Cimarex Energy Co

Latest Cimarex Energy Co News and Updates

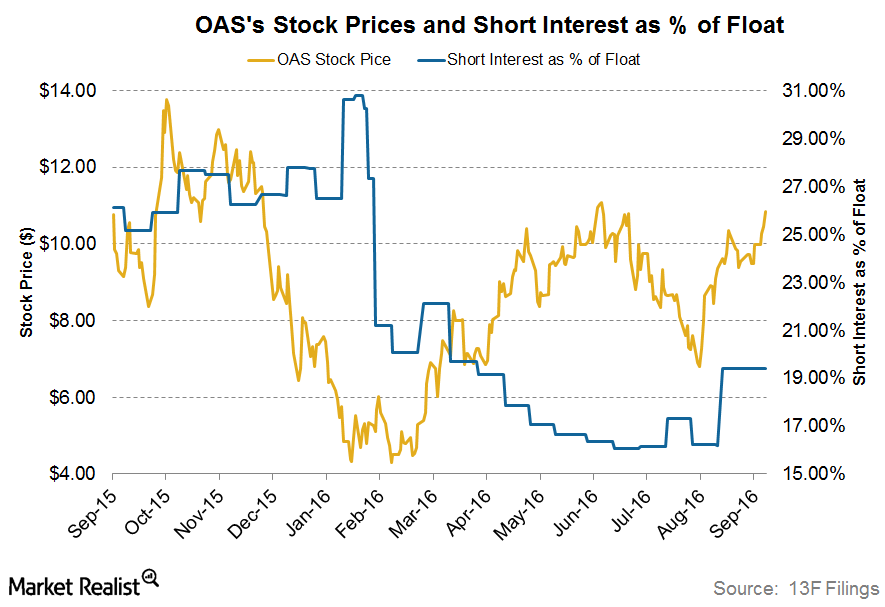

Analyzing Short Interest Trends in Oasis Petroleum

Oasis Petroleum’s short interest ratio on September 13, 2016, was ~19.4%. Its short interest ratio on June 30, 2016, was 16.1%.

What’s Been Driving Diamondback Energy’s Stock Price Movement?

Diamondback Energy’s stock price saw uptrend from October 2012 to June 2014. When NYMEX WTI crude oil started falling in June 2014, FANG’s stock peaked.

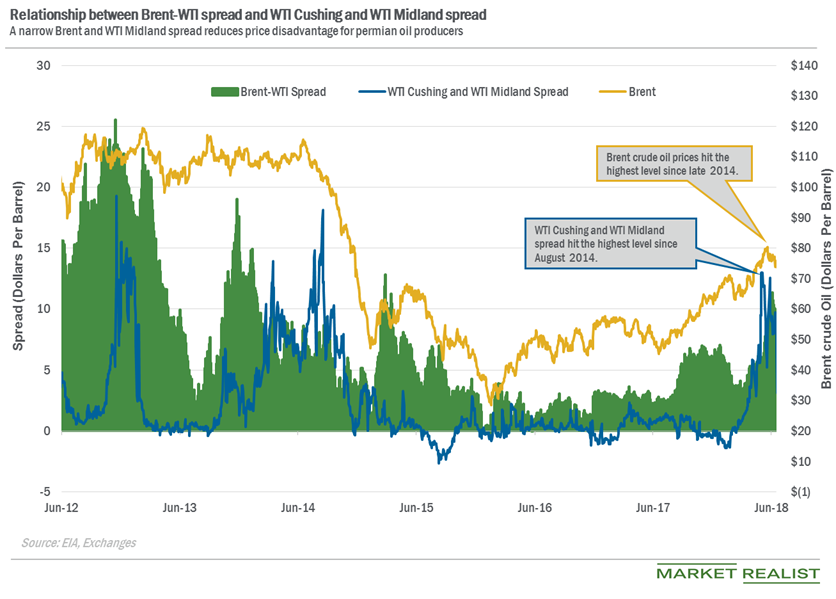

Why Did the WTI Cushing-WTI Midland Spread Drop?

The WTI Cushing-WTI Midland spread was at $4.12 per barrel on June 25—compared to $9.7 per barrel on June 18. The spread fell 58% on June 18–25.

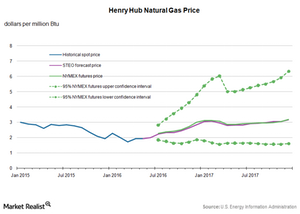

Natural Gas Prices Are Trading above Key Moving Averages

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

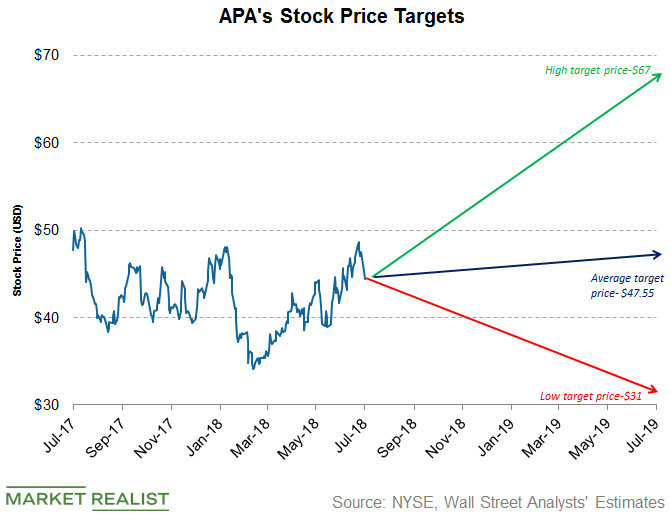

Apache Stock: What Are Analysts’ Recommendations?

On June 11, Argus upgraded Apache stock from “hold” to “buy.” On March 7, UBS initiated coverage on Apache stock with a “sell” rating.

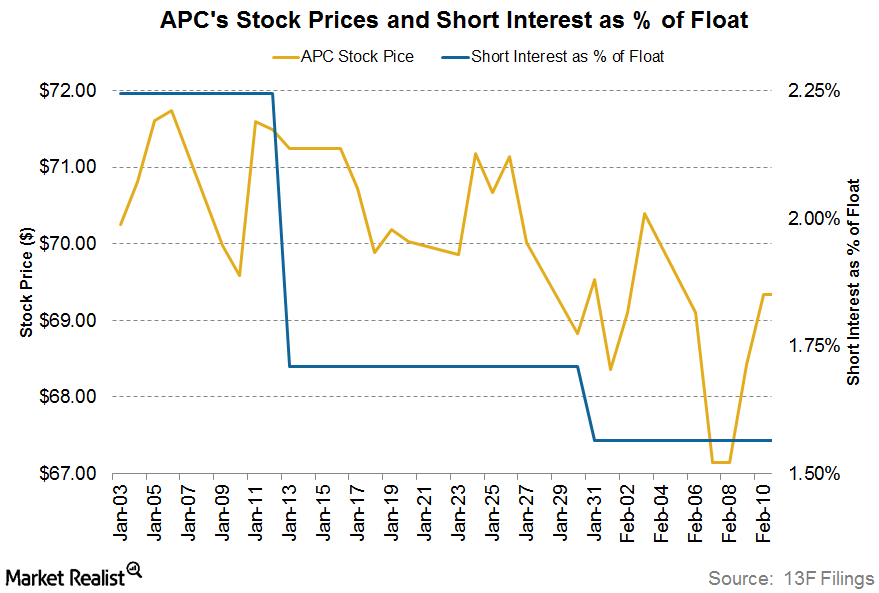

Anadarko Petroleum: Key Short Interest Trends

Anadarko Petroleum’s (APC) short interest ratio on February 10, 2017, was ~1.6%. At the beginning of the year, its short interest ratio was ~2.2%.

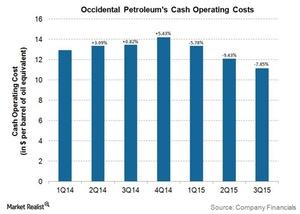

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

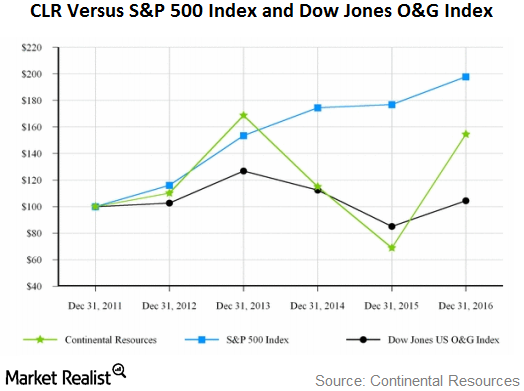

How Has CLR Performed Compared to S&P 500 and Dow Jones?

Let’s take a look at Continental Resources’ (CLR) stock performance in comparison to the performances of the S&P 500 Index and the Dow Jones Oil & Gas Index since 2011.

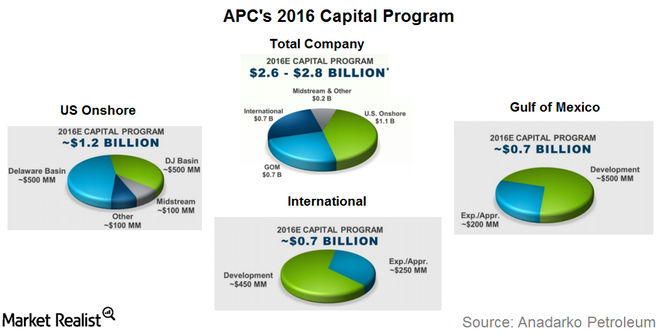

What Are Anadarko’s Capex Plans in 2016?

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

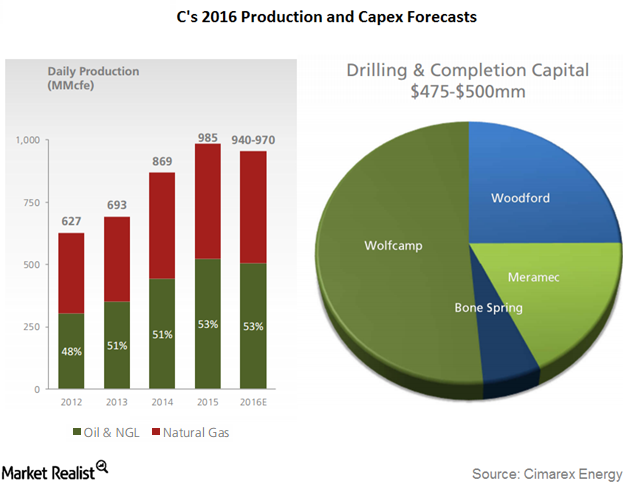

What Happened to Cimarex’s 1Q16 Production Volumes and Realized Prices?

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY

EOG Resources Failed to Hold above Its 200-Day Moving Average

In 3Q15, excluding the one-time items, EOG reported a profit of $0.02 per share, $0.32 better than the analyst consensus for a loss of $0.30 per share. Its revenues fell ~58% year-over-year to ~$2.17 billion.

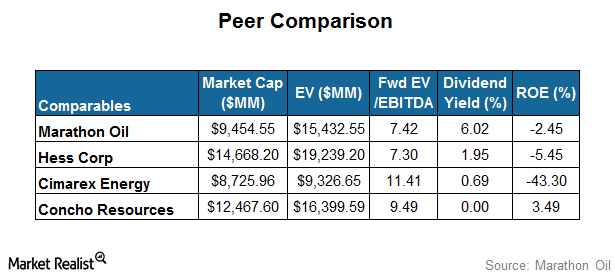

Marathon Oil’s Relative Valuation: A Comparison with Its Peers

In this part of the series, we’ll look at Marathon Oil’s (MRO) relative valuation against its peers’ multiples.

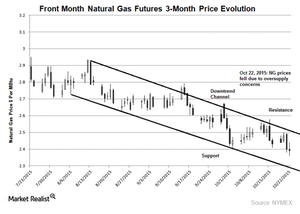

Will Natural Gas Prices Hit New Lows?

Cold winter weather could drive natural gas prices higher. But on the other hand, record natural gas stocks will push natural gas prices lower.