What Happened to Cimarex’s 1Q16 Production Volumes and Realized Prices?

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY

June 20 2016, Updated 9:08 a.m. ET

1Q16 production

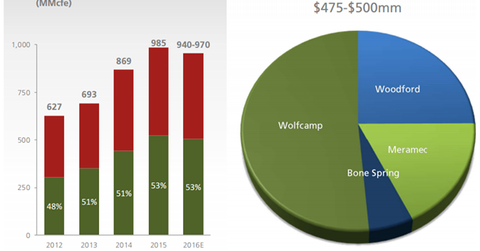

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY (year-over-year). Sequentially, it represents a decline of 1%. XEC’s production has grown consistently since 2012 but is expected to dip in 2016.

By comparison, Whiting Petroleum (WLL) has provided 2016 production growth guidance of -18% at the midpoint, while Oasis Petroleum (OAS) has provided a growth guidance of -6% at the midpoint. Concho Resources (CXO) has provided a growth guidance of 0%. PDC Energy (PDCE), however, expects its annual production to grow in the range of 30%–40% in 2016. Together, these companies make up ~6.6% of the iShares US Oil & Gas Exploration & Production ETF (IEO).

1Q16 realized prices

XEC’s realized crude oil price in 1Q16 averaged $28.02 per barrel, which was ~34% lower than its realized crude oil price in 1Q15. Its realized natural gas price was $1.92 per thousand cubic feet, which was 31% lower than its realized natural gas price in 1Q15. XEC’s realized natural gas liquids price in 1Q16 was $9.84 per barrel—down ~37% from 1Q15.

2016 production and capex guidance

In 2016, Cimarex Energy expects its annual production to be in the range of 940 MMcfe–970 MMcfe, 3% lower than its 2015 production at the midpoint.

XEC’s exploration and development capex (capital expenditure) budget for 2016 is $650 million–$700 million, ~23% lower than last year’s budget.