How Political Parties Impact US Crude Oil Production

Under President Obama’s tenure, US crude oil production rose 92% and peaked at 9.6 MMbpd (million barrels per day) in June 2015.

Nov. 7 2016, Published 8:42 a.m. ET

US crude oil production

President Barack Obama is the 44th and current US president. He belongs to the Democratic party. He became president on January 20, 2009. Under his tenure, he established economic stimulus through quantitative easing.

The availability of cheaper credit led to massive investments into oil and gas exploration projects. Technological innovation, supported by the shale revolution, led to the rise in US crude oil production between 2010 and 2015. Under President Obama’s tenure, US crude oil production rose 92% and peaked at 9.6 MMbpd (million barrels per day) in June 2015. However, US crude oil production is up 70% from January 2009 levels despite the crude oil glut. For more on weekly and monthly US crude oil production updates, read Part 4 of this series.

US crude oil production under Democratic and Republican presidents

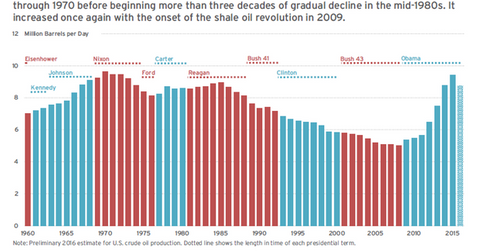

The above chart illustrates that US crude oil production mainly rose under Democratic presidents. However, US crude oil production fell during former president Bill Clinton’s tenure. Hillary Clinton belongs to the Democratic party. Will she support US crude oil production?

On the other hand, US crude oil production usually fell under the Republican party. Donald Trump belongs to the Republican party.

Impact on crude oil producers and ETFs

Changes in US crude oil production will impact US crude oil (XLE) (XOP) (USO) prices. Volatility in crude oil prices impacts oil producers, refiners, and ETFs. Volatility in crude oil prices can impact oil and gas producers’ earnings such as ExxonMobil (XOM), Chevron (CVX), Tesoro (TSO), Valero (VLO), Carrizo Oil & Gas (CRZO), PDC Energy (PDCE), and Swift Energy (SFY).

The ups and downs in crude oil prices also impact funds such as the PowerShares DWA Energy Momentum ETF (PXI), the Direxion Daily Energy Bear 3x ETF (ERY), the iShares US Energy (IYE), the ProShares UltraShort Bloomberg Crude Oil (SCO), the Fidelity MSCI Energy ETF (FENY), the ProShares Ultra Bloomberg Crude Oil (UCO), the iShares Global Energy (IXC), and the iShares US Oil Equipment & Services (IEZ).

Next, we’ll discuss whether or not the US depends on energy imports.