Halliburton Reacts to Changing Crude Oil Prices: Update

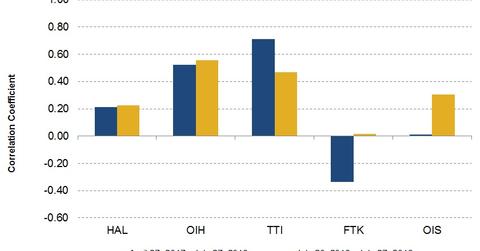

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22—a moderately positive correlation.

Nov. 20 2020, Updated 3:30 p.m. ET

Correlation between Halliburton and crude oil

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22. So, Halliburton and crude oil prices had a moderately positive correlation in the past week, which could mean that the stock was impacted less by crude oil’s movement on a daily basis.

Halliburton’s correlation with the VanEck Vectors Oil Services ETF (OIH), an ETF consisting of 25 oilfield equipment and services stocks, on July 20–27 was 0.69. Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!

What does Halliburton’s correlation with crude oil mean?

A positive correlation between Halliburton and crude oil indicates that the two are related and that moves in crude oil are impacting Halliburton stock. If crude oil prices increase, it can be an advantage for Halliburton’s stock price. Halliburton’s correlation with crude oil prices increased marginally in the week ending July 27—compared to Halliburton’s correlation with crude oil in the past three months since April 27.

Correlation between Halliburton’s peers and crude oil

In the past three months, the VanEck Vectors Oil Services ETF’s (OIH) correlation with crude oil was 0.52—lower than the past week. As a whole, the sector has a positive sensitivity to crude oil prices.

In the past three months, TETRA Technologies’ (TTI) correlation with crude oil was 0.71—the highest in the OFS (oilfield equipment and services) industry. In comparison, Flotek Industries’ (FTK) correlation with crude oil was -0.33—the lowest in the OFS industry in the past three months. A negative correlation implies that the stock’s price has moved inversely to crude oil prices on a daily basis. Oil States International’s (OIS) correlation with crude oil was close to zero (0.01) in the past three months. Oil States International’s stock price movement wasn’t related to crude oil’s changes in the past three months.

Read What Drove Halliburton’s Second-Quarter Earnings? to learn more.