Northern Oil & Gas Inc

Latest Northern Oil & Gas Inc News and Updates

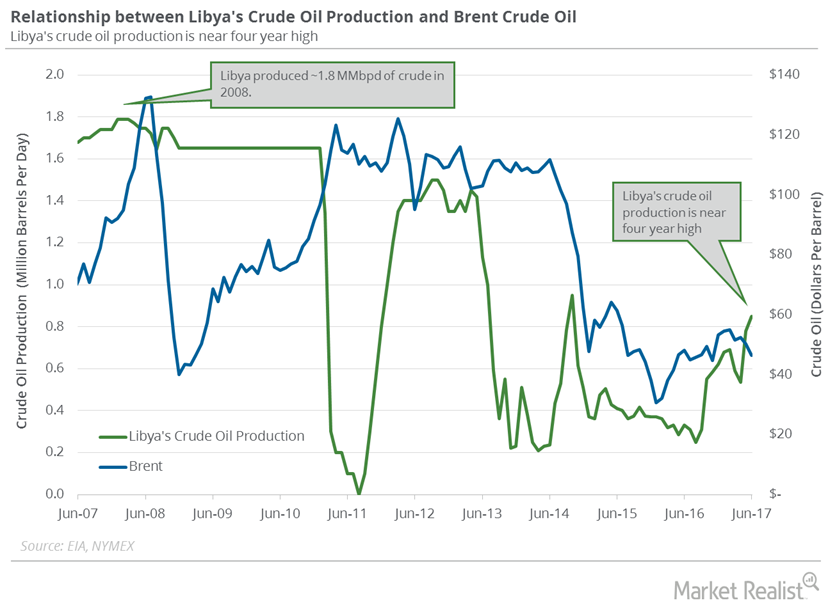

Libya’s Crude Oil Production: Bears Could Control Oil Prices

Libya’s crude oil production was at 1,030,000 bpd in July 2017. Production has risen ~60% from its levels in January 2017.

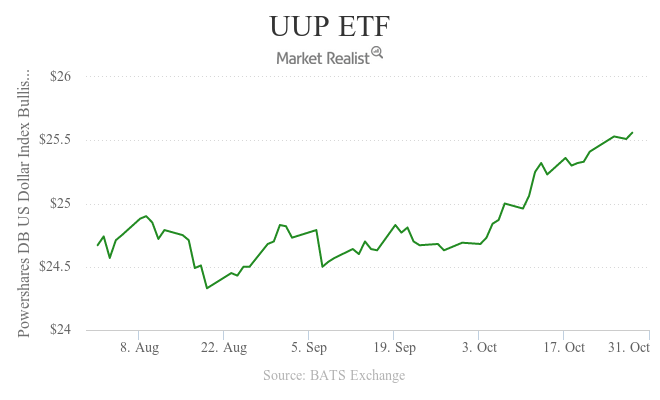

US Dollar Index Fell: How Will It Impact Crude Oil Prices?

The US Dollar Index fell 0.5% to 98.3 on October 28, 2016. It fell due to political uncertainty in the US. It had risen earlier in the morning on October 28.

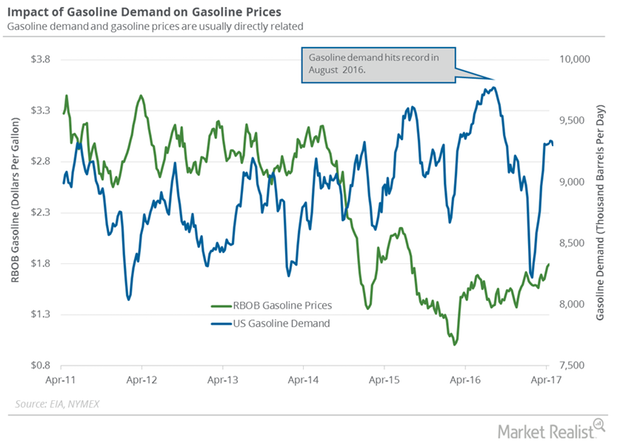

Why Investors Are Tracking US Gasoline Demand

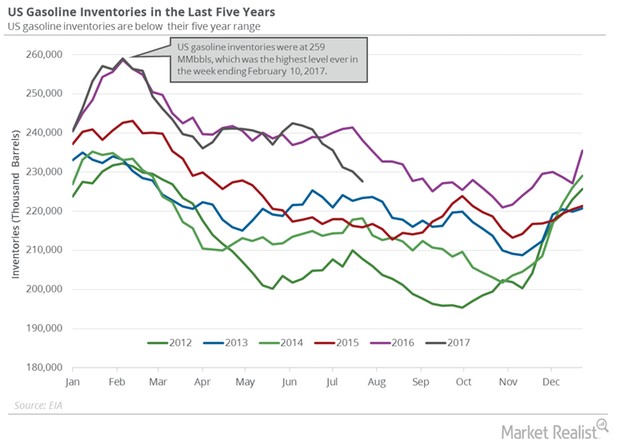

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd to 9,237,000 bpd on April 14–21.

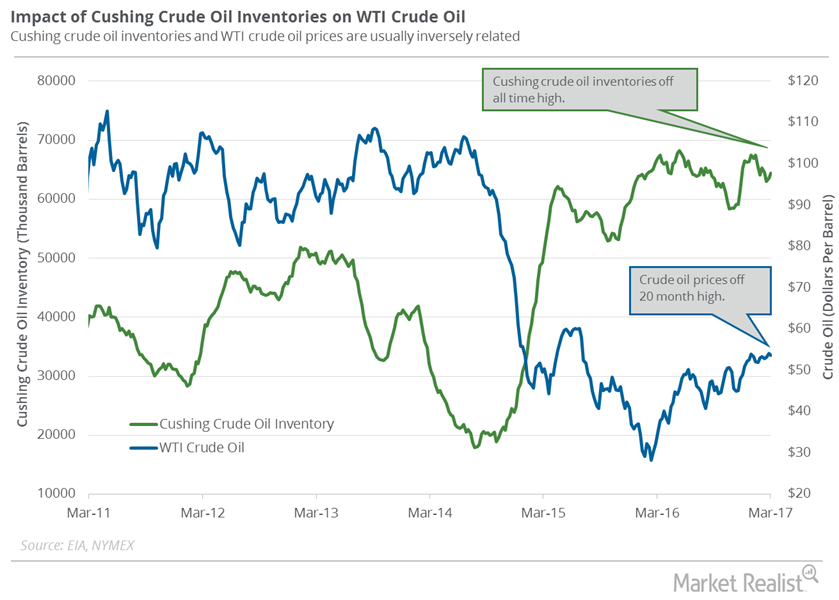

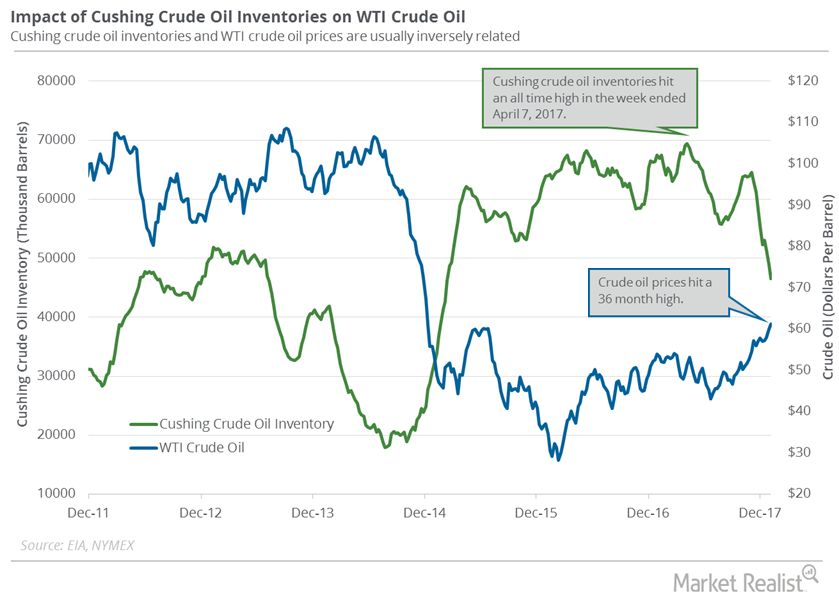

Cushing Crude Oil Inventories: More Pain for Oil Prices?

Market surveys estimate that Cushing crude oil inventories rose from March 3–10. A rise in crude oil inventories could pressure US crude oil prices.

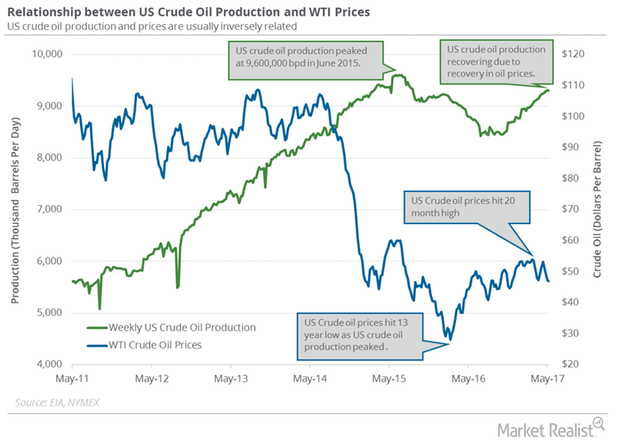

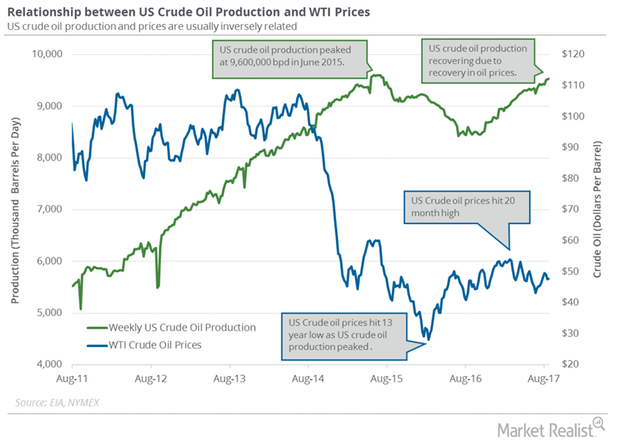

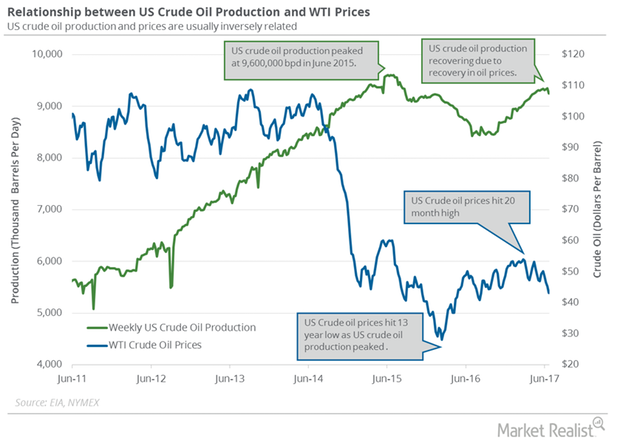

US Crude Oil Production Fell for the First Time since February

US crude oil production fell by 9,000 bpd to 9,305,000 bpd on May 5–12, 2017. Production fell 0.1% week-over-week, but rose 5.8% year-over-year.

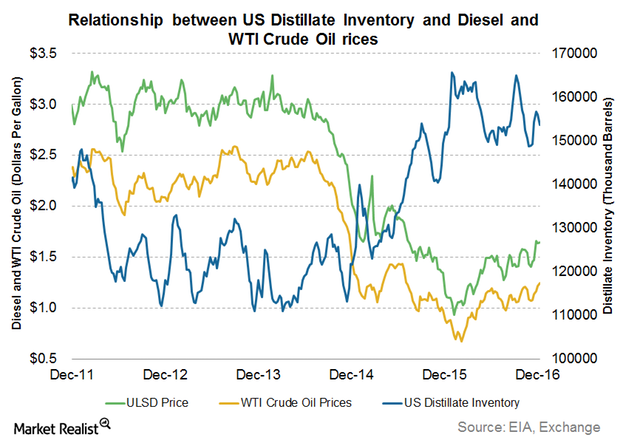

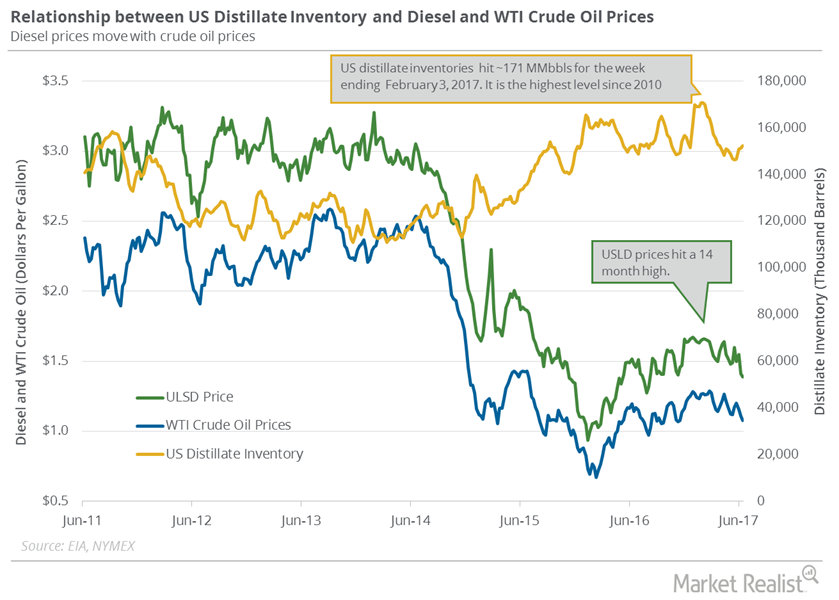

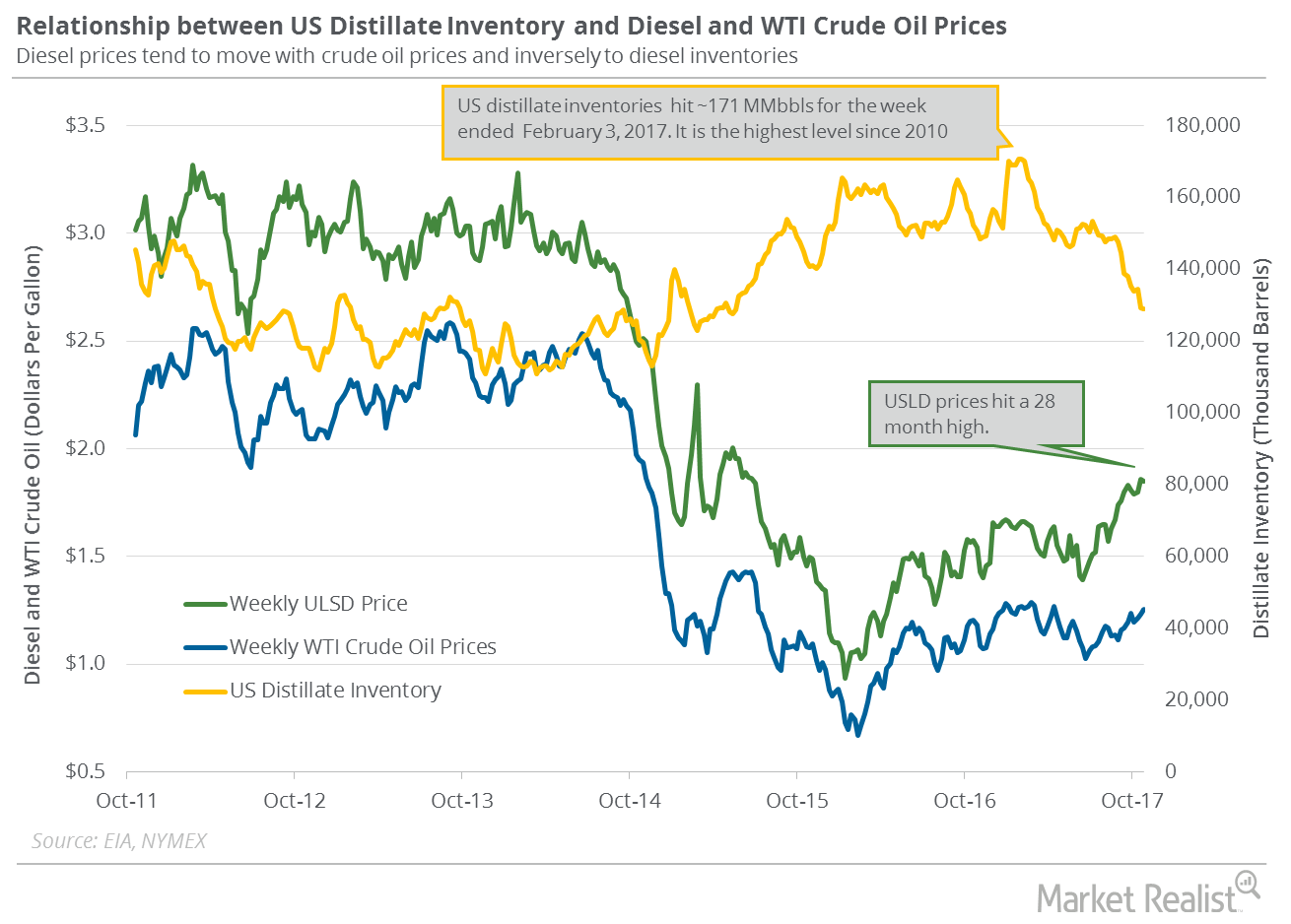

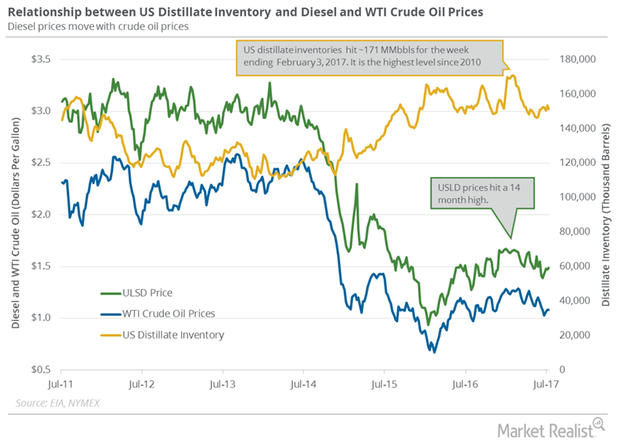

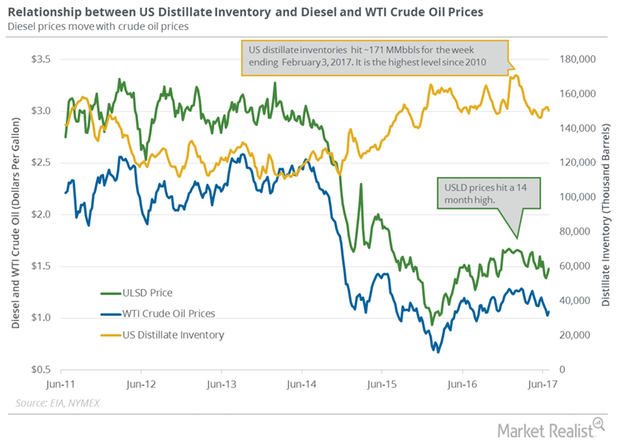

US Diesel Futures Follow Crude Oil Prices

February 2017 NY Harbor ULSD futures fell and settled at $1.66 per gallon on December 21. Diesel futures fell despite the fall in distillate inventories.

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

US Distillate Inventories Are near a 3-Year Low

US distillate inventories fell by 302,000 barrels to 128.9 MMbbls (million barrels) on October 20–27, 2017. It’s the lowest level since April 10, 2015.

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

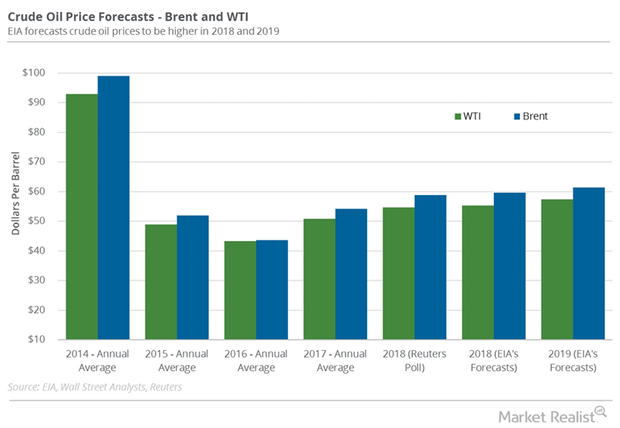

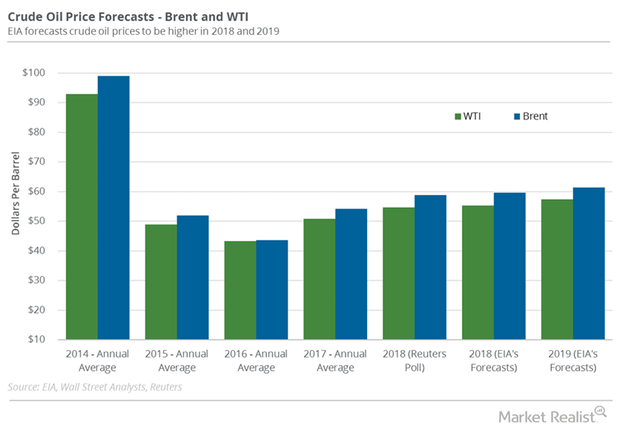

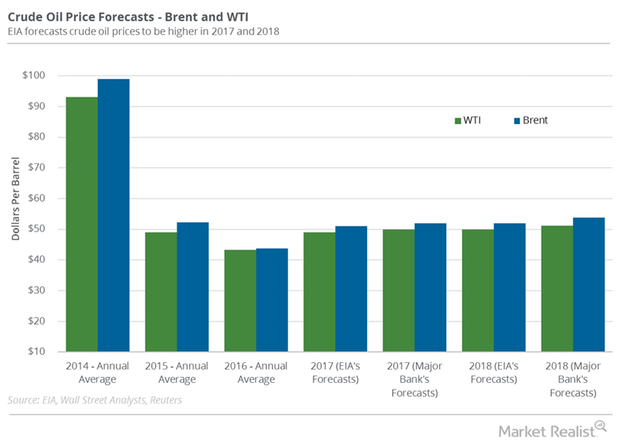

EIA Upgraded Crude Oil Price Forecasts for 2018

The EIA forecast that Brent (BNO) crude oil would average $59.74 per barrel in 2018—4.3% higher than the previous estimates in December 2017.

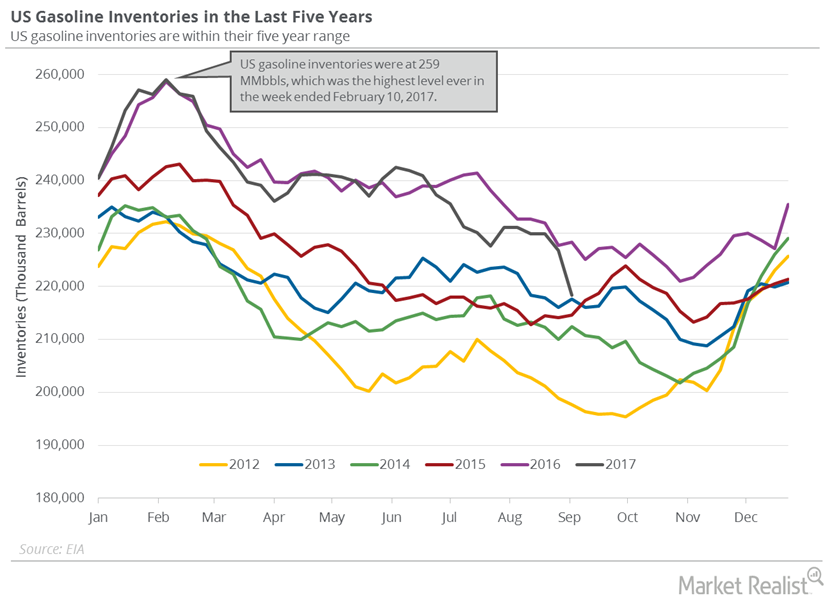

Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

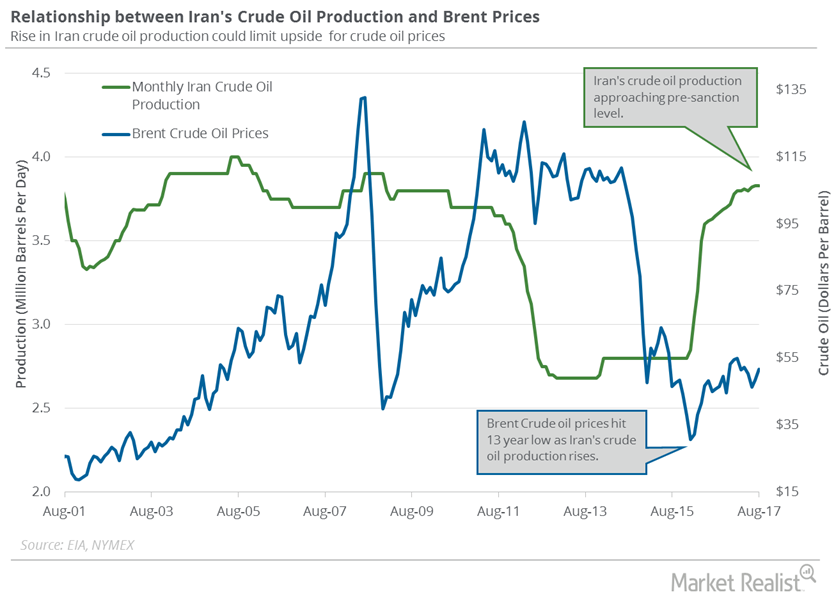

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

How Hurricane Harvey May Impact US Crude Oil Production

US crude oil production The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 2,000 bpd (barrels per day) to 9,530,000 bpd between August 18 and 25, 2017. Production rose 1,042,000 bpd, or 12.3%, from the same period in 2016. It has risen for three consecutive weeks to August 25, and has reached […]

Will US Crude Oil and Gasoline Inventories Support Oil Prices?

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017.

US Distillate Inventories Fell for the Second Straight Week

The EIA reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017.

US Crude Oil Production: Biggest Weekly Fall since July 2016

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd to 9,250,000 bpd on June 16–23, 2017.

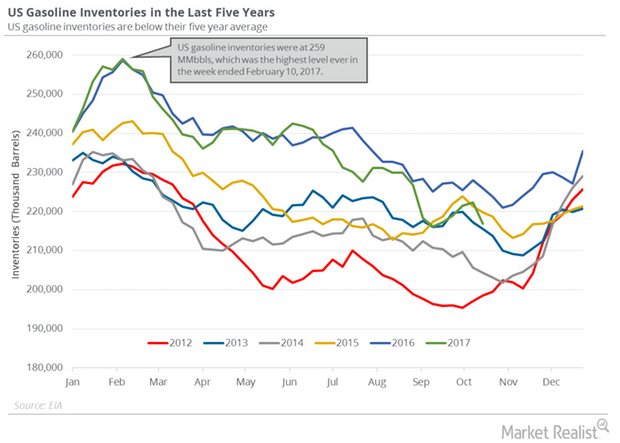

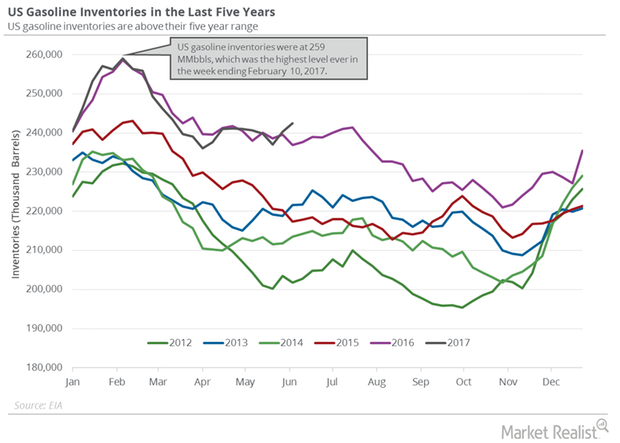

Analyzing US Gasoline Inventories and Gasoline Demand

US gasoline inventories rose by 2.1 MMbbls to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year.

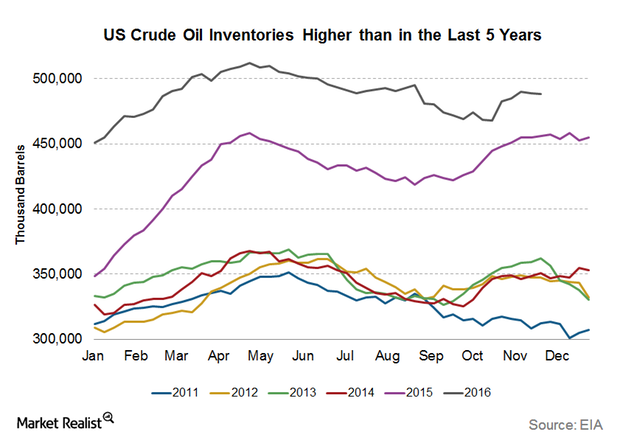

US Crude Oil Inventories Supported Crude Oil Prices

The EIA (U.S. Energy Information Administration) reported that US crude oil inventories fell by 884,000 barrels to 488.1 MMbbls from November 18–25, 2016.

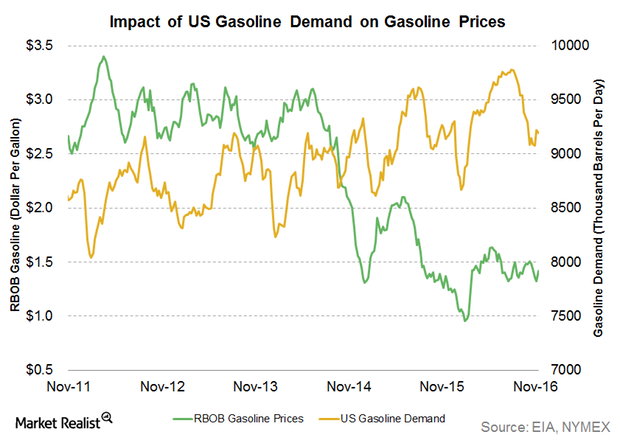

Gasoline Demand Impacts Crude Oil and Gasoline Prices

US gasoline prices hit $1.14 per gallon on February 8, 2016—the lowest in 12 years. As of November 29, 2016, prices rose 21.1% from their lows in February.

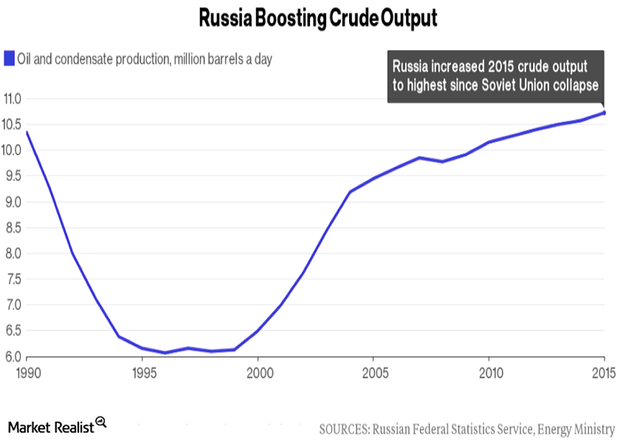

Russia’s Crude Oil Production Will Pressure the Crude Oil Market

Russia’s crude oil production rose to 10.84 MMbpd in June 2016—compared to the previous month—according to sources from the Russian Energy Ministry.

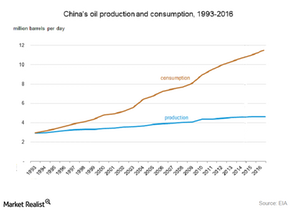

How Will China and India Impact the Crude Oil Market in 2016?

China’s crude oil production fell to the lowest level in four years. It fell by 5.6% YoY (year-over-year) to 16.6 metric tons in April 2016.

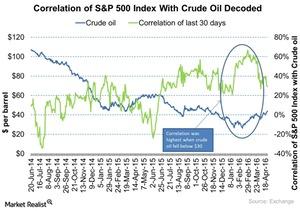

How Are Crude Oil Prices and the S&P 500 Correlated?

Historically, crude oil prices and the S&P 500 index have influenced each other.

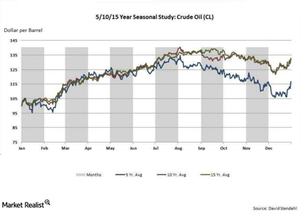

How Seasonality Impacts Crude Oil Prices

Seasonality plays a key role in influencing crude oil prices. Crude oil prices tend to rise in August due to the summer driving season, which results in a rise in gasoline demand.