Contango Oil & Gas Co

Latest Contango Oil & Gas Co News and Updates

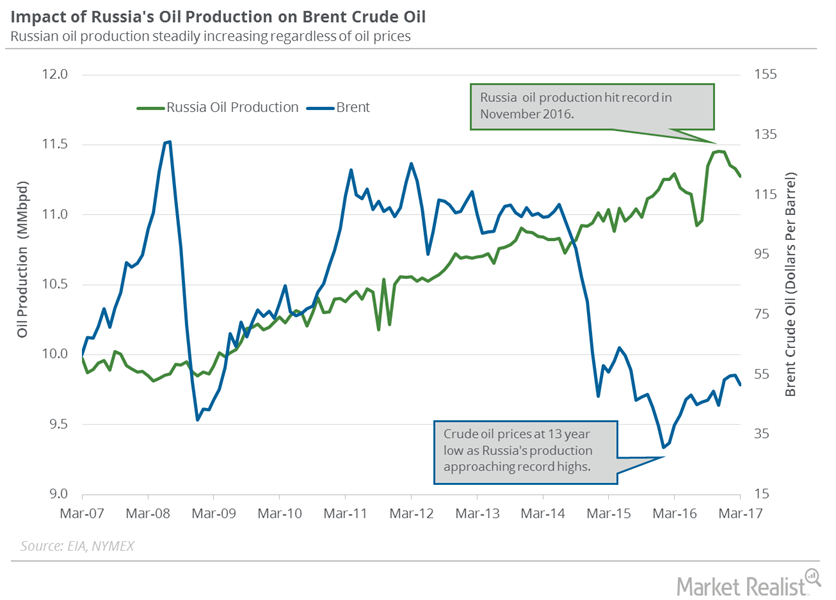

Will Russia’s Oil Production Fall in the Coming Months?

Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

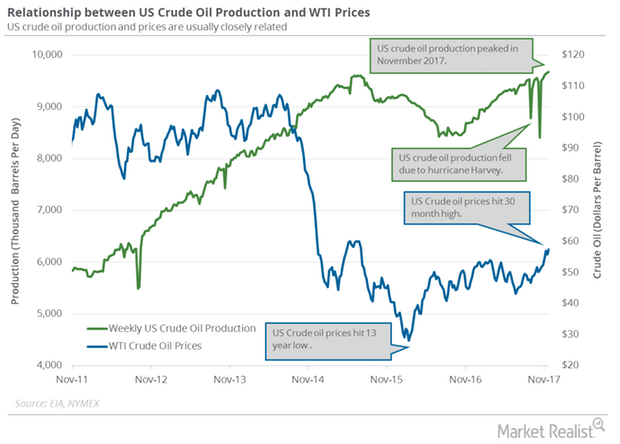

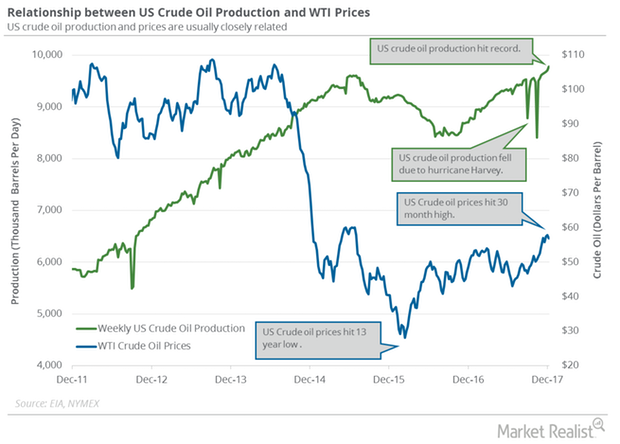

Traders Track US Crude Oil Production and Exports

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

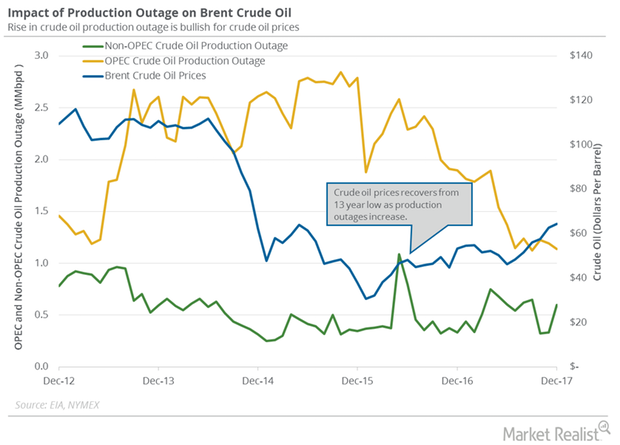

Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

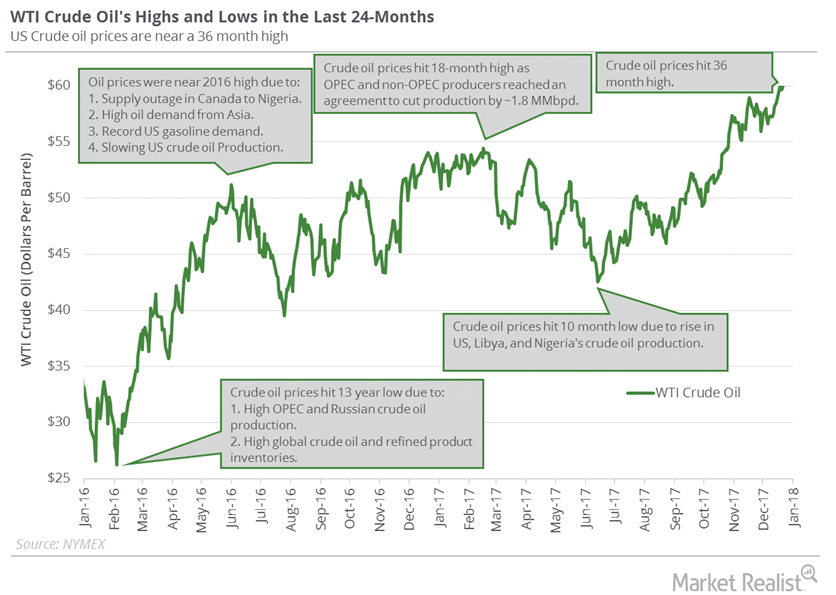

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

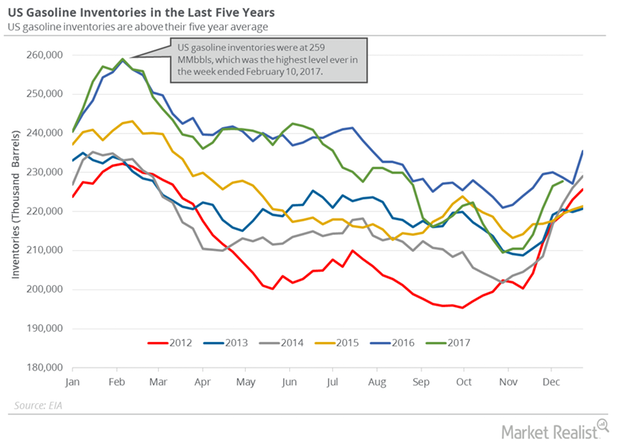

US Gasoline Inventories: Bearish Driver for Crude Oil Futures

The EIA estimated that US gasoline inventories rose by 1.2 MMbbls (million barrels) to 227.7 MMbbls on December 8–15, 2017.

US Crude Oil Production Has Risen 16% since July 2016

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA.

OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

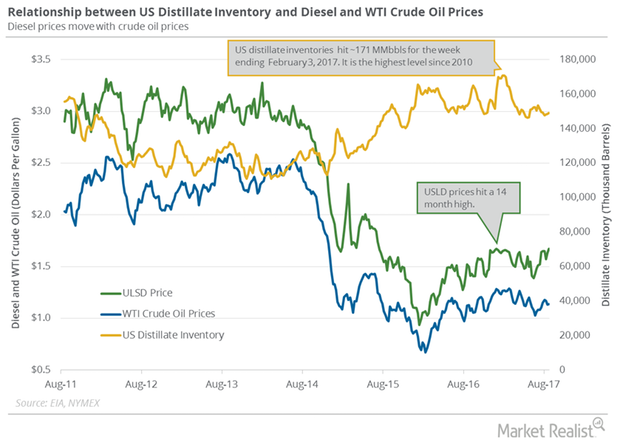

US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]