US Crude Oil Production: Biggest Weekly Fall since July 2016

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd to 9,250,000 bpd on June 16–23, 2017.

June 29 2017, Updated 12:35 p.m. ET

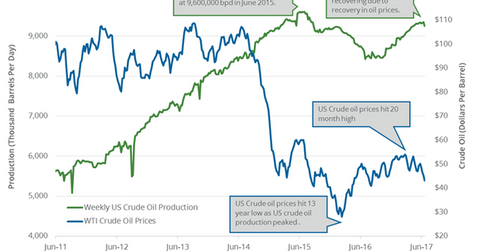

Weekly US crude oil production

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd (barrels per day) to 9,250,000 bpd on June 16–23, 2017. Production fell 1.1% week-over-week but rose 7.3% year-over-year.

It’s the biggest weekly fall in US crude oil production since July 2016. Some traders think that production fell due to Tropical Storm Cindy in the Gulf of Mexico and routine maintenance work in Alaska. So, the fall in crude oil production is temporary. Any fall in US crude oil production is bullish for crude oil (RYE) (UCO) (IEZ) prices. Prices rose on June 28, 2017, due to the decline in weekly US production.

Higher crude oil prices have a positive impact on oil and gas producers’ earnings like Comstock Resources (CRK), Chevron (CVX), Northern Oil & Gas (NOG), and Triangle Petroleum (TPLM). However, higher prices would have a negative impact on refiners like Western Refining (WNR), Phillips 66 (PSX), Tesoro (TSO), and Marathon Petroleum (MPC).

US crude oil production estimates

The EIA estimates that US crude oil production could average 9.33 MMbpd (million barrels per day) and 10 MMbpd in 2017 and 2018, respectively. Production averaged 9.42 MMbpd and 8.87 MMbpd in 2015 and 2016, respectively. US crude oil production could hit record in 2018 due to:

- President Trump’s energy plans

- US crude oil rig count has risen 138% since the lows in May 2016

- technological advancement

- improving US shale oil producers break even and production cost in 2017

Impact of a rise in US crude oil production

US crude oil production has risen ~11% from the low in July 2016. The rise in crude oil production from non-OPEC producers like the US, Brazil, and Canada could pressure oil prices. Likewise, a rise in production from OPEC producers like Libya and Nigeria would add to the glut. It might even offset the production cut deal.

In the next part of this series, we’ll look at US gasoline inventories.