ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

May 4 2021, Updated 10:28 a.m. ET

ConocoPhillips’s operational highlights

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d (thousand barrels of oil equivalent per day), excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

COP’s 4Q15 production volume was 1,599 Mboe/d excluding Libya. This represents a 3% year-over-year growth after adjusting for dispositions and downtime.

ConocoPhillips noted in its 4Q15 earnings that the production growth was brought about by growth coming from major projects and improved well performance.

ConocoPhillips’s capital and operating costs guidance

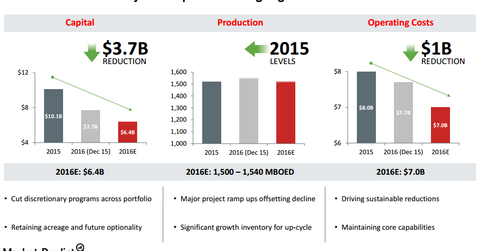

ConocoPhillips’s capex (capital expenditure) fell significantly in 2015. The company spent $10.1 billion in 2015 compared to $17 billion in 2014. In December 2015, COP provided an interim capex budget of $7.7 billion for 2016. In the recent 4Q15 earnings release, this figure was reduced to $6.4 billion.

COP’s operating costs in 2015 were $8 billion compared to $9.7 billion in 2014. In December 2015, COP provided an operating cost guidance of $7.7 billion for 2016. In the recent 4Q15 earnings release, this figure was further reduced to $7 billion.

Like ConocoPhillips, many of its peers also slashed their 2016 capex as a result of weak energy prices. Hess (HES) and Anadarko Petroleum (APC) slashed their 2016 capex by ~40% and ~50%, respectively, compared to 2015. Apache (APA) is expected to announce capex reductions in its 4Q15 earnings. It already slashed its 2015 capex by ~65% compared to 2014. These companies combined make up ~9% of the Energy Select Sector SPDR ETF (XLE).