Marathon Oil’s Relative Valuation: A Comparison with Its Peers

In this part of the series, we’ll look at Marathon Oil’s (MRO) relative valuation against its peers’ multiples.

Jan. 4 2016, Updated 6:05 p.m. ET

Marathon’s relative valuation

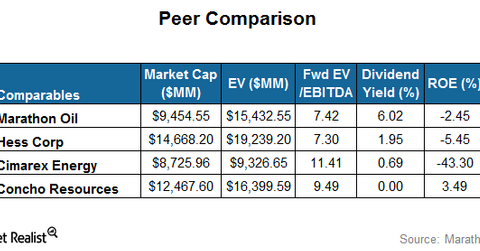

In the previous part of this series, we compared Marathon Oil’s (MRO) EV-to-EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) multiple against its own historical levels. In this part, we’ll look at the company’s relative valuation against its peers’ multiples.

Marathon’s forward EV-to-EBITDA

A peer group comparison shows that Marathon’s forward EV-to-EBITDA multiple of ~7.4x is lower than most of its peers. Cimarex Energy (XEC) is currently trading at a forward EV-to-EBITDA multiple of ~11.4x. Concho Resources (CXO) is trading at a multiple of ~9.5X. Hess (HES) is trading at a slightly lower EV-to-EBITDA multiple of ~7.3. So MRO appears to be undervalued compared to its peers. Together, these companies make up ~3% of the Vanguard Energy ETF (VDE).

Why is MRO trading at a discount?

As we saw in the previous parts, MRO’s EBITDA has fallen considerably this year, and so have its cash flows. We saw in Part 3 that the company is heavily levered to oil prices. A prolonged downtrend in oil prices could cause the company to cut its dividend, given the recent dividend adjustment (read Part 4). So MRO’s lower forward EV-to-EBITDA multiple compared to its peers implies a valuation discount due to higher risk.

Marathon’s returns

In terms of returns, Marathon Oil offers one of the better returns when its profitability is scaled by its shareholder equity. This calculation is called ROE (return on equity). MRO’s ROE stands at -2.5%. Among the company’s peers, CXO has the highest ROE at 3.5%. XEC has the lowest ROE at -43%.

In the next part, we’ll look at Marathon’s stock drivers.