Market Vectors® Oil Services ETF

Latest Market Vectors® Oil Services ETF News and Updates

Energy & Utilities Why improvement in Libya pushed down the crude price last week

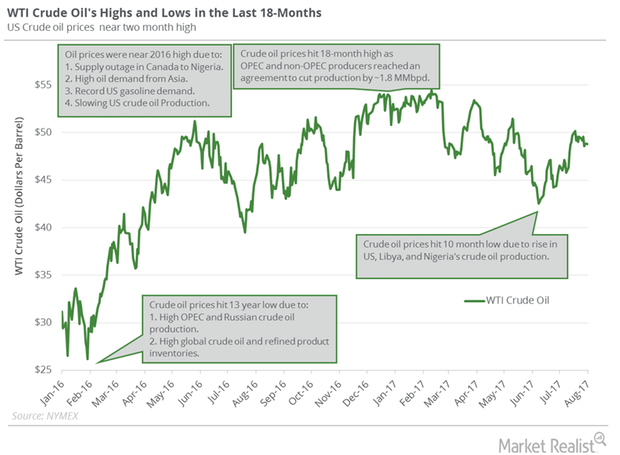

For most of the last two years, WTI crude oil has been range-bound between ~$85 per barrel and ~$110 per barrel.

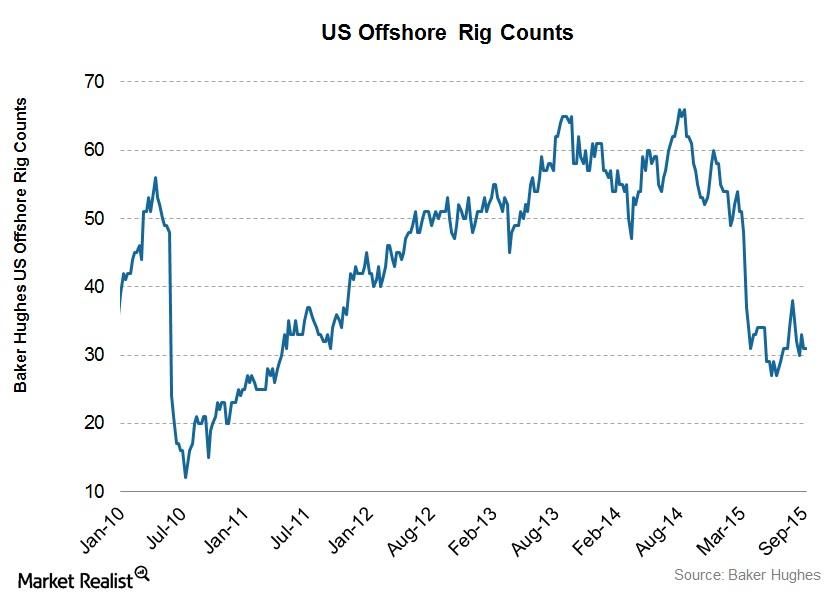

US Offshore Rig Count Was Steady in the September 18 Week

In the week ending September 18, 2015, the US offshore rig count didn’t change. The offshore rig counts have averaged 33 over the past eight weeks.

Seadrill Stock Rose 98% in Week 20

The offshore drilling industry made headlines last week, especially Seadrill (SDRL), which reached a 52-week high of $0.73.

Will US Crude Oil Futures Surpass their 200-Day Moving Average?

Let’s track some important events for oil and gas traders from August 14 to 18, 2017.

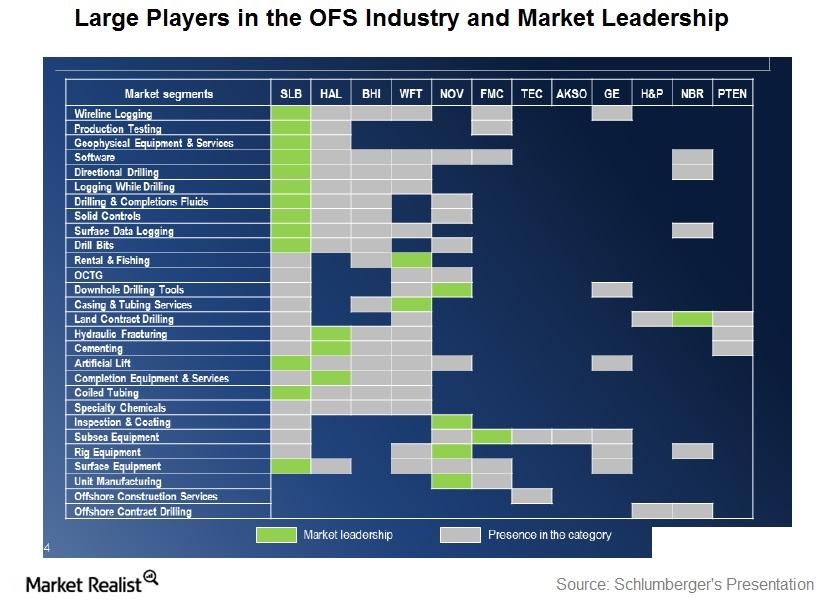

A quick overview of oil and gas field services biz Schlumberger

Schlumberger Limited is a Houston-based energy company. It provides technology, integrated project management, and information solutions to oil and gas exploration and production (or E&P) companies around the world.

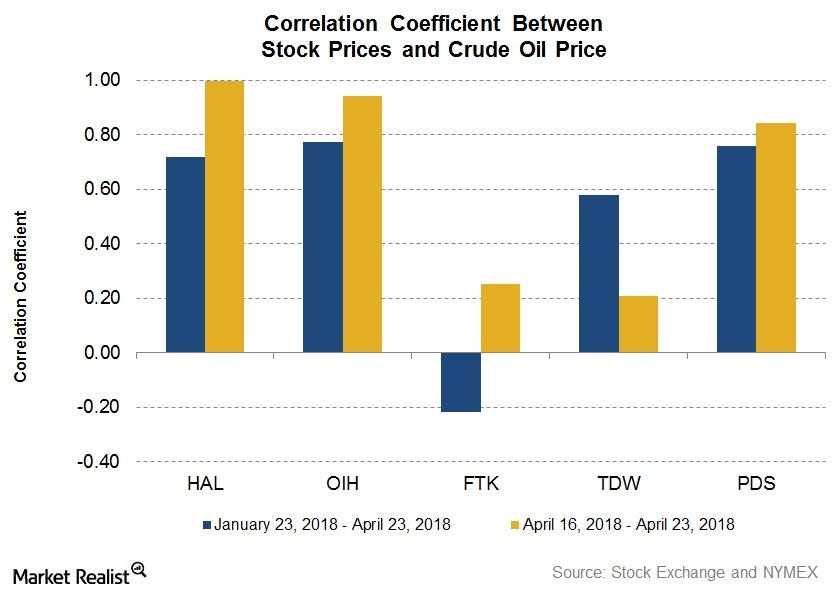

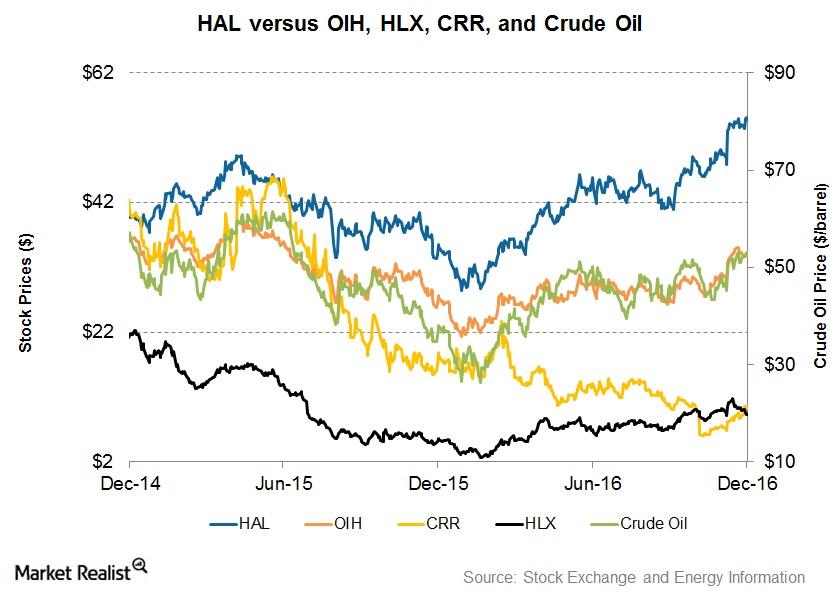

How Halliburton Has Reacted to Crude Oil Prices

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

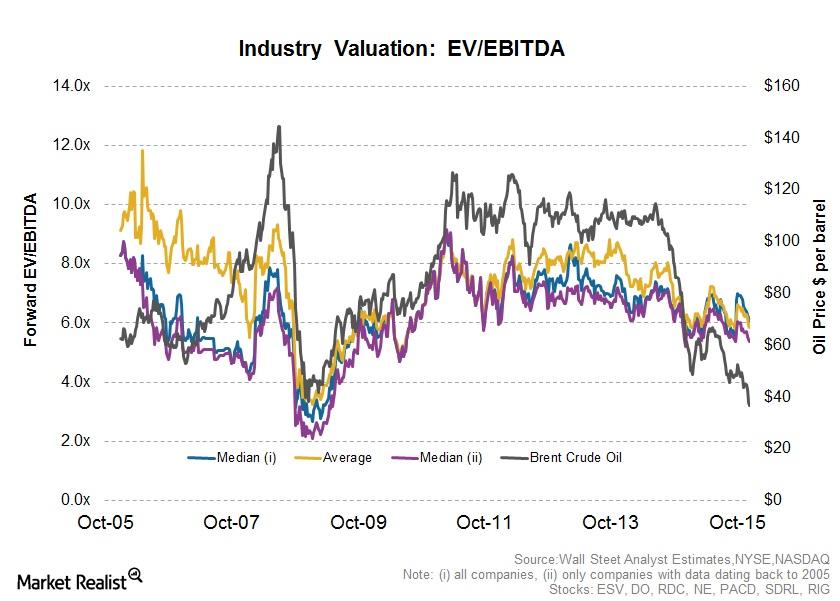

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

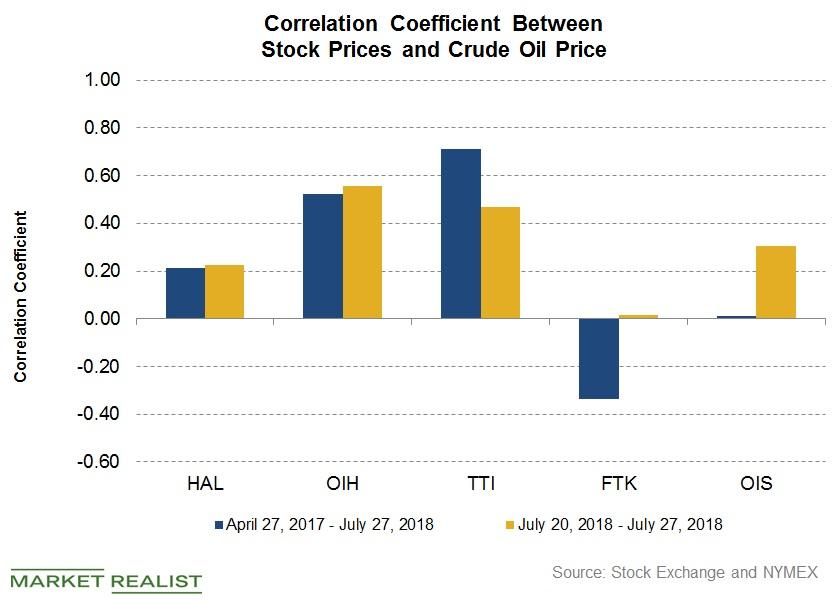

Halliburton Reacts to Changing Crude Oil Prices: Update

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22—a moderately positive correlation.

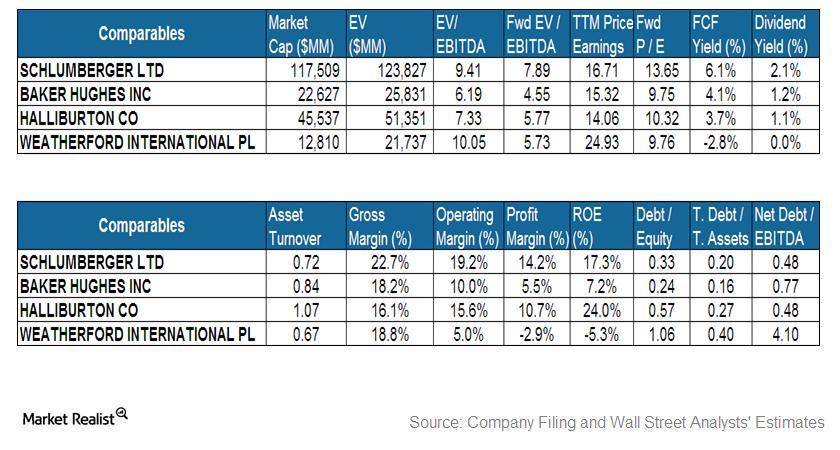

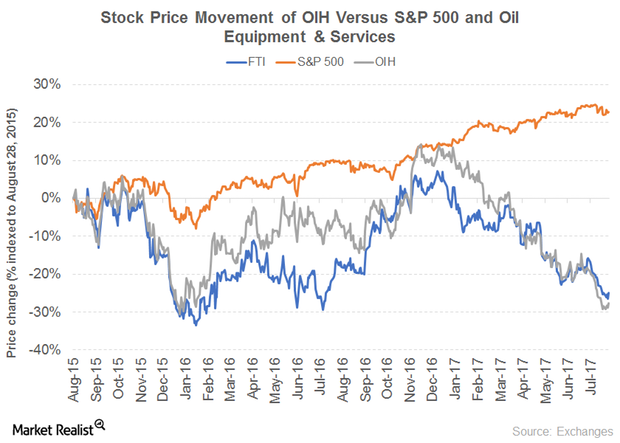

Schlumberger and Halliburton Compared to the Industry

By market capitalization, Schlumberger is the largest OFS company. Schlumberger’s stock price has declined 4% since May 3, 2017.

Extracting the Basics: An Introduction to Offshore Drilling

Oil is one of the most important and most frequently traded commodities, and offshore drilling is an integral part of the oil industry.

Why Schlumberger’s Stock Price Is Bearish

In the past year, Schlumberger’s stock price rose until January 2017. Schlumberger’s revenue fell slowly in the four quarters leading up to 1Q17.

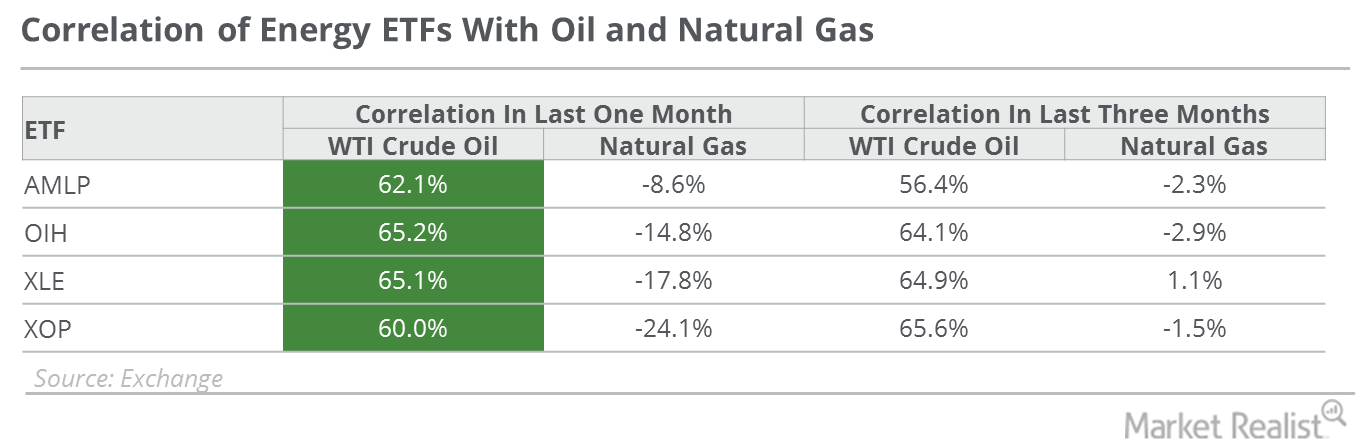

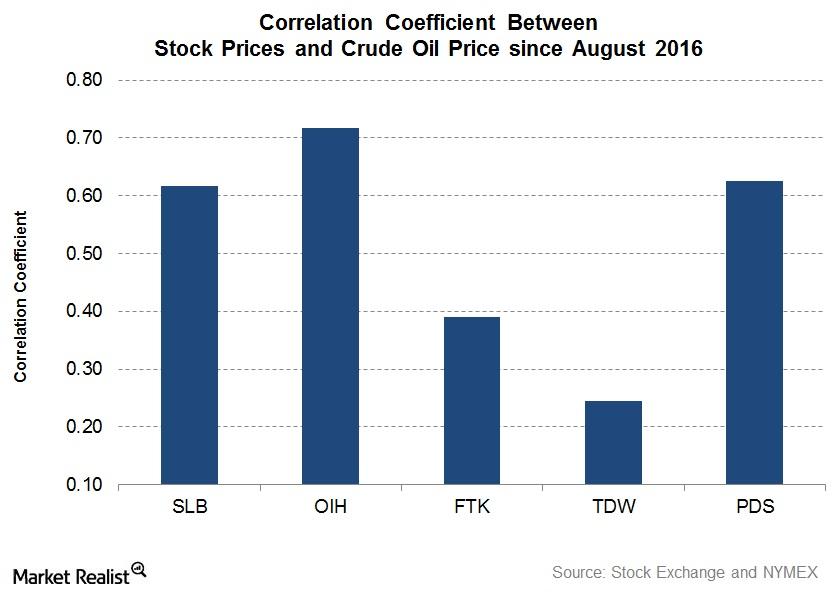

How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

Must-read comparison: Schlumberger and its peers

Schlumberger’s yearly price-to-earnings ratio is in line with the group. Haliburton has the lowest price-to-earnings ratio.

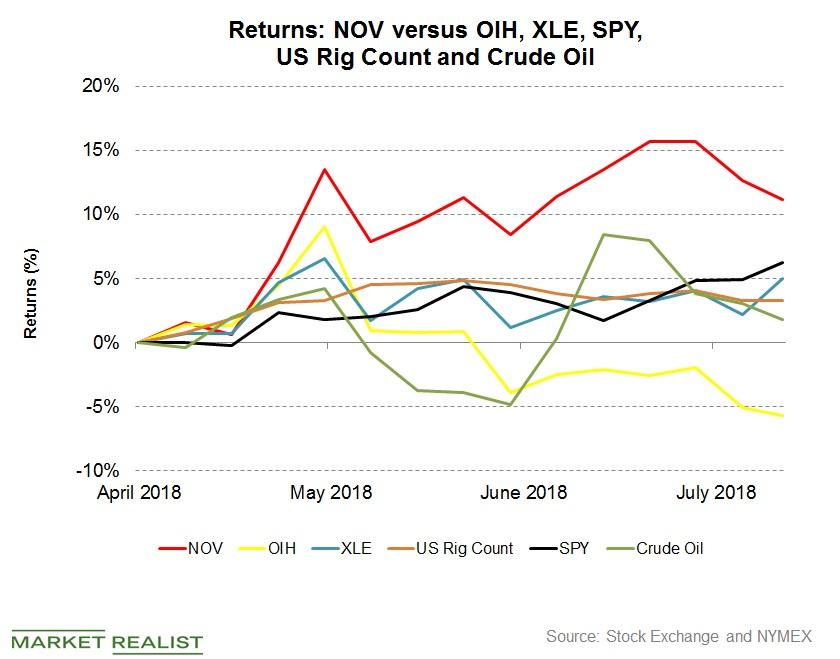

National Oilwell Varco’s Q2 2018 Earnings and the Market

Since April 26 when National Oilwell Varco released its Q1 2018 financial results, NOV stock has risen 10%.

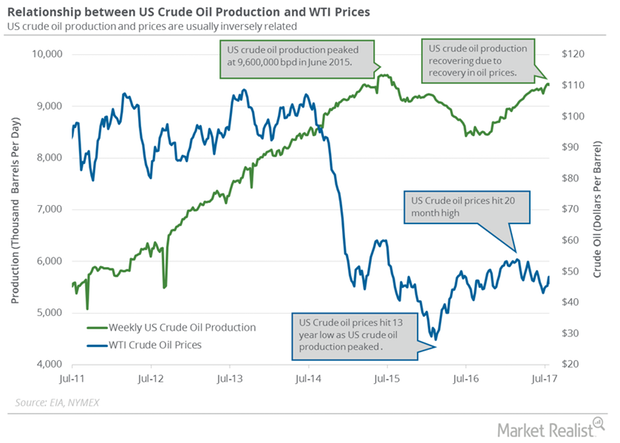

What US Crude Oil Production’s 26-Month High Could Mean

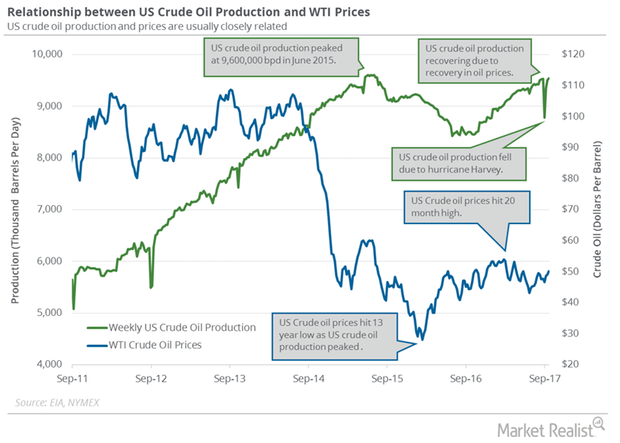

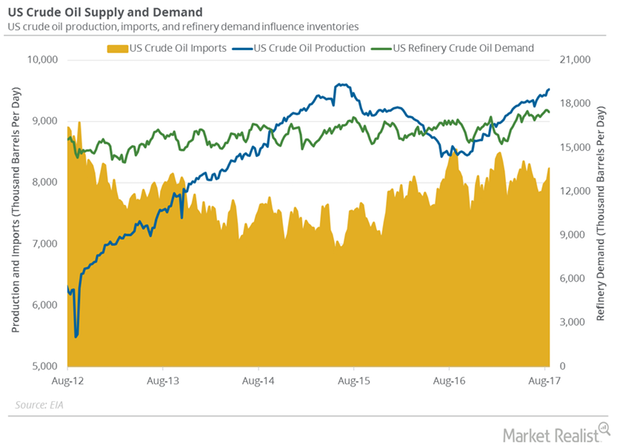

On September 27, 2017, the EIA estimated that US crude oil production rose 37,000 bpd (barrels per day) to ~9.5 MMbpd from September 15–22, 2017.

Where Is US Crude Oil Headed? An Energy Update

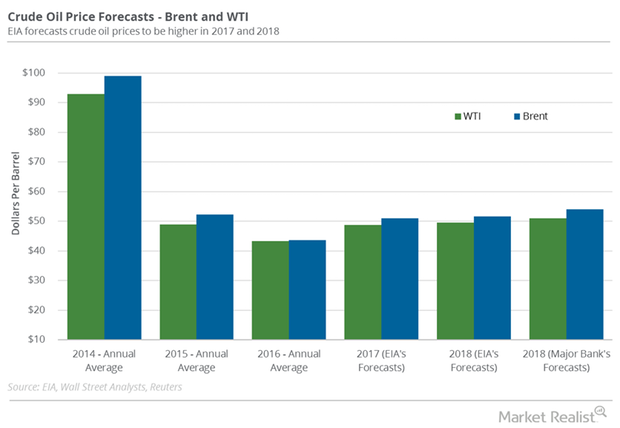

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

How US Production Is Affecting WTI Crude Oil Prices

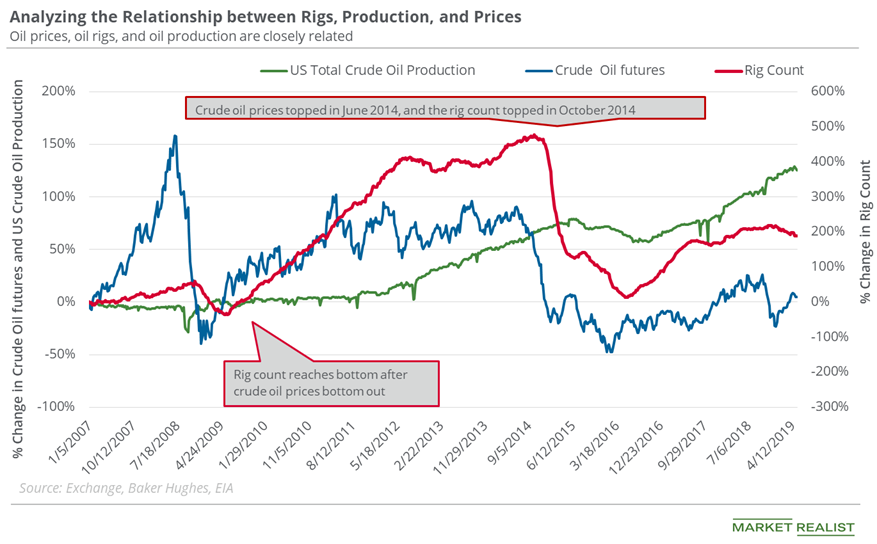

Between February 11, 2016, and July 15, 2019, WTI crude oil prices rose 127.3%. The United States Oil Fund LP (USO) gained 53.9% in the period.

Rise in Oil Pushed Energy ETFs Higher

US crude oil active futures have risen 8.6% in the trailing week, which might have boosted or limited the downside in OIH, XOP, XLE, and AMLP. They have returned 5.8%, 5%, 3.7%, and -0.7%, respectively.

Is the Oil Rig Count Dragging US Oil Production?

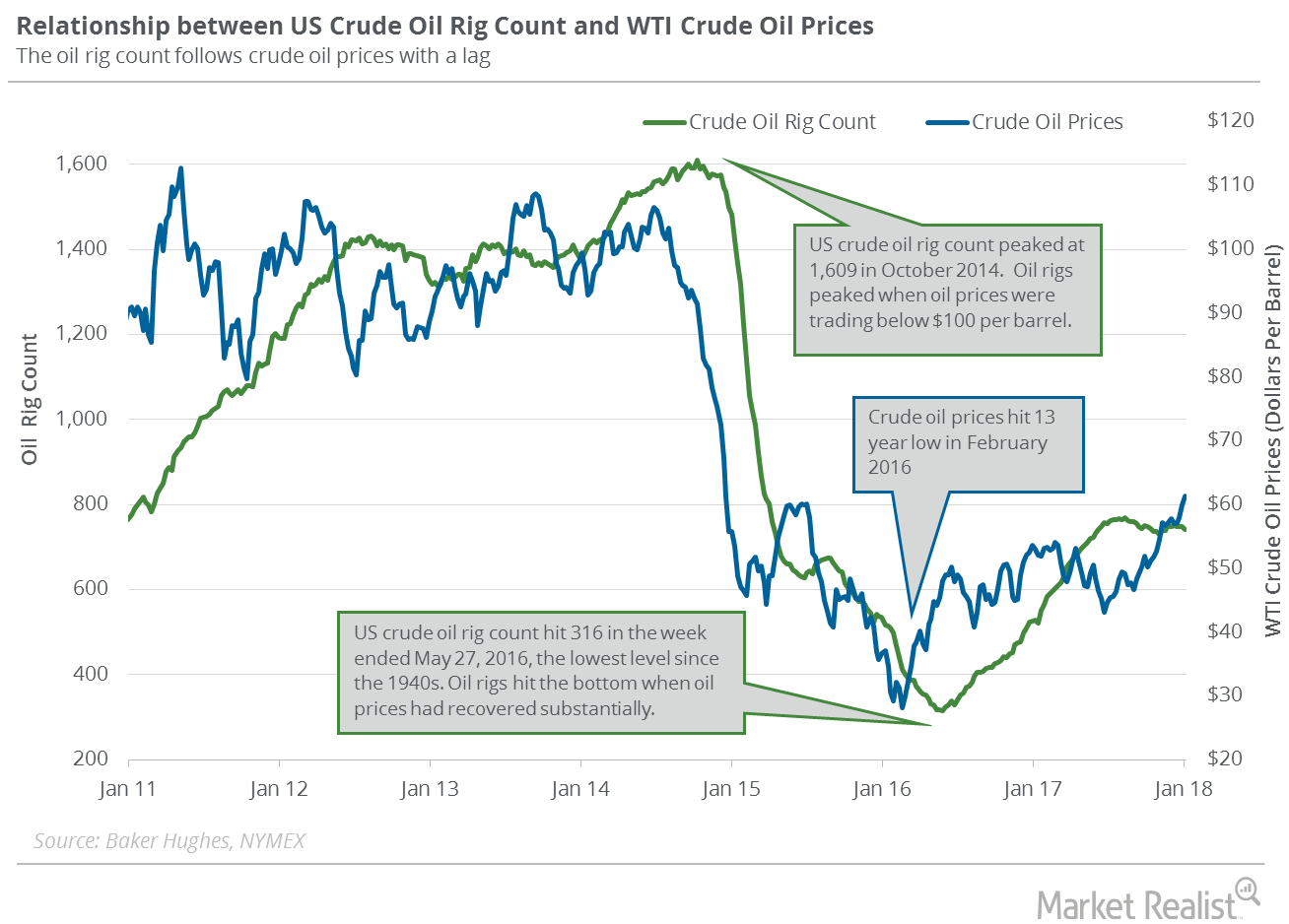

Last week, the oil rig count fell by three to 802—the lowest level since March 30.

Why Weatherford’s 1Q18 Earnings Beat Estimates

Weatherford International released its 1Q18 earnings results today.

Ranking OFS Companies by Their Valuation Multiples

Flotek Industries’ (FTK) forward EV-to-EBITDA multiple is at the steepest discount to its current EV-to-EBITDA multiple on March 9, 2018.

Are US Crude Oil Rigs Indicating a Slowdown in Oil Production?

On January 19, 2018, Baker Hughes released its weekly US crude oil rigs report. US crude oil rigs decreased by five to 747 on January 12–19, 2018.

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

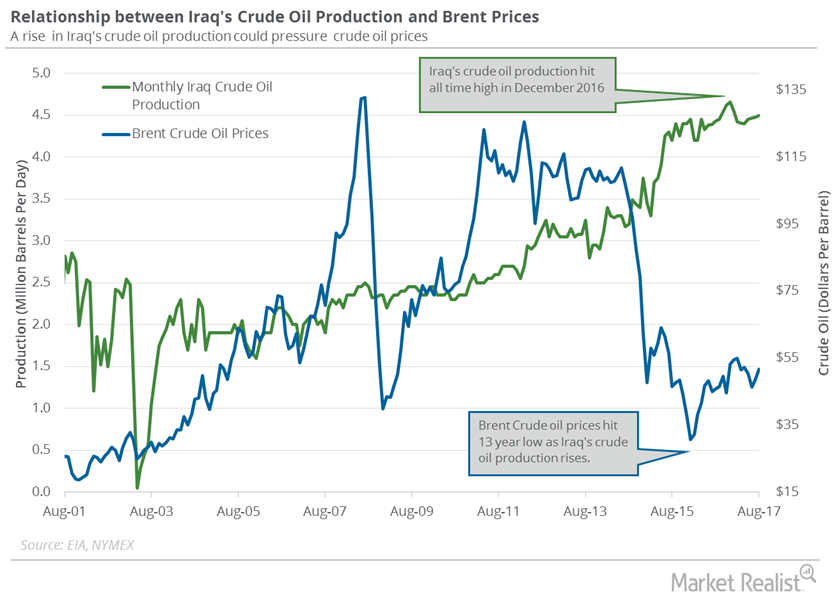

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

Hedge Funds Are Turning Bearish on US Crude Oil

Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017.

Will the FOMC Meeting Drive the US Dollar and Crude Oil Futures?

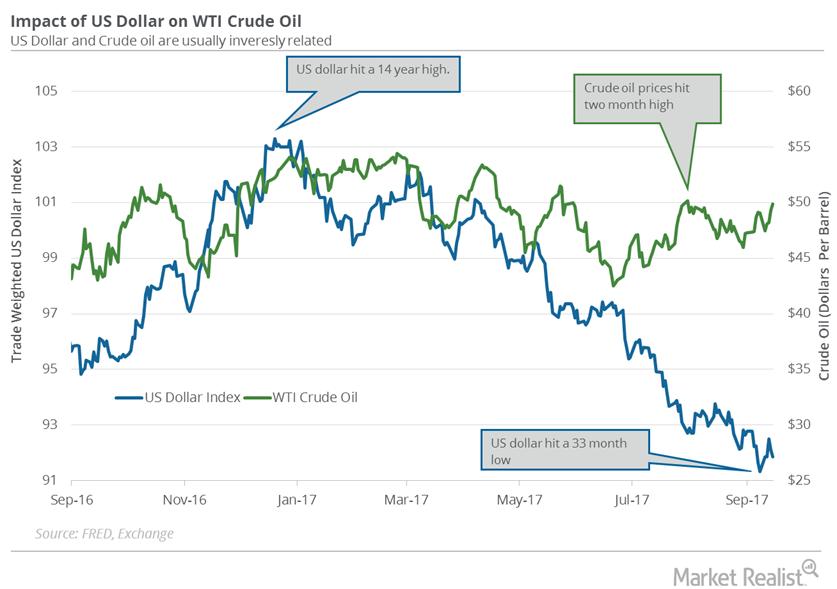

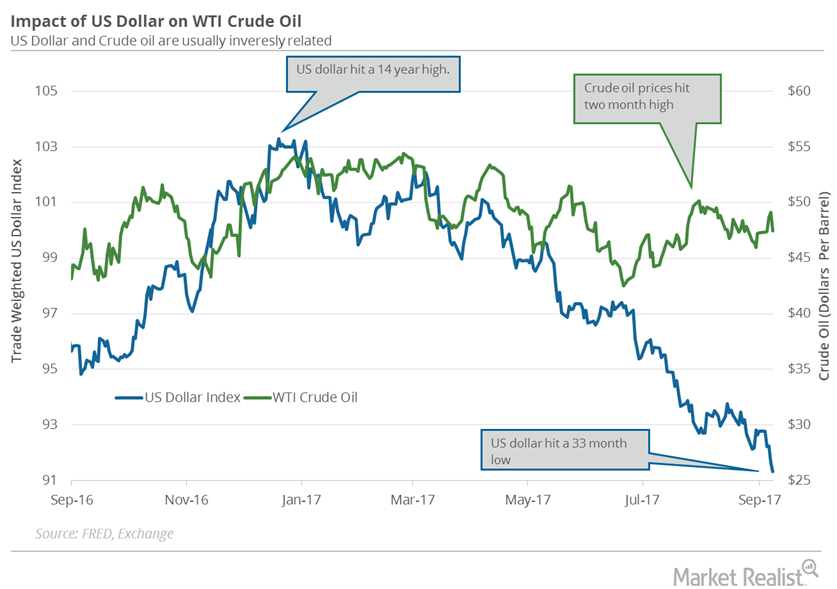

The US Dollar Index fell 0.27% to 91.86 on September 15. It’s near a 33-month low. Prices fell due to the surprise decline in US retail sales in August.

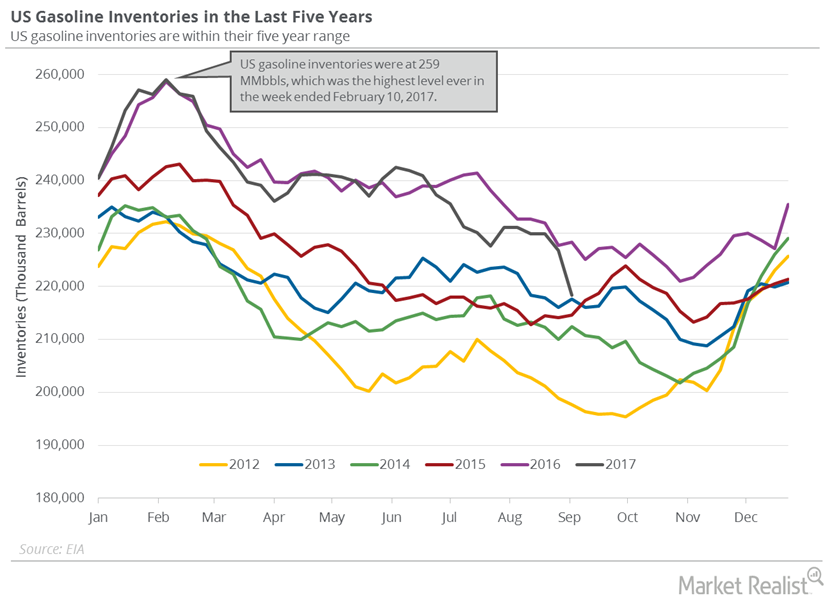

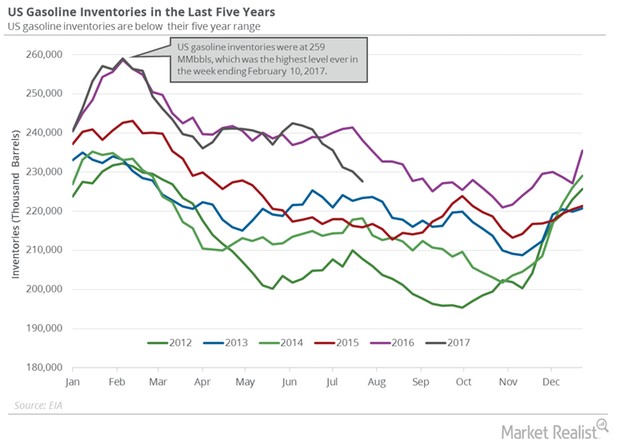

US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

Why the US Dollar Hit a 33-Month Low

The US Dollar Index fell 0.34% to 91.33 on September 8—the lowest level in the last 33 months. Prices fell due to the following factors.…

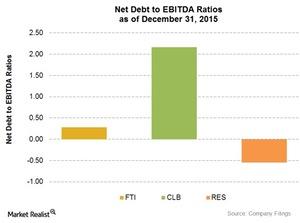

What Could Drive TechnipFMC’s Dividend Yield

How TechnipFMC intends to maintain its yield FMC Technologies and Technip merged to become TechnipFMC (FTI) in 2017, an international provider of subsea, onshore, offshore, and surface projects. The synergy aims to combat the challenges of low oil prices and a challenging outlook through cost cutting and the enhancement of efficiency. The company recorded 51% revenue […]

Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

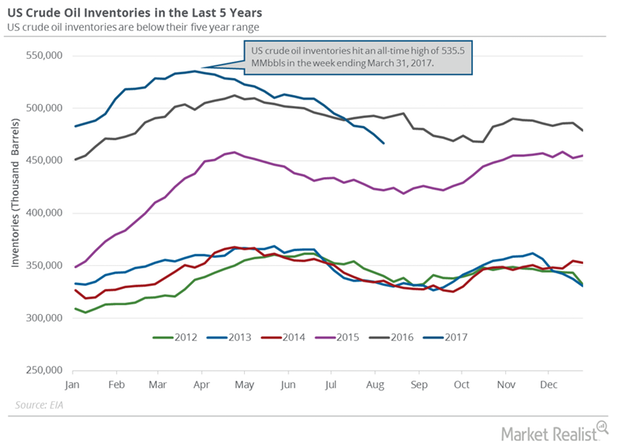

US Crude Oil Inventories: Biggest Draw since September 2016

The EIA reported that US crude oil inventories fell by 8.9 MMbbls or 1.8% to 466.4 MMbbls on August 4–11, 2017—the biggest draw since September 2016.

Will US Crude Oil and Gasoline Inventories Support Oil Prices?

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017.

EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

How Schlumberger Correlates with Crude Oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

Analyzing Halliburton’s Stock Price Returns

From December 2014 to December 2016, Halliburton’s (HAL) stock price reached the highest level in December 2016. It troughed at ~$28 in January 2016.

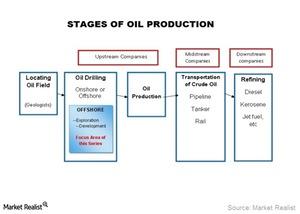

The Oilfield Services Industry: A Brief Introduction

The oilfield equipment and services industry refers to all products and services associated with the oil and gas exploration and production process, or the upstream energy industry.

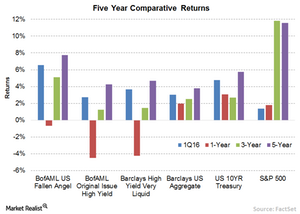

Interest Rate Outlooks Don’t Affect All Asset Classes: Here’s Why

Historically, it seems that fallen angels generally perform well across interest rate environments.

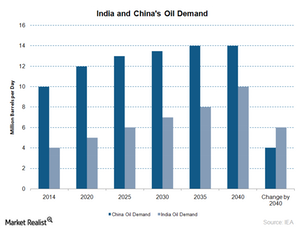

India’s Crude Oil Demand Will Likely Drive the Crude Oil Market

The EIA reported that India produced 1 MMbpd (million barrels per day) of crude oil in 2014 and 2015. It’s expected to increase marginally in 2016 and 2017.

Analyzing the Net-Debt-to-EBITDA Ratios of 4 Major Mid-Cap OFS Companies

In fiscal 2015, RPC’s (RES) net-debt-to-EBITDA ratio stood at -0.54, down from the 0.34 it saw in 2014. The company’s long-term debt stood at zero in 2015.

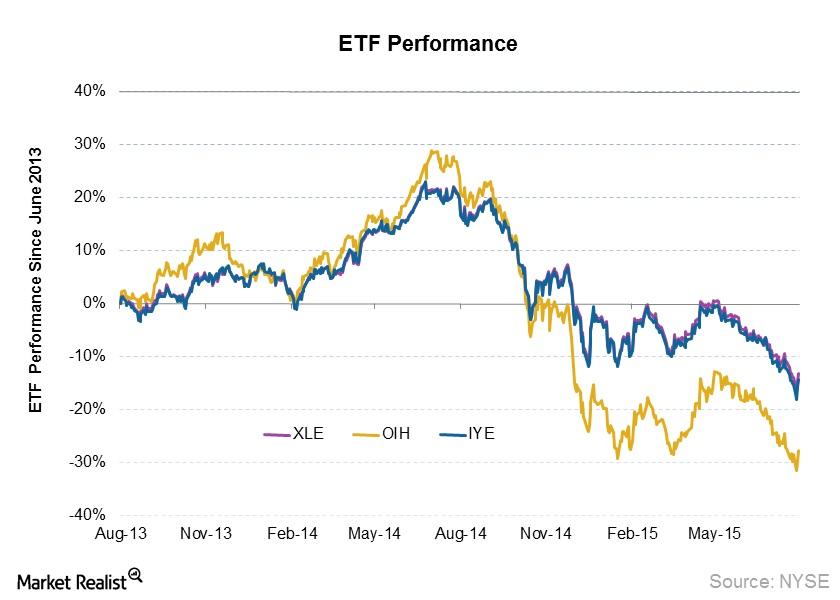

ETF Exposure in the Offshore Drilling Space

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

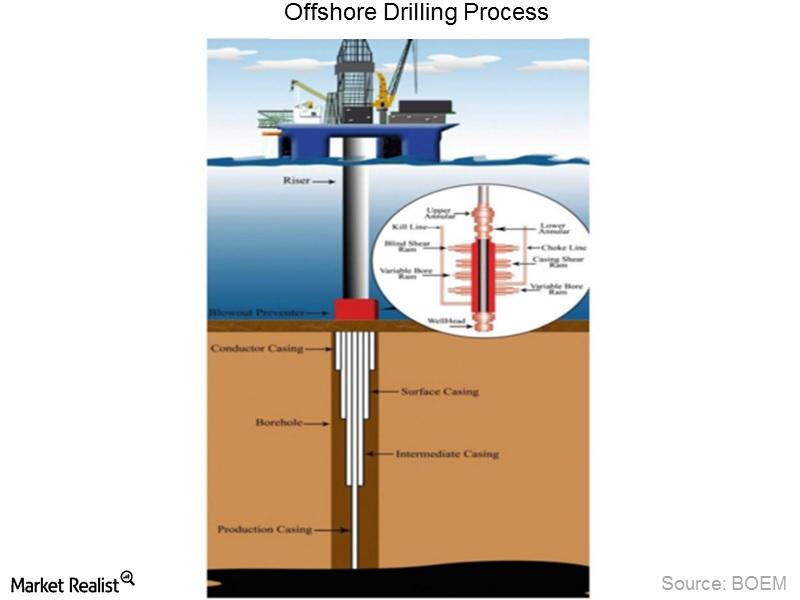

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.

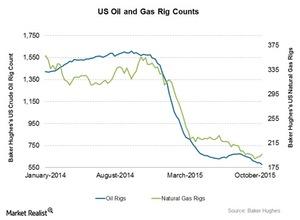

How the Late October Oil Rig Count Dip Hurt the Total US Rig Count

By October 30, 2015, the total US rig count fell by 16 crude oil rigs. The number of crude oil rigs has continued to fall in the past nine weeks.

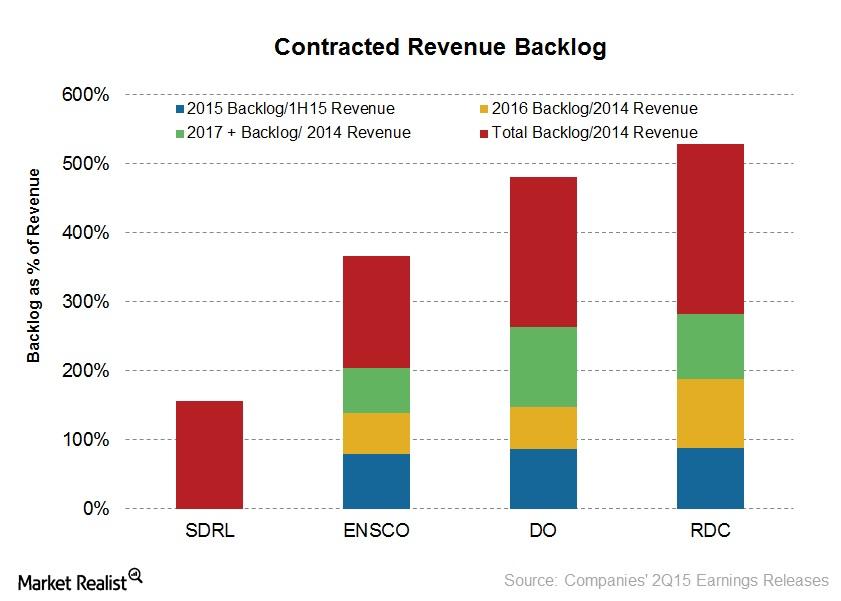

Rowan Companies Has Highest Backlog among its Peers

Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.

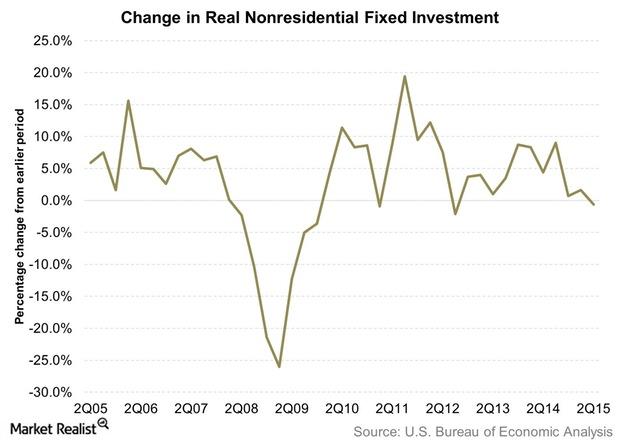

Why Is US Business Fixed Investment Subdued?

Business fixed investment represents business spending on plants, equipment, and machines. It forms an important component in the calculation of economic output.

Must-know: An overview of Halliburton

Halliburton (HAL) is a Texas-based energy company. It’s an oil and gas equipment and service provider. In the past year, Halliburton’s stock price went down ~22%.

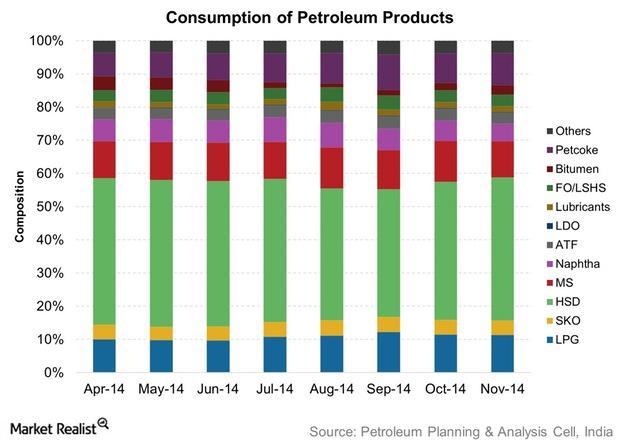

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

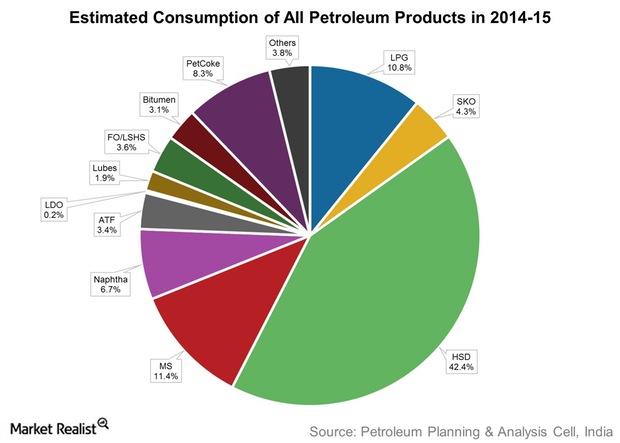

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.Consumer BP lost 55% shareholder value after the Deepwater Horizon incident

Deepwater Horizon was a deepwater, offshore oil drilling rig owned by Transocean (RIG) and operated by BP Plc. (BP). On April 20, 2010, while drilling at the Macondo Prospect, there was an explosion on the rig caused by a blowout that killed 11 crew members.