Cushing Inventories: Largest Weekly Fall since 2009

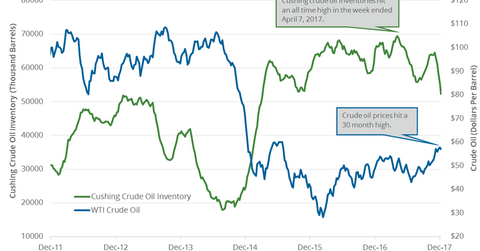

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA.

Dec. 18 2017, Published 9:07 a.m. ET

Cushing inventories

Cushing, Oklahoma, is the largest crude oil storage hub in the US. Wall Street analysts estimated that Cushing inventories would fall on December 8–15, 2017. Any fall in Cushing inventories has a positive impact on oil (USO) (USL) prices.

US crude oil (DWT) (DBO) prices were near a three-year high. They have risen 9.5% YTD (year-to-date). However, the Fidelity MSCI Energy Index (FENY) and the iShares U.S. Energy ETF (IYE) have fallen more than 6% YTD. These ETFs track the performance of US equities in the energy sector.

EIA’s Cushing inventories

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA. Inventories fell 6% week-over-week and by 14,264,000 barrels or 21.4% year-over-year. It was the largest weekly fall since 2009.

Cushing inventories were near the lowest level since March 2015. Inventories fell for the fifth straight week. Any fall in the inventories is bullish for oil (UWT) (SCO) prices. Higher oil prices benefit oil producers’ (FXN) (IXE) earnings like W&T Offshore (WTI), Stone Energy (SGY), PDC Energy (PDCE), and Contango Oil & Gas (MCF).

EIA’s US crude oil inventories

Nationwide crude oil inventories fell by 5.1 MMbbls or 1.1% to 442.9 MMbbls on December 1–8, 2017, according to the EIA. Inventories fell by 40 MMbbls or 8.3% from the same period in 2016. US crude oil inventories fell 17.3% from their record level in March 2017.