Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

Aug. 29 2017, Updated 3:36 p.m. ET

Energy calendar this week

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

- Tuesday, August 29: The API (American Petroleum Institute) should release its crude oil inventory report.

- Wednesday, August 30: The US Energy Information Administration (or EIA) is scheduled to release its “Weekly Petroleum Status” report.

- Thursday, August 31: The EIA should release its weekly natural gas inventory report.

- Friday, September 1: Baker Hughes is slated to release its US oil rig count report.

High and low

US crude oil (IXC)(IYE)(FENY) futures hit $54.45 per barrel on February 23, 2017, which was the highest level in more than two years. In contrast, prices hit $26.21 per barrel on February 11, 2016—the lowest level in more than 13 years.

Crude oil price drivers for this week

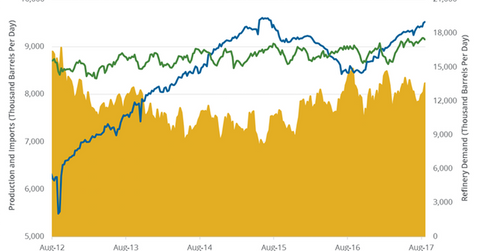

US crude oil (ERY)(ERX) prices are at a five-week low. Prices could fall this week due to weak demand due to Tropical Storm Harvey. But a fall in US crude oil production, an expectation of fall in US crude oil inventories, and a fall in OPEC’s crude oil exports and production in August 2017 could support crude oil prices.

Higher crude oil (OIH)(DIG)(USO) prices have a positive impact on oil and gas producers such as Sanchez Energy (SN), ExxonMobil (XOM), Chevron (CVX), and Goodrich Petroleum (GDP).

Moving averages of October US crude oil futures

October US crude oil futures are below their 20-day, 50-day, 100-day, and 200-day moving averages $48.41, $47, $48.42, and $51.12 per barrel as of August 25, which suggests that prices could trade lower this week.

In the next part of this series, we’ll see how Cushing crude oil inventories impact prices.