Hess Corporation

Latest Hess Corporation News and Updates

John Hess Built His Net Worth in the Oil and Gas Industry

The U.S. should do more to stabilize oil prices, Hess Corp. CEO John Hess told CNBC. His family's involvement in the oil industry has helped build his net worth.

Perfect Storm for Natural Gas—What Are the Top Stock Picks?

With nearly 100 percent gains YTD, natural gas has become one of the top-performing commodities in 2021. What are the best natural gas stocks to buy now?

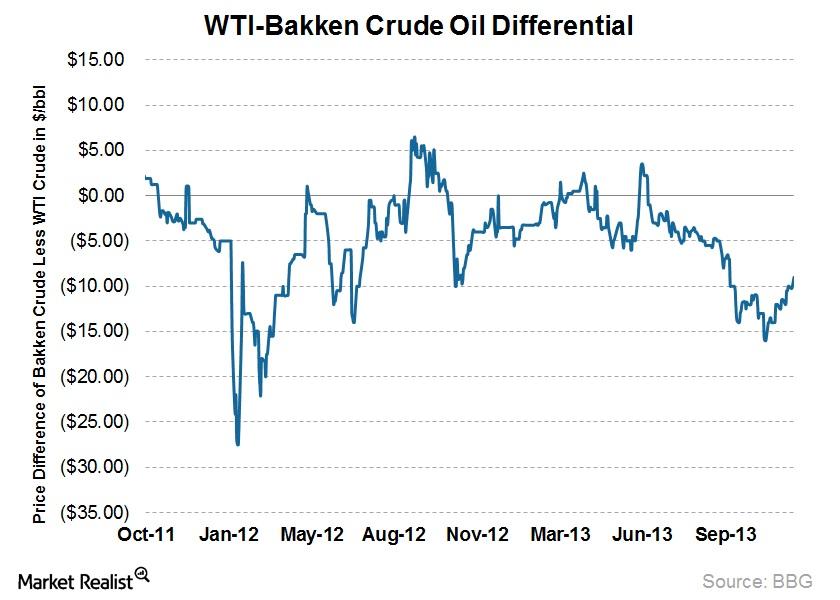

Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

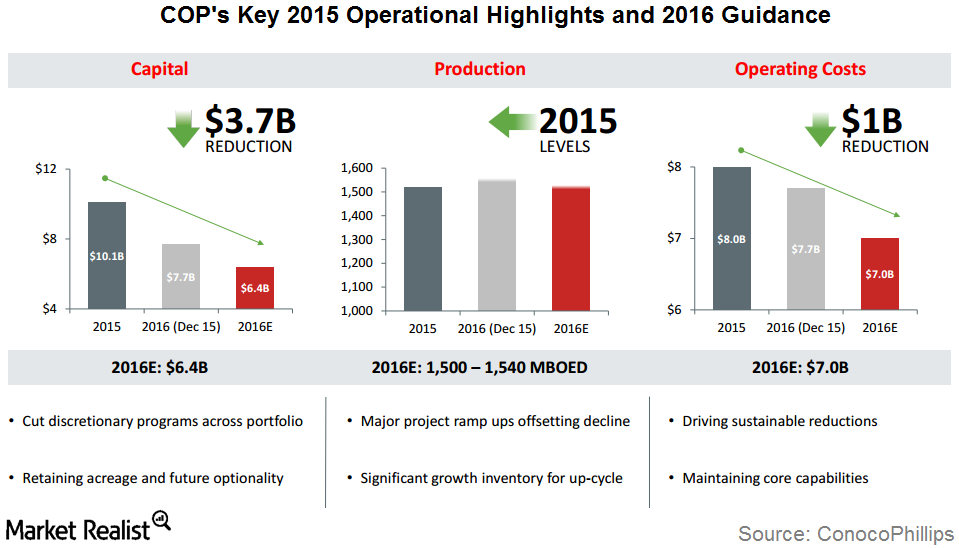

ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

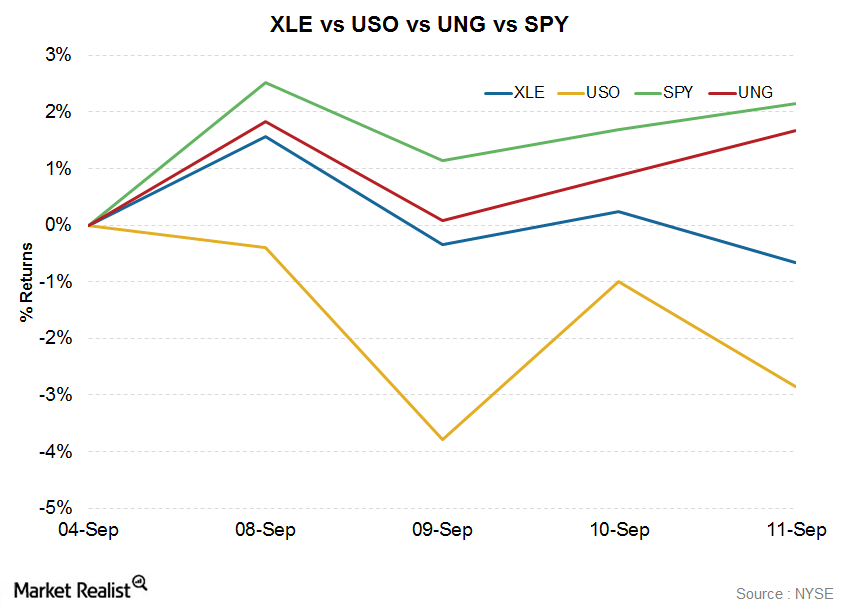

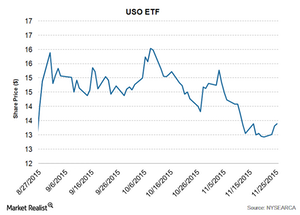

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

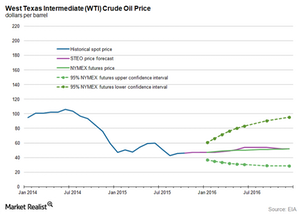

Why oil prices spiked on tensions in Gaza and Ukraine

Early last week, WTI crude oil had eased to close to $99 following Libya’s restarting exports from major ports and abating fears over supply disruptions in Iraq.

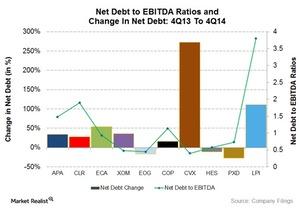

Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

Crude Oil Prices Rally Due to Short Covering

WTI (West Texas Intermediate) crude oil futures contracts for January delivery rose slightly by 0.4% and closed at $43.04 per barrel on Wednesday.

Are You Looking at the Right Oil-Weighted Stocks?

On May 16, US crude oil June futures rose 0.3% and closed at $71.49 per barrel, a more-than-three-year high.

Why US Crude Oil Prices Are Steady

On June 14, Russia and Saudi Arabia announced a bilateral framework to increase cooperation and manage the oil market.

Crude Oil Bear Market: Worst Case Scenarios for 2016

Goldman Sachs (GS) suggests crude oil prices could test $20 per barrel in a worst case scenario in 2016.

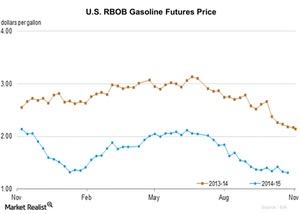

Why Did RBOB Gasoline Outperform Heating Oil?

The EIA reported RBOB gasoline futures contract 1 prices at $1.30 per gallon on November 23, representing a fall of ~1.8% from $1.32 per gallon on October 16.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.

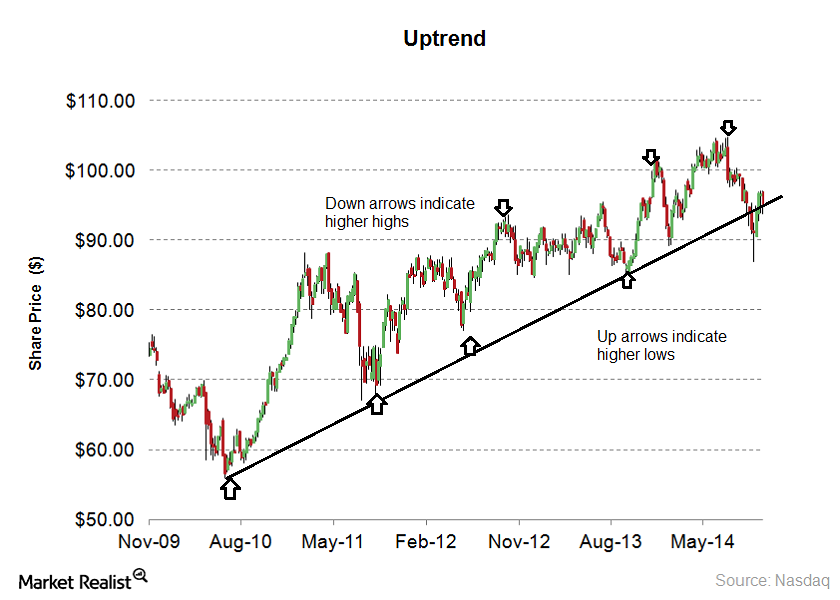

Why investors should buy stocks during an uptrend

Stocks are in an uptrend when they’re making higher highs and higher lows. An uptrend forms when psychological or fundamental factors are improving.

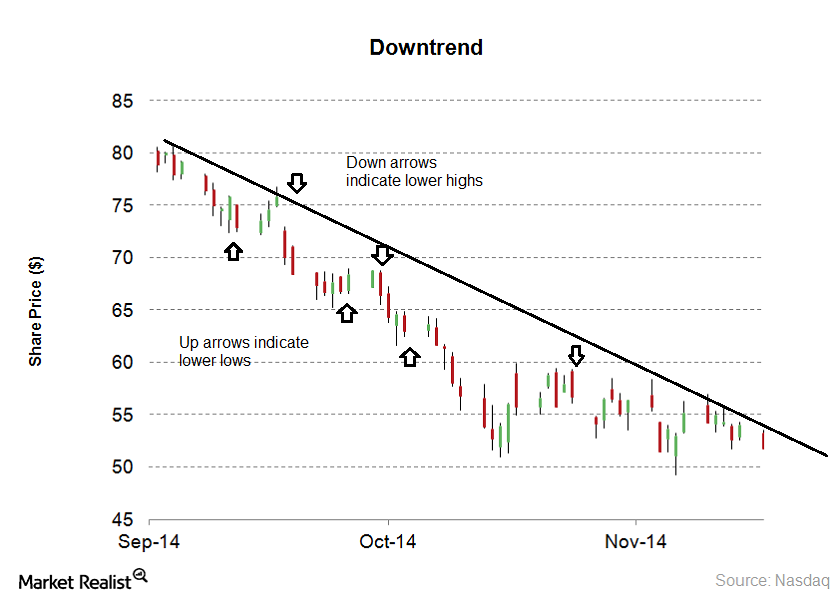

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

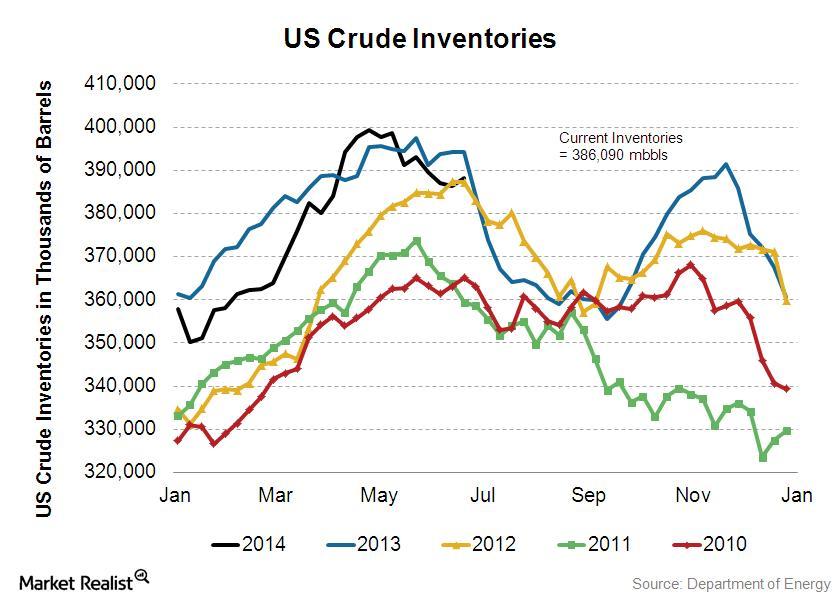

Must-know: Why crude oil inventories can affect prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.

Why the US Imposed Sanctions on Iran and Why They Matter

The United States first imposed restrictions on its activities with Iran in 1979, after the seizure of the US embassy in Tehran.

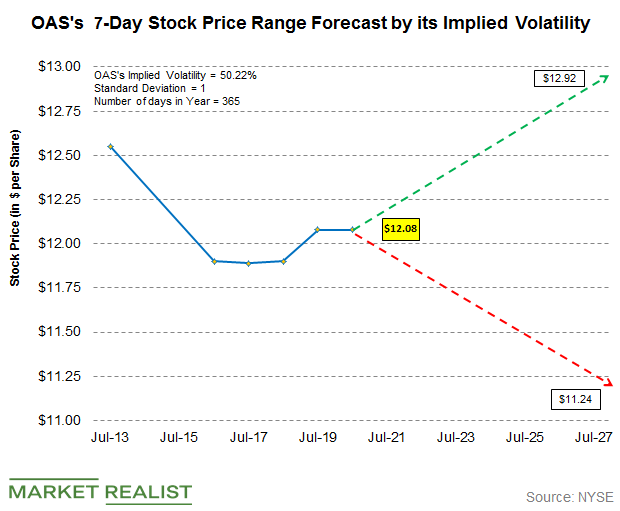

Using Implied Volatility to Forecast Oasis’s Stock Price Range

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%.

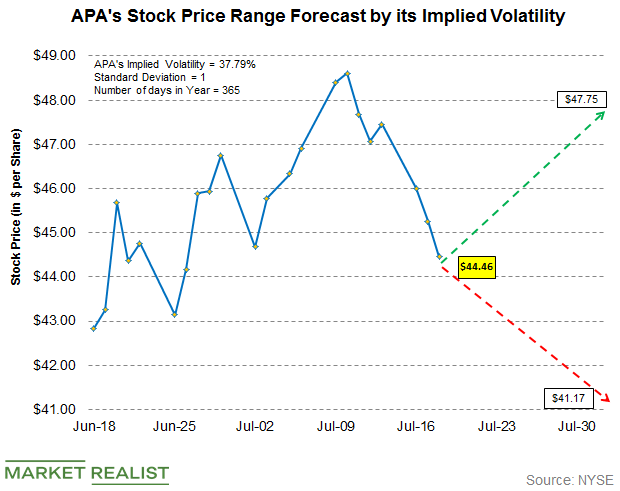

Forecasting Apache’s Stock Price Range

The current implied volatility in Apache’s stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

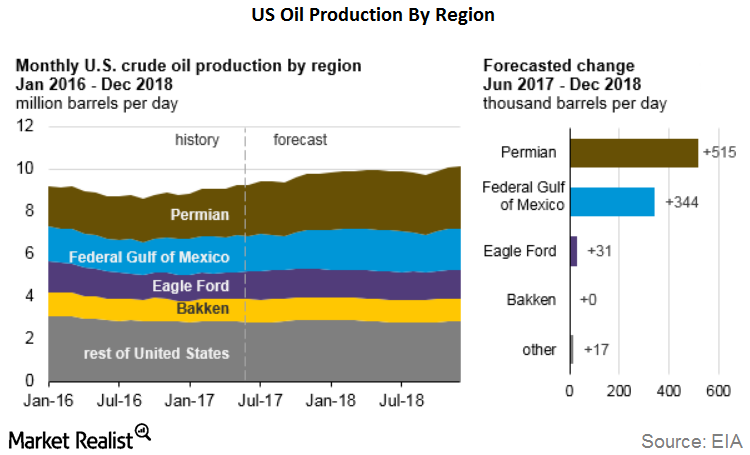

Could Permian Basin Drive Growth in US Crude Oil Production?

In its November Short-Term Energy Outlook (or STEO) report, the EIA forecast that US crude oil production in 2017 would average 9.2 million barrels per day.

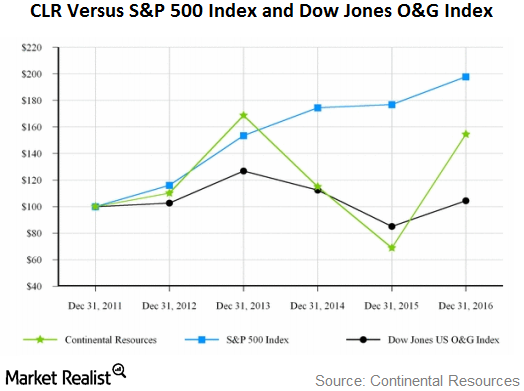

How Has CLR Performed Compared to S&P 500 and Dow Jones?

Let’s take a look at Continental Resources’ (CLR) stock performance in comparison to the performances of the S&P 500 Index and the Dow Jones Oil & Gas Index since 2011.

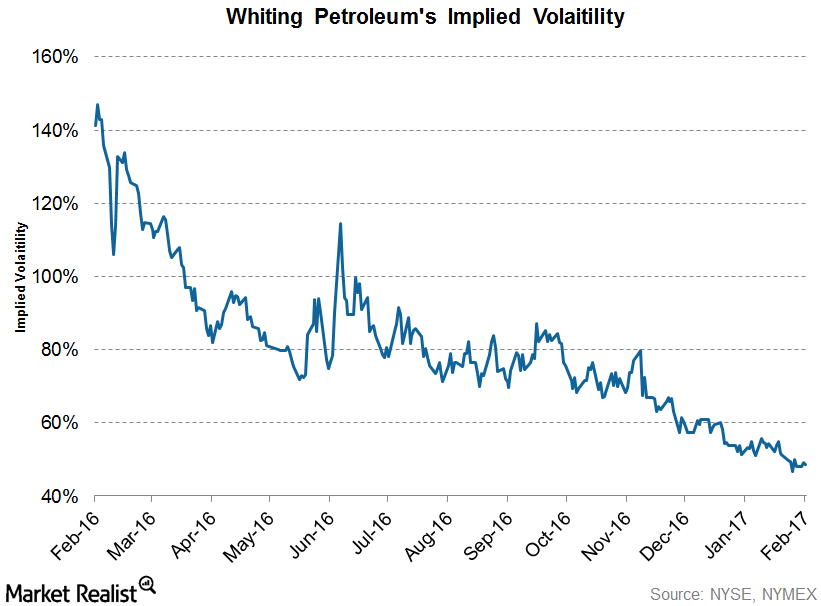

Whiting Petroleum’s Implied Volatility: Key Trends

Whiting Petroleum’s (WLL) implied volatility as of February 22, 2017, was 48.5%, which was ~4.3% lower than its 15-day average of 50.7%.

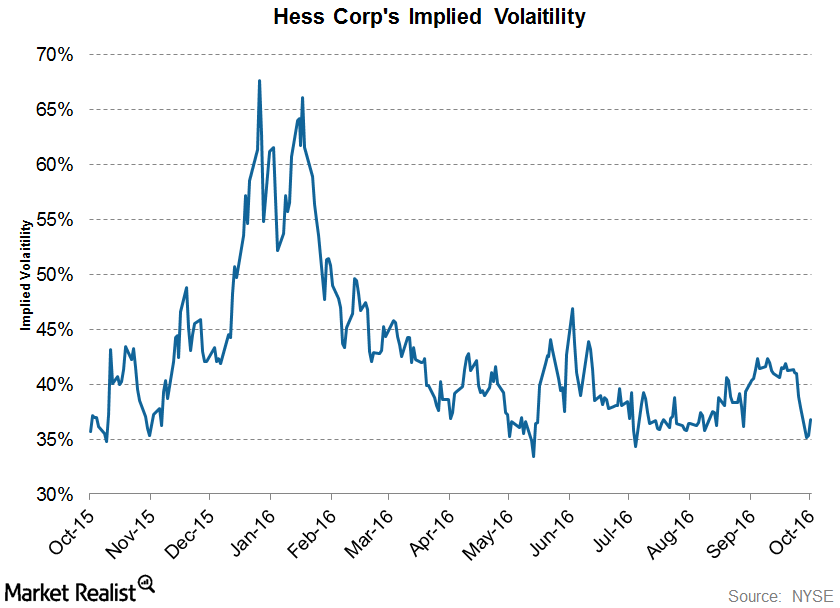

What Analysts Recommend for Hess after 3Q16 Earnings

About 42% of analysts rate Hess a “buy,” and ~58% rate it a “hold.” The average target price of $64.89 implies a return of ~29% in the next 12 months.

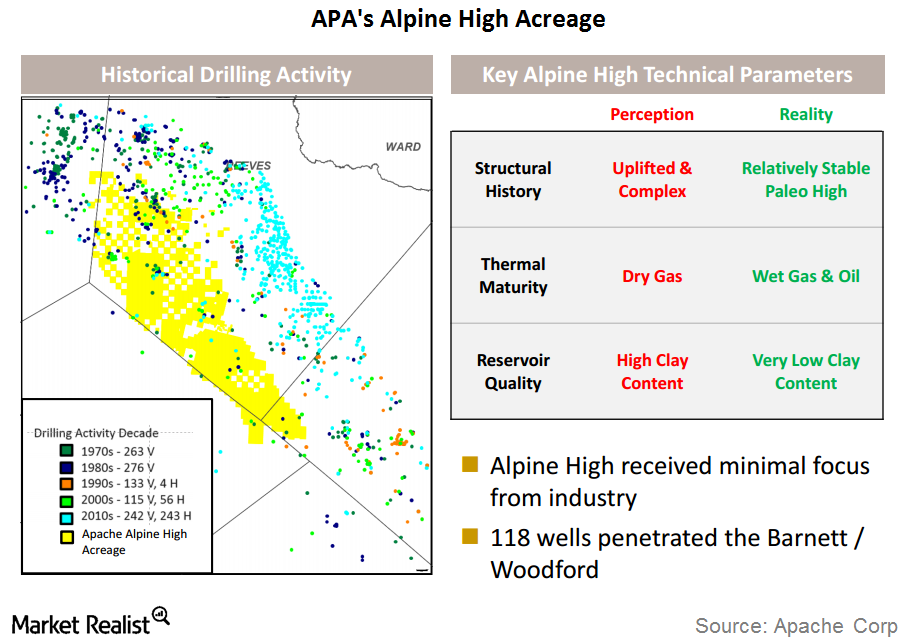

Apache Announces a New Oil and Gas Discovery

On September 7, 2016, Apache (APA) announced a new resource play, Alpine High, in the Delaware Basin of Texas.

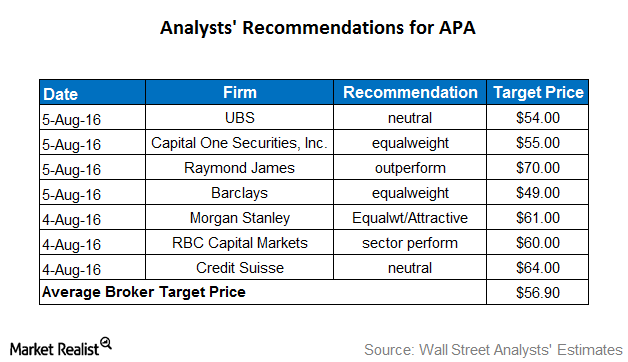

What Analysts Recommend for Apache after 2Q16 Earnings

Approximately 33% of analysts rate Apache (APA) a “buy,” and 55% rate it a “hold.” The remaining 12% rate it a “sell.”

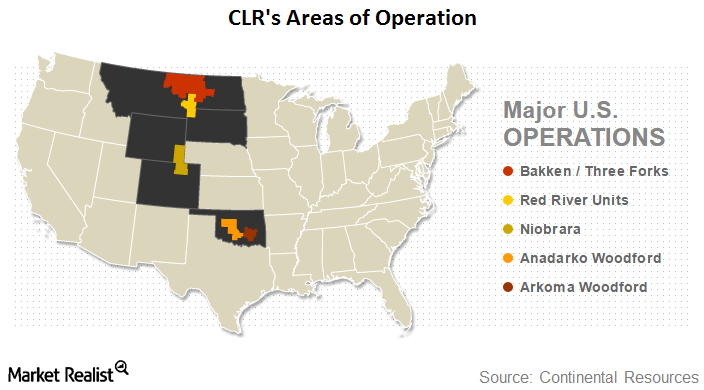

Continental Resources: An Introduction

In this series, we will analyze how badly Continental Resources (CLR) was hit by weak oil prices, and what measures it has taken to counter this situation. In 2015, crude oil accounted for 66% of CLR’s total production and 85% of its revenues.

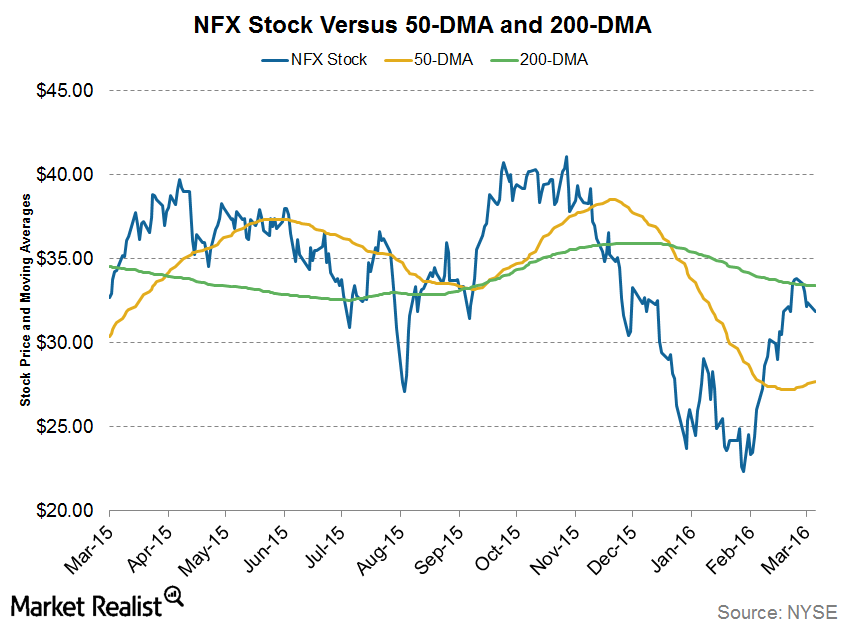

Newfield Exploration Stock Is Up, but for How Long?

With the recent rally in crude oil prices, Newfield Exploration (NFX) stock has been on an uptrend. On March 1, 2016, it crossed its 50-day moving average for the first time in 2016.

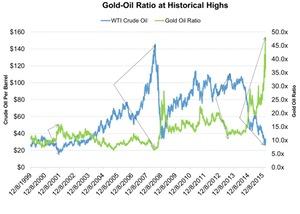

Gold-Oil Ratio Is at a Historic High: Why Isn’t the Bottom Near?

A rise in the ratio can be correlated the corresponding rise in gold prices. An increase in the ratio indicates that gold is more expensive than crude oil.

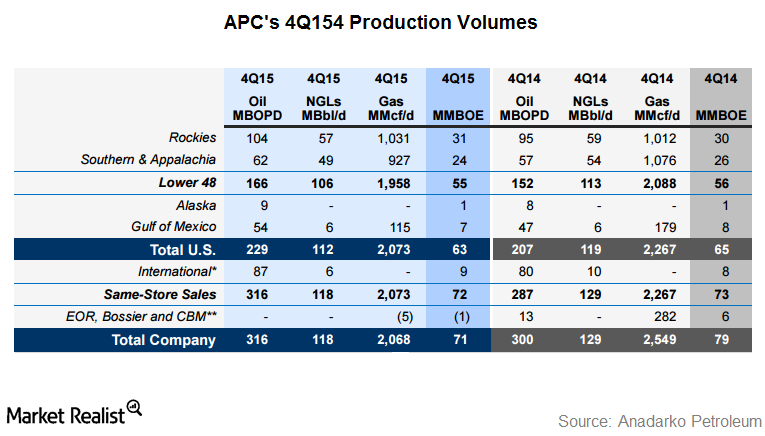

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

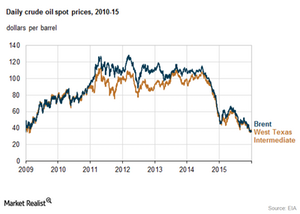

WTI and Brent Crude Oil Prices in 2015, Lowest since 2009

US benchmark WTI crude oil prices averaged at $49 per barrel in 2015. WTI and Brent crude oil prices closed below $40 per barrel in 2015.

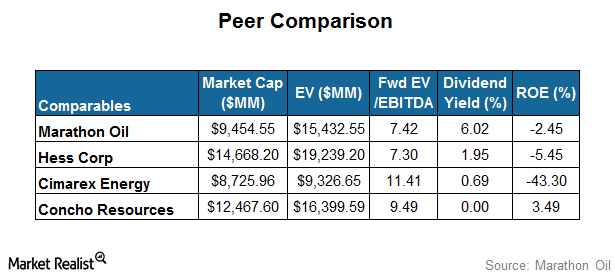

Marathon Oil’s Relative Valuation: A Comparison with Its Peers

In this part of the series, we’ll look at Marathon Oil’s (MRO) relative valuation against its peers’ multiples.

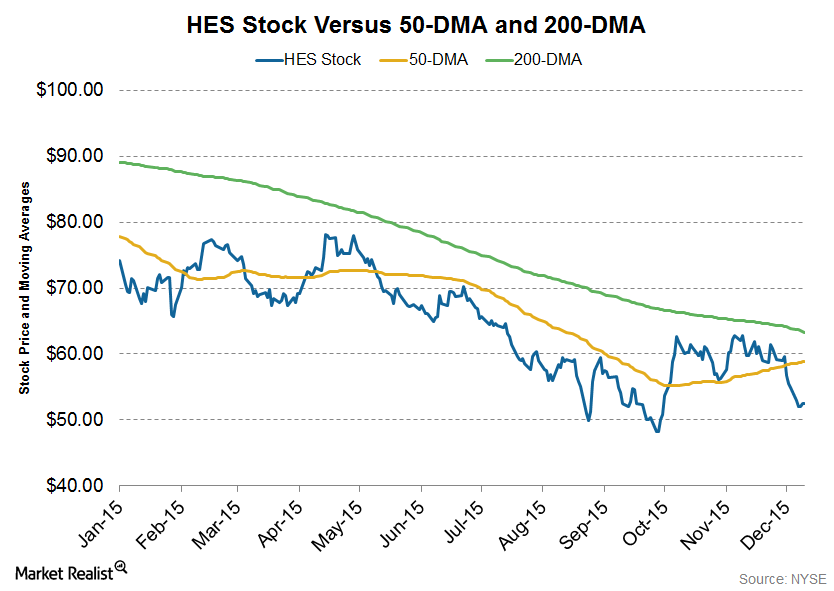

Hess Moves below its 200-Day Moving Average

On December 11, 2015, Hess was trading 17% below its 200-day moving average, a strong upside resistance for the stock. It has narrowed the gap considerably since October.

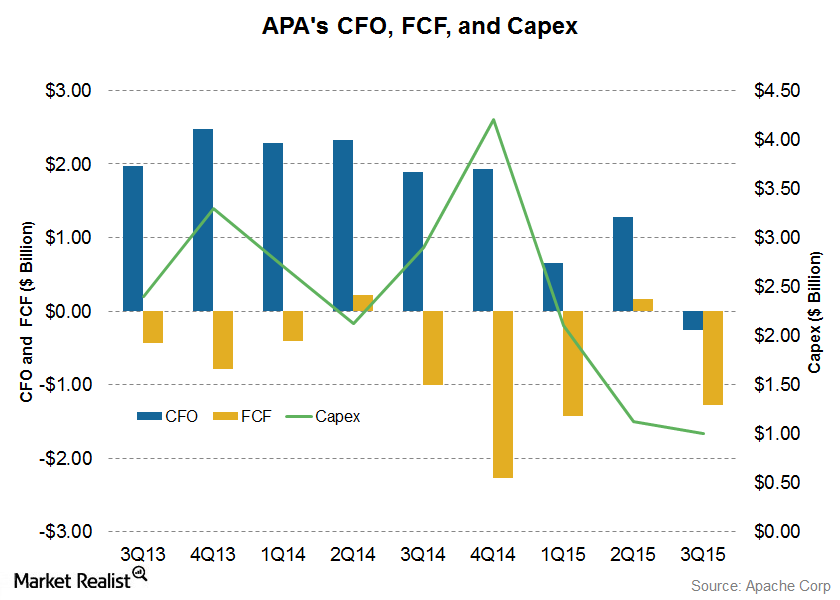

An Analysis of Apache’s Free Cash Flow Trends

Apache’s free cash flow has been mostly negative in the past nine quarters. In 2Q15, it reported FCF of $157 million despite weakness in commodity prices.

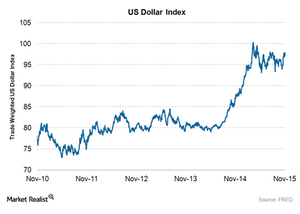

How Does the US Dollar Index Influence Crude Oil Prices?

Crude oil and the US Dollar Index are inversely related. The appreciation of the US dollar will negatively influence crude oil prices.

A Volatile Week for Crude Oil Prices: Analyzing the Key Reasons

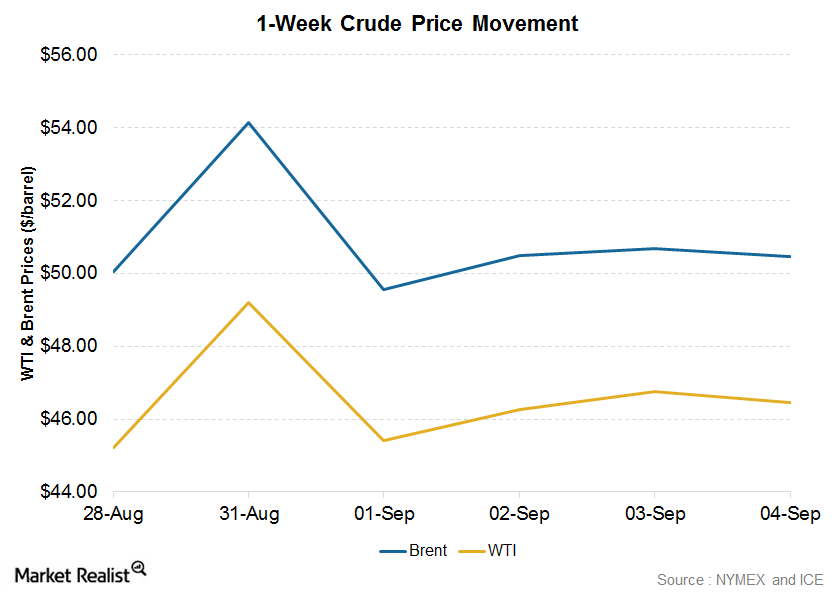

WTI crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

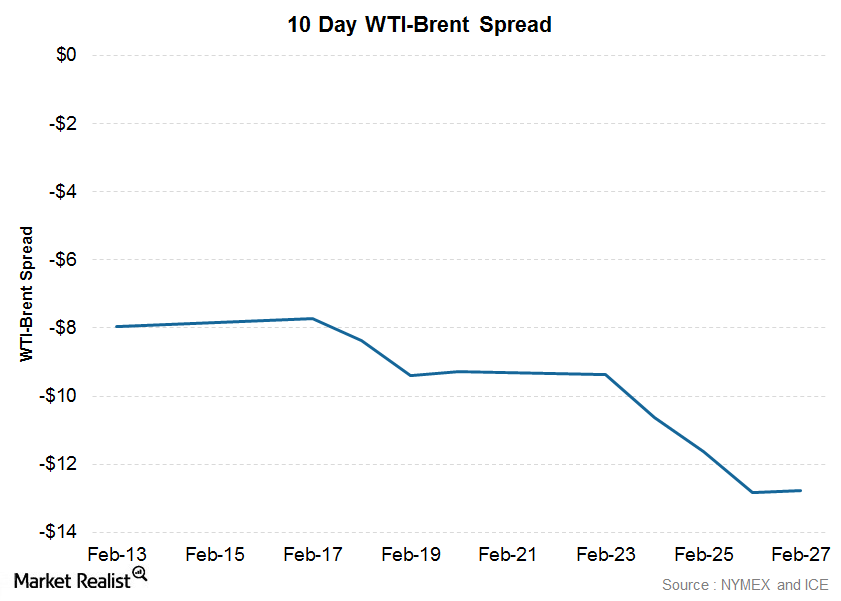

What caused the WTI-Brent spread to widen?

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small compared to Brent’s 18% increase.

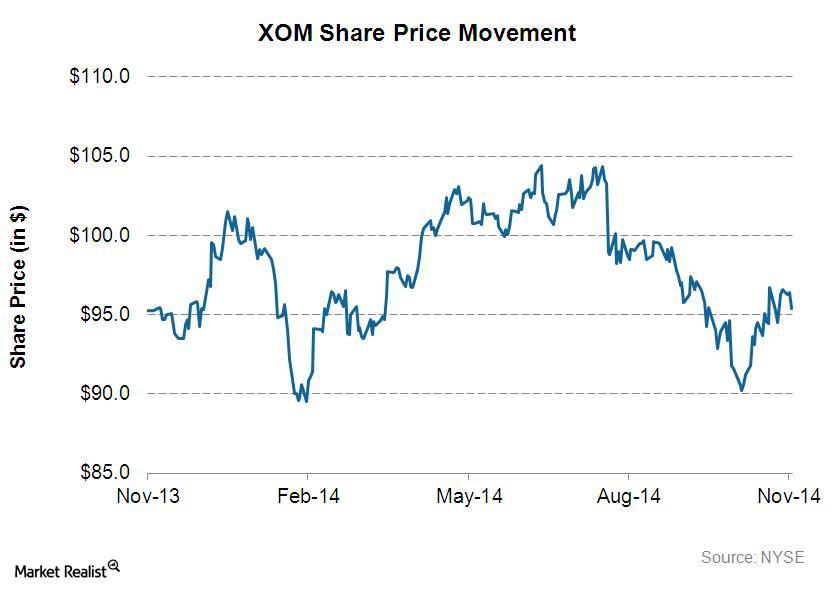

An overview of ExxonMobil

Exxon Mobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014. Starting in November 2013, Exxon Mobil’s share price went up by 1.5%.