gas Equipment & Services ETF (XES).

In the last part of this series, we’ll take a look at how US crude oil production impact crude oil prices in 2017.